Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More

A new San Francisco startup, Skyfire, is launching today in beta with $8.5 million in seed round funding to become the “Visa for AI” by allowing you to equip autonomous AI agents made by other companies with your money and let them spend it while they go off on and work for you.

“We’re enabling is AI agents to be able to autonomously make payments, receive payments, hold balances,” said Skyfire’s co-founder and CEO Amir Sarhangi, in a video call interview with VentureBeat earlier this week. “Essentially, think of us as FinTech infrastructure for AI.”

The company’s seed round was backed by Neuberger Berman, Brevan Howard Digital, Intersection Growth Partners, DRW, Inception Capital, Arrington Capital, RedBeard Ventures, Sfermion, Circle, FBG, Gemini, Crossbeam Venture Partners, EveryRealm, Draper Associates, ARCA, and Ripple.

Why should we be giving AI agents money to spend on our behalf through Skyfire?

Read on to find out about how Skyfire’s tech works, its value proposition and how it maintains security in a fast-moving space.

What Skyfire offers

Skyfire claims it is offering the world’s first payment network designed to support fully autonomous transactions across AI agents, large language models (LLMs), data platforms, and various service providers.

This development marks a significant step toward creating a new global economy where AI agents can function as independent economic actors, capable of making and receiving payments without human intervention.

“We really see that next million users for a lot of these [vendor] companies coming from AI agents being the customer,” said Sarhangi.

Right now, AI agents and “agentic AI” are some of the most talked about subjects in the rapidly shifting field of generative AI. Essentially, both concepts refer to the idea of letting programs powered by advanced AI models — LLMs, small language models (SMLs) and large multimodal models (LMMs) — perform actions on the user’s behalf.

Instead of you opening a spreadsheet and editing numbers or cropping a photo, an AI agent could do it on your behalf — even without you uploading the necessary file — as long as it was set up to have permissions to your files and accounts.

But there’s a big problem: if you want AI agents to do more advanced activities such as help you shop, book flights, or build new apps, services, websites, and businesses — there’s a good chance that they will come to a place where they need to pay for plane tickets or web hosting or some other product or service, and can’t. That’s currently where their utility ends.

“The problem is that AI agents don’t have identities, they don’t have bank accounts, and they can’t do those things because that identity and ability to have access to financial is basically not possible for them,” said Sarhangi. “So that’s what we’re unlocking.”

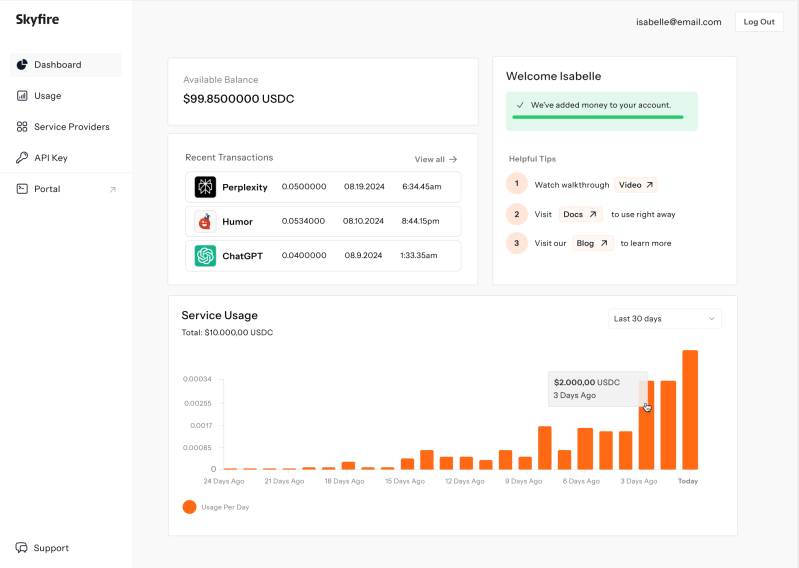

Skyfire has set up a new, secure payments system that will allow end-users to give AI agents a set amount of money and have them spend it on their behalf.

Think of giving your human assistant money to go get you coffee or telling them to use their company card. That’s exactly what Skyfire is trying to do, but for non-human software.

