In January 2025, ViaBTC, in collaboration with CoinEx, published the “2024 Crypto Annual Report,” offering an in-depth analysis of the cryptocurrency market’s performance over the past year. ViaBTC focuses on the review of the cryptocurrency mining sector in 2024 and provides exclusive insights into the future trends shaping the industry in this report.

Bitcoin Mining

In 2024, the Bitcoin network’s total annual output was valued at approximately $20 billion. Because of the fourth halving, Bitcoin’s yearly output dropped by 35% compared to 2023. However, thanks to BTC’s record-breaking price highs, the overall output saw a 43% increase year-on-year, bolstering investor confidence in Bitcoin mining and driving continued growth in network hash rate.

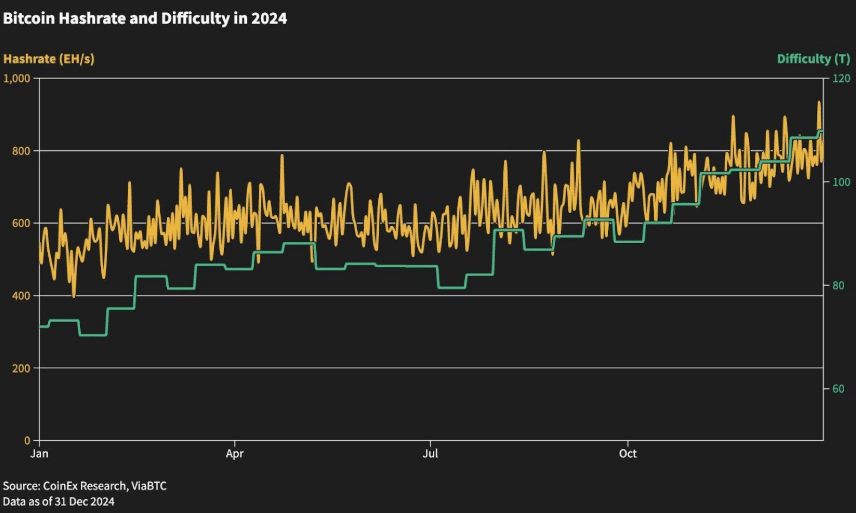

The Bitcoin network’s hashrate grew by 51% in 2024. Although the growth rate slowed slightly compared to 2023, it still outpaced the growth rates of 2022, 2021, and 2020.

