- Solana and Ethereum saw varying volumes of daily active addresses.

- The ETH TVL has remained ahead of SOL’s by considerable volume.

According to a recent report, Solana [SOL] had more activity than Ethereum [ETH] in the past 24 hours. Additionally, this increase in activity led to Solana experiencing higher trading volume than Ethereum.

Data showed that Solana had a busy 24 hours, with impressive numbers in some key metrics. Solana had more active addresses than Ethereum and Bitcoin combined, the two largest networks.

A deeper analysis of both platforms revealed a significant divergence in their active addresses over the past few days.

Comparing Solana and Ethereum

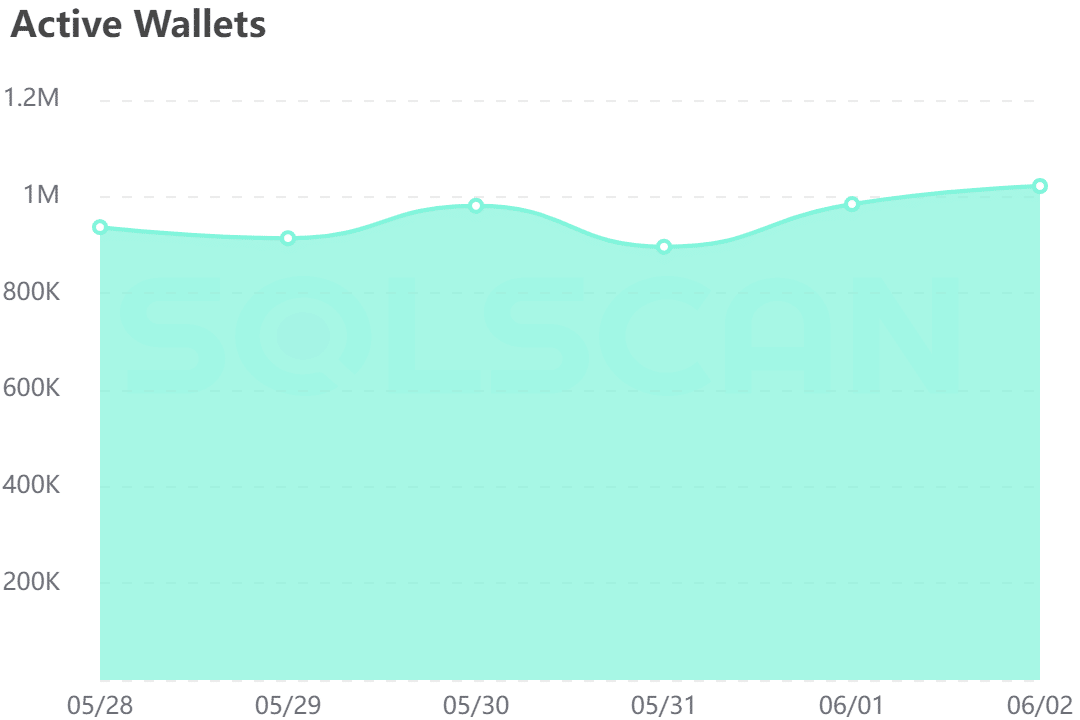

An analysis of Solana’s active addresses on its scanner revealed an interesting trend. The chart showed that in the past few weeks, the network’s lowest number of active addresses remained above 800,000.

The chart indicated that the number of active addresses had surpassed 1 million at the time of this writing. This suggests that the network has been experiencing increased activity recently.

