- Solana is currently the fifth-largest digital asset.

- SOL’s price surged to an ATH before retracing.

In an interesting turn of events, Solana [SOL] briefly surpassed Tether [USDT] to claim the fourth-largest spot in the cryptocurrency rankings by market capitalization.

This surge was driven by a remarkable rally in SOL’s price, which soared to a high of $295 in the last trading session.

While SOL has since retraced to the fifth position with a market cap of $126 billion, the question remains: Could Solana challenge Ethereum [ETH] next?

Memecoin mania fuels Solana

Solana’s brief flip of USDT was fueled by a significant boost in network activity, attributed to the launch of the OFFICIAL TRUMP memecoin.

The memecoin’s debut on Solana has brought substantial liquidity, spiked trading volumes, and heightened investor interest.

Early reports show that the token has captured social media attention, increasing adoption and transactions on the Solana blockchain.

Notably, daily transactions surged to 850,000, while trading volume exploded from $9 billion to $20 billion within 48 hours. Furthermore, Solana’s Total Value Locked (TVL) reached an unprecedented $11.3 billion.

Technical indicators signal strong momentum

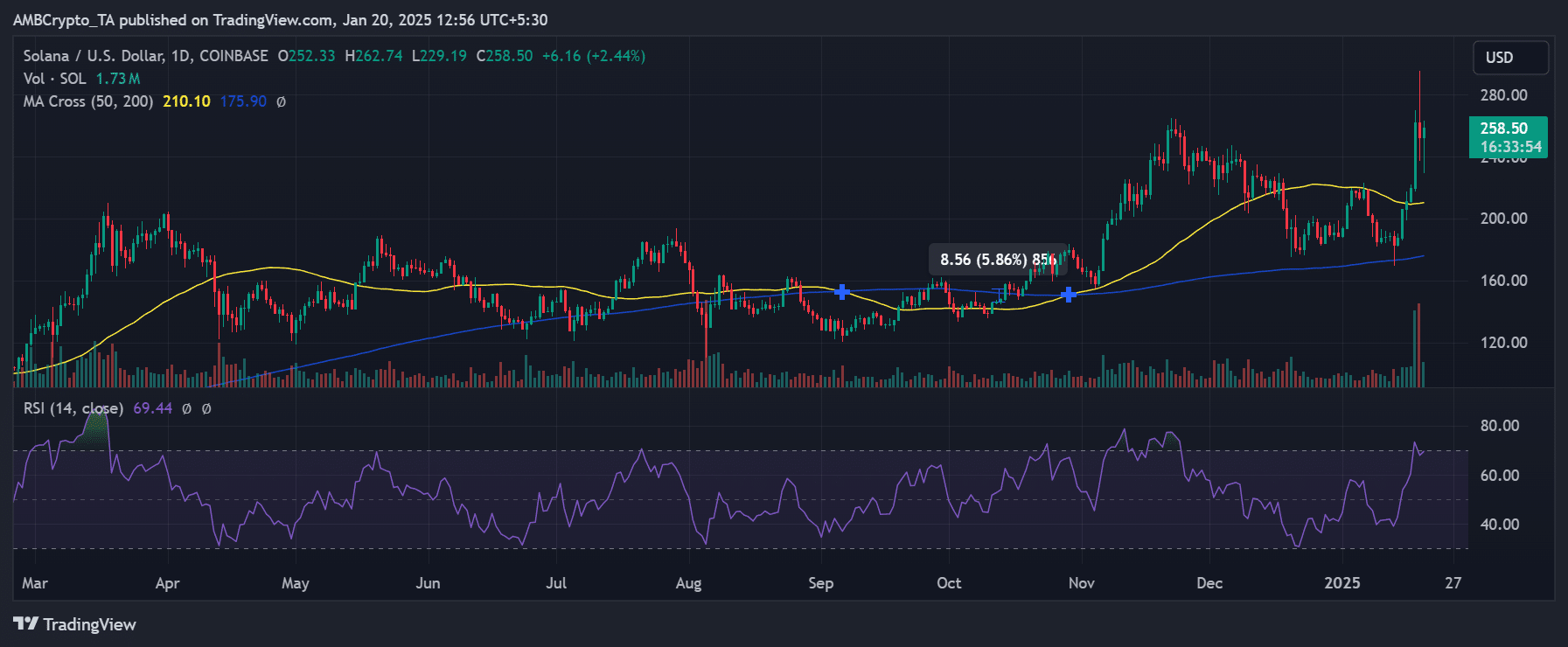

Solana’s price action demonstrated robust technical strength, with the 50-day moving average at 210.10, maintaining a healthy gap above the 200-day MA at 175.90.