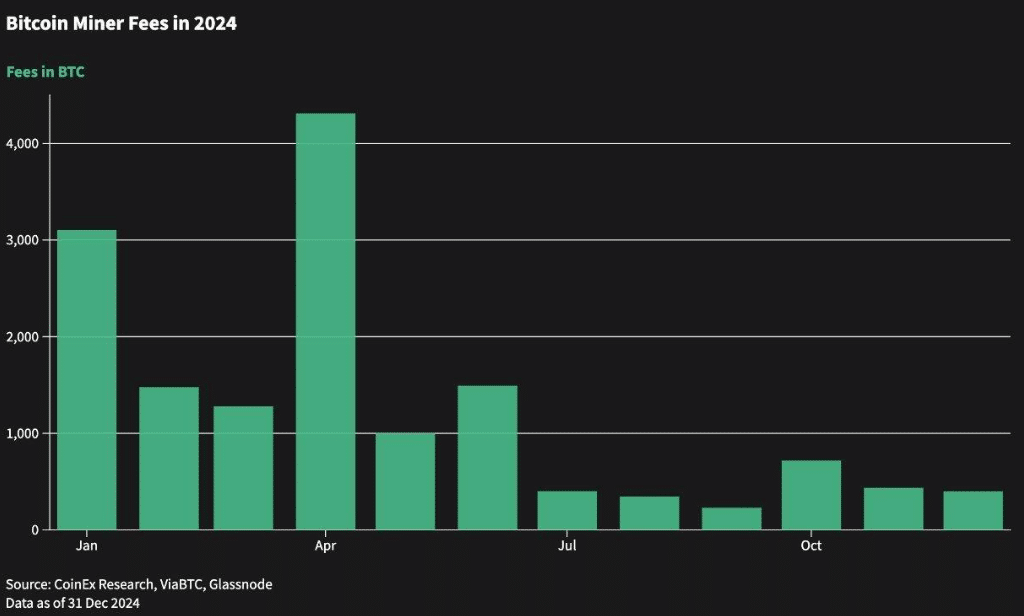

In terms of miner revenue, total transaction fees on the Bitcoin network amounted to 15,192 BTC in 2024, contributing an additional 6.98% to miners’ income. April marked the annual peak for transaction fees, reaching 4,311.66 BTC, driven by the active period of the Runes protocol following the halving. However, with a decline in the popularity of Bitcoin-related ecosystem projects during the second half of 2024, total miner fees dropped by 36% compared to 2023.

