- Bitcoin whales resumed shorting as price approached $65K.

- The bot tracker indicator says there is increased buy-side bot activity.

Bitcoin’s [BTC] price movement is closely watched by the market as it is the biggest cryptocurrency and thus, influences the overall market performance.

Recently, whales resumed shorting BTC as it neared $65K, sparking concerns about a potential drop before any significant upward move.

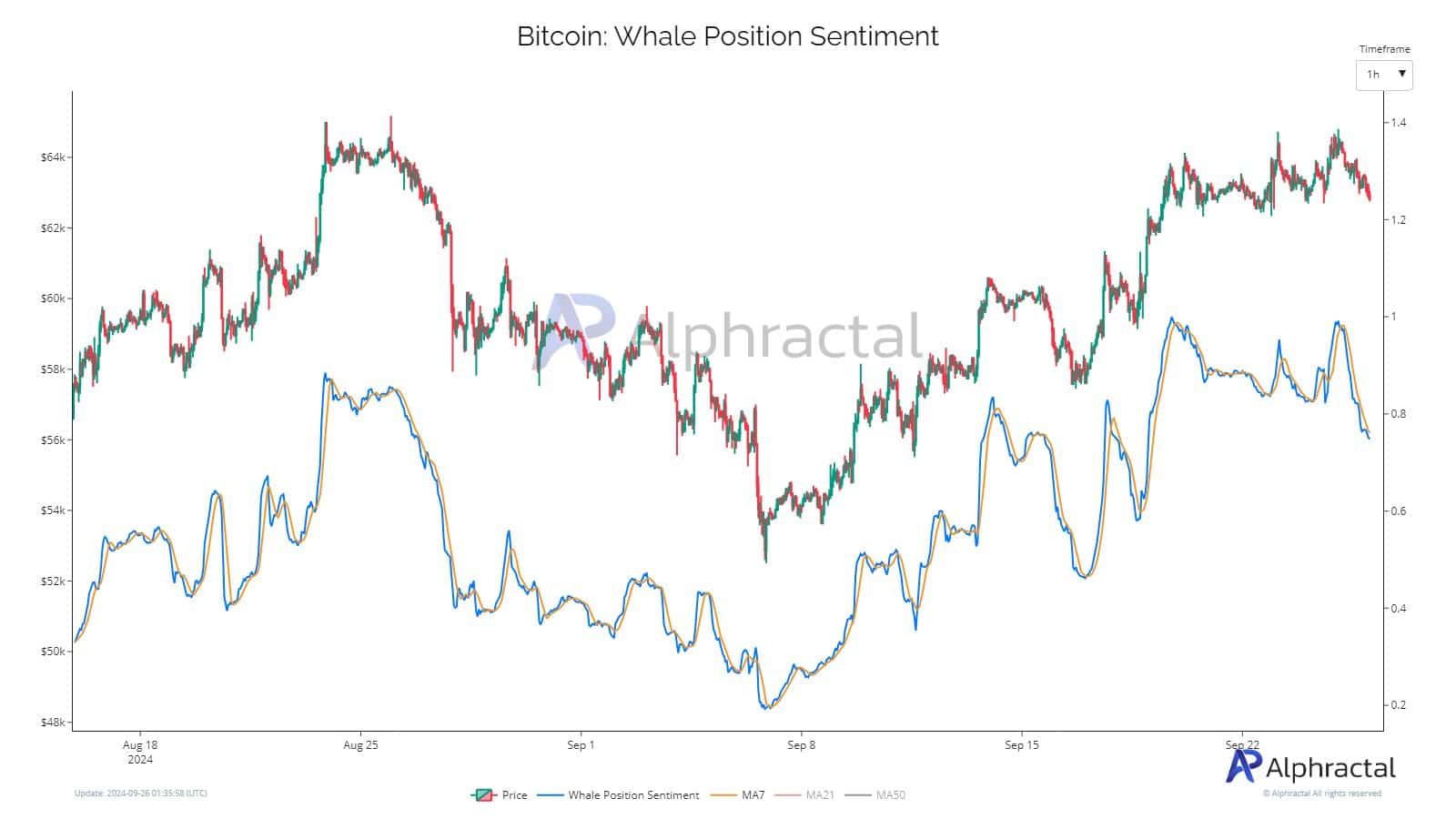

Whale Position Sentiment, an indicator tracking whale activity across exchanges, has showed a decrease in sentiment, signaling more short positions being taken. This sentiment shift often has a strong correlation with Bitcoin’s price action.