Source: Solscanner

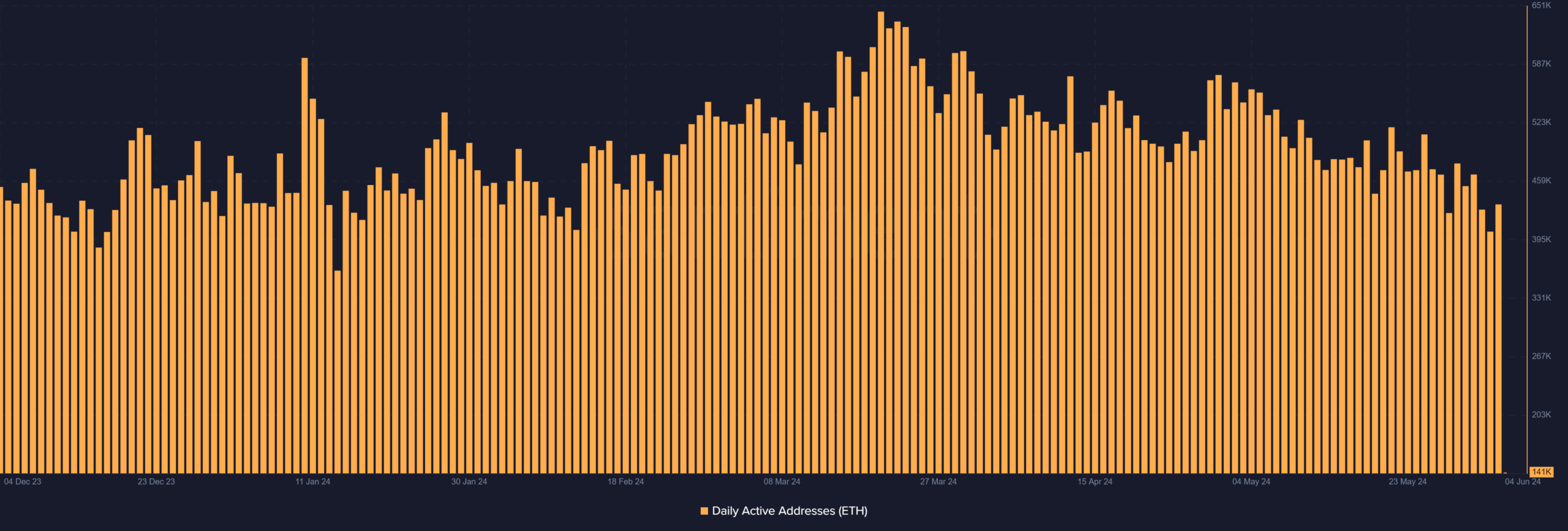

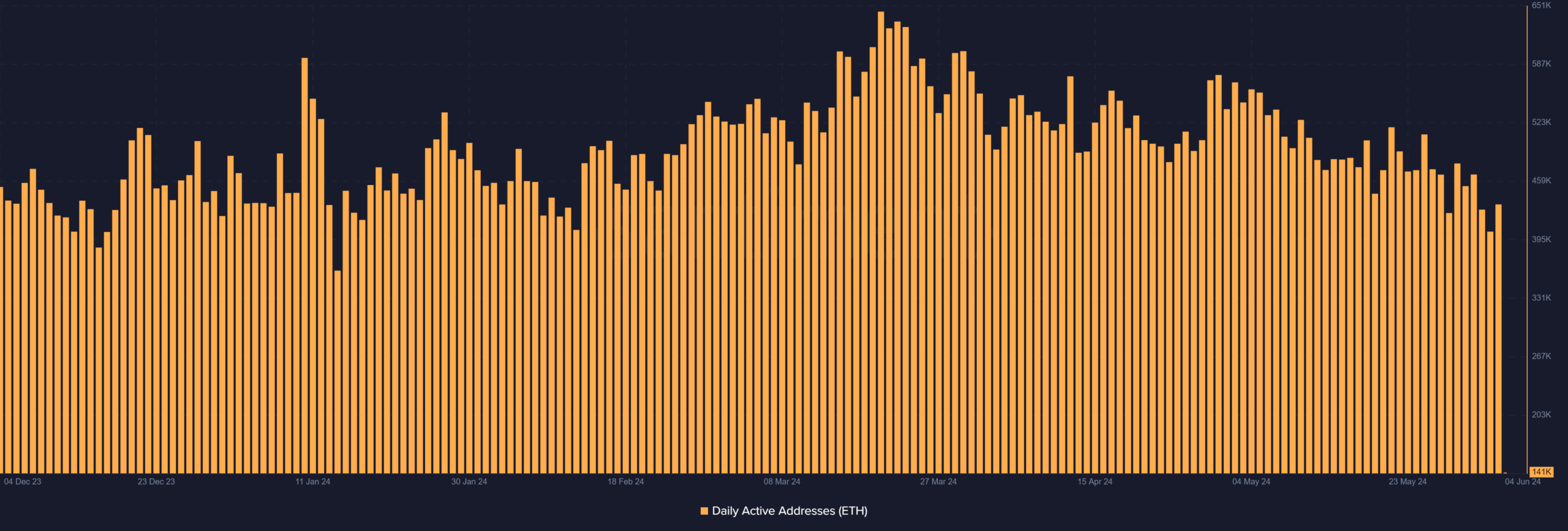

However, the analysis of Ethereum’s active addresses showed a decline over the past few weeks. The chart revealed that the number of active addresses remained below 500,000 throughout the previous month.

