- BTC reclaimed $100k, albeit briefly, after cooler-than-expected inflation data

- XRP reclaimed its 7-year high while ONDO faced $2.4B token unlock pressure.

On Wednesday, Bitcoin [BTC] bounced off and retested $100k following cooler-than-expected U.S inflation data, lifting the entire market. The inflation data, CPI (Consumer Price Index), came in at 3.2% YoY(year-on-year) against the 3.3% projected by economists.

Source: Coinmarketcap

This dampened inflation fears and Fed rate cut outlook that had earlier tanked markets and dragged BTC below $90k.

Worth pointing out, however, that the markets are still pricing a 97% chance of an ‘unchanged’ Fed interest rate in the next meeting towards the end of January.

AI agents lead recovery, XRP hits new high

Following BTC’s rally, Solana [SOL] and Ethereum [ETH] posted 14% and 12% gains, respectively. However, the AI agent sector saw a bigger rally, with Virtuals Protocol [VIRTUAL] and Aixbt [AIXBT] recording gains of 25% and 35%, respectively.

Other tokens with the AI agent narrative, like Fartcoin and Cookie, also logged double-digit gains. In fact, some agent tokens posted triple-digit gains in a day too.

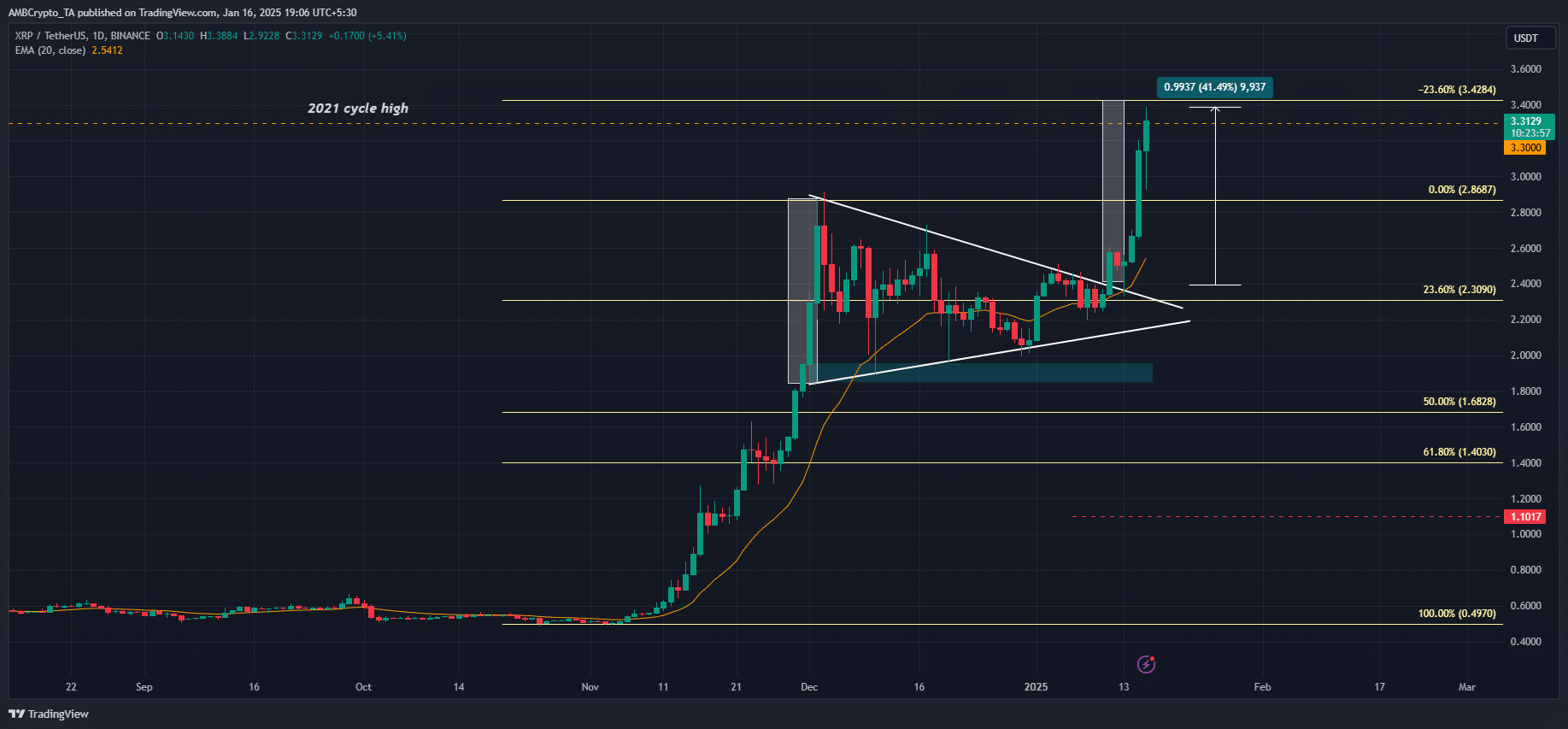

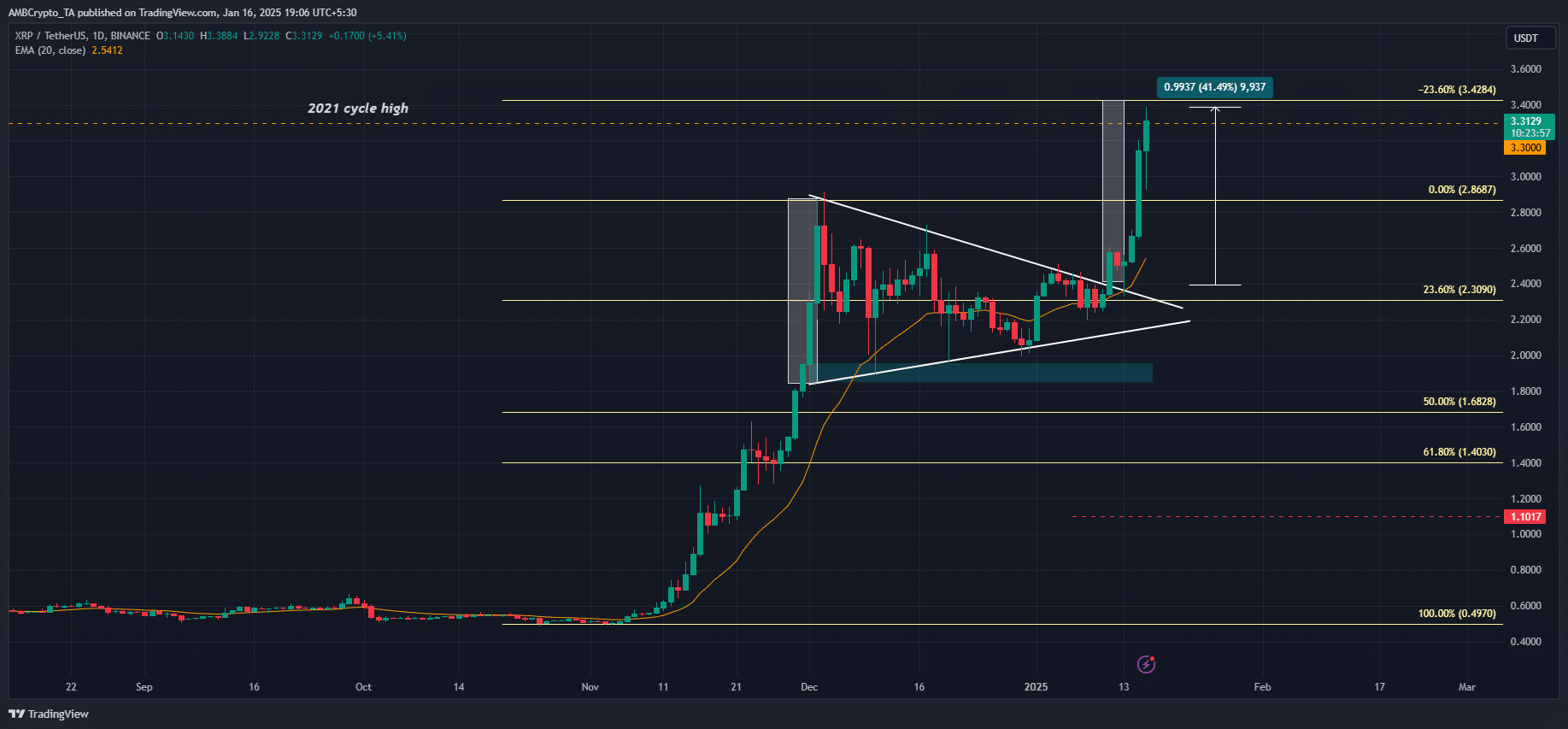

However, the key market highlight was XRP. At press time, the altcoin hit a high of $3.38, crossing its 2021 cycle high in the process. The feat effectively extended its breakout gains to +40%, with the altcoin unfazed by legal developments as the SEC filed an appeal against Ripple Labs.

