- In a significant move, a whale has transferred over $29 million worth of PEPE to a private wallet.

- This transaction aligns with PEPE’s rebound from the support level of a bullish symmetrical pattern.

Despite enduring a prolonged downtrend on both monthly and daily charts, Pepe [PEPE] has squeezed a modest gain of 0.94% over the last week.

Market trends now indicate that the memecoin is gearing up for a rally, aiming to revisit its May peak of $0.00001725 and potentially climb higher as key factors align.

Whale actions bring hope for PEPE

A recent report from Lookonchain revealed that in a significant transaction, a whale—defined as an investor holding a large number of tokens—has transferred 4 billion PEPE, valued at approximately $29,868,000, from the centralized exchange Bybit to a private wallet.

Such movements, from a centralized exchange to a private wallet, generally indicate that investors are gaining confidence in the asset, potentially leading to a supply squeeze.

A supply squeeze occurs when the available supply of a cryptocurrency becomes limited, often resulting in higher prices if demand continues unabated, as buyers compete for a shrinking pool of available coins.

Despite this optimistic activity, the immediate impact on PEPE’s price has been muted, with a decline of 3.93% in its daily candlestick movement. However, AMBCrypto suggests that a rally may be on the horizon.

Golden crossover and symmetrical pattern position PEPE favorably

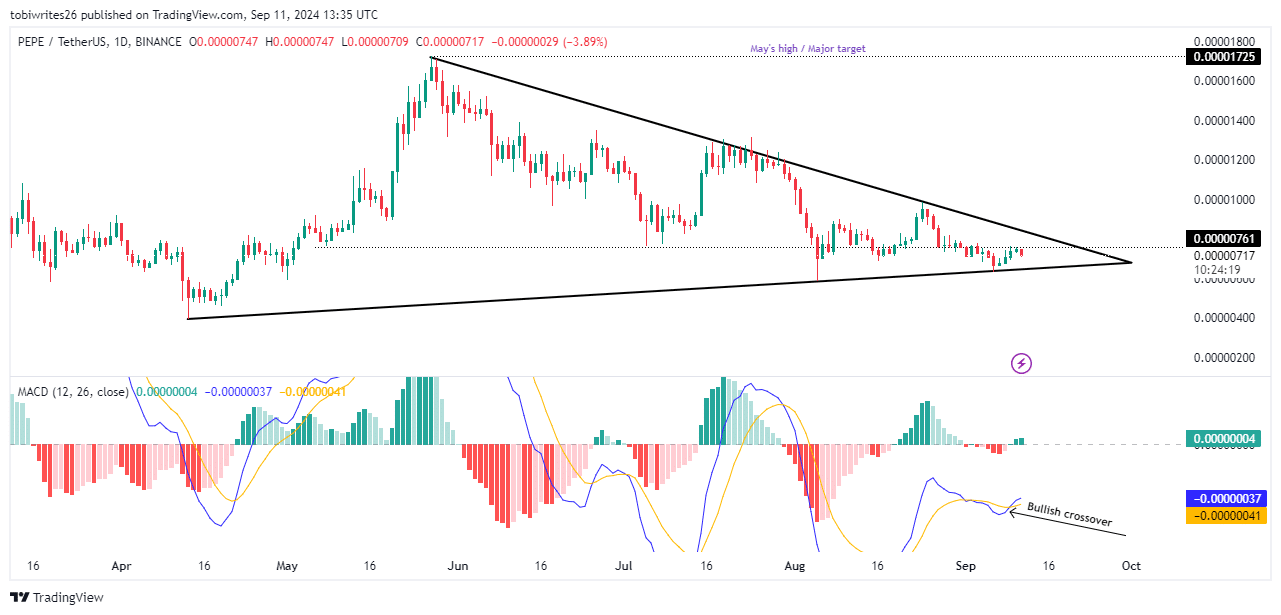

PEPE is currently trading within a bullish symmetrical triangle, a pattern characterized by converging diagonal support and resistance lines that create a sloping structure.

In this formation, prices typically oscillate within these levels until a breakout occurs near the point of convergence.

PEPE is now at this critical juncture, having rebounded from the lower support line—a key catalyst for movement. This rebound coincides closely with the convergence point.

Should a breakout occur, PEPE is set to revisit its peak at the pattern’s apex, recorded in May at $0.00001725, with the potential for even higher gains.

Source: Trading View

Furthermore, the Moving Average Convergence Divergence (MACD) is an instrumental tool in pinpointing the turnaround point of an asset by providing possible buy and sell signals to traders based on the strength of the price trend, showing that PEPE might rally soon.