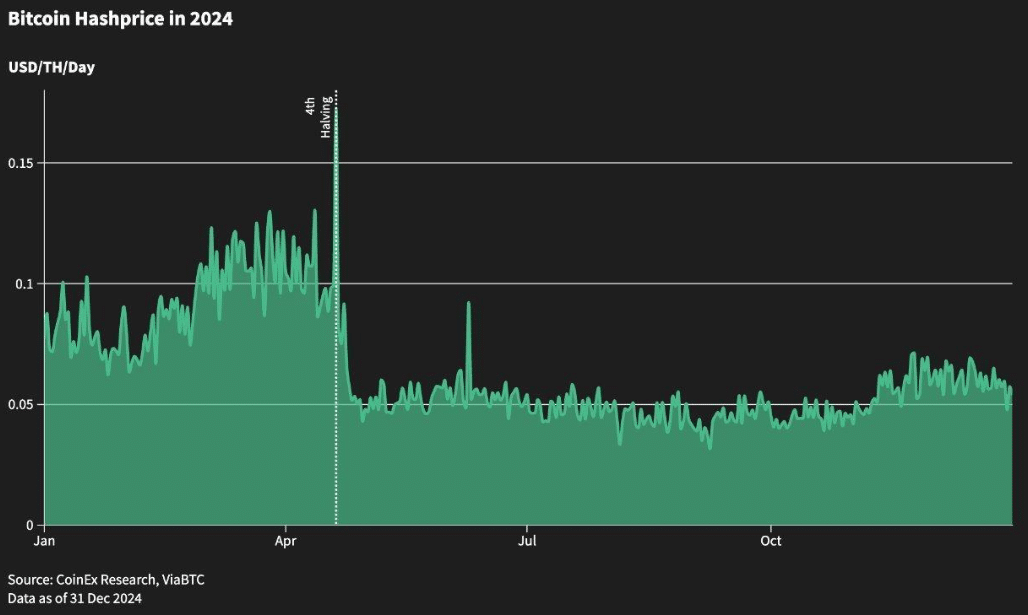

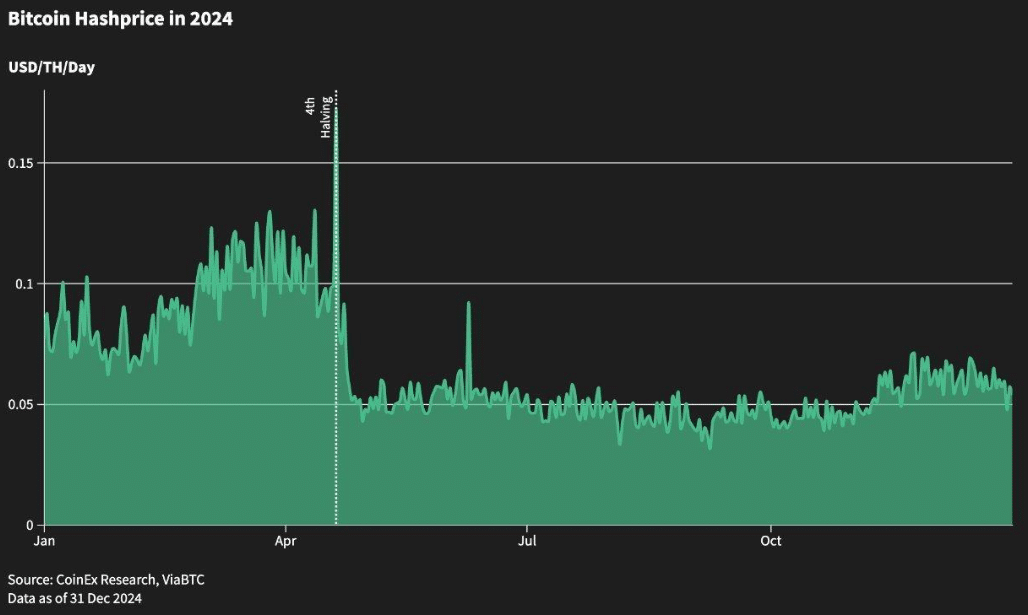

Hashprice, a key indicator of mining profitability, remained between $0.06 and $0.1 before the halving. On the day of the halving, boosted by the spike in transaction fees, hashprice reached its annual high, exceeding $0.17. However, as interest in Ordinals and the Runes protocol waned, the impact of the halving became evident, causing hashprice to drop to a historic low of below $0.04. Fortunately, as Bitcoin prices climbed steadily from October, hashprice recovered and stabilized at around $0.06.

Altcoin Mining

In 2024, the Litecoin’s annual output value reached $136 million, while its merged mining coin, Dogecoin, produced $1.57 billion. This year, meme coins like BELLS, LKY, PEPE, and JKC joined Litecoin’s merged mining. As the market rebounded, Litecoin miners saw a 48% increase in earnings per unit of hashrate, with DOGE revenue