- Memecoins face a fresh debacle over the community’s impact on the price action

- Short-term positions could be the most vulnerable

If Elon Musk wasn’t enough to “dodge” accusations of market manipulation, ZachXBT, a crypto investigator, has uncovered 11 wallets linked to Murad Mahmudov, a prominent memecoin advocate on X (formerly Twitter), holding over $24 million in memecoins.

This situation highlights the ongoing debate about memecoins in the crypto scene, weighing their potential to draw in new investors against the risks that come with them.

Revisiting the 2021 cycle

When Elon Musk first tweeted about Dogecoin in April, 2019, it was trading at a mere $0.003 with a market cap of just $300 million.

However, his endorsement sent the memecoin skyrocketing, helping it reach an ATH of $0.73 in May 2021. Today, DOGE remains the market’s largest memecoin, boasting a market cap of over $15 billion.

Source : IntoTheBlock

Musk’s influence has clearly attracted a surge of market participants, as highlighted by the chart above. In fact, there was also a significant increase in trading activity on exchanges during the period following his tweet.

As a result, while many locked in profits from his backing, others likely incurred losses when DOGE retraced to $0.164 exactly a month after hitting its ATH. This led to heightened volatility, prompting many traders to exit.

Nearly four years have passed since DOGE reached its ATH, and since then, the coin has trended bearishly. Even with Musk’s continued support, DOGE has struggled to replicate that rally, with the altcoin trading at $0.107 at press time.

In short, the market shows concern when a few wallets concentrate a large stash of memecoins. Especially as they are highly volatile and susceptible to sudden price swings.

Impact on memecoins’ price action

As noted previously, memecoins are community-driven, and figures advocating for the tokens significantly influence their price action.