Source: XRP/USDT, TradingView

The agency is dissatisfied with U.S District Judge Analisa Torres’s ruling that classified XRP as non-security and reduced Ripple Labs’ $2B fine to $125M.

Despite speculation that the agency would not appeal the case, it did so, irking Ripple’s leadership, who termed the move a waste of taxpayer money. However, there are reports that the new Trump administration could ‘freeze’ some crypto lawsuits, including Ripple’s case.

Finally, the RWA (real-asset tokenization) market leader, Ondo [ONDO], will unlock nearly 800M tokens (worth $2.4B) on 18 January.

This will translate to 134% of its market cap and could expose the token to significant volatility and selling pressure. Despite a broader market recovery at press time, the altcoin is already down by 42%. Priced at $1.2, it hasn’t recovered from December’s sell-off so far.

Source: CryptoRank

Finally, next week marks the D-day of Donald Trump’s presidential inauguration, and a new chapter for crypto will be ushered in.

As the market shifts focus to this historical event, trading firm QCP Capital noted greater interest from Options traders in the $100k-$110k price targets. The firm stated,

“On the options front, BTC JAN calls dominated the market yesterday as traders adopted an increasingly bullish view, snapping up contracts with strikes ranging from $100K to $110K. This is a promising sign as we head into March which currently holds the highest concentration of open interest at the $120K strike.”