accounting for 91.76%, making it the dominant source of income for LTC miners. This stable revenue stream fueled a continued increase in Litecoin’s network hashrate, which grew by 117% throughout the year.

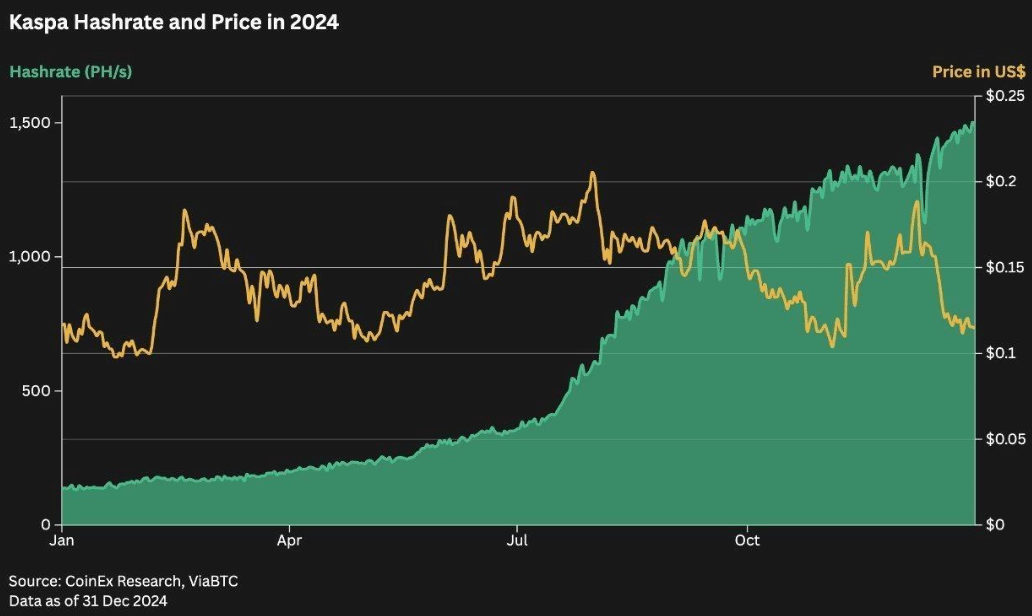

In 2024, Kaspa’s total annual output value was around $360 million, ranking as the third-largest PoW coin by value. Kaspa’s price was highly volatile throughout the year, peaking at over $0.20 in August. Its network hashrate surged from 132.19 PH/s to 1.486 EH/s, a 1024% increase year-over-year.

Alephium saw the most significant hash rate growth in 2024, with its network hash rate jumping from 0.13 PH/s to 25.327 PH/s. This rapid growth was driven by the launch of ASIC miners, specifically designed for ALPH mining, by manufacturers like Bitmain. Early strong returns on these miners attracted a large influx of miners, enabling ALPH to quickly shift from GPU to ASIC mining.