Source: Alphractal

For BTC to avoid slipping into bearish territory, it must hold above $62K, the Short-Term Holder Realized Price, a key level signaling the continuation of the current trend.

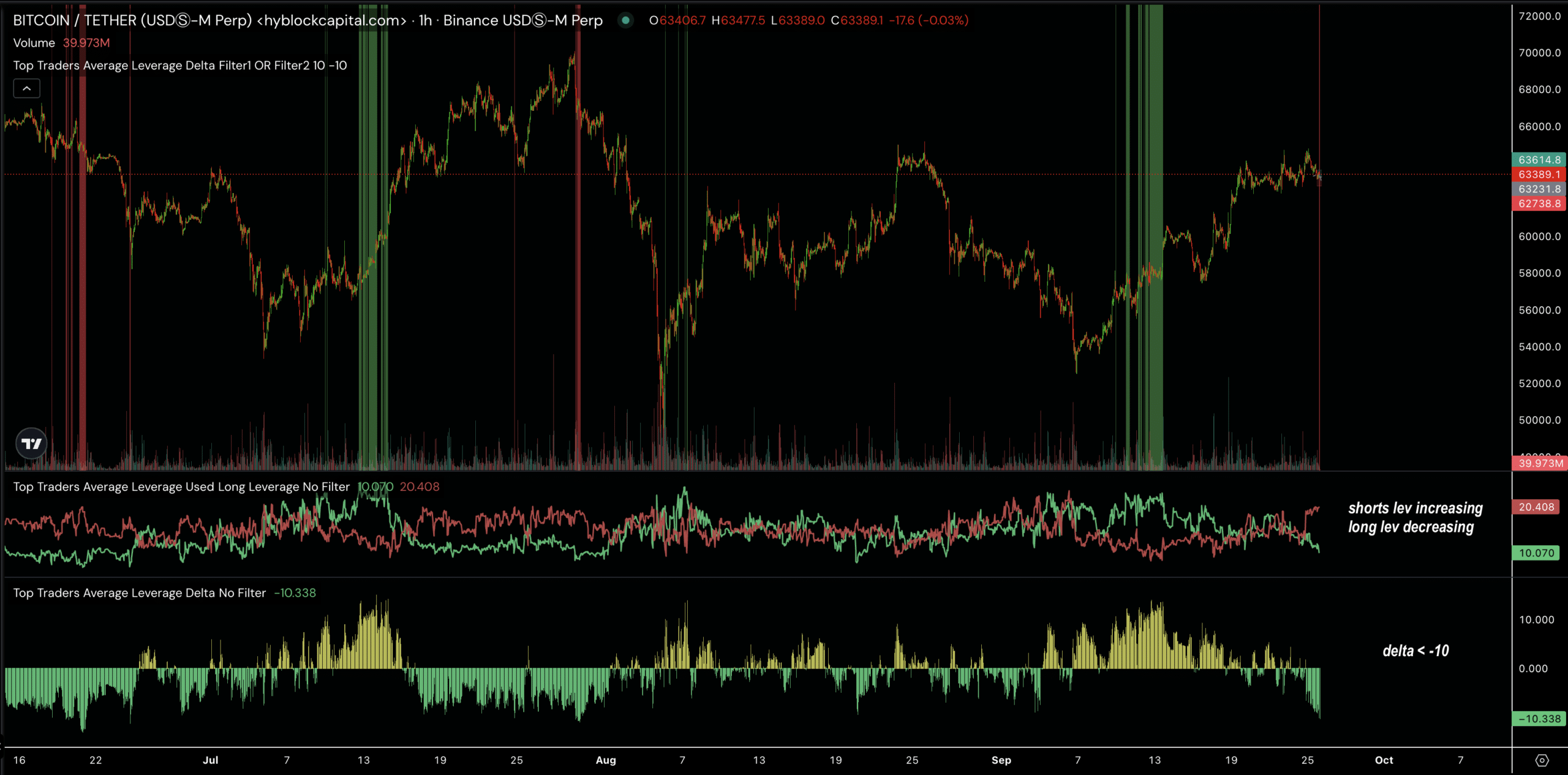

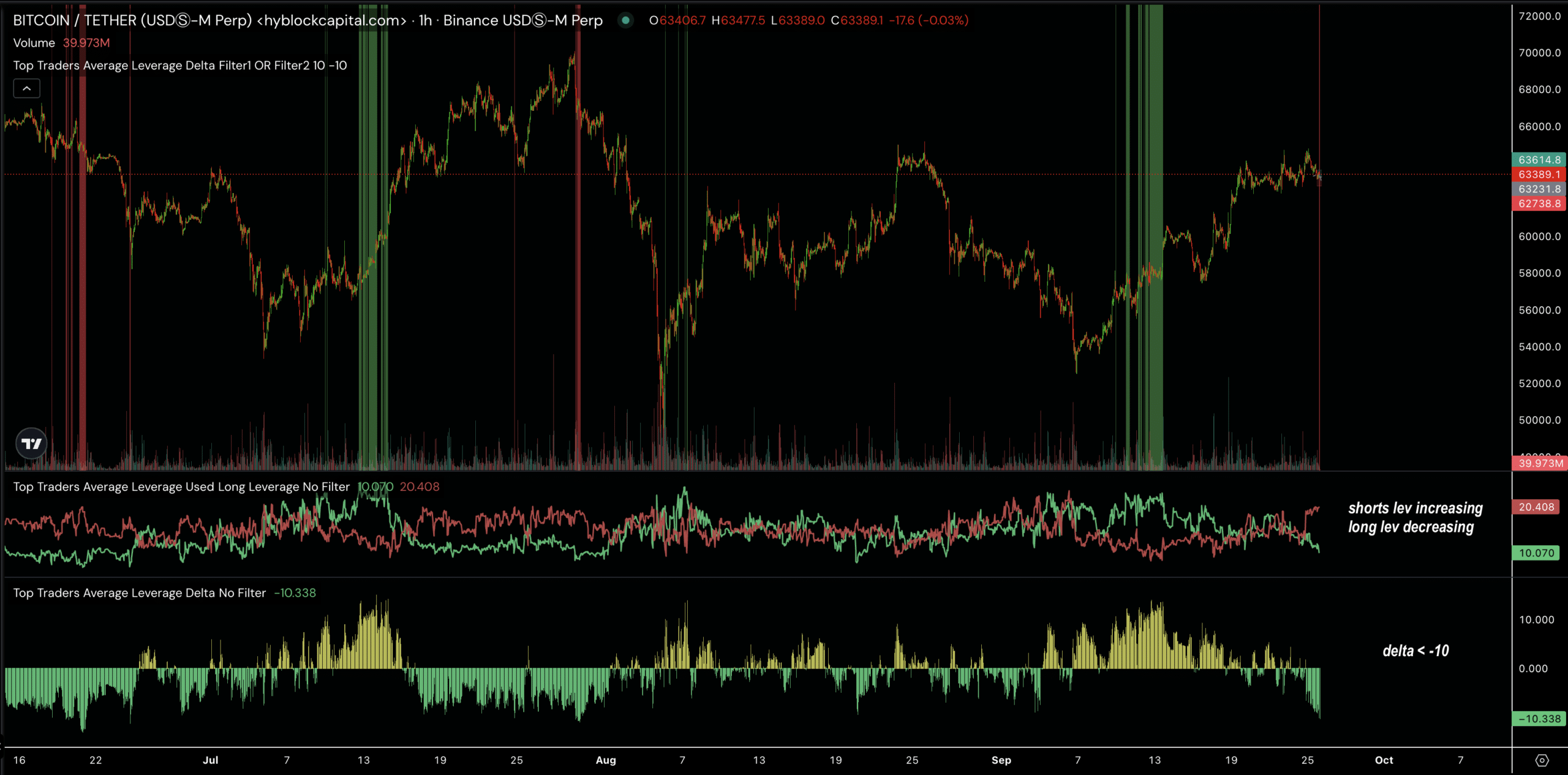

Average leverage delta

The fall in whale sentiment has caused Bitcoin’s average leverage delta between longs and shorts to drop below -10. This means that short leverage is currently dominating the market, which was previously driven by long leverage.

Although whales have shifted their positions, the average leverage delta does not confirm a bearish outlook just yet. Bitcoin is still holding above the $63K level, maintaining support at the 200 exponential moving average.

