- Moonwell, as at press time, was one of the best performers in the past week.

- Volume, TVL and active loans adding to WELL’s momentum.

Moonwell [WELL], one of the fastest-growing lending platforms, has been performing well both in its lending services and its token price performance.

According to CoinMarketCap, Moonwell’s native token, WELL, has surged over 100% in the past seven days, gaining significant attention in the crypto community.

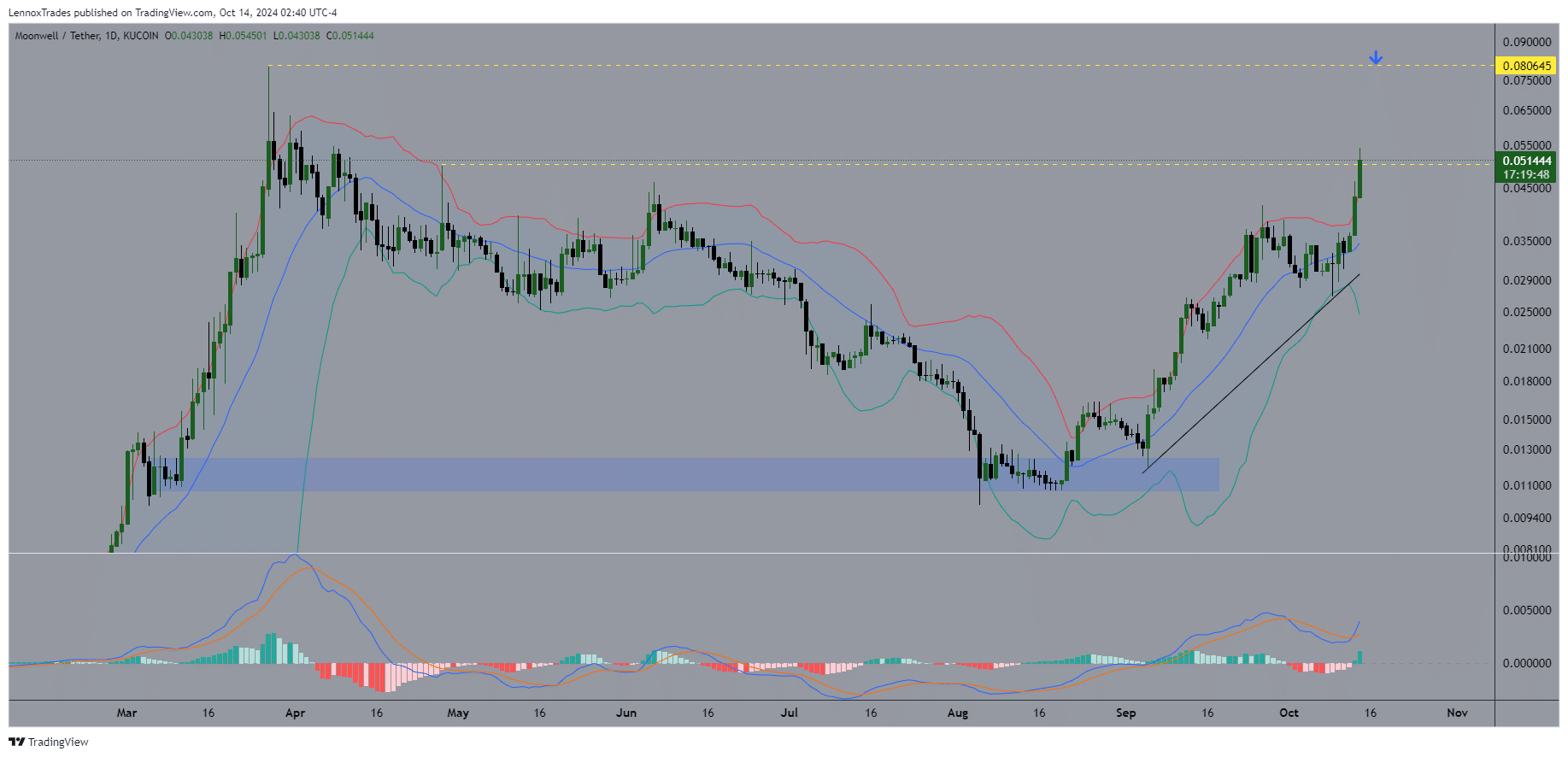

Moonwell price action and prediction

Moonwell’s price action is currently bullish, with the WELL token trading above $0.05. Since August 20th, WELL/USDT has been steadily climbing after confirming the low during the market crash, marked the bottom.

Since then, WELL has maintained a higher trajectory, aiming to break and hold above the key $0.05 level. If this happens, it could push the token towards the $0.08 target, resulting in potential gains of over 63%.

Source: TradingView

Moonwell’s rising market cap suggests growing interest, and if WELL hits its target, it could establish a new all-time high (ATH).

The Bollinger Bands also indicate increased momentum, while the MACD, having flipped bullish, points to enough volume for the price to continue moving higher and possibly surpass the $0.08 mark.

On-chain analytics and stakeholder reports have also shown positive growth, adding to the momentum behind WELL’s rise.

