- Price action suggests that SOL could easily reach the $195 level in the coming days.

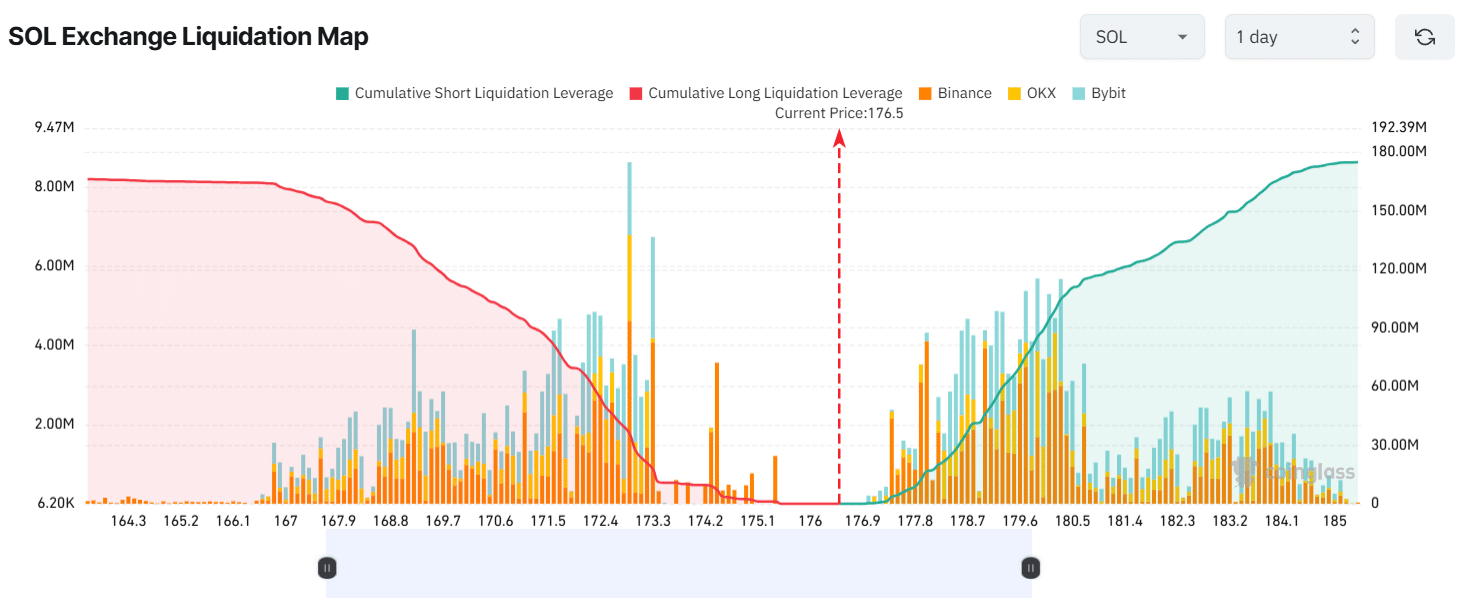

- SOL’s liquidation data indicates that bulls are currently dominating the asset, meaning bets on the long side are significantly higher.

It appears that whales are back in action, as Solana [SOL], the world’s fifth-largest cryptocurrency by market cap, approaches the breakout level of $195.

Whales bags $35 million of Solana

On 28th October, the blockchain-based transaction tracker Lookonchain posted on X (previously Twitter) that whales accumulated a significant 202,400 SOL worth $35 million in the past week.

In addition, these whales have staked their acquired SOL tokens, suggesting optimism among traders around SOL as a long-term investment. According to data, these notable SOL acquisitions were made by only three whales.

Lookonchain noted that the whale wallet address “AA21BS” withdrew over 153,511 SOL worth $26.4 million. Another wallet address “EHax,” withdrew 35,498 SOL worth $6.12 million, and the last whale’s wallet address “EGzi,” withdrew 13,000.8 SOL worth $2.3 million.

However, these notable withdrawals were made from the Binance and Kraken cryptocurrency exchanges.