Source: Hyblock Capital

Despite the whales’ activity, this suggests that BTC may still push higher if certain conditions are met…

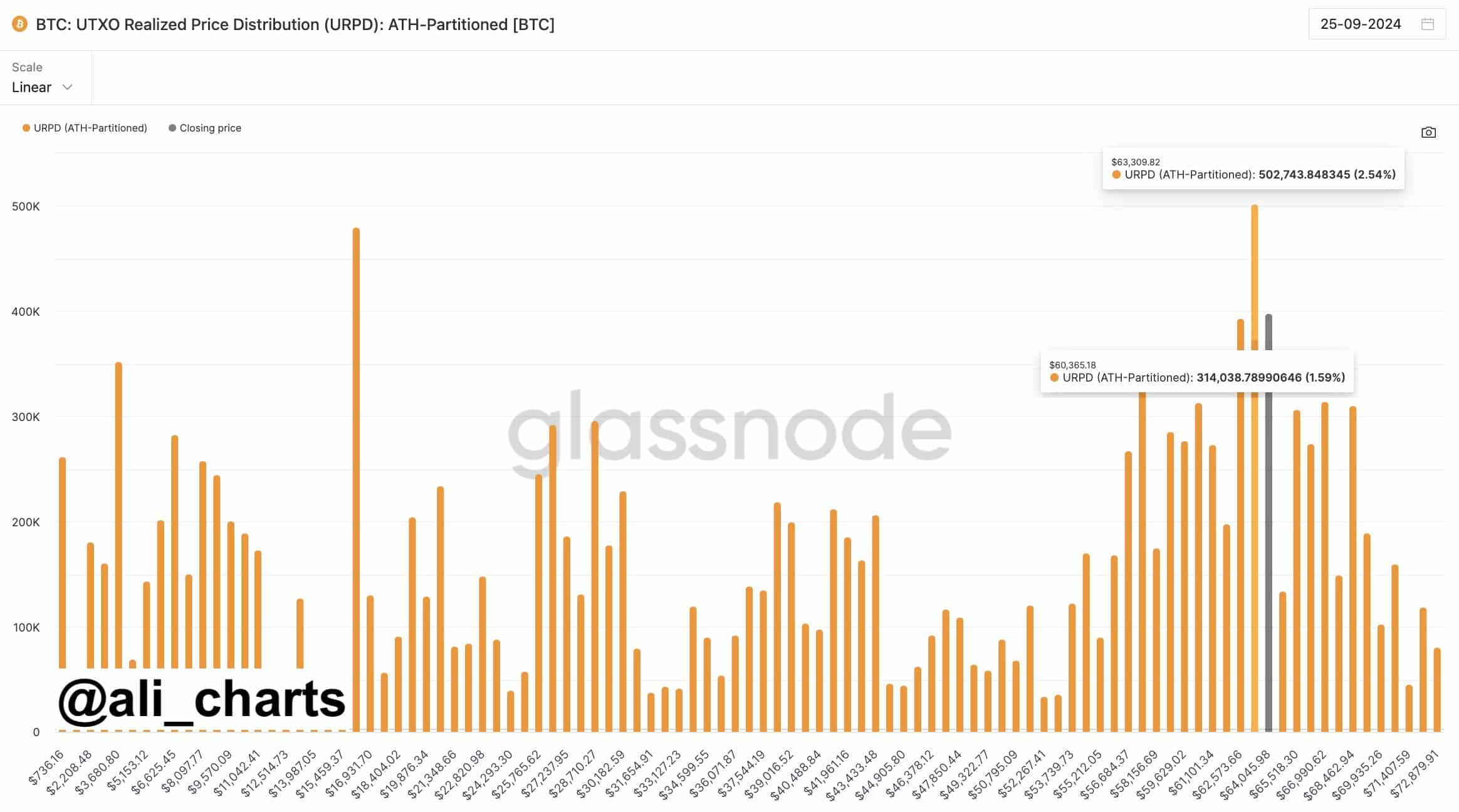

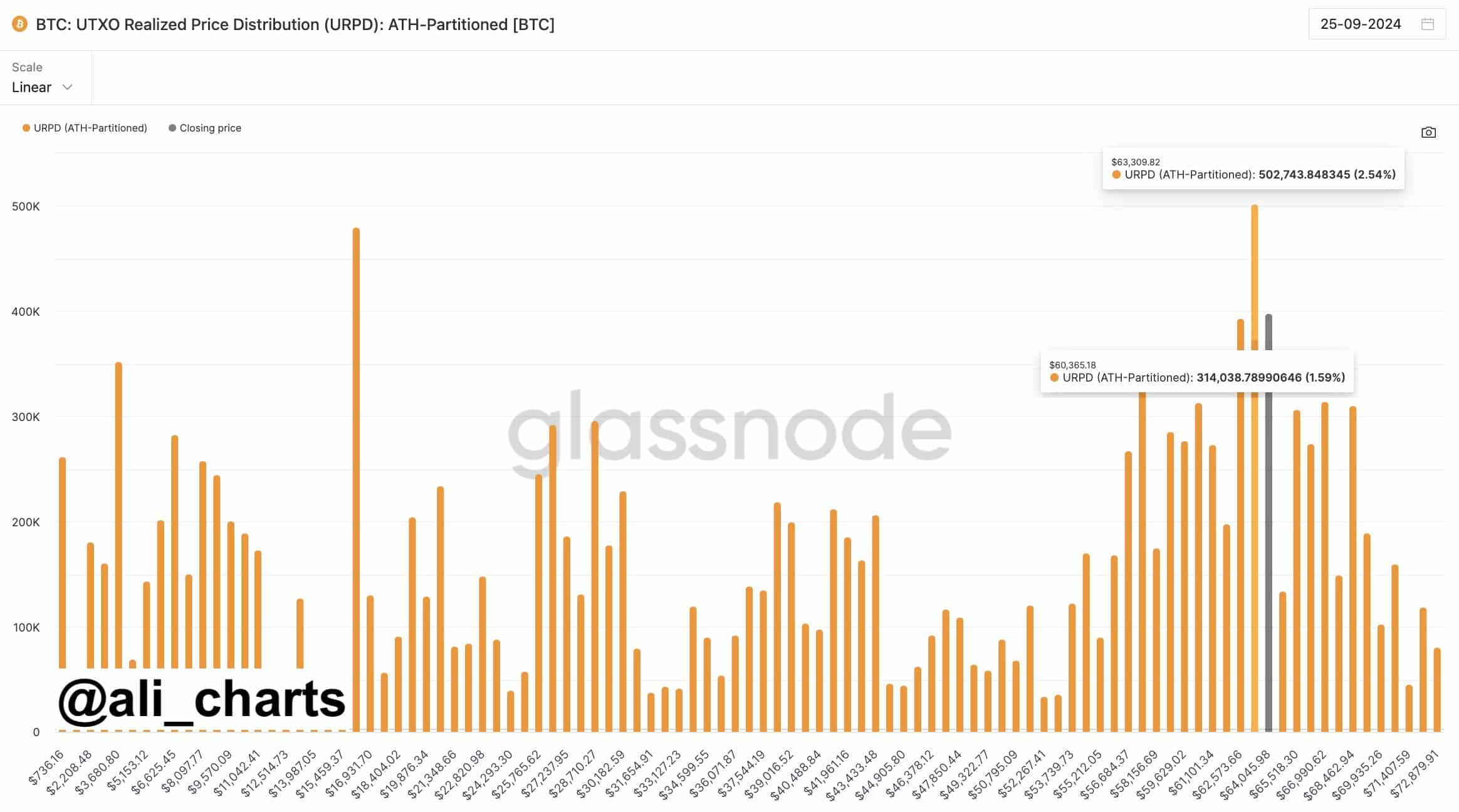

UTXO realized price distribution

The first crucial indicator supporting Bitcoin’s outlook is the UTXO Realized Price Distribution (URPD), which reveals that the $63K level serves as one of the most important support zone. This area also includes the $65K resistance level.

Source: Ali/Glassnode

If Bitcoin manages to stay above $63K, it has the potential to break through $65K. However, a drop below this support could lead to a dip to $60K before any upward move resumes. The market is carefully watching this zone to determine Bitcoin’s next direction.

Bitcoin bot tracker indicator

Further supporting a bullish outlook for Bitcoin is the Bot Tracker Indicator. This tool tracks high-frequency bot-like activity in the market, showing that bots are accumulating long positions.

Increased buy-side bot activity often correlates with a rise in price. If Bitcoin experiences a slight pullback to $60K, it could attract more whale buying at discounted prices, which may push BTC back up toward $65K, resulting in significant gains for larger holders.

Source: Hyblock Capital

While whales have resumed shorting Bitcoin as it nears $65K, the overall market structure remains intact. As long as BTC holds above key levels such as $62K and $63K, there is potential for higher gains.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bot activity and other on-chain indicators support a bullish outlook, suggesting that any dip may be short-lived before BTC makes another upward move.

Traders and investors should keep a close eye on these key support and resistance levels to gauge the market’s next move.