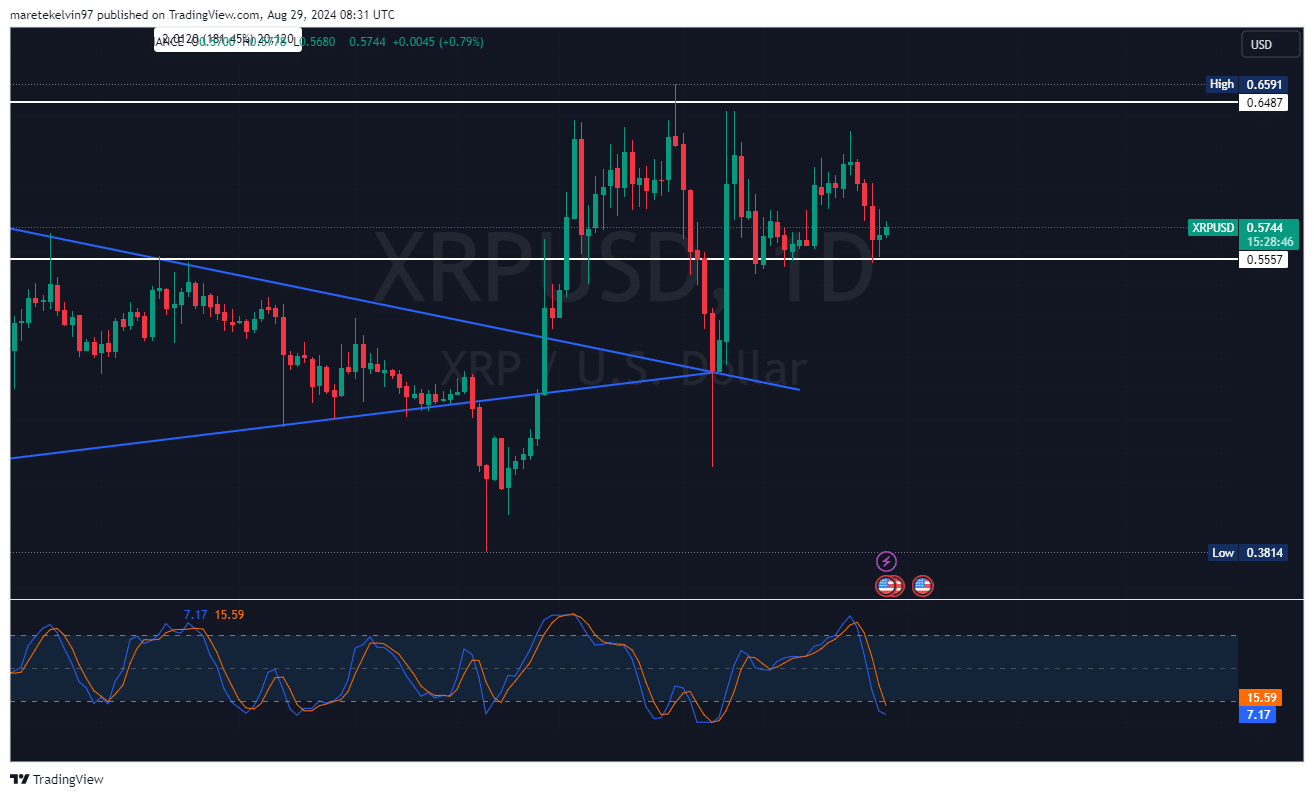

- XRP showed signs of bullish momentum after bouncing off critical support at $0.5557.

- Metrics signaled a continued bullish rally.

XRP has shown signs of a comeback, as it increased by 4% after a successful retest of the critical support of $0.5557.

The price action of XRP indicated a recovery from $0.5557, which had acted as a significant level of support and resistance for the previous price.

The retesting of this level as per the bullish scenario reinforces the intention of the bulls.

XRP had declined by 12% before the current bullish run. This building bullish momentum is a positive sentiment that may lure the big players into the market.

Source: TradingView

The stochastic RSI has recovered from below the boundary of an oversold zone, suggesting that any other increase in the price might be incoming.

Indeed, this bullish crossing over shows that it is more than returning to XRP but extending its level, and more of it is coming soon.

