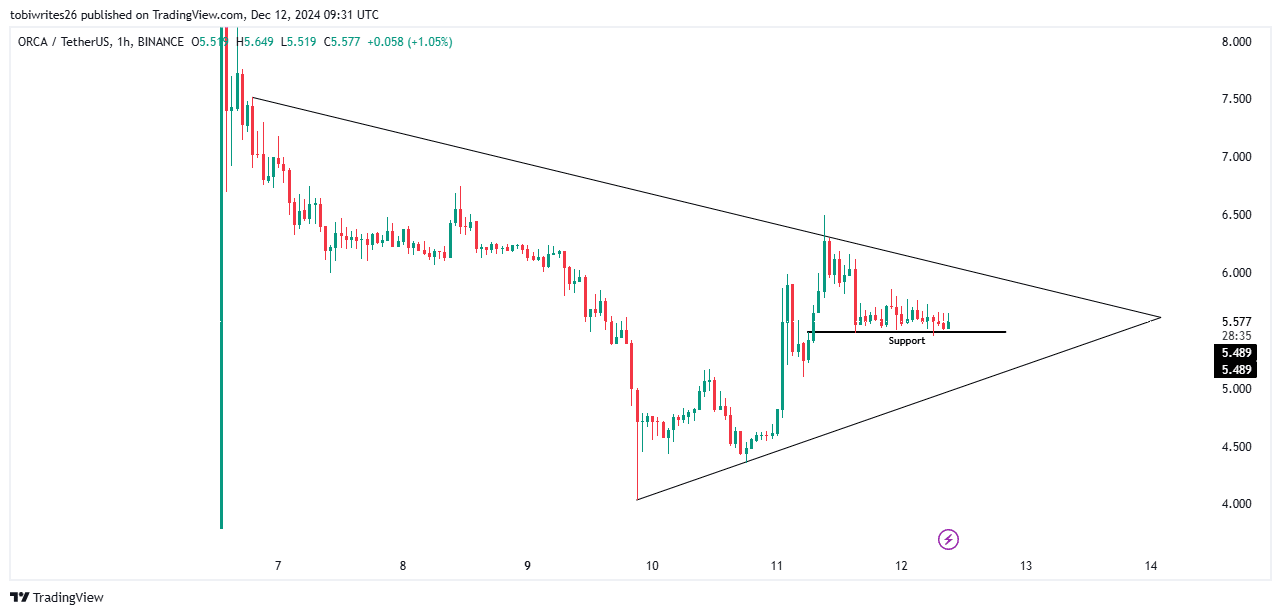

- ORCA crypto was trading within a symmetrical triangle pattern at press time.

- There was adequate buying pressure from market participants.

Orca [ORCA] has recorded a 15% gain over the past week due to increased market interest.

However, the momentum that drove its surge has faltered, with significant selling activity causing a 6.73% price drop in the last 24 hours.

Despite this decline, AMBCrypto’s analysis indicated that there was still a chance for ORCA to rebound from its current levels.

Orca crypto: Rally now depends on…

ORCA’s overall structure remained bullish as it traded within an ascending triangle pattern, with the price oscillating between well-defined zones.

However, within this symmetrical triangle, ORCA has been losing value and was bouncing off a critical support level at press time, which has historically prevented further declines.

If this support holds and acts as a catalyst for upward momentum, ORCA could rally toward its next major target of $7.5.

