- PEPE outperformed rivals post its Coinbase listing, with consolidation possibly ahead

- If a certain strategy plays out, a quick rebound can be expected from the memecoin

The memecoin market is heating up, and one token is rapidly catching attention. With triple-digit gains in just seven days, Pepe [PEPE] is now just a step behind the top spot on the weekly gainers chart. This has positioned the memecoin as a serious challenger to Dogecoin’s [DOGE] long-standing dominance.

Trading at $0.00002199 at press time, PEPE recently hit a new all-time high following its Coinbase listing just two days ago. However, a small setback caused PEPE to drop by 14%.

As a result, many traders who sold at the listing price of $0.00001921 are now either stuck with losses or looking for a new entry. This creates an ideal setup for a potential short squeeze, one where the price can quickly rise as these traders close their positions or re-enter.

THIS setup presents critical opportunity for bulls

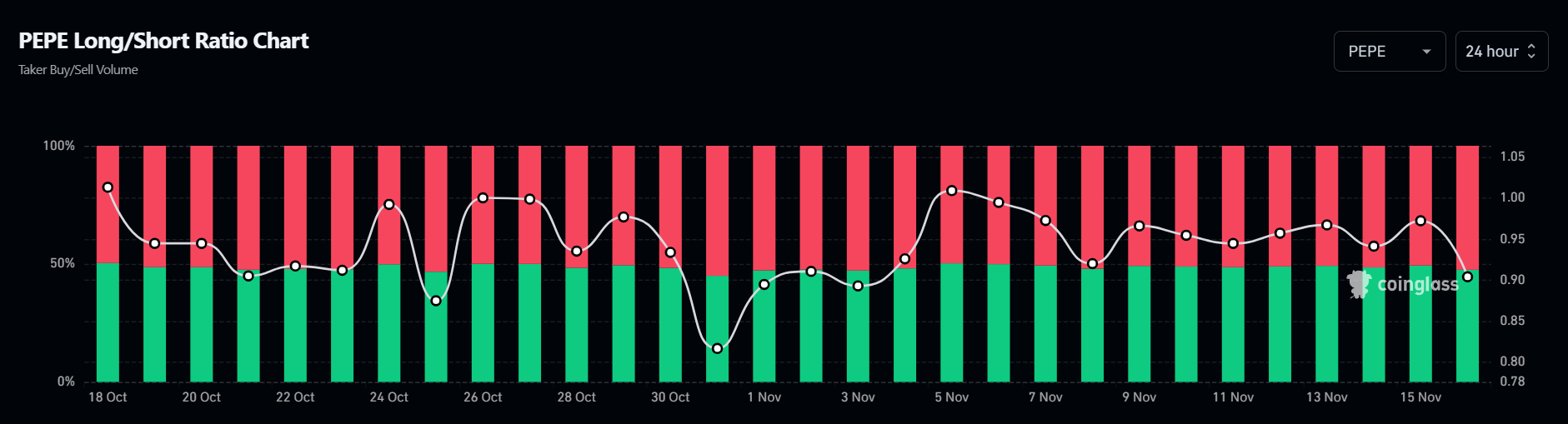

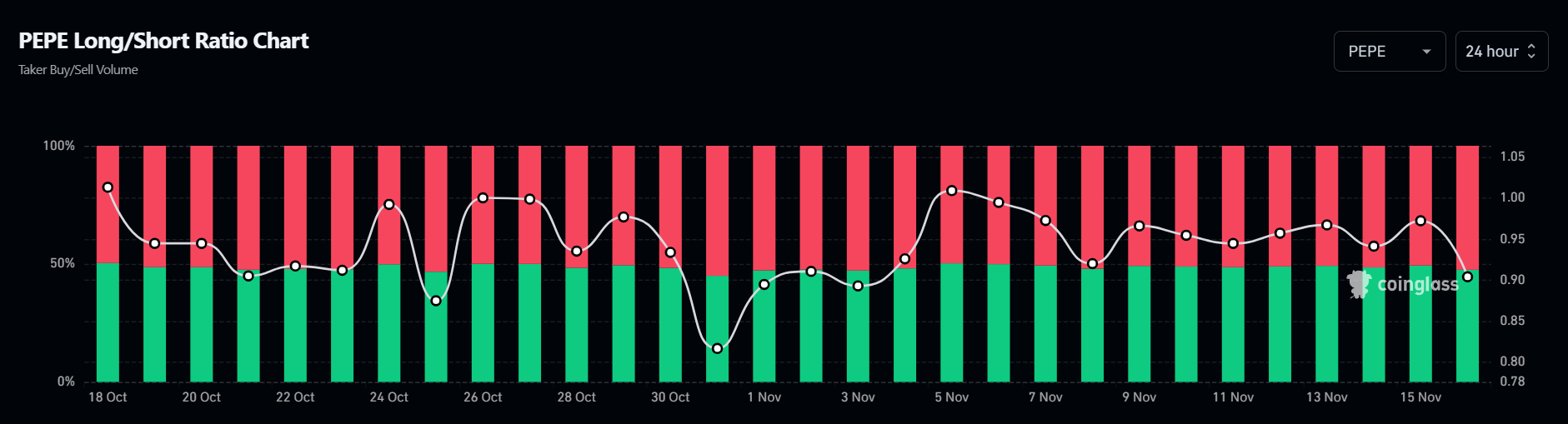

Interestingly, bears have been actively shorting PEPE for much of this month, creating significant resistance and preventing the memecoin from reclaiming its ATH of $0.00002524.

