- Two market analysts have forecasted a downturn for Solana’s price action

- AMBCrypto is predicting a near-term descent to $120 or possibly lower for SOL’s price

Over the last 40 days, Solana has faced some significant challenges on the charts, with SOL down by 17.26%. This downward trajectory could accelerate as further insights supporting the decline are revealed.

Notably, after this drop, SOL can be expected to trade higher, which is why the latest decline might be the final catalyst for a major move up.

Crossroads for SOL, potential decline anticipated

According to Carl Runefelt, a prominent market analyst, SOL is at a vital juncture right now and could either rise or fall in the coming days. As per his analysis, Solana is now trading within a descending triangle, a pattern that could have bullish or bearish outcomes depending on its formation.

Source: Trading View

In fact, Runefelt is predicting a potential drop to $112.5 if bears dominate the market. On the contrary, he is also backing the likelihood of a rise to $155—just above the pattern’s peak—where significant liquidity is likely.

Echoing this sentiment, analyst Kaleo also foresees a sharper decline for SOL, targeting the $80-mark. This level has been identified as a key support area, one expected to attract enough liquidity to counteract selling pressure and propel prices higher.

Source: Trading View

In his words,

“[SOL will reach a] new all-time highs.”

Kaleo had previously projected $120 as a critical support zone to push SOL to new highs. However, his focus shifted to the $80-level as market conditions evolved.

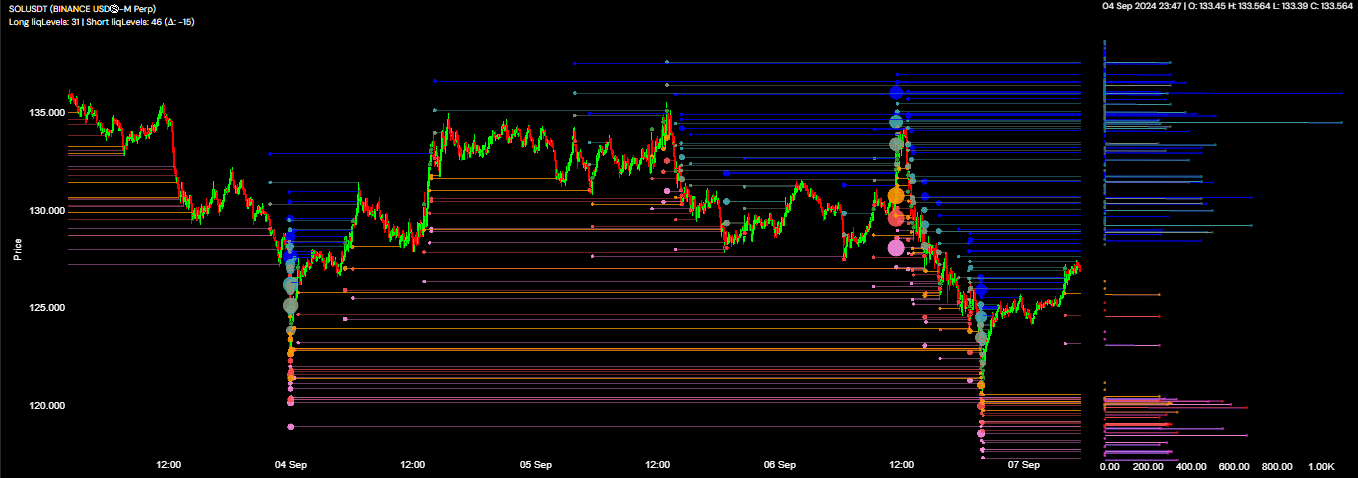

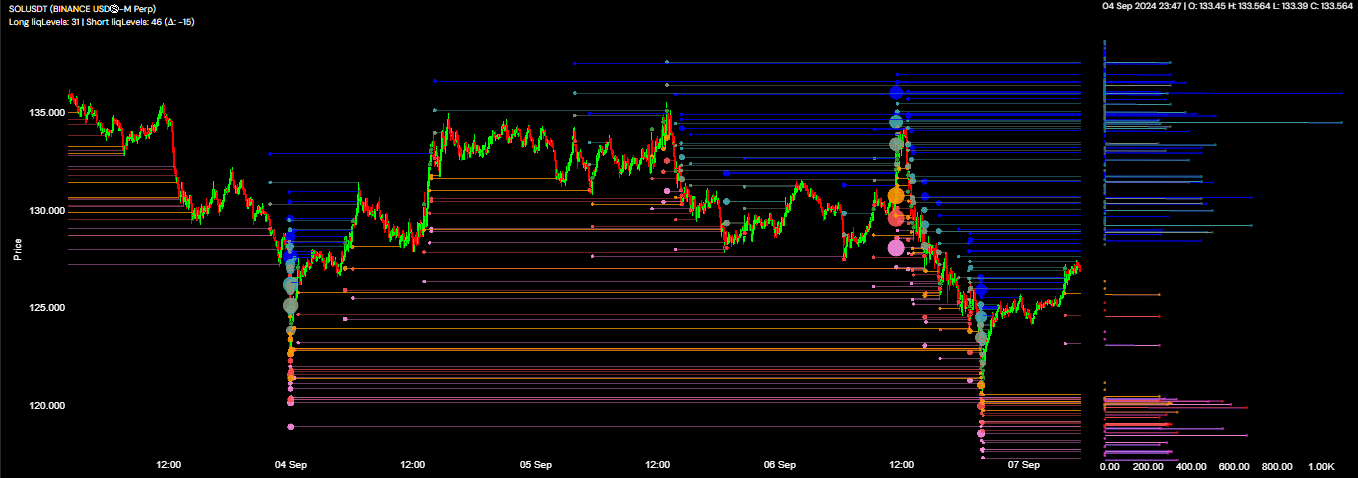

AMBCrypto also observed a trend on Coinglass where long traders, who expected a price hike for SOL, faced losses. In fact, $8.99 million was lost in the last 24 hours as the market moved against their positions.

Additionally, according to Hyblock, the cumulative liquidation level delta turned negative with a reading of -15. This indicated that short sellers have started to dominate the market.

Further analysis revealed a significant liquidity cluster at and below the $120-level, suggesting that the price will trade lower into these liquidity areas. This can potentially clear existing liquidity clusters before acting as a pivot point for price reversals upwards.

Source: Hyblock

AMBCrypto then went a step further to monitor Open Interest to predict SOL’s next move.

Traders are invested in SOL’s fall

The Open Interest (OI), a metric which measures the total active contracts in a market to gauge liquidity and market sentiment, indicated a bearish outlook for SOL.

At the time of writing, the Open Interest had fallen by 4.97% to $1.94 billion in just 24 hours. This decline suggested that traders anticipated a drop in SOL’s price, with the altcoin trading at $127.49.

If this bearish sentiment persists, SOL’s price might likely fall further from the aforementioned level.