Source: Trading View

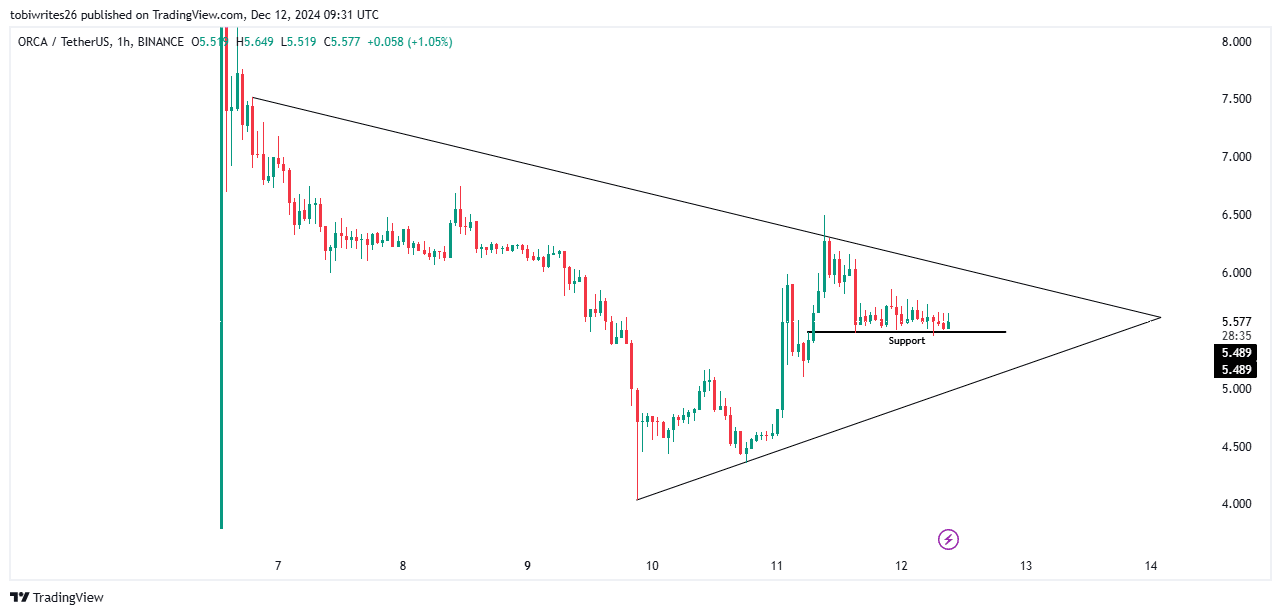

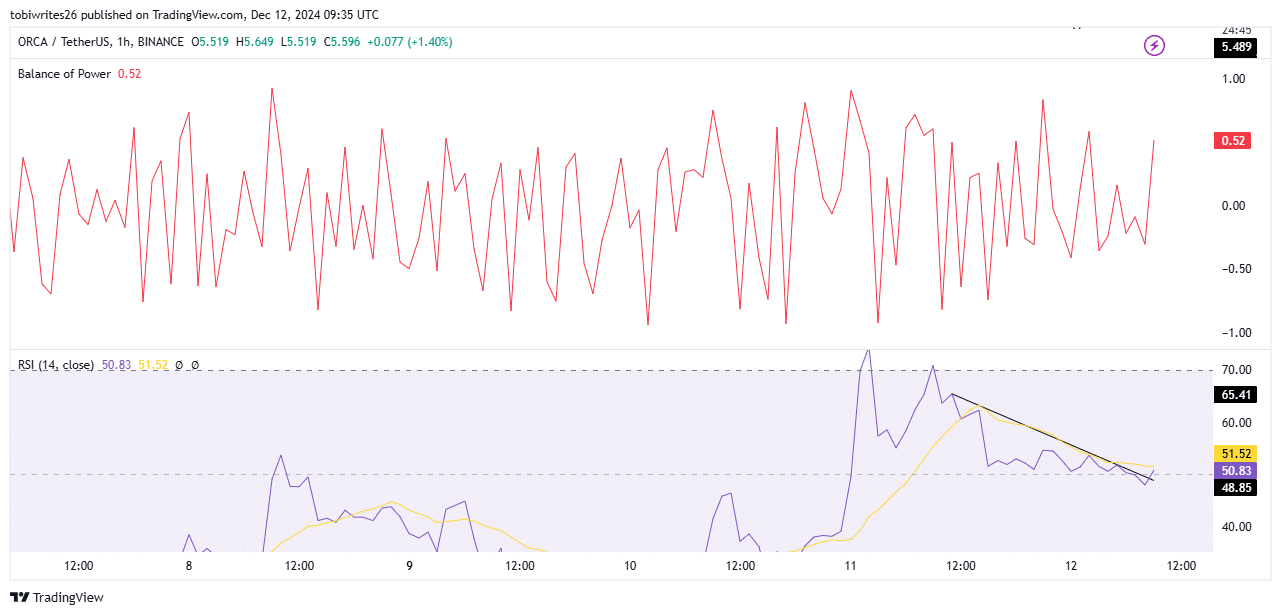

AMBCrypto analyzed the market consensus using technical indicators and on-chain metrics, which provide further insights into ORCA’s potential trajectory.

Momentum is gradually building

AMBCrypto analyzed market dynamics to identify which cohort holds the most influence, revealing that bulls currently have the upper hand.

This conclusion was supported by the Balance of Power (BoP) indicator, which measures market momentum by comparing buying and selling pressure to signal potential trend reversals.

At the time of writing, the BoP surged to 0.52, reflecting the market’s sustained strength.

Source: Trading View

Similarly, the Relative Strength Index (RSI) has broken out of its trendline pattern. Previously, its drop below the neutral zone triggered a market sell-off.

