- ETH long-term holders were more bullish than their BTC colleagues.

- ETH/BTC was at a pivotal point, but a strong rebound was yet to be triggered.

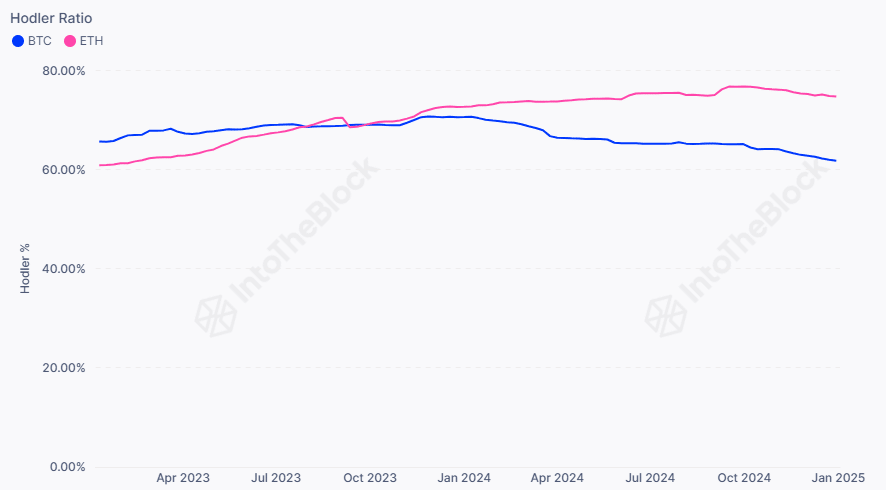

Ethereum’s [ETH] long-term holders (LTH) have shown more bullish conviction than their Bitcoin [BTC] counterparts.

Analytics firm IntoTheBock showed that the market shift began in early 2024 and intensified into 2025 as the ETH LTH cohort increased holdings and dominance to nearly 75%.

On the contrary, the BTC LTH cohort has been relentlessly liquidating their holdings, dragging their dominance below 60%. The firm stated,

“Currently, 74.7% of Ethereum addresses are long-term holders, significantly outpacing Bitcoin. This trend is likely to hold until Ethereum approaches its all-time high and holders start taking profits.”

Source: IntoTheBlock

Will ETH gain ground in Q1?

The update isn’t surprising because ETH price performance has lagged behind BTC since early 2024. BTC crossed its previous cycle high and topped $108K, making nearly every holder profitable.

ETH hasn’t achieved such a feat. So, most ETH bulls might be holding in anticipation of a future rally to make a profit or break even on their investments.

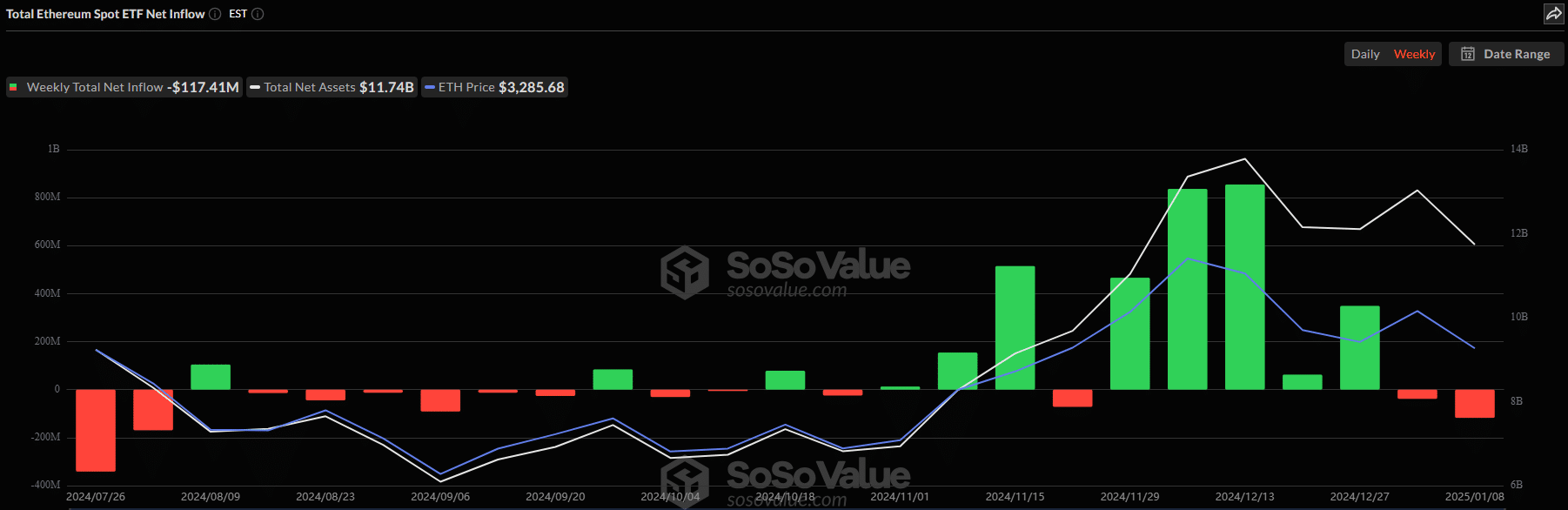

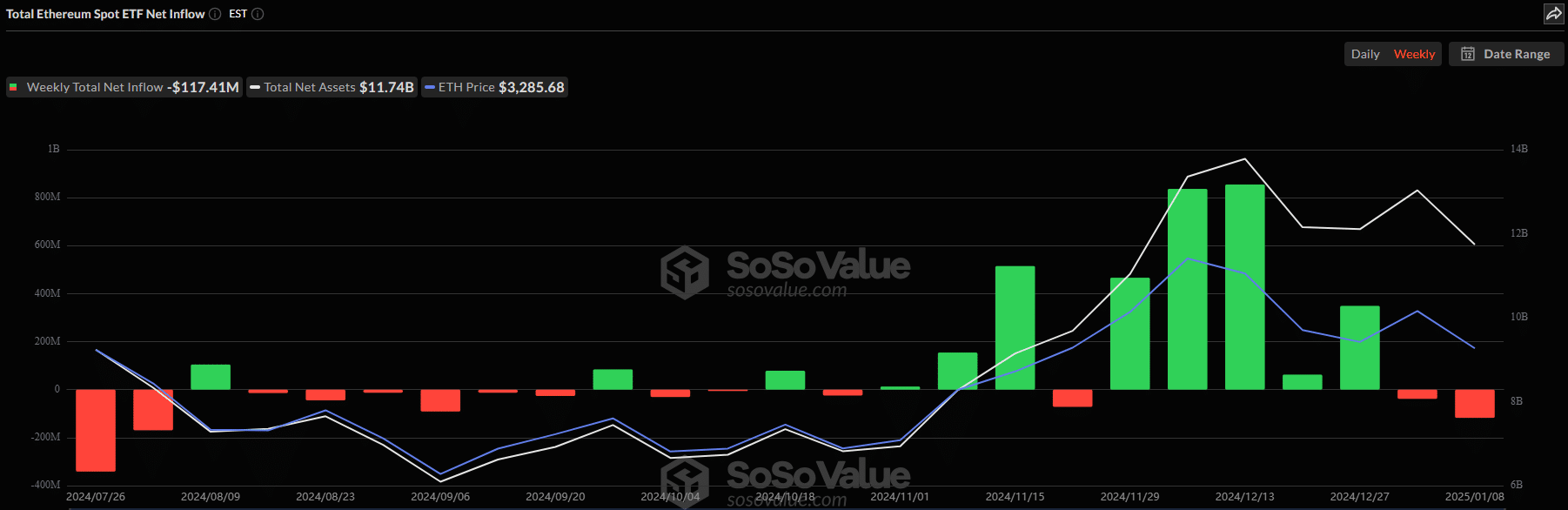

Institutional demand for ETH and BTC was slightly distorted into the new year. According to Soso Value data, ETH ETFs are on track to close the second week of outflows. This contrasts with the demand seen in November when the products logged five consecutive weeks of inflows.

Source: SoSo Value

In contrast, BTC saw net inflows in the past two weeks. If this institutional demand trend persists, BTC could outperform ETH on the price charts.

However, another indicator, the ETH/BTC ratio, showed a potential pivot for ETH. This indicator tracks ETH’s relative price performance against BTC. It dropped to a 4-year low of 0.30, underscoring ETH’s underperformance over that period.

Yet, it formed a double bottom pattern, indicating a potential rebound and likely market shift in favor of ETH.

Source: ETH/BTC ratio, TradingView

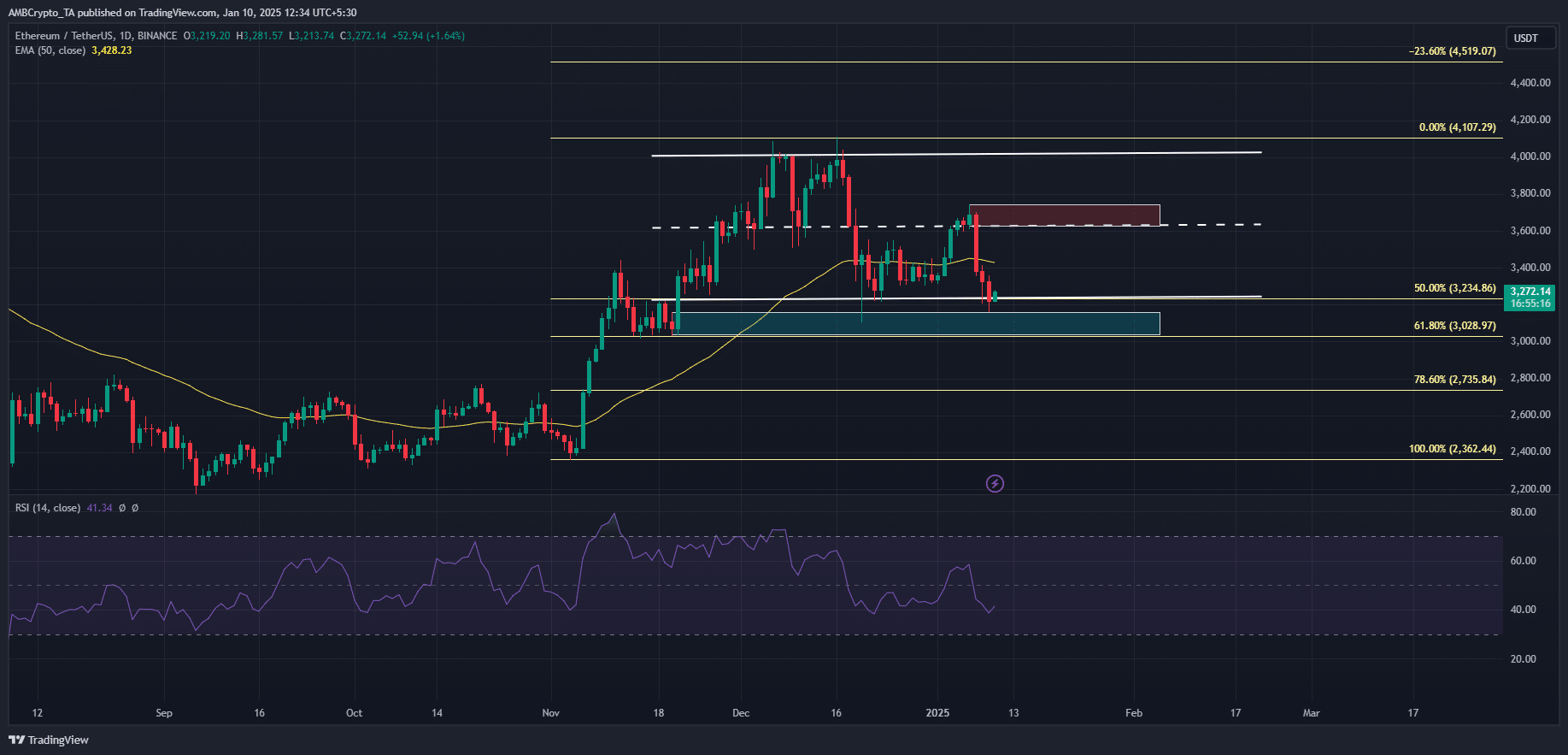

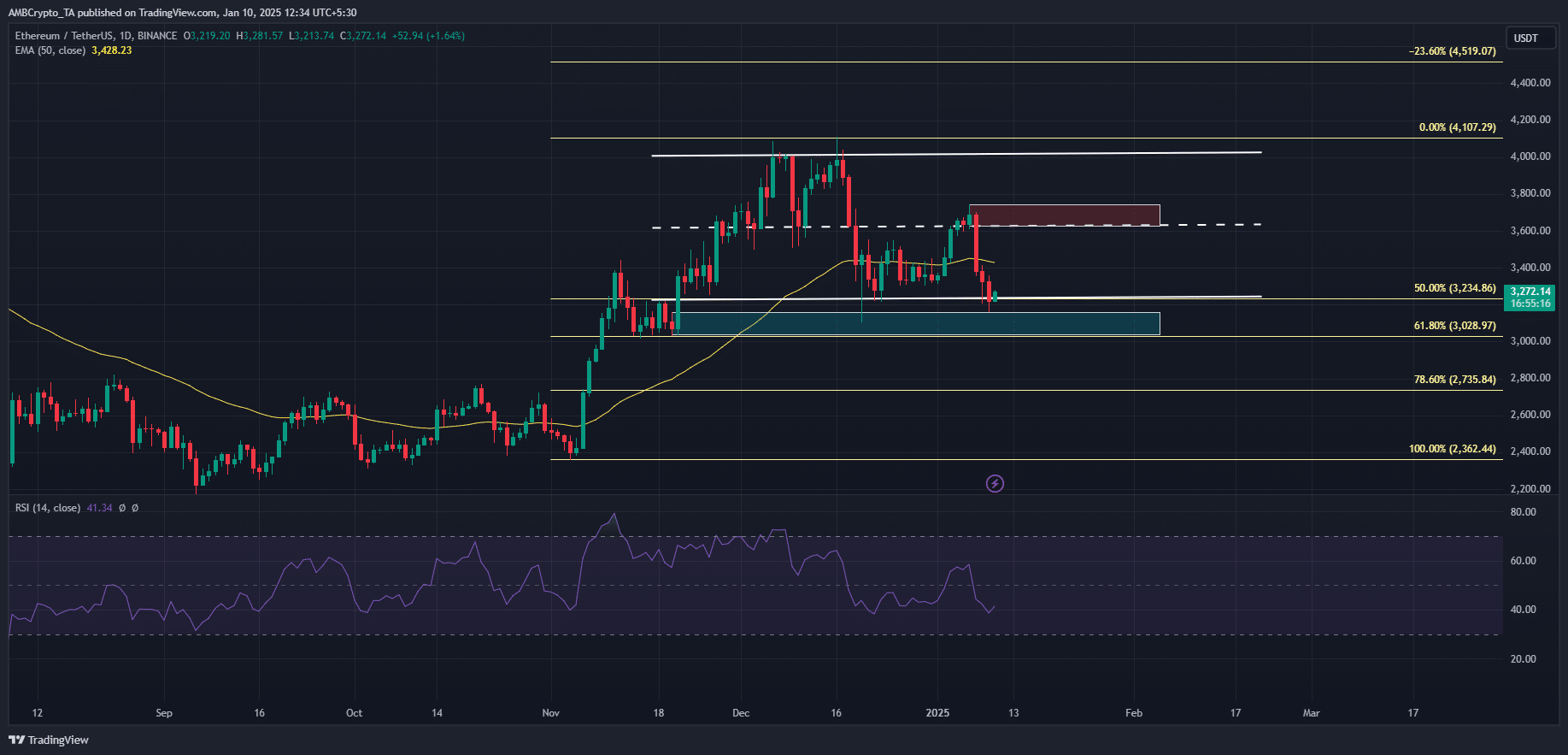

That said, the recent market crash dragged ETH to its December lows above $3K. ETH could attempt a rebound from the $3K-$3.3K support zone, with the immediate target at $3.6K. This was the same outlook shared by some ETH traders on X (formerly Twitter).

Read Ethereum’s [ETH] Price Prediction 2025–2026

However, ETH’s likely recovery could be further strengthened if it reclaimed the 50-day EMA.

Source: TradingView