It gradually decreased to the 400,000 range and has not risen above this level in recent days. According to data from Santiment, the number of active addresses was approximately 141,000 at the time of this writing.

Source: Santiment

Solana trumps Ethereum volume

Analysis of the volume trends of both networks on DefiLlama showed that Ethereum has had higher volumes than Solana in the past few weeks. However, at one point, Solana’s volume surged past Ethereum’s.

As of this writing, Solana’s network volume was around $1.1 billion, while Ethereum’s was around $1.5 billion. This indicates that ETH’s volume has declined while SOL’s network volume has maintained momentum.

Additionally, it’s worth noting that ETH’s Total Value Locked (TVL) remains higher than SOL’s. According to DefiLlama, ETH’s TVL was over $65 billion, while SOL’s TVL was around $4.8 billion.

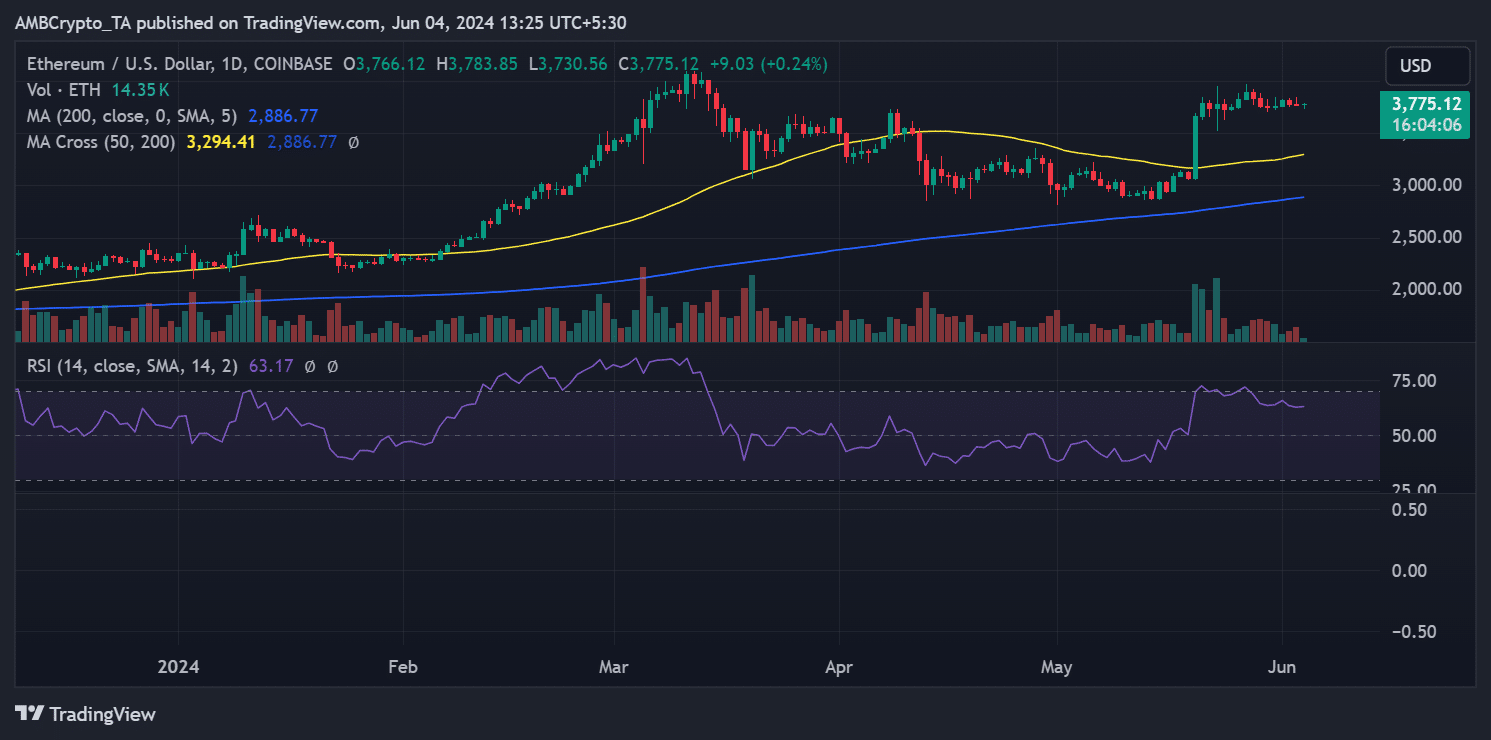

ETH and SOL see varying bull trends

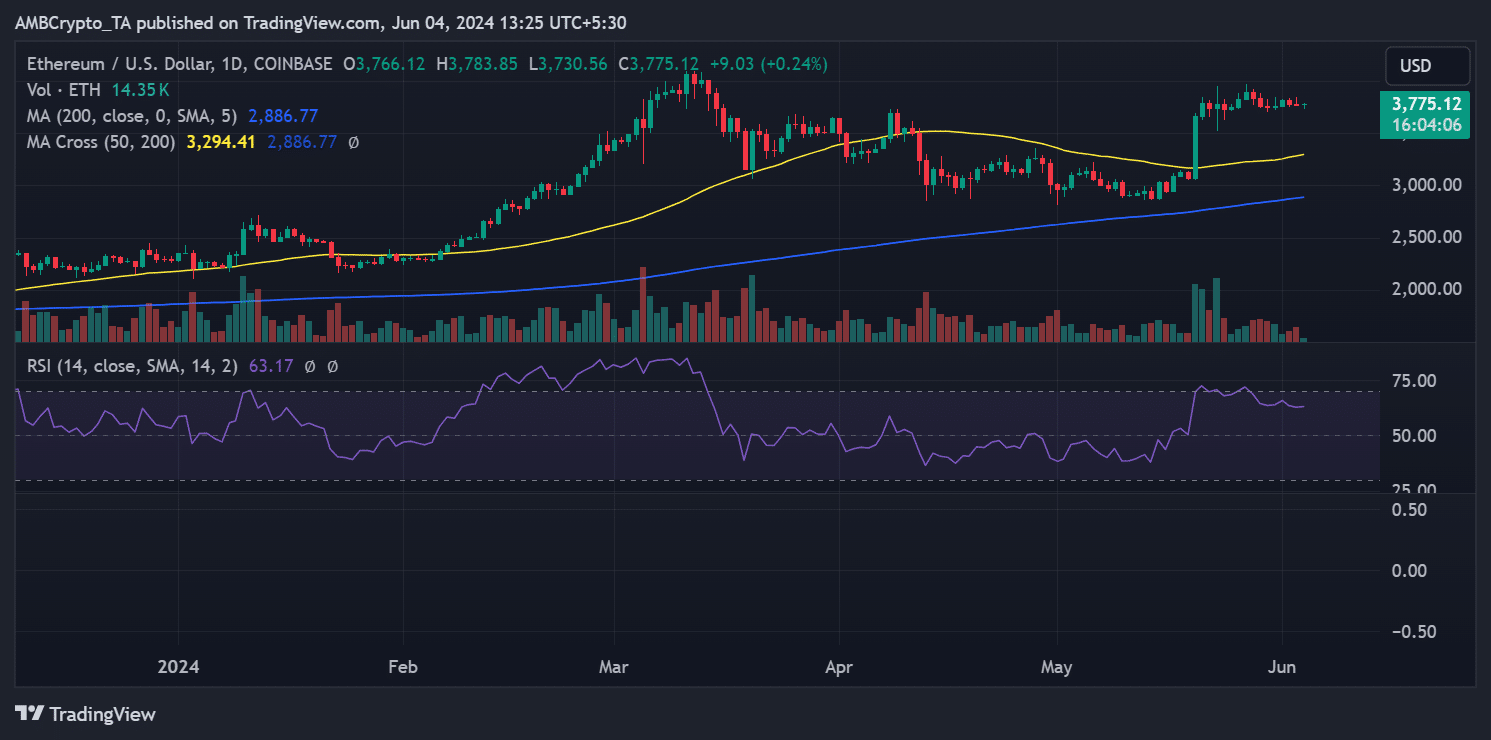

AMBCrypto’s analysis of Ethereum on a daily timeframe chart showed that it has remained in a bull trend. The Relative Strength Index (RSI) was above 60 at the time of this writing, indicating a strong trend.

