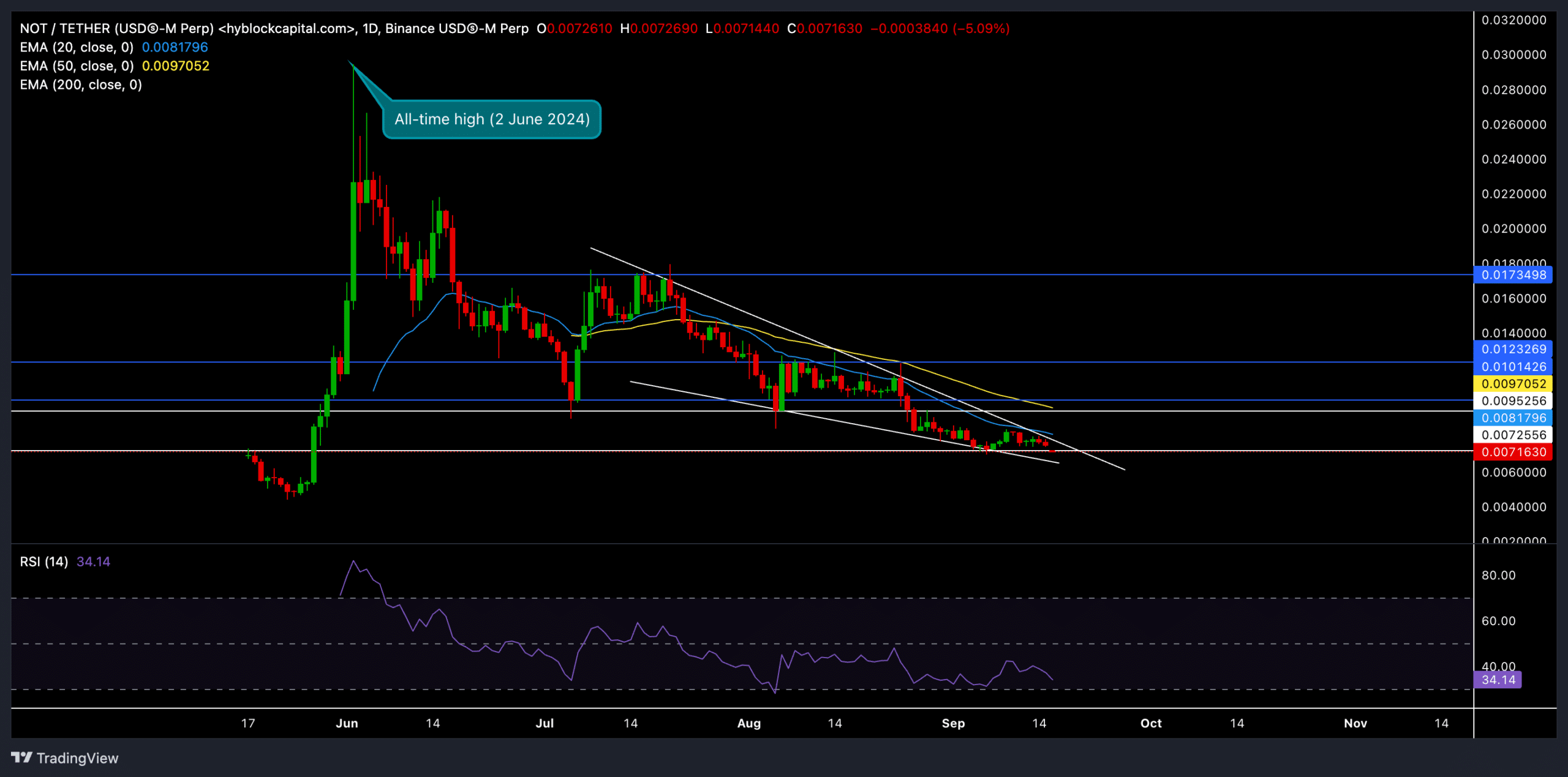

- Notcoin continued its downtrend while chalking out a falling wedge pattern on the daily chart.

- Derivates data on Binance kept some near-term recovery hopes alive.

Notcoin [NOT] experienced an extended downtrend after reaching its all-time high (ATH) of $0.032 on 2nd June. The token witnessed consistent selling pressure after the market-wide bearish sentiment set in.

As a result, its price dipped below both the 20 and 50-day EMAs.

At press time, NOT traded at $0.00716 and was down by around 8% in the last 24 hours. The $0.007 support level is essential for bulls to protect to prevent further declines.

Can this falling wedge pattern cause a potential reversal?

Source: TradingView, NOT/USDT

The current downtrend has pulled Notcoin to a critical support zone of around $0.0072. This level coincided with the lower boundary of the falling wedge and is crucial for the bulls to hold if they aim for a near-term reversal.

Historically, falling wedges are considered bullish reversal patterns, but buyers still need to trigger an immediate reaction.

In the coming sessions, a close above the 20-day EMA at $0.0081 could set the stage for a potential recovery. In this case, bulls could target the $0.0095 resistance, followed by a possible retest of the $0.01 mark.

On the other hand, a breach below the $0.0072 support could open the door for further downside toward the $0.005 level before any meaningful reversal can occur.

The Relative Strength Index (RSI) hovered near 34.5 at press time, indicating oversold conditions. A reversal from this level could reinforce a bullish divergence, but a failure to bounce could validate further downward movement.

Derivates data revealed THIS

Source: Coinglass

On the derivatives front, Notcoin’s open interest (OI) dropped by nearly 6.92% over the past day, showing a rather waning market interest. The overall long/short ratio remained skewed toward shorts, at 0.9102, reflecting bearish sentiment among traders. However, the long/short ratio on Binance showed a reading of 3.6992 (for all accounts).

This indicated that while short-term traders leaned towards short positions, the broader market sentiment was not overwhelmingly bearish, leaving room for a potential recovery.

While Notcoin continued to trade under bearish pressure, forming a falling wedge pattern and oversold RSI levels could present a window for a bullish reversal.

Read Notcoin’s [NOT] Price Prediction 2024–2025

A decisive move close to $0.0081 resistance could encourage buyers to re-enter the market and drive the price toward the $0.0095 mark.

However, failure to defend the $0.0072 support may trigger a further correction and potentially drag the price down to the $0.005 range before any major recovery attempt.