- Uniswap sees a sharp decline in large transactions.

- Metrics signal a potential continued bullish momentum.

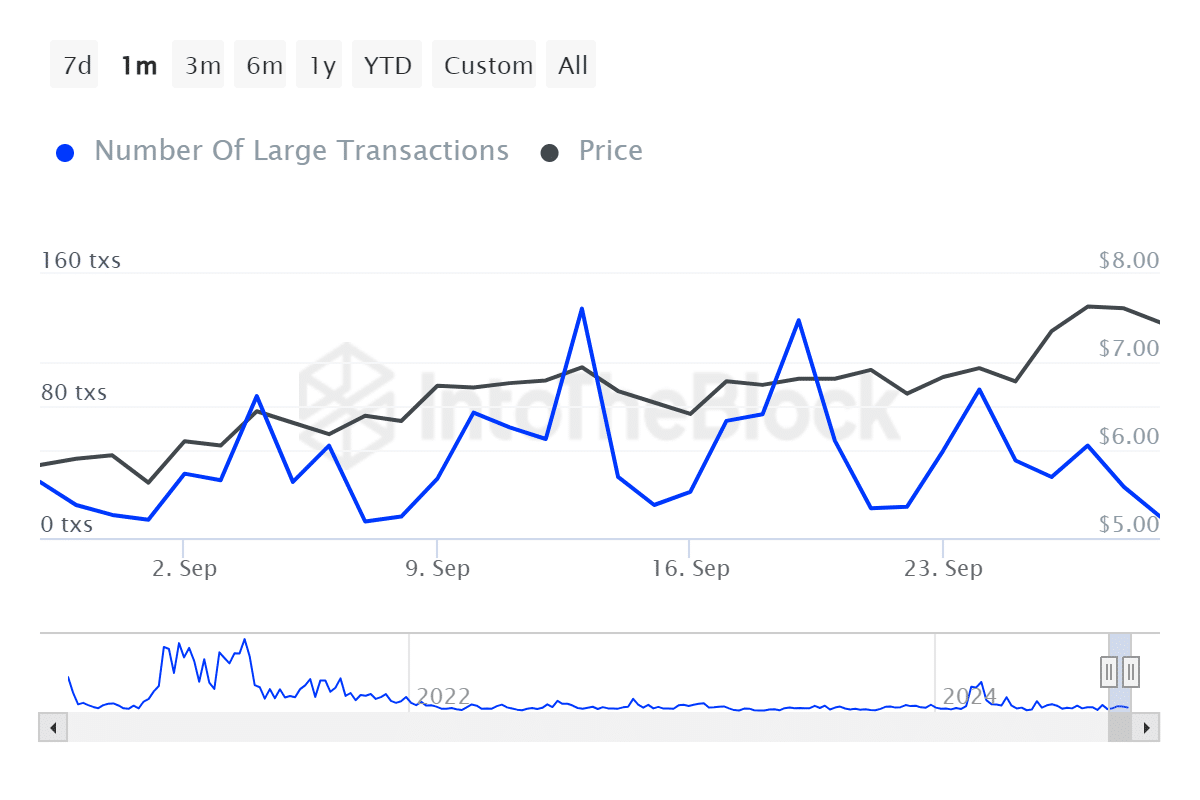

Uniswap [UNI] has recorded a heavy slip in large transactions, but the market sentiment remains fairly optimistic. A significant percentage of holding addresses increased amid the growth in daily active addresses.

Despite the 64% drop in large transfers, an increase in the number of active addresses and a positive percentage of holding addresses suggest that more momentum is left in the uptrend.

Uniswap big dip, but not a slip

Uniswap has suffered a sharp 64% decline in large transactions. This reduction in high volume trades might indicate large investors are being cautious or shifting to other platforms.

Yet it does not seem to reflect the general state of the DEX. The Uniswap ecosystem still shows strength despite this decline.