However, its price has not seen significant movement in the last few days. Previously, ETH experienced a daily decline of less than 1% for the past two days. As of this writing, it was trading at around $1,877, with an increase of less than 1%.

Source: TradingView

Read Solana (SOL) Price Prediction 2024-25

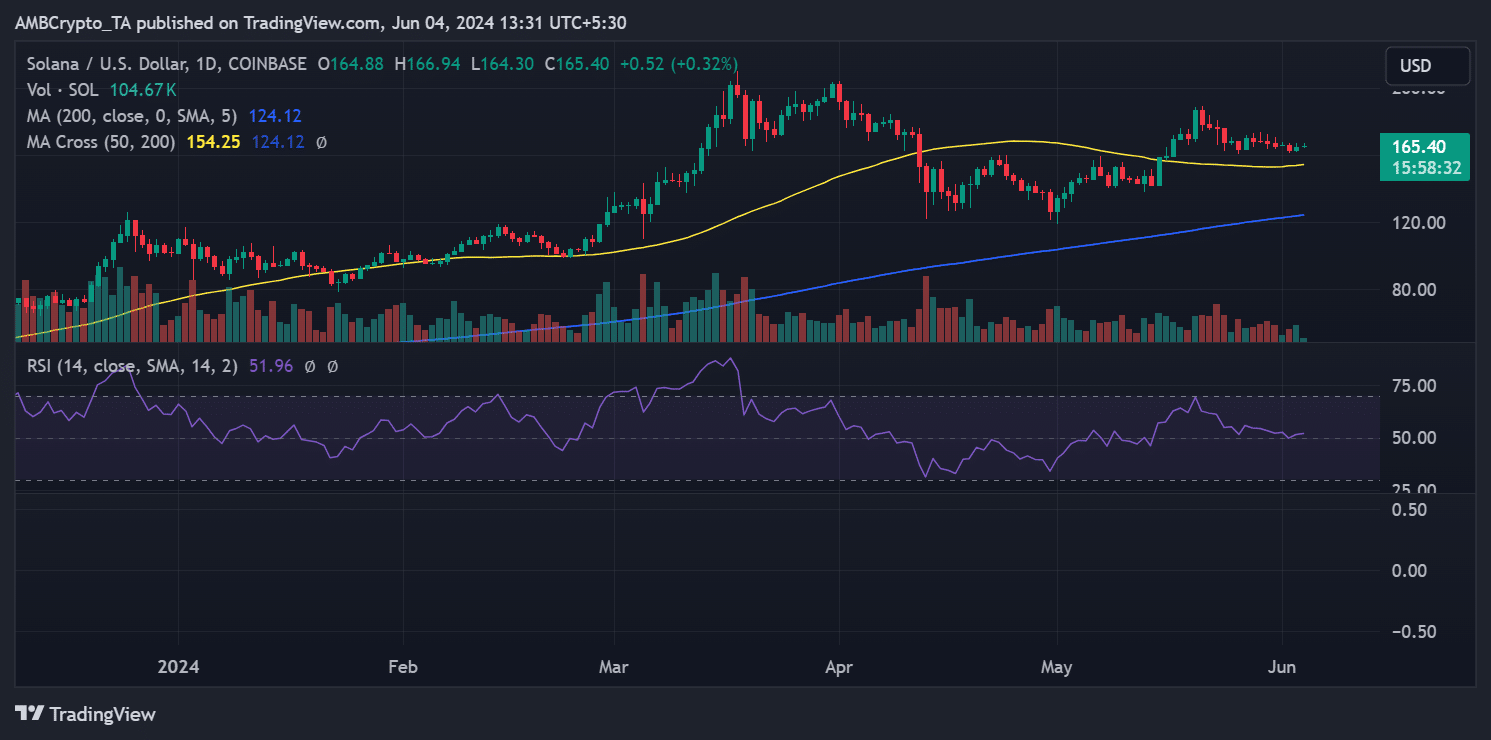

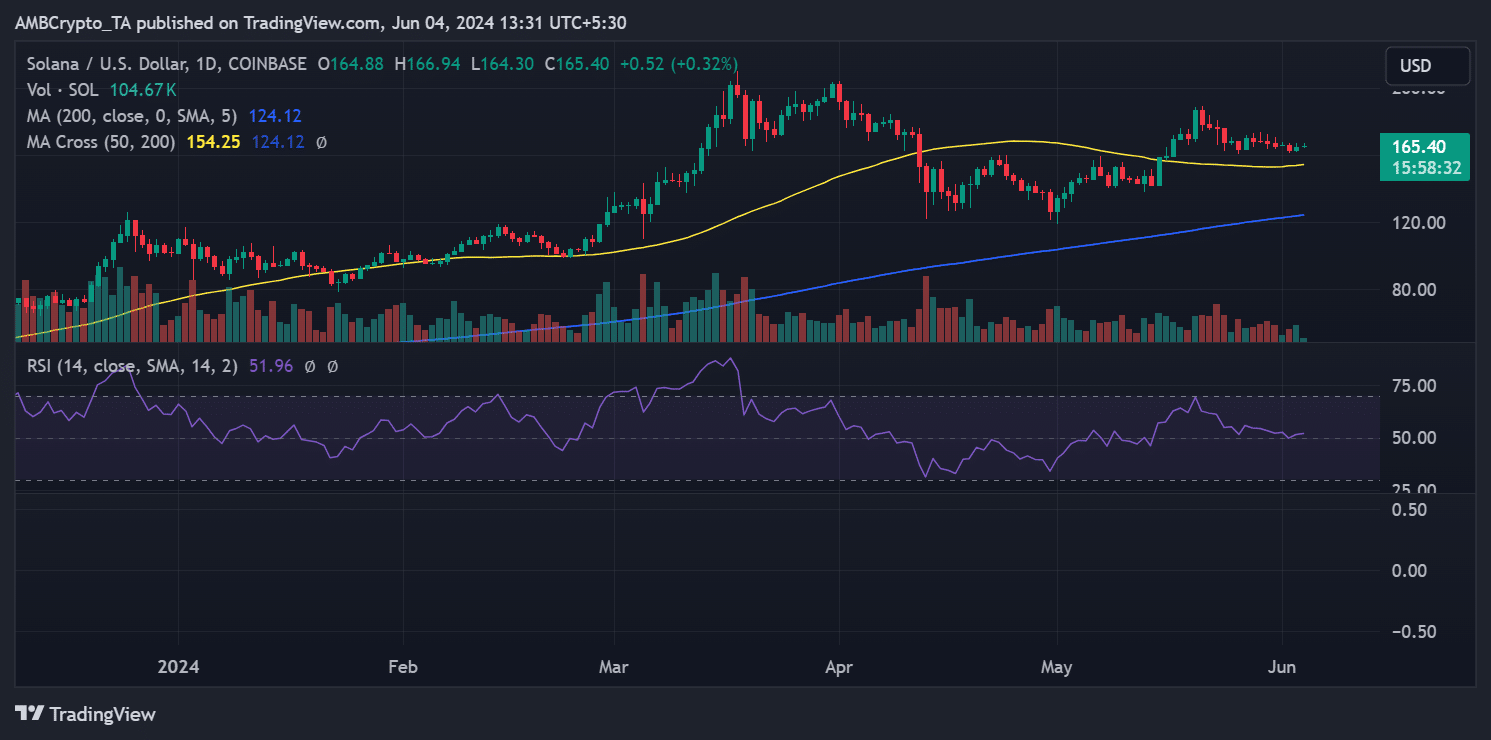

Analysis of Solana’s RSI showed that it rested on the neutral line at the time of this writing. This indicates that while Solana is still in a bull trend, it is currently weak.

As of this writing, Solana was trading at around $165, with an increase of less than 1%. Like Ethereum, it has not seen significant movements in the last few days.

Source: TradingView