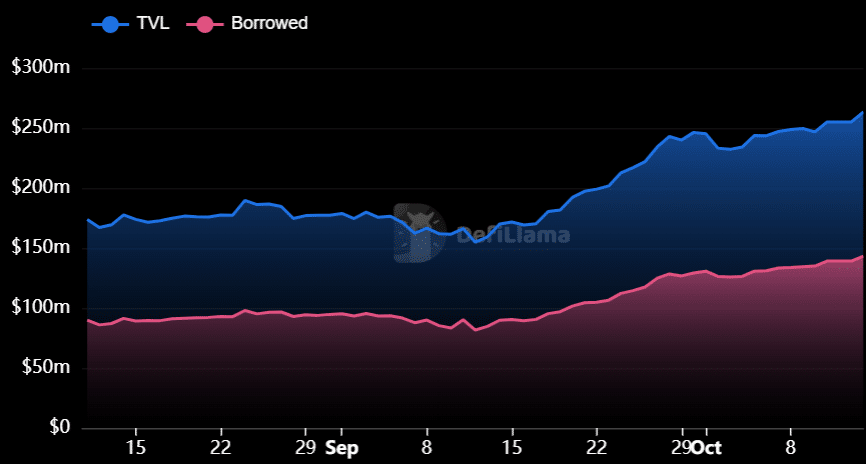

TVL and active loans

From a technical standpoint, Moonwell’s migration to the Base blockchain has triggered a surge in its total value locked (TVL) and the amount borrowed, signaling increased user engagement.

The TVL now stands at $263.36 million, with $143 million borrowed. Additionally, active loans have grown by 56% monthly, while TVL has risen by 72%, which translates to an additional $102 million.

Source: DefiLlama

Data from Token Terminal further highlights a significant increase in fees generated by Moonwell’s protocol, affirming its steady growth.

WELL volume and net deposits

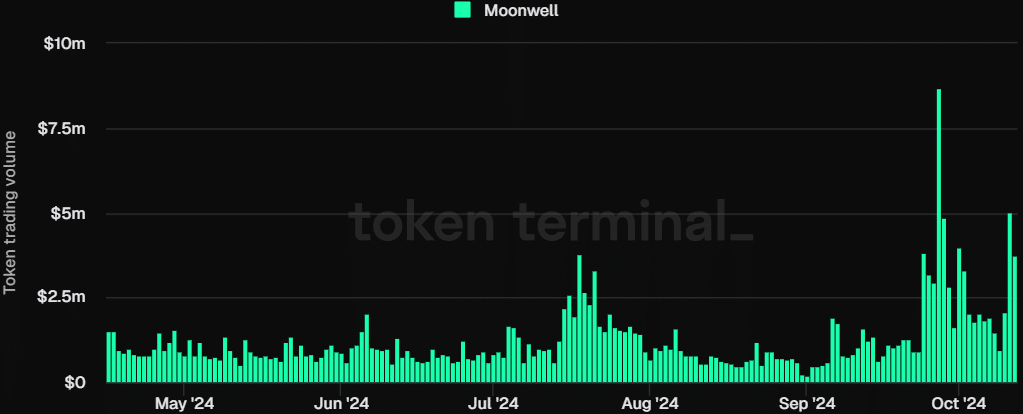

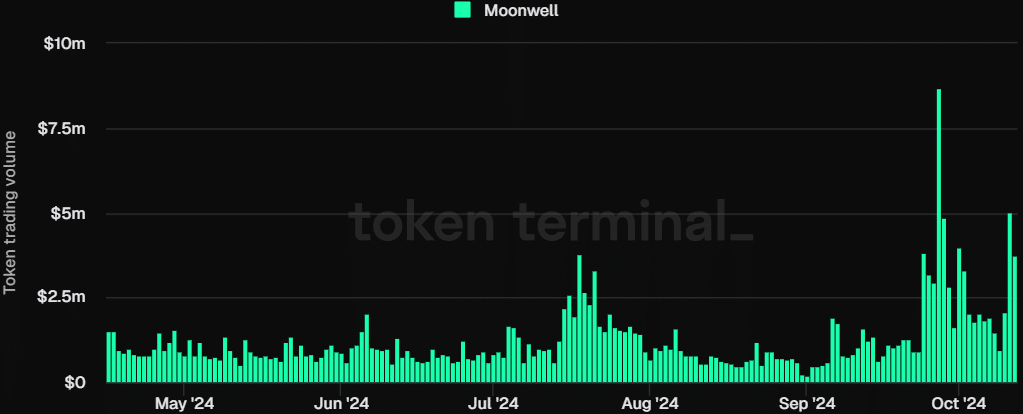

Trading volume for WELL has also followed an upward trend, with a 204% increase over the past month, equating to approximately $70 million.

Net deposits have shown similar growth, rising by 63%, totaling $229 million. The market cap has increased by 41% in the past 30 days, reinforcing Moonwell’s promising potential.

Source: Token Terminal

For investors looking for both short-term gains and long-term growth, Moonwell’s price action presents a strong opportunity.

If Bitcoin and Ethereum continue their upward momentum, Moonwell’s staking rewards and liquidity could see an even greater boost, driving the token’s value higher.

With its positive outlook, WELL is well-positioned to continue its climb, potentially reaching new highs in the coming months.