Mining Industry

In 2024, the efficiency gains of new Bitcoin mining machines slowed down, while some new manufacturers began exploring new opportunities in the altcoin mining rigs. On the other hand, home ASIC miners gained traction. Many home miners are adopting innovative solutions like heat recovery to harness the heat generated by their machines for home heating, further reducing energy costs.

The latest Bitcoin mining machines (such as the S21, M63 series) have a break-even price range of $20,000 to $50,000. For widely used previous-generation models, such as the M60, M50, and S19 series, the break-even price typically falls between $40,000 and $70,000. Across the board, most bitcoin mining rigs have a ROI period of around two years.

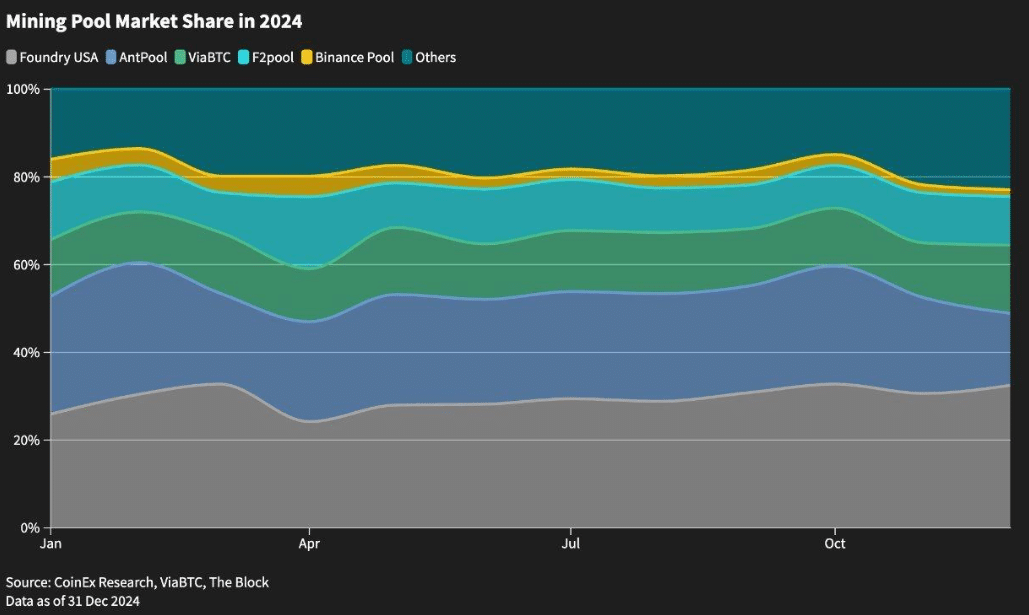

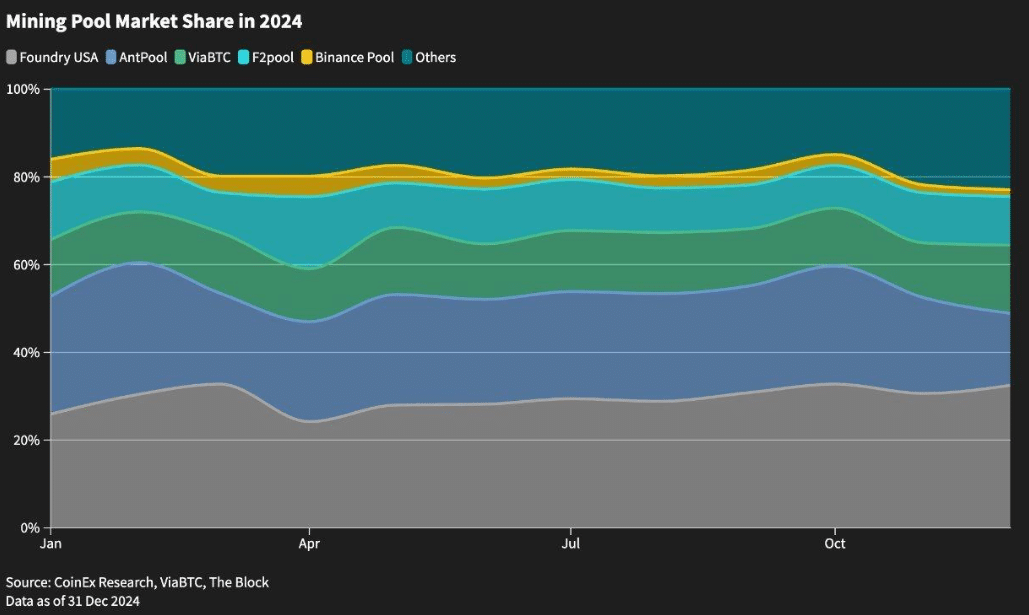

As the network difficulty continues to rise, the number of solo miners continues to decline, with more miners choosing to join mining pools. In 2024, Bitcoin mining pools accounted for 97.9% of the total network output. Foundry USA’s market share increased to 32.50%, while ViaBTC’s share rose to 15.56%, and AntPool and F2Pool’s shares dropped to 16.39% and 11.11%, respectively.

Regarding energy, Bitcoin mining is gradually shifting toward renewable energy sources. According to Woocharts data, the proportion of renewable energy used in Bitcoin mining has reached 56.76%, surpassing traditional energy sources. As mining costs continue to rise, miners worldwide are searching for more cost-effective energy sources and increasingly demanding greater policy stability:

- North America: With stable policies and abundant power resources, North America is one of the largest Bitcoin mining markets globally. In the U.S., large mining farms are being built in states such as Texas, Georgia, and New York.

- Russia: Known for its abundant and low-cost energy, Russia has attracted significant mining investments. However, 2024 saw stricter regulations, including a ban on mining in regions like Dagestan and temporary mining bans in areas like Irkutsk during peak energy demand periods. The long-term impact of these policies remains to be seen.

- Africa and South America: These regions are rapidly emerging as key players in Bitcoin mining. In Africa, Ethiopia’s approval of Bitcoin mining has drawn substantial investments from mining companies. In South America, restrictive mining policies in Paraguay have prompted some miners to relocate to neighboring countries like Argentina.