Metrics support the bullish case

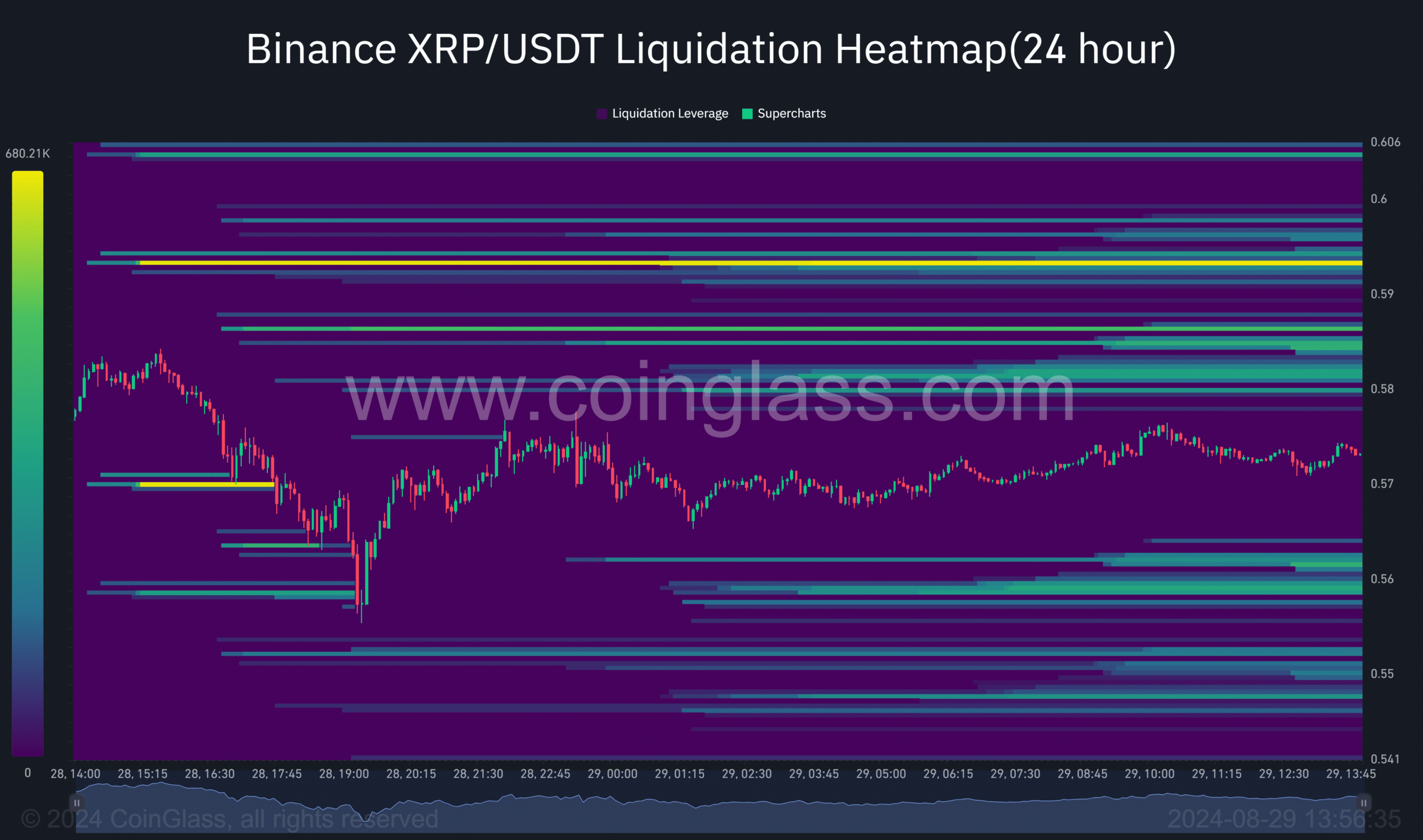

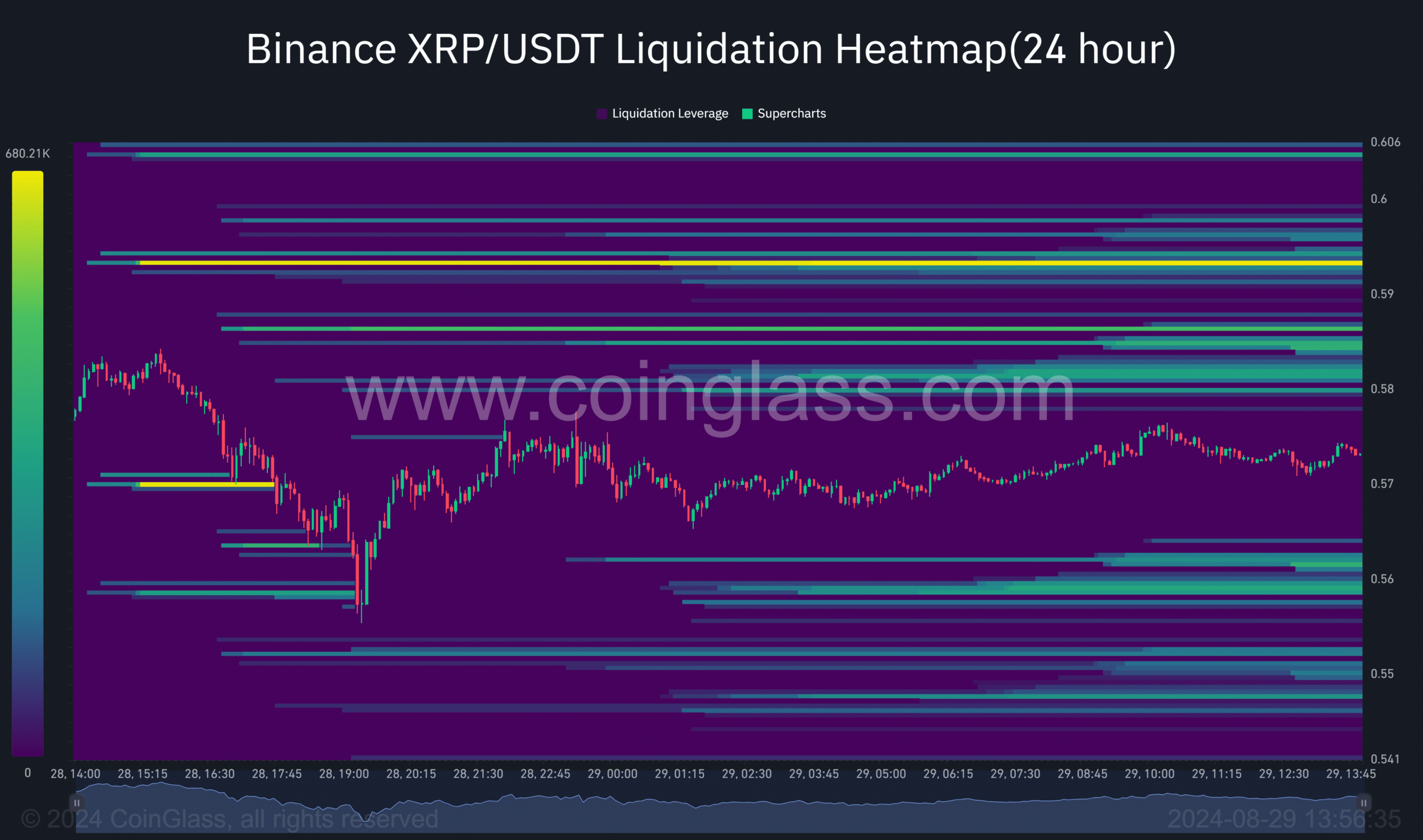

AMBCrypto analysis of on-chain metrics indicated the case is even stronger for bulls. From the Coinglass liquidation heatmap data, there is a decline in the sell-side liquidations.

This supported that the chances of large sell-offs pushing prices down were getting lower.

Source: Coinglass

In addition to the aforementioned bullish bias, the magnitude of Open Interest in XRP Futures has been growing consistently.

This indicated an improving sentiment among both institutional and retail investors.

Source: Coinglass

XRP bulls versus bears

Also, AMBCrypto analyzed the Long/Short Ratio Chart from Coinglass to determine the market direction in the short run.

The data indicated a growing bullish trend. The ratio was 0.96 at press time. This suggested that bulls were winning the war, with the market shifting to the bullish side.

Source: Coinglass

Read Ripple’s [XRP] Price Prediction 2024–2025

Considering the addressed factors, XRP’s price movements appeared to be progressive enough to get to the upper resistance levels.

The $0.64 price level is realistically achievable in the near future if the bullish pressure continues.