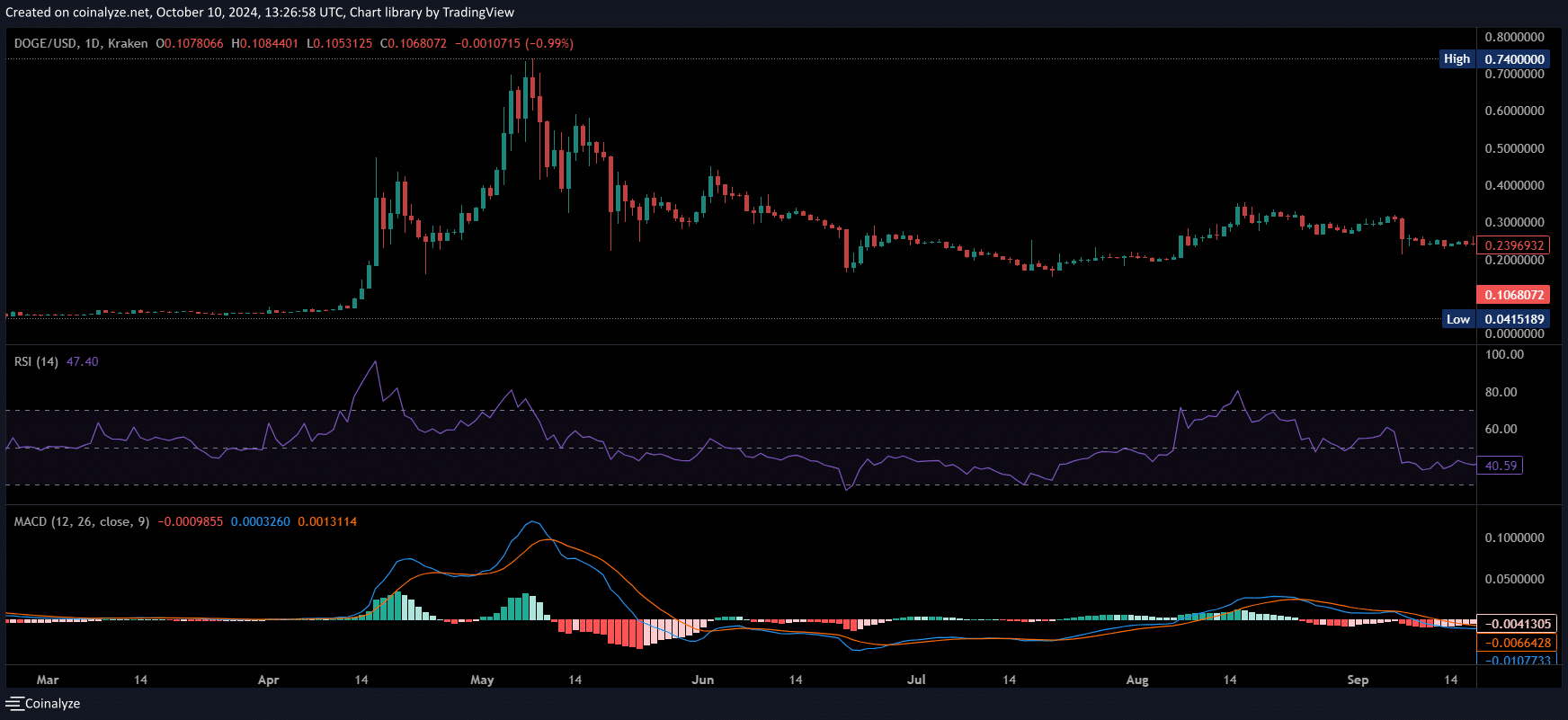

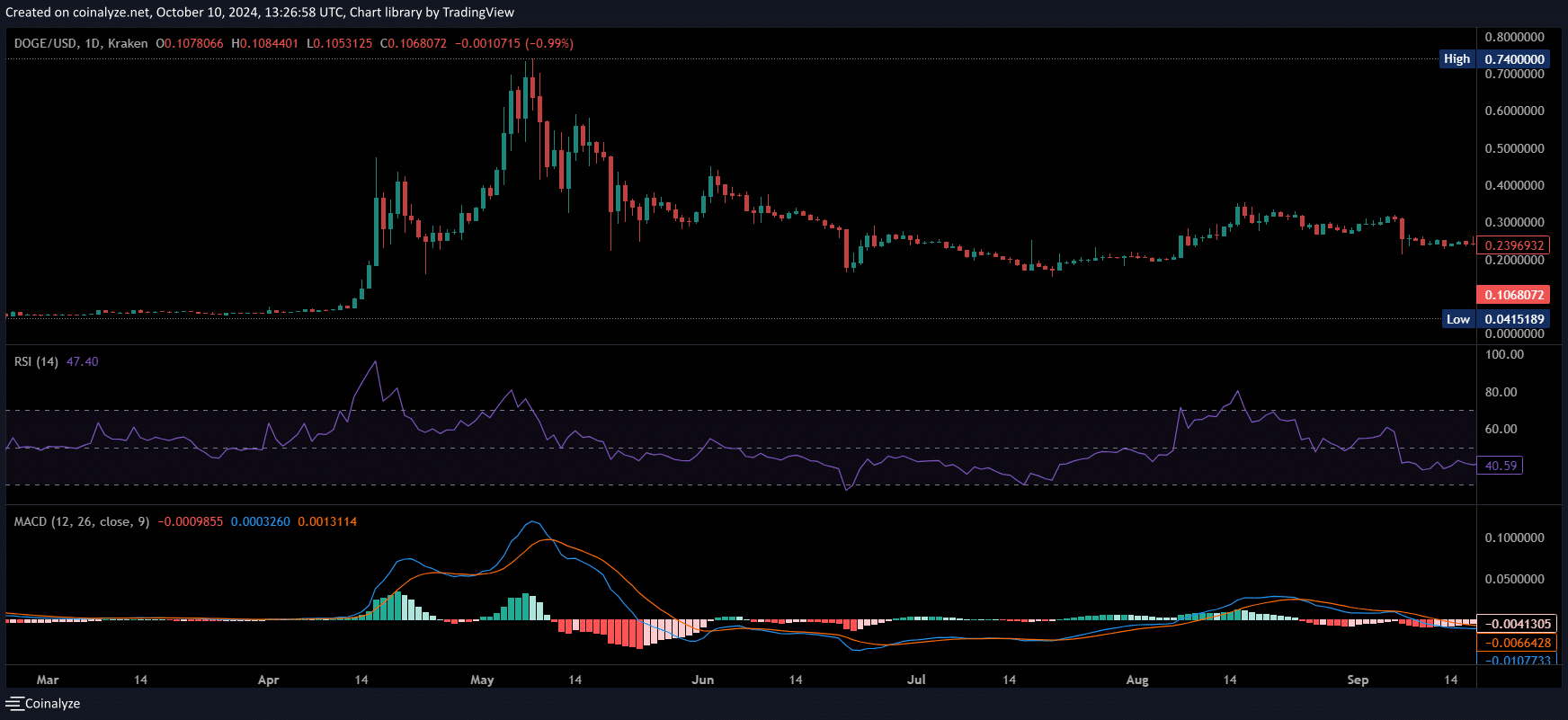

While Musk’s backing caused DOGE to witness its first parabolic rally – A feat it hasn’t repeated since – A bullish MACD crossover and a rising RSI also supported this surge. This alluded to signs of market overheating.

Source : Coinalyze

While his endorsement was a cult move, other influencers advocating for memecoins through their social media following can generate short-term gains too.

However, these communities don’t solely impact the memecoin ecosystem. Other investors also influence it by basing their decisions on a variety of metrics.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

If a contradiction arises, it could jeopardize the anticipated plan, particularly for swing traders looking to maximize profits within a shorter timeframe.

Therefore, keeping a close eye on other aspects is key when purchasing memecoins. That said, the recent controversy might echo the 2021 cycle, but with the amount of data surfacing, confirming an all-out trend reversal will be challenging.

Even so, short-term positions may remain particularly vulnerable to such advocacy.