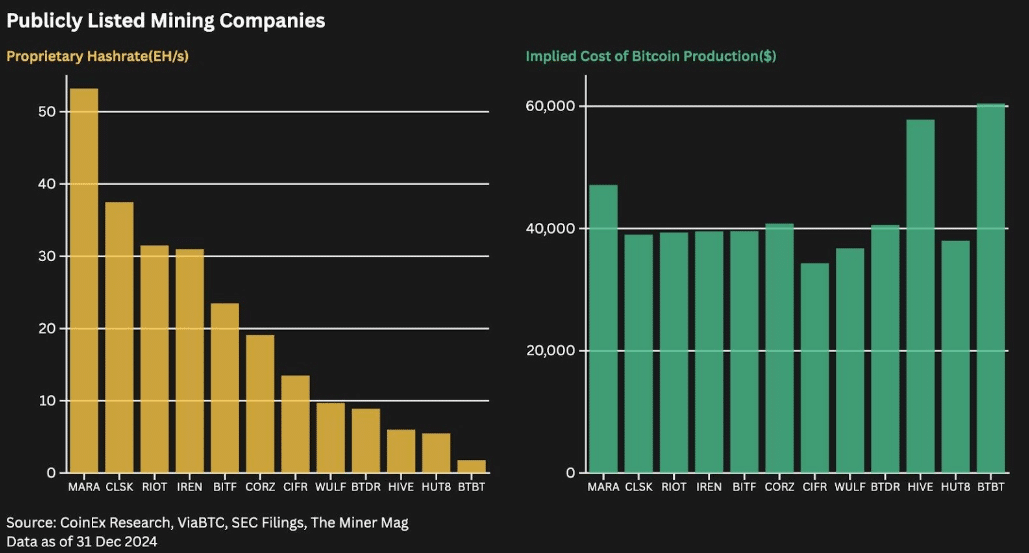

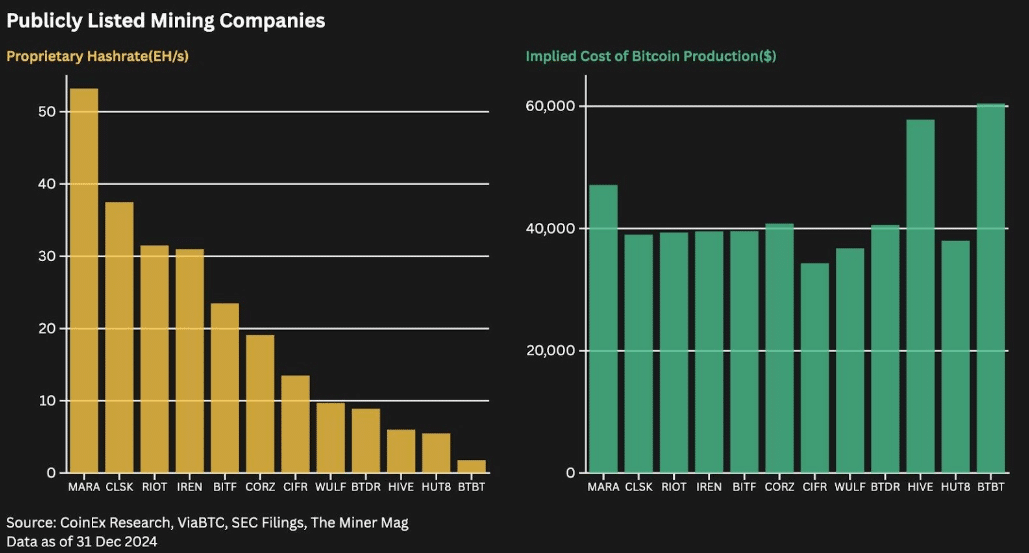

Institutional investment in mining companies continues to rise, with over ten Bitcoin mining companies successfully listing in the United States. As of December 2024, these listed companies’ combined hashrate accounts for over 30% of the global Bitcoin network hashrate, surpassing 240 EH/s, a 132% year-on-year increase, far outpacing the overall Bitcoin network’s annual growth. With the U.S.’s abundant financing options, these publicly listed mining firms can expand rapidly while effectively reducing operational costs, with production costs ranging between $30,000 and $60,000 per BTC.

Summary

In 2024, despite facing challenges such as the halving event the crypto mining industry showed resilience, with Bitcoin and altcoin hash rates continuing to rise, producing over $22 billion in total value. Bitcoin remains the dominant PoW coin, accounting for over 90% of miner earnings, while LTC and merged mining coins like DOGE contributed 7%.

Bitcoin’s fourth halving marked the start of a new mining cycle, driving miners to optimize efficiency. However, the efficiency improvements driven by hardware upgrades have diminished, and more manufacturers are focusing on home mining rigs, with heat recycling becoming a key topic.

Meanwhile, the hashrate controlled by institutional mining companies has increased further. With sufficient resources, institutional miners have reduced operational costs and strengthened their competitive edge. Some are diversifying into AI and HPC to explore new profit opportunities beyond crypto mining.

Looking toward 2025, with favorable market trends, cryptocurrency mining is expected to continue growing. PoW cryptocurrencies, due to their straightforward nature and market acceptance, are likely to attract more attention from the public and investors, with hash rates anticipated to rise further. At the same time, as the scale of mining operations expands, the regulatory related to crypto mining will continue to emerge across countries. These regulations may include energy restrictions or a more favorable stance towards the industry. Miners and investors should keep a close eye on policy trends and prepare for potential shifts.

For more in-depth information about the crypto industry, please refer to the “CoinEx &ViaBTC | 2024 Crypto Annual Report“

About ViaBTC

Founded in May 2016, ViaBTC has provided mining services to over one million users across 150+ countries and regions, supporting more than twenty types of cryptocurrencies, including BTC, LTC/DOGE, and KAS. With total mining output surpassing several billion dollars, ViaBTC ranks among the top three BTC mining pools and is the number one LTC mining pool globally.

As a pioneer in the cryptocurrency industry, ViaBTC is committed to a user-first philosophy, offering a secure, stable, and efficient mining experience to global users through robust technology, reliable products, comprehensive tools, and efficient customer support.

Disclaimer: This is a paid post and should not be treated as news/advice.