Solana technical analysis and key levels

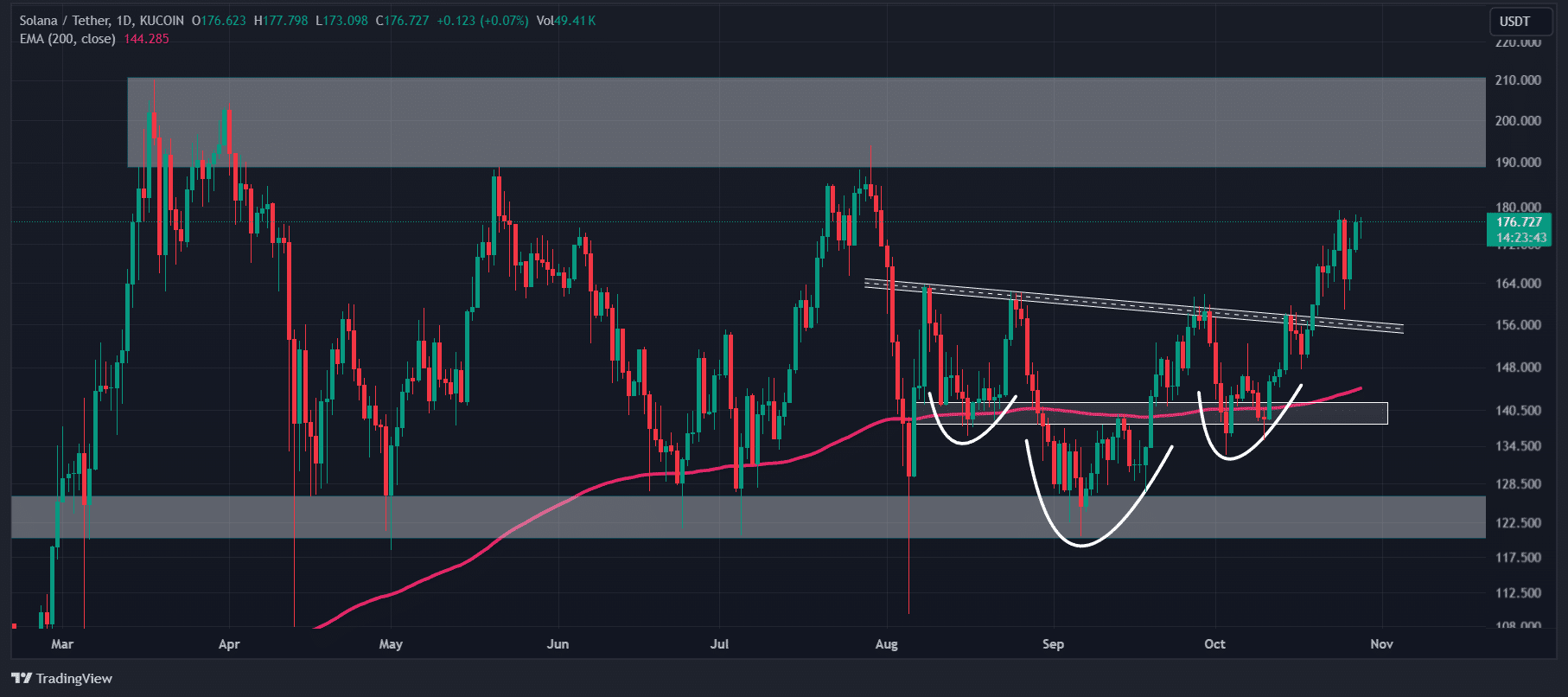

As per the data, these significant accumulations followed the breakout retest of a bullish inverted head and shoulders pattern, indicating a positive outlook for SOL holders.

Source: TradingView

According to AMBCrypto’s technical analysis, SOL appears bullish and is approaching a crucial resistance level of $195. Based on recent price action, there is a strong possibility that SOL could reach the $195 level in the coming days.

However, these notable SOL acquisitions and the current sentiment suggest that SOL has the potential to reach its all-time high of $260 level in the coming days. As of now, the 200 Exponential Moving Average (EMA) indicates an uptrend.