Source: IntoTheBlock

Source: IntoTheBlock

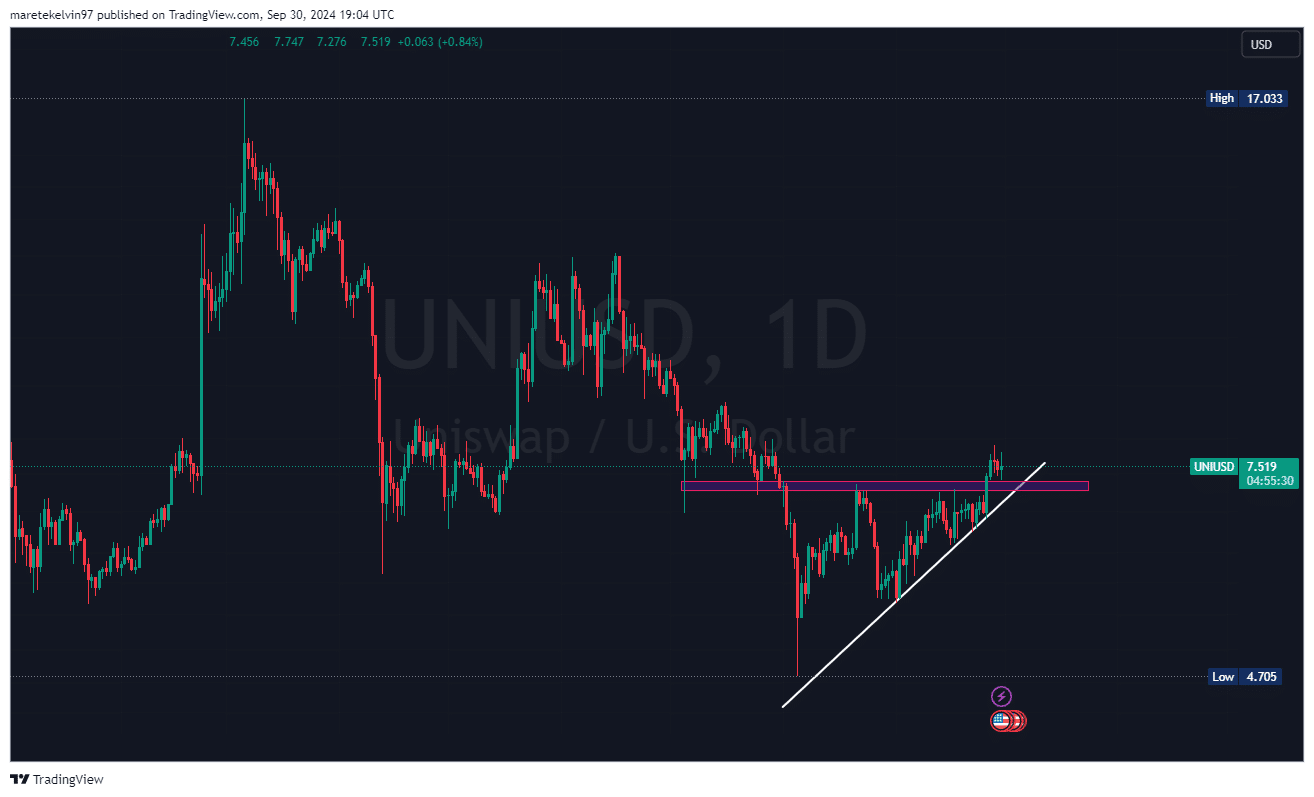

Bullish momentum grows without a rush

While large transactions are down, Uniswap’s price movement has taken a bullish tone. The token has been gaining upward momentum on the charts, indicating that the market sentiment is becoming positive.

Market participants are now starting to take notice of the bullish setup on Uniswap and could be fueling further price action in the future.

