- Raydium surpassed Ethereum in 24-hour fees, generating $3.4 million.

- Its TVL also reached $1.7 billion, marking its highest in almost three years.

Raydium [RAY] recently made headlines by briefly surpassing Ethereum in fees generated over 24 hours. This surge in activity on the Solana-based decentralized exchange (DEX) highlights a growing trend in its network usage, and its native token has followed suit with positive price movement in recent days.

Raydium surpasses Ethereum in 24-hour fees

For a brief period, Raydium generated more fees than Ethereum, an impressive feat considering the size and dominance of Ethereum’s ecosystem.

Data from DefiLlama revealed that Raydium’s 24-hour fees surged to approximately $3.4 million, edging past Ethereum’s $3.3 million at the time.

As of now, Ethereum has reclaimed its lead, generating $3.7 million in fees compared to Raydium’s $2.8 million. However, the fact that Raydium could briefly overtake Ethereum in this metric is noteworthy.

A comparison of their 7-day fee trends shows Ethereum still far ahead with $34 million, while Raydium comes in at $18.2 million. Nevertheless, Raydium’s rise is significant, considering the two platforms’ relative size and TVL (Total Value Locked).

Raydium’s volume and TVL continue to rise

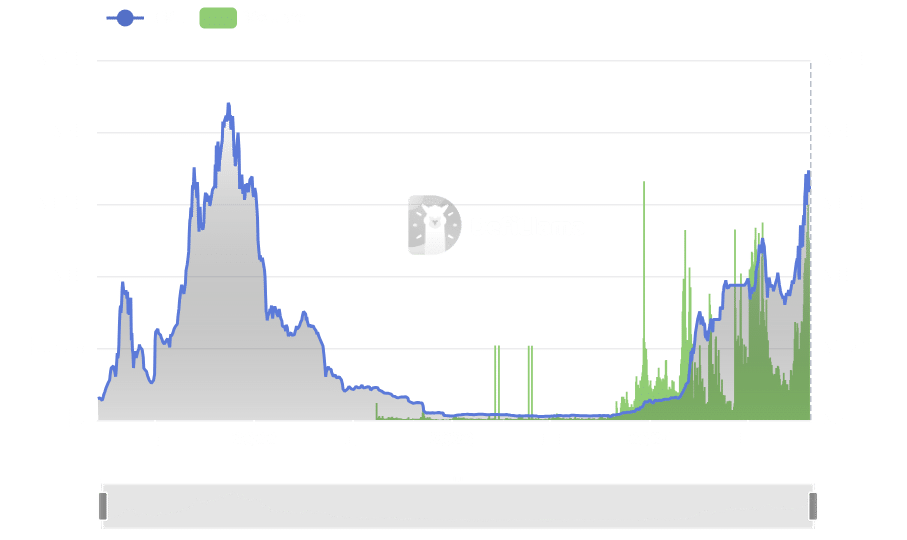

An analysis of Raydium’s fee trend shows a notable uptick in recent days, pointing to increased transaction activity on the network. A deeper look at its trading volume supports this observation, with the platform recording substantial growth.

Source: DefiLlama

Raydium’s trading volume had stayed below $1 billion since August, but it began to climb around 10th October. By 13th October, it had surpassed $1 billion, and by 20th October, it neared $1.5 billion.

As of now, Raydium’s volume stands at approximately $1.2 billion. In addition, its TVL has also seen a significant boost, peaking at $1.7 billion on 21st October, the highest in almost three years, before dipping slightly to $1.6 billion as of this writing.

RAY’s price remains bullish

Raydium’s token (RAY) has been on a strong bullish trend over the past few weeks. Currently trading at $2.587, the token has experienced a slight pullback of 1.45%.

However, it continues to trade above both its 50-day and 200-day moving averages, signaling sustained bullish momentum.

Source: TradingView

The Chaikin Money Flow (CMF) indicator is positive at 0.24, reflecting strong buying pressure and positive capital inflows. This accumulation has been driving RAY’s recent price gains.

The token also broke through a key resistance level around $1.75, supported by a “golden cross” where the 50-day and 200-day moving averages crossed, adding further bullish confirmation.

Realistic or not, here’s RAY market cap in BTC’s terms

Overall, Raydium’s momentum appears strong, though today’s slight pullback could indicate a period of consolidation before another potential upward move.