Mixed on-chain metrics

Despite this positive outlook, SOL on-chain metrics hint at a mixed sentiment. According to the on-chain analytics firm Coinglass, SOL’s Long/Short ratio currently stands at 1.03, indicating a bullish sentiment among traders.

However, its open interest has dropped by 7%, suggesting a potential liquidation of short positions amid the recent rally.

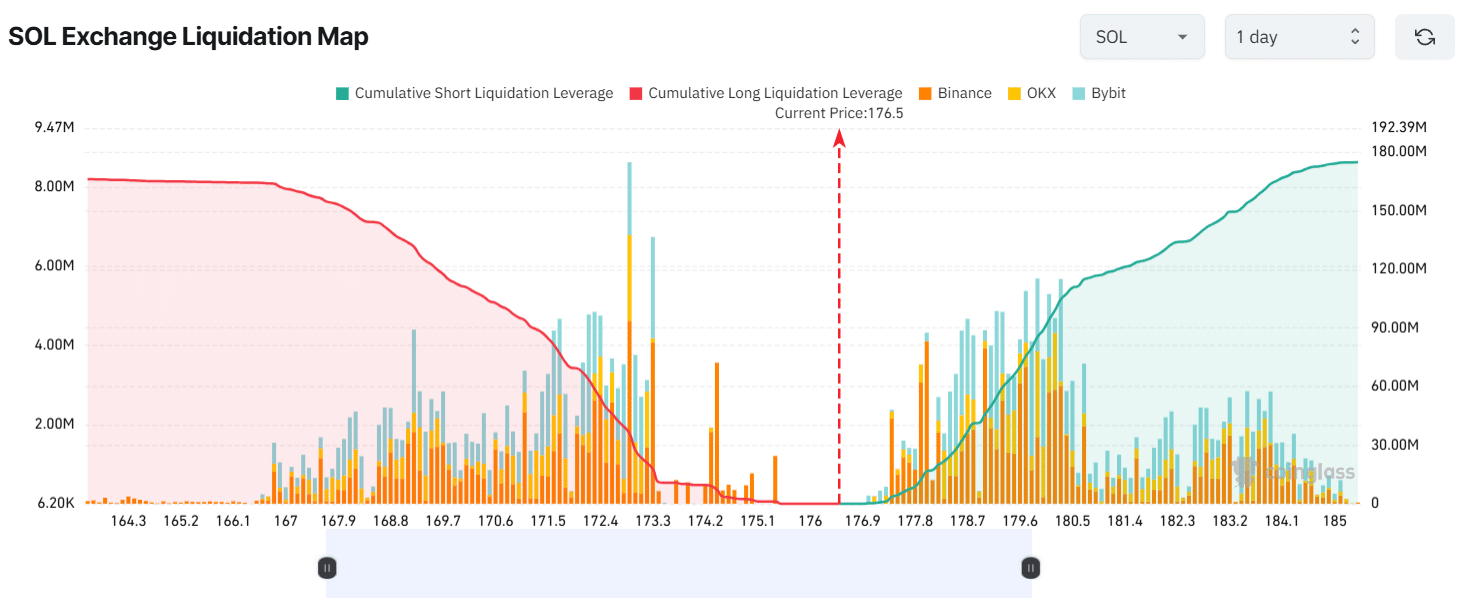

As of now, the major resistance levels are at $172.9 on the lower side and $178 on the upper side, with traders over-leveraged at these levels, according to the Coinglass data.

Source: Coinglass

If SOL’s sentiment remains unchanged and the price rises to $178, nearly $16.70 million worth of short positions will be liquidated. Conversely, if the sentiment shifts and the price drops to $172.9, approximately $36.06 million worth of long positions will be liquidated.

Is your portfolio green? Check out the SOL Profit Calculator

This liquidation data indicates that bulls are currently dominating the asset, as long positions are double the short positions.

At press time, SOL was trading near $176.33 and has experienced a modest price surge of 1.2% in the past 24 hours. During the same period, its trading volume jumped by 30% indicating heightened participation from traders and investors amid whale participation.