Source: Tradingview

Uniswap daily growth indicates market flow

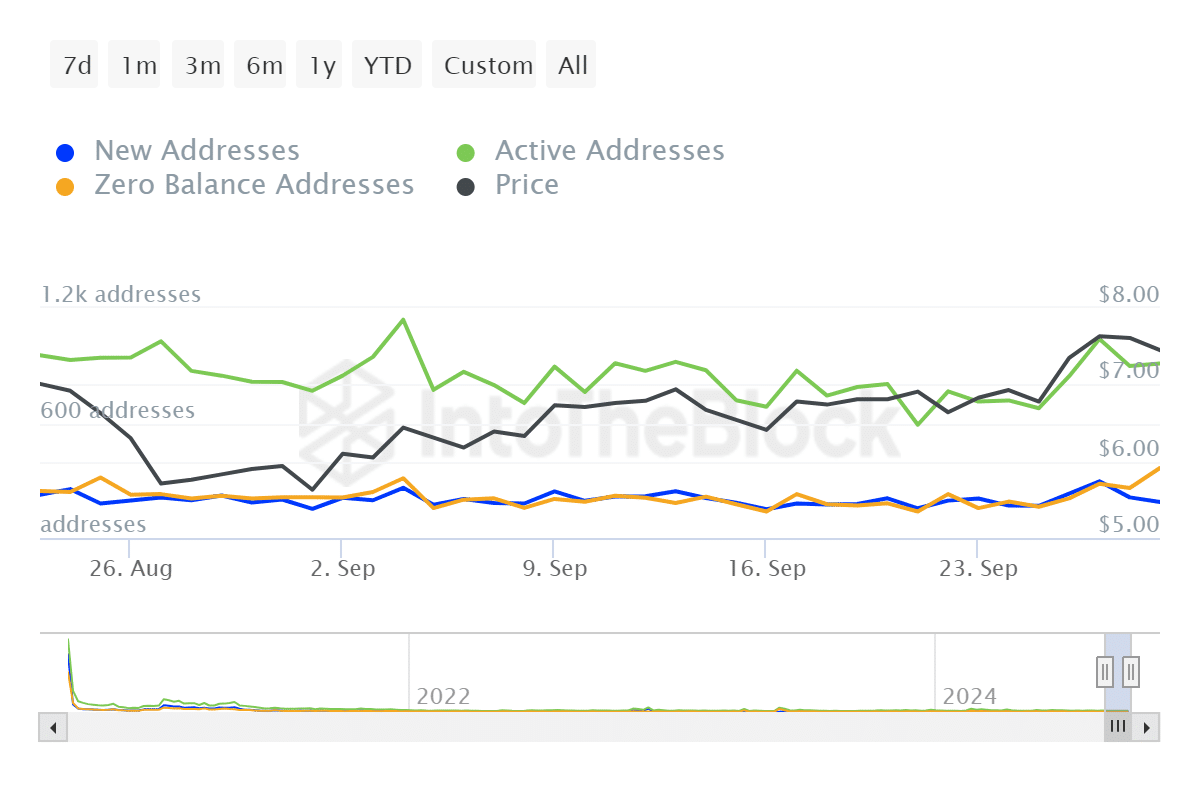

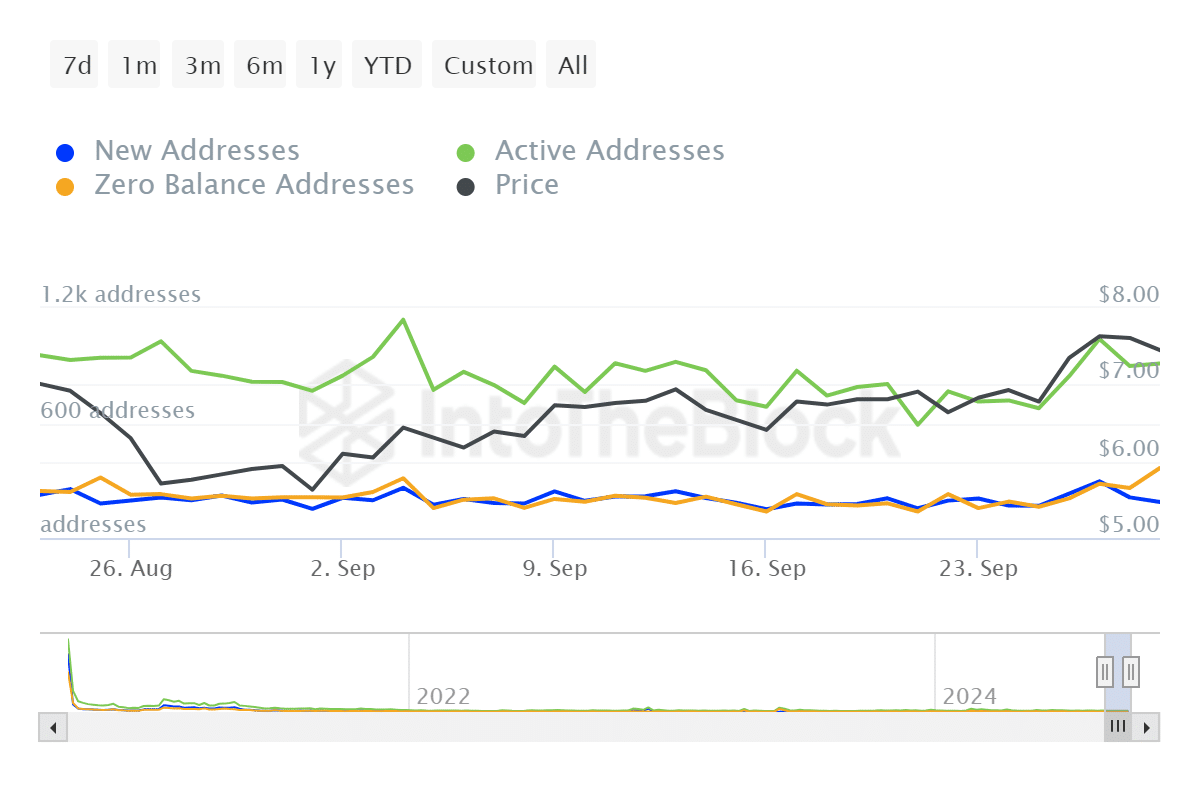

In the last 24 hours, Uniswap has also seen a 2% gain in active daily addresses. The increase in the number of active addresses points to higher user participation.