However, it has now rebounded to 50.83, placing it in buying territory and signaling incoming buying pressure that could drive the asset higher from its current level.

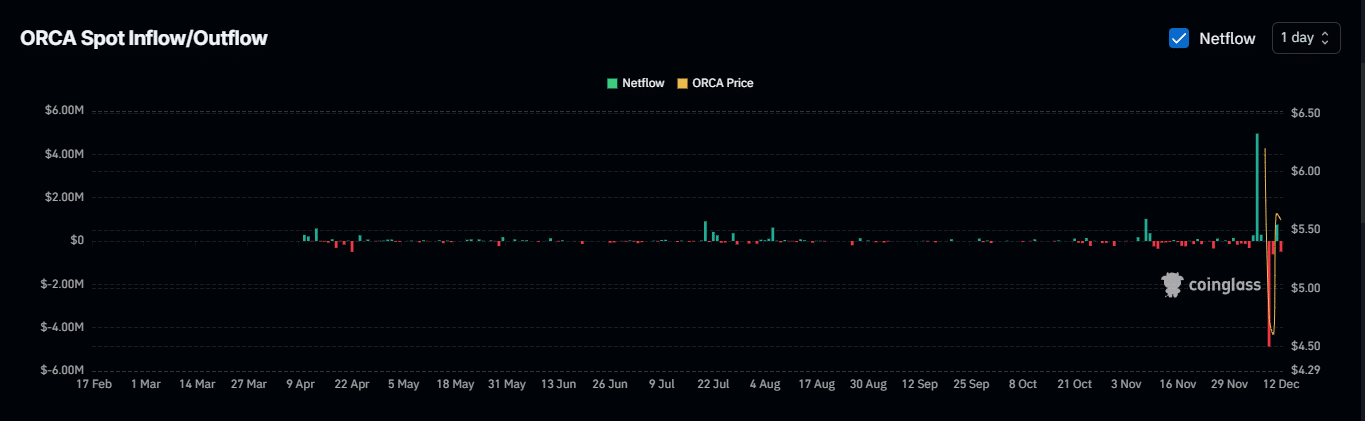

Investors turn bullish

Investors have been transferring ORCA from exchange wallets to private wallets, with a total of $444,650 moved so far.

When assets are moved from exchange wallets to private wallets, it typically signals growing investor confidence. This suggests investors are opting for long-term holding, with no immediate intention to sell.

Source: Coinglass

Read Orca’s [ORCA] Price Prediction 2024–2025

Simultaneously, Open Interest—a measure of derivative trading activity—has been rising significantly. In the past 24 hours, Open Interest increased by 14.24%, reaching $18.64 million.

If this upward trend continues, it will further strengthen the asset’s bullish outlook.