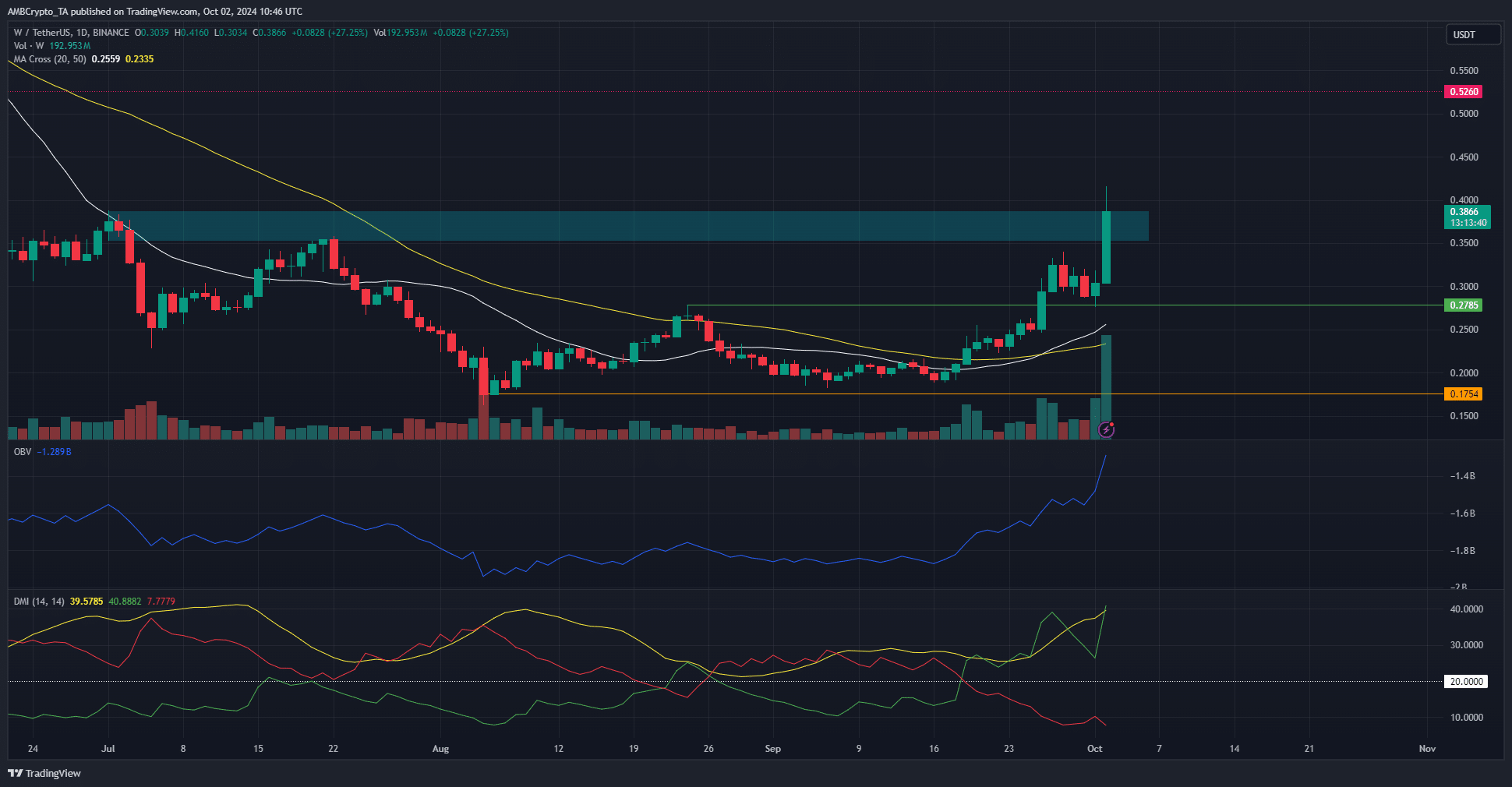

- The moving averages formed a bullish crossover, reinforcing the idea of hefty upward momentum.

- The bearish order block from July was likely to be breached on W’s first try.

Wormhole [W] bulls were in a hurry to drive prices past the $0.4 level. The $0.278 level, which had been a resistance for just over a month, was breached and retested as support. The trading volume increased manifold compared to last week.

This encouraged traders and holders that the token could see more gains in the coming weeks, with the next target being the $0.52 resistance level.

Wormhole crypto breaks the weekly structure

Source: W/USDT on TradingView

The $.2785 level was the recent lower high on Wormhole’s downtrend on the weekly chart. The price surge beyond this level showed a bullish market structure break on the weekly, with the daily also flipped.

The same level was retested as support over the past few days before Wormhole crypto saw a massive price surge. It has gained just over 40% within the past 24 hours and could continue to move higher.