A bullish crossover is evident when the MACD line (blue) crosses over the Signal line (yellow), accompanied by increasing volume—a scenario the memecoin has recently mirrored, setting the stage for a potential rally.

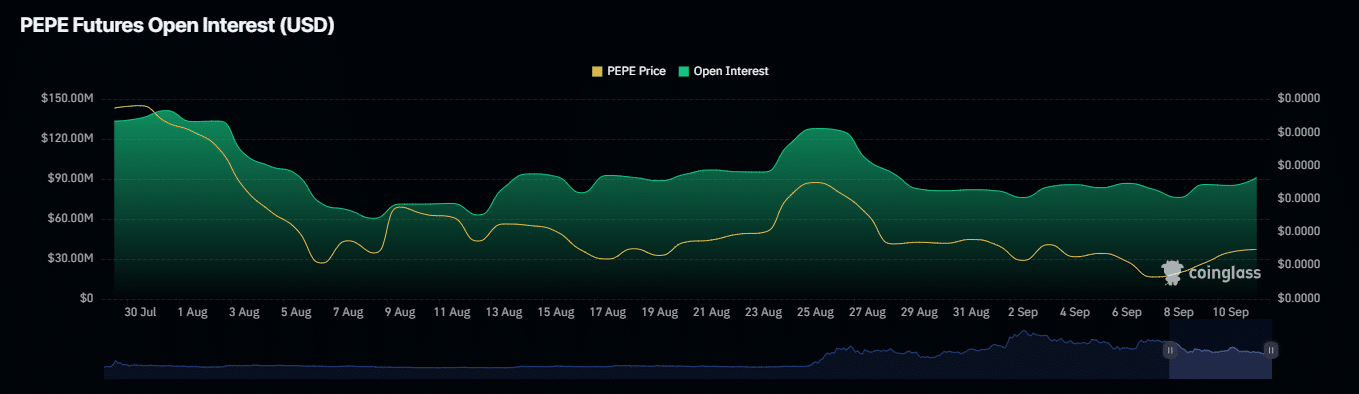

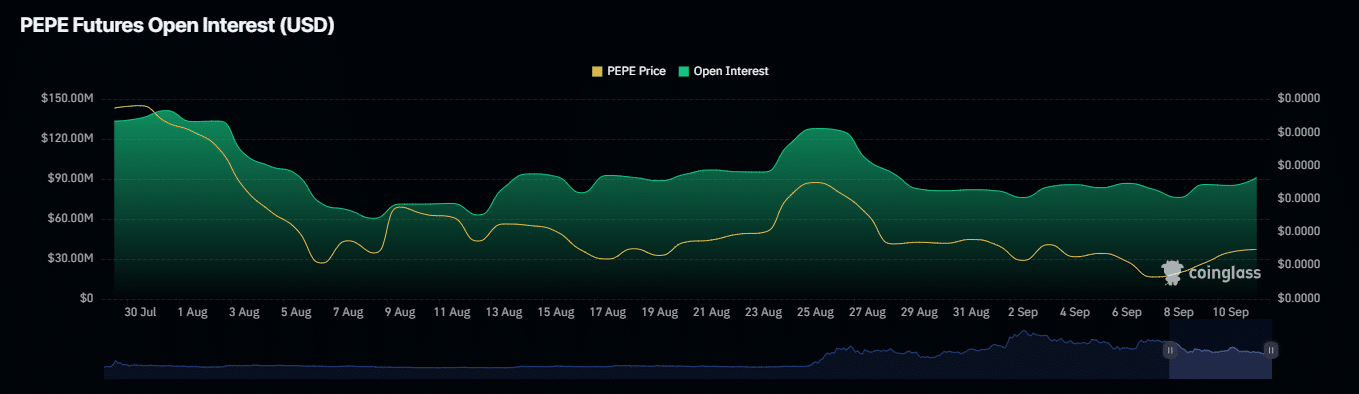

Rising open interest in PEPE signals the potential for new highs

The open interest in PEPE, a key indicator of retail trader activity, has experienced a notable uptick, reflecting a continued momentum trend with current figures at $91.16 million according to Coinglass.

Source: Coinglass.

Is your portfolio green? Check the Pepe Profit Calculator

In essence, the rise in open interest signifies an increase in contracts being opened but not yet settled. This suggests a strengthening trend as new investments or positions enter the market, potentially signaling a bullish outlook.

If this trend maintains its current pace, a PEPE rally appears inevitable.