Source : Coinglass

As a result, despite the Coinbase listing, the memecoin entered a consolidation phase, trading within a defined range of $0.00002100 to $0.00002400.

Typically, a hike in short positions alongside a price dip often suggests that bullish traders are expecting a parabolic move, one where they’re compelled to exit their positions to limit losses. This dynamic creates a balance between buyers and sellers, confining the price within a narrow range.

However, this setup can present a critical opportunity for the market’s bulls. A breakout from consolidation could force shorts to cover, pushing the price higher as traders who sold or shorted will rush to buy back in at this key price point.

Bulls must maintain conviction to drive PEPE forward

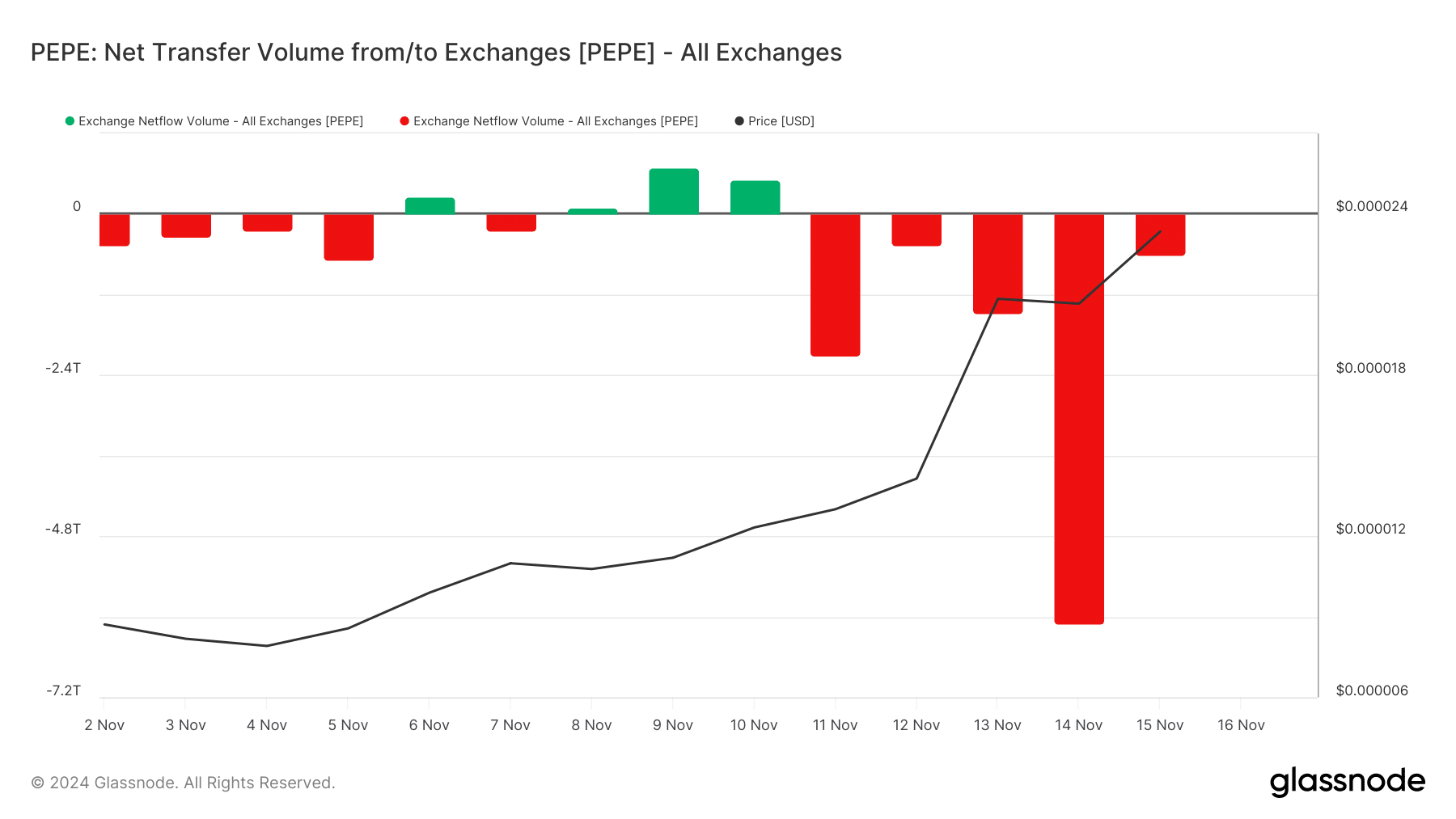

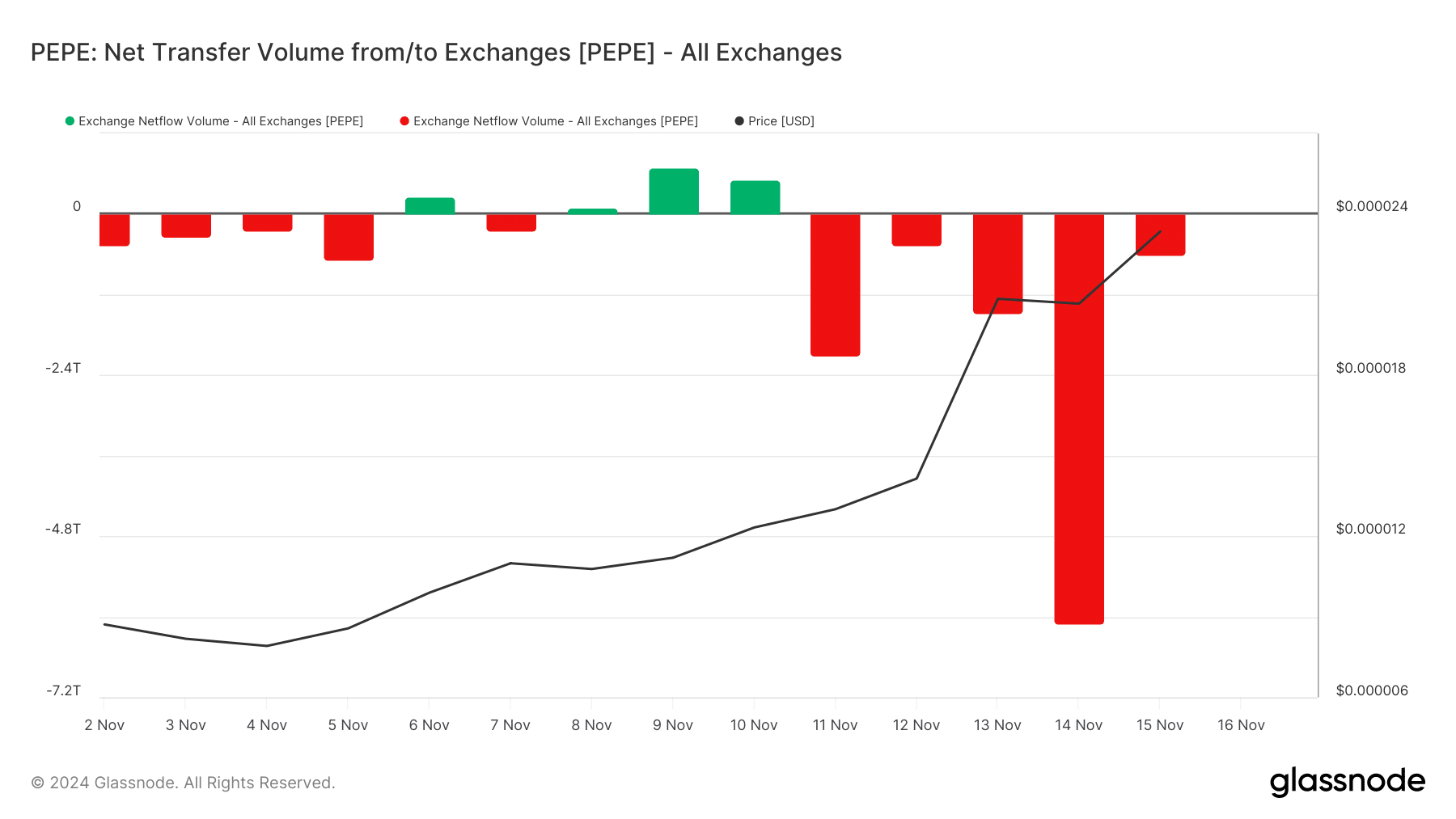

On the day of its listing, traders withdrew a staggering six trillion PEPE tokens from exchanges, driving a remarkable 47% intraday surge and pushing PEPE to a new all-time high.

However, large HODLers have since pulled back significantly, with withdrawals dropping to 942 billion tokens – A sharp decline from nearly 5 trillion just two days prior.

Source : Glassnode

This slowdown highlighted a waning conviction in PEPE’s long-term potential. For PEPE to break free from its current tug-of-war and reclaim its top spot on the charts, a reversal in this trend will be essential.

Without renewed momentum, the excitement from the Coinbase listing and the election cycle may dissipate, leaving bulls with little incentive to counter growing bearish pressure.

Read Pepe’s [PEPE] Price Prediction 2024-25

However, if bulls continue to accumulate, seeing the press time price as a “dip” worth buying, a short-squeeze could propel PEPE to $0.00002530.

This scenario seems more likely given the overall bullish market sentiment. Moreover, Bitcoin’s [BTC] recent breakout past key psychological levels also positions PEPE as a strong alternative amid rising market volatility.