Skyfire’s key features

Skyfire’s platform is designed to be a comprehensive financial stack for the AI economy, providing essential tools and protocols for AI Agents to operate independently. Key features include:

- Open, Global Payments Protocol: Allows AI Agents to access LLMs, datasets, and API services without requiring traditional payment methods like subscriptions or credit cards. This open protocol ensures global interoperability and seamless transactions.

- Automated Budgets and Control: Developers and their customers can set specific spending limits, ensuring that AI Agents operate within predefined business parameters. This feature supports both single transactions and ongoing campaigns.

- AgentID & History Verification: Skyfire provides open identifiers for AI Agents, ensuring secure authentication and authorization. The system also maintains a history of transactions, offering an additional layer of trust and verification for both Agents and service providers.

- Verification Service: The platform includes a verification service for Agent developers and businesses, granting users visibility and control over network connections. This helps maintain a secure and trustworthy ecosystem for autonomous transactions.

- Funding On-Ramps: AI Agents can be funded through traditional banking methods or stablecoins, with all transactions completed instantly.

Initially, the company is focused on reaching other AI providers and AI-based, agent builders as a B2B software provider, allowing them to integrate a payments layer into their AI agents and products.

That way, if a developer wants to add the ability for their customers and end-users to load up an AI agent with money, Skyfire can help them do it — no matter what the underlying AI model is.

“There’s over 160 LLMs today,” Sarhangi pointed out. “So we enable a developer to be able to use any of these 160 LLMs through our through our protocol, without having to go to each one, opening up a bank account, and also having to hold balances at any of them.”

Craig DeWitt, co-founder and Head of Product at Skyfire, highlighted the importance of enabling AI Agents to act autonomously in the economic sphere in a statement provided via press release. “AI can’t truly change the world until it can transact freely. Agents need more than intelligence; they need the autonomy to complete economic tasks without human intervention. That’s the AI economy,” DeWitt stated.

The company will take a cut of each transaction made through its platform and also offers value-added software atop the payments layer which it charges software-as-a-service (Saas) fees for on a subscription basis.

Skyfire establishes strong security through simplicity and verification

The idea of letting AI agents carry and spend real peoples’ money may strike some readers as worrisome and rife with security risks, by Skyfire’s co-founders are confident that they have set up their system such that it is just as safe as spending money directly online.

“The only thing that is required for sign up today is a user signs up with their email, and from that email, we give them a space through this open protocol to be able to fund accounts, to be able to set balances, and to be able to connect to our service providers through Skyfire,” said DeWitt. “It’s not like we’re getting social security numbers from people.”

Instead, the user setting up a Skyfire account — typically a developer — will have the option as to which other existing payment providers they can link to, including other major financial institutions and major credit cards. Then, they or their end users can use these existing major financial institution accounts, log-ins and APIs to equip the Skyfire-powered AI agent with the amount of money chosen by the end-user.

Skyfire also allows developers and their end-users to set hard limits for how much cash an AI agent can spend. And as always, it’s up to the customer as to how much money to equip an agent with in the first place.

In addition, Skyfire is offering among its value-added services verification for a subscription fee to users who want to be sure that the agents are acting lawfully.

‘We’re able to verify ‘this agent is owned by who it says it is, or this person is operating an agent is who they say they are,’” said DeWitt. “There will be certain individuals and there will be certain businesses that will only transact with other participants if they’ve gone through that verification process. And so it’s kind of a step on top of this open network.”

A strong track record

The leadership team at Skyfire brings extensive experience in payments and technology.

Before co-founding Skyfire and leading it as CEO, Sarhangi previously served as a VP of Product at Ripple, where he worked on developing instant, universally accepted payment solutions.

Prior to that, he founded Jibe Mobile, which was acquired by Google in 2015.

DeWitt was also as an early developer at Ripple, contributing to the foundational payments technology that has become integral to the cryptocurrency and blockchain industry.

Prior to that, he worked at Bloomberg on its financial products.

Both Sarhangi and DeWitt have a track record of building scalable, global software and payments infrastructure, positioning Skyfire to rapidly establish itself as an industry leader.

Skyfire’s payment network is now open to Agentic AI developers, LLMs, and API providers, who can begin integrating the platform through the company’s website, skyfire.xyz.

With its innovative approach to AI commerce and strong backing from investors, Skyfire is poised to redefine the economic landscape for AI Agents and the broader AI ecosystem.

Correction: This article originally misstated Sarhangi’s role at Ripple. It has since been updated and corrected. We apologize for the error.

Source link