This further indicates that market participation is becoming more interactive with the exchange.

The more the number of active users grows, the more substantial liquidity there tends to be to possibly support upward price movement.

Source: IntoTheBlock

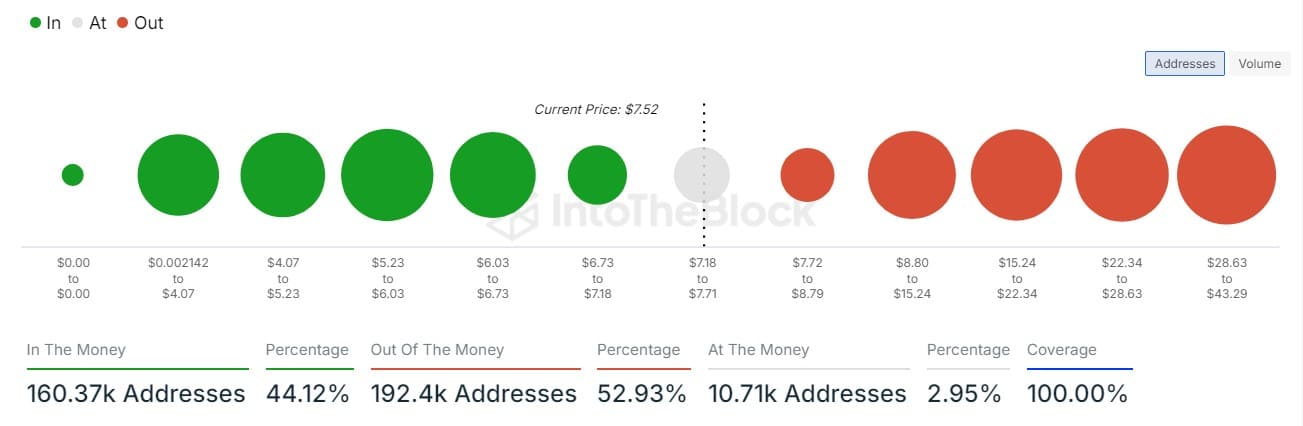

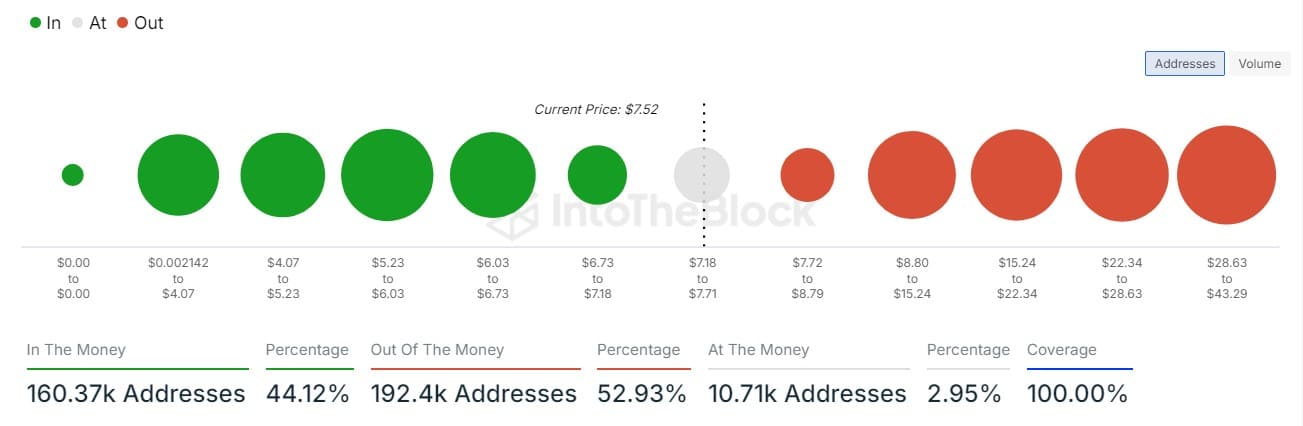

Holding addresses in profit fuel optimism

A significant 44% of the holding addresses are currently in profit. This adds more market optimism for Uniswap.

Such profitability suggests a very strong position for many Uniswap holders, which may raise confidence in the token’s long-term potential.

Based on this setup and the current bullish momentum, these metrics tend to point toward further shifts to the upside.

Source: IntoTheBlock

Is your portfolio green? Check out the UNI Profit Calculator

Though the number of large transactions on Uniswap is declining, it does not eradicate a bullish outlook.

Indeed, an increase in the number of daily active addresses and a large number of holders in profit suggest that Uniswap’s bullish rally might still be yet to come.