The RSI reading of 69.44 suggested strong momentum while leaving room for further upside. Trading volume of 1.73M SOL indicated substantial market engagement during this rally.

Source: TradingView

Ethereum’s market position remains formidable

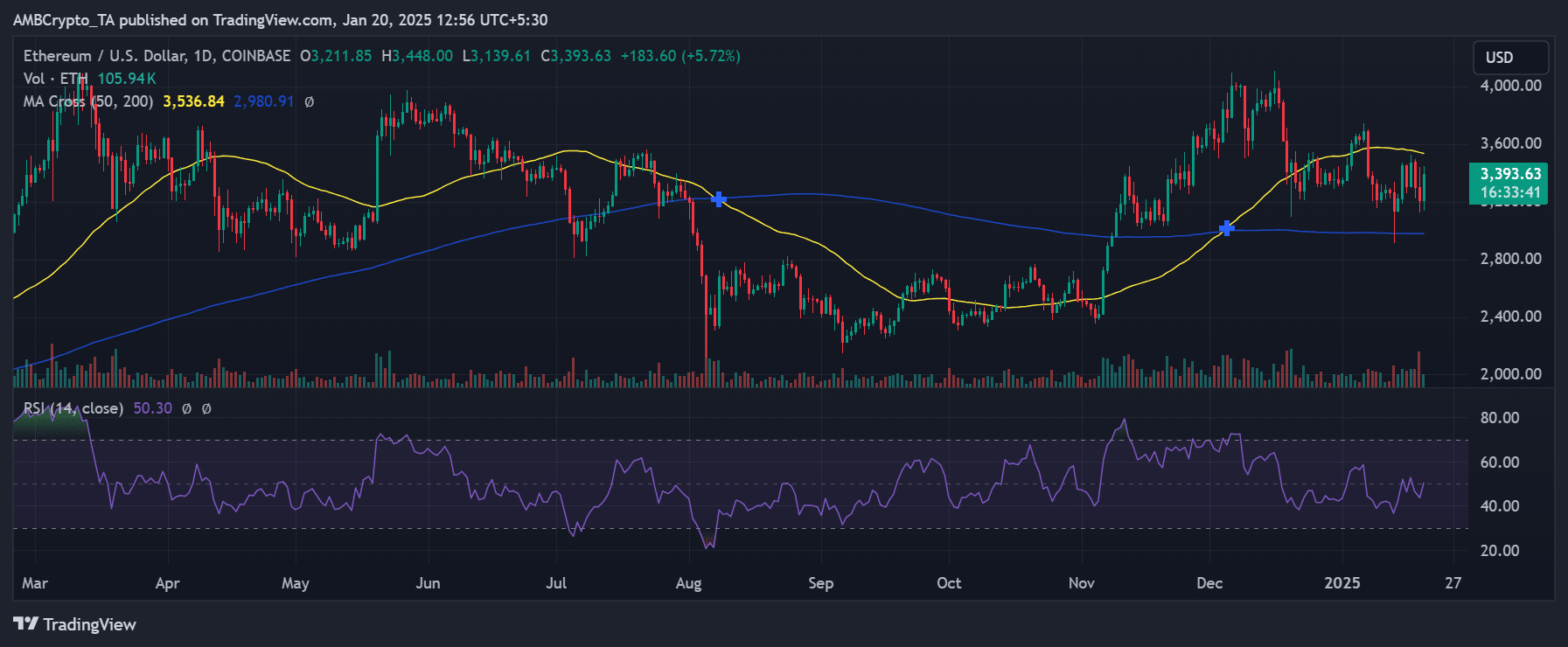

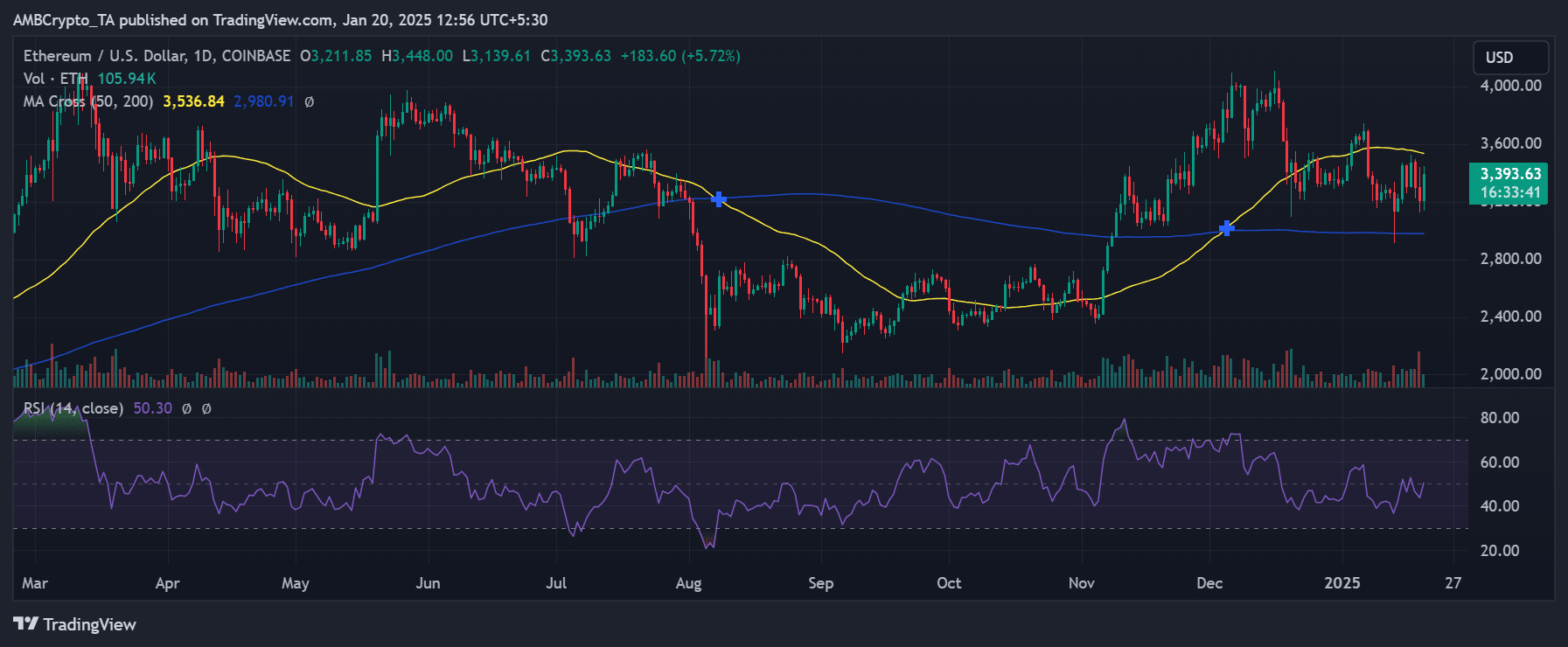

Meanwhile, Ethereum traded at $3,393.63, supported by its 50-day MA at 3,536.84. With a market capitalization exceeding $411.3 billion, ETH maintained a significant lead over Solana’s current $126 billion valuation.

To challenge Ethereum’s position, SOL would need to reach approximately $850, assuming current supply levels remain constant.

Source: TradingView

Can Solana flip Ethereum?

Despite retreating to fifth position with a market cap of around $126 billion, Solana’s trajectory presents interesting possibilities.

The gap between SOL and ETH stands at roughly $285 billion, suggesting significant upside potential if network activity maintains its current momentum.

However, the sustainability of this growth largely depends on organic adoption beyond speculative memecoin trading.

Looking ahead, SOL’s immediate challenge lies in maintaining momentum above $250 while building sustainable network usage.

While the TRUMP token has catalyzed impressive growth, long-term success will require broader ecosystem development and continued technical robustness.

Is your portfolio green? Check out the SOL Profit Calculator

The recent market cap milestone demonstrates Solana’s potential to challenge established players, though flipping Ethereum remains a substantial task requiring more than temporary memecoin enthusiasm.

As the network matures, its ability to attract and retain substantial development activity will likely determine its position in the crypto hierarchy.