The bearish order block at $0.36-$0.38 was on the verge of being breached. Swing traders can consider taking profits around these levels and waiting for consolidation around or above the resistance before looking to re-enter a long position.

The OBV showed high demand for W and the DMI outlined an intense uptrend in progress on the 1-day chart. The retest of the July resistance meant taking profits, at least partially, was a viable option for traders.

Short-term sentiment flies to the moon

Source: Coinalyze

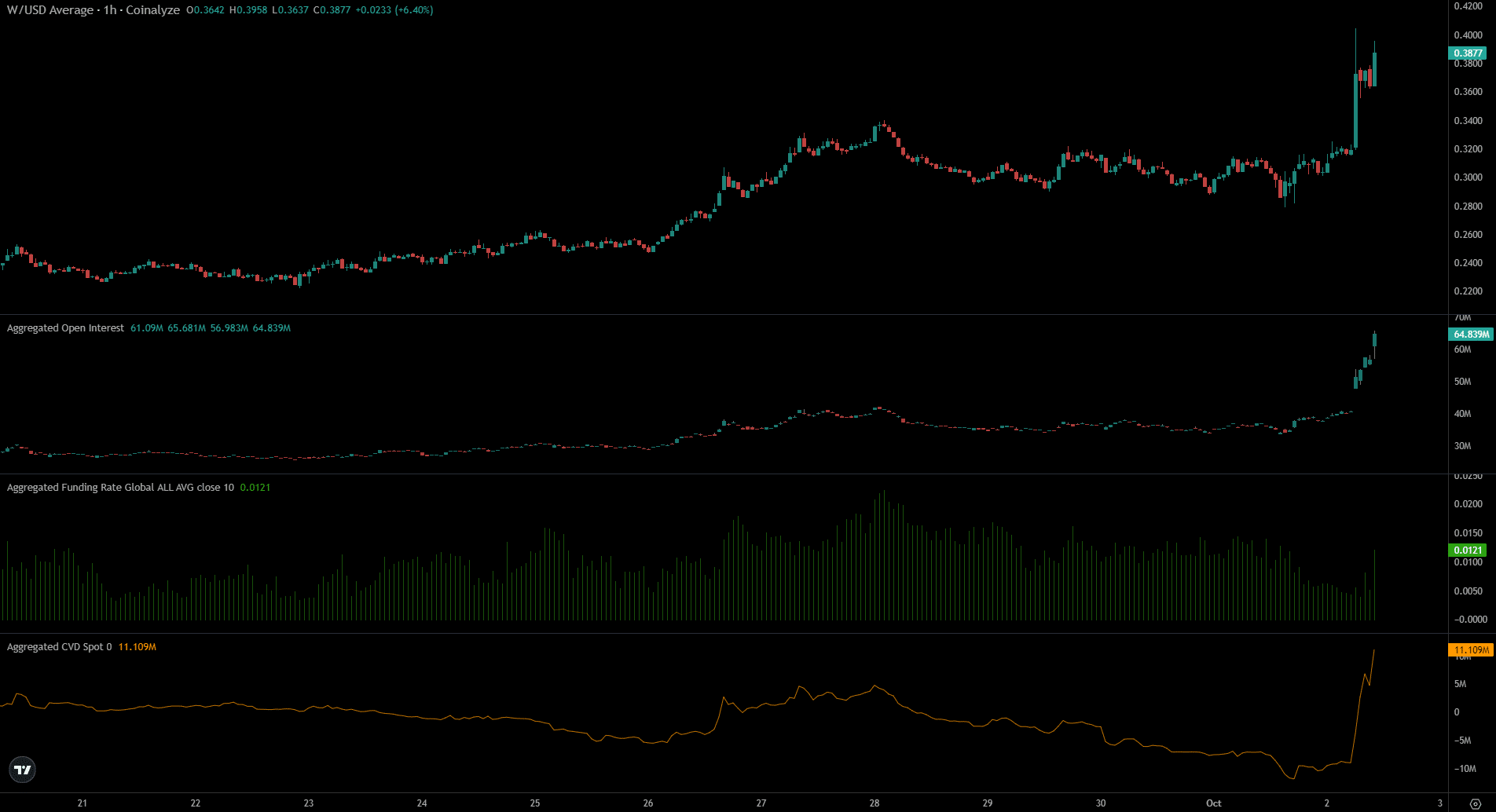

The Open Interest was at $44 million a day earlier. It increased by nearly 50% to stand at $64.8 million, showing firm bullish conviction. Buyers were eager to go long, and this trend was repeated in the spot market as well.

Is your portfolio green? Check the Wormhole Profit Calculator

The funding rate dipped in recent hours but began to trend higher to show more participants were willing to go long. The price action and the futures data showed that a move to $0.4 was likely.

It remains to be seen whether the rally will continue or if the bulls need some breathing time.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion