- BTC dropped near the $60K psychological support after FOMC Minutes.

- Will U.S. CPI data trigger a rebound or escalate the decline?

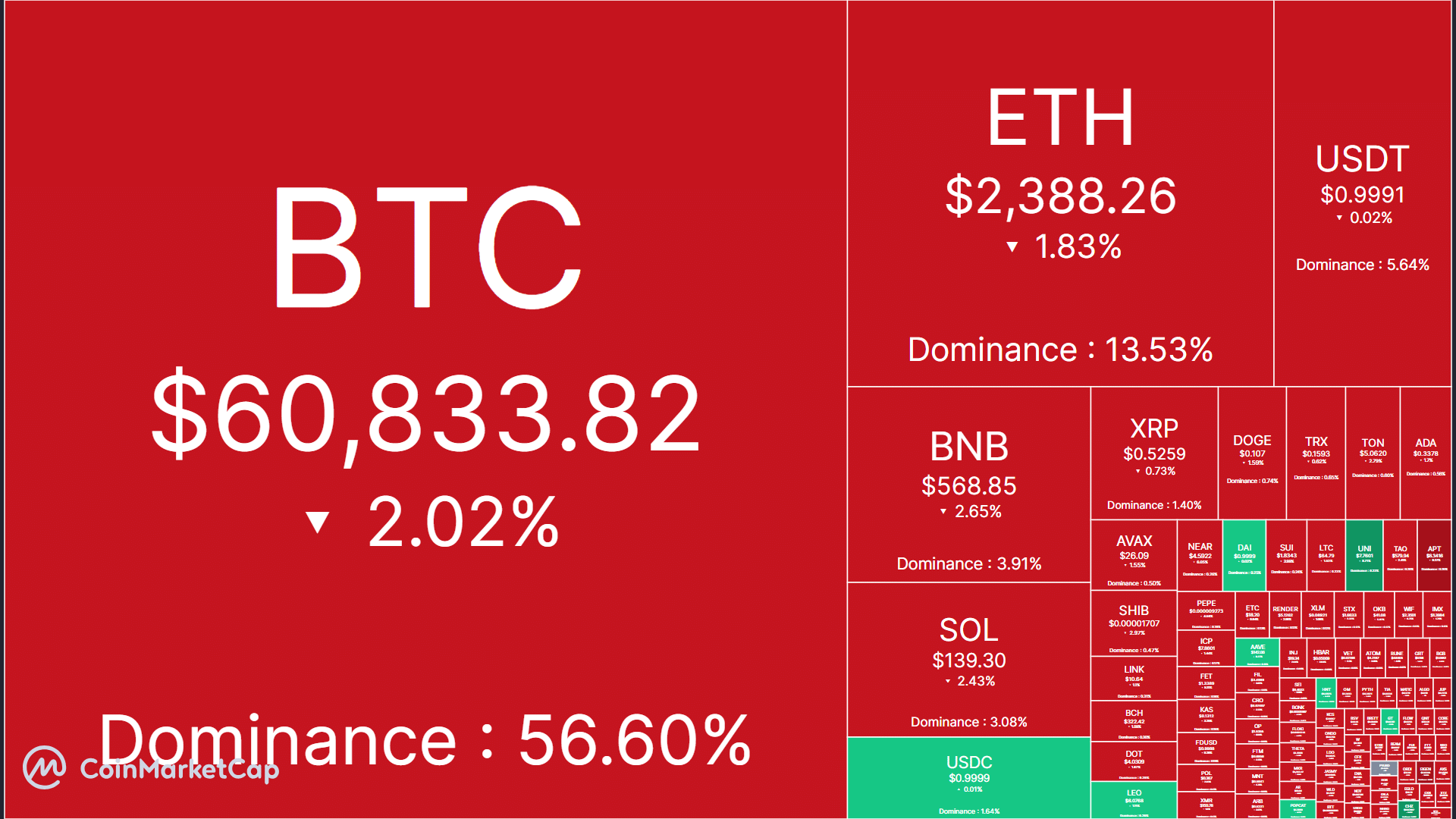

On the 9th of October, Bitcoin [BTC] led the crypto market decline, shedding 2.45% and sinking to critical support.

The world’s largest digital asset lost $1.5K, dropping from $62.5K to a low of $60.3k, following the release of FOMC Minutes from the September meeting.

FOMC minutes sink BTC, crypto

Source: CoinMarketCap

Among the majors, Binance [BNB] saw the highest retracement at 2.65% at press time.

XRP saw a negligible decline, while Solana [SOL] and Ethereum [ETH] were down 2.4% and 1.8% respectively. But Uniswap [UNI] emerged as a top daily gainer.

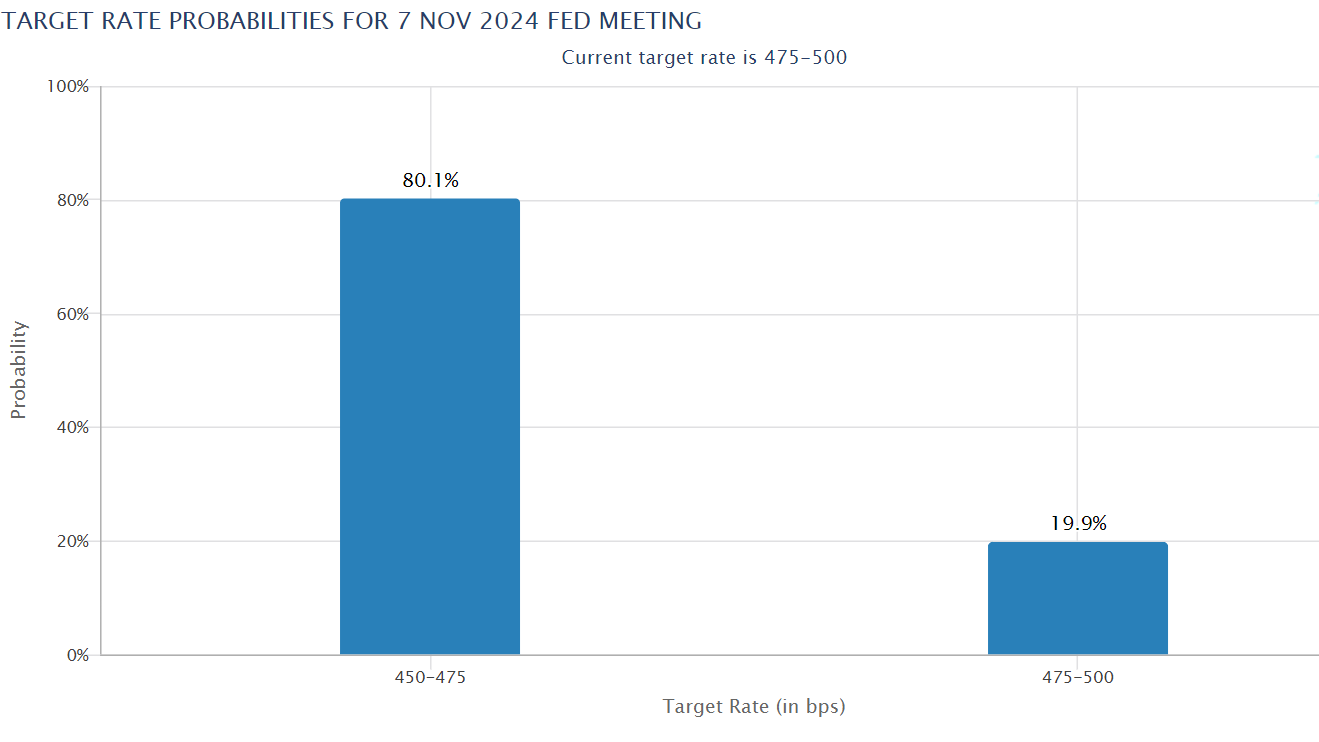

The market decline was due to FOMC Minutes, which lowered expectations of another 50 bps (basis points) Fed rate cut in November.

Notably, the minutes showed that most members supported the aggressive 50 bps Fed rate cuts in September, citing weak US labor market conditions. This was based on the data at that time.

However, the U.S. labor market has since seen remarkable growth. According to data released on the 4th of October, 250K roles were added in September, exceeding analysts’ expectations.

This meant that labor market concern, a critical factor in an aggressive rate cut projection, was off the table.

Ergo, analysts projected that the Fed would choose to implement a 25 bps rate cut or maintain current rates unchanged.

At press time, traders were pricing 80% of a 25 bps cut and a 20% chance of keeping the current rates unchanged.

Source: CME FedWatch

However, this could change depending on the September inflation data (CPI). BTC has shown increased sensitivity to Fed rate cut expectations and U.S. equities, a typical reaction common with ‘risk-on’ assets.

Interestingly, U.S. equities didn’t sink like crypto markets after the FOMC Minutes. U.S. stocks closed in green, as BTC faced increased sell pressure.

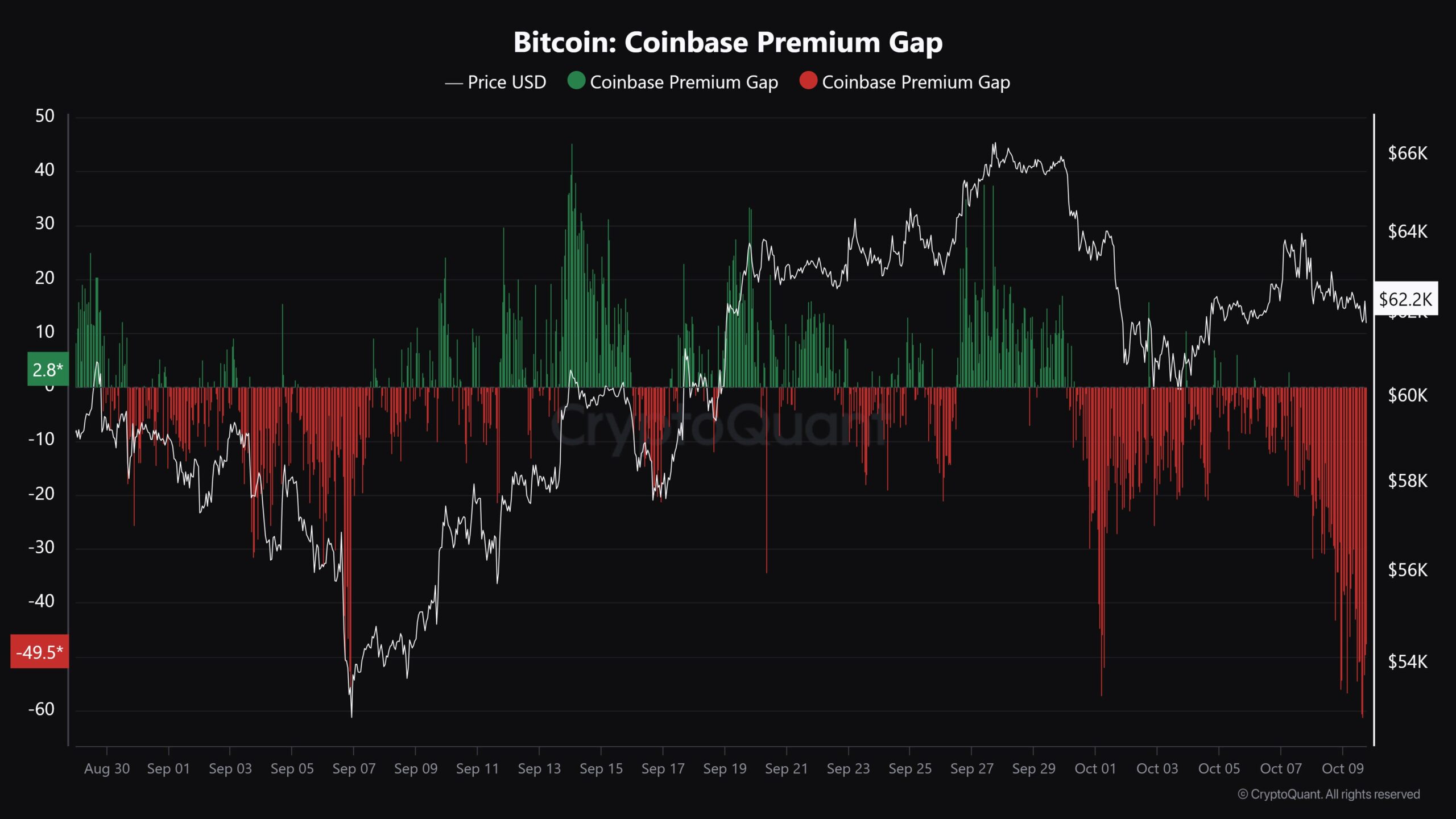

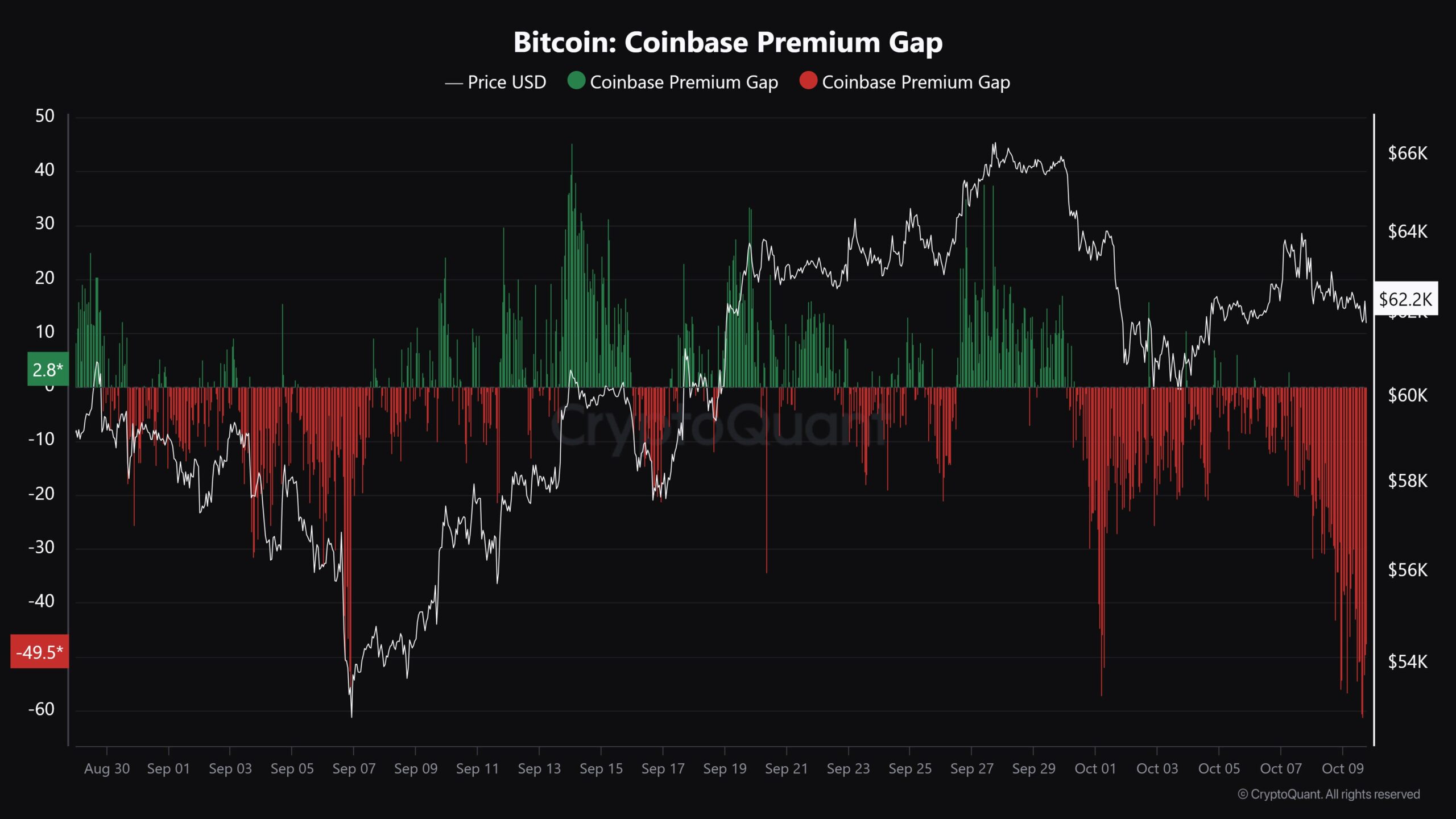

According to CryptoQuant’s JA Maartun, the BTC plunge could reverse if the U.S. investors eased the selling pressure.

“Prediction: Bitcoin is poised for a sharp rise once the Coinbase seller is finished.”

Source: CryptoQuant

On price charts, BTC was at key support near $60K. Although the support stopped the plunge in early October, whether it will hold after the U.S. CPI data remained to be seen.

Should the $60K support hold, a rebound toward the 200-day MA (Moving Average) of $63.5K would be feasible.

However, a crack below the support post-CPI could drag BTC to the next support at $58K.

Source: BTCUSDT, TradingView