- MKR dipped by 32.58% over the past month.

- An analyst predicted a trend reversal, citing a bullish crossover of key indicators.

While the crypto market has experienced a considerable upswing over the past month, Maker [MKR] has followed a different path. The altcoin faced a significant decline in its price charts.

At press time, Maker was trading at $1111, showing a 32.58% decline on monthly charts and a 6.14% drop over the past week.

But market optimism had revived over the past day as MKR’s trading volume surged by 55.39%. This upswing has given MKR a sign of revival.

With renewed market interest, crypto analysts were buzzing. Ali Martinez, a popular analyst, suggested on X (formerly Twitter) that MKR is showing a bullish crossover, citing the Stochastic RSI (StochRSI).

Analyzing market sentiment

In his analysis, Martinez posited that Maker’s TD sequential flashed a buy signal. This implies that the current trend has been exhausted. Therefore, the bearish trend is ending as buying pressure enters the market.

Source: X

According to him, MKR’s RSI on the 3-day chart is in oversold territory, which now presents a buying opportunity with investors buying the dip.

The analyst further looked at StochRSI arguing that it’s indicating a bullish crossover. In this context, the K line crossed above the D line three days ago. This pointed that the upward momentum was building.

Finally, Martinez completed his bullish case for MKR proposing that the MACD was on the verge of turning bullish.

What MKR charts say…

While, the analysis provided by Martinez provides, a positive outlook for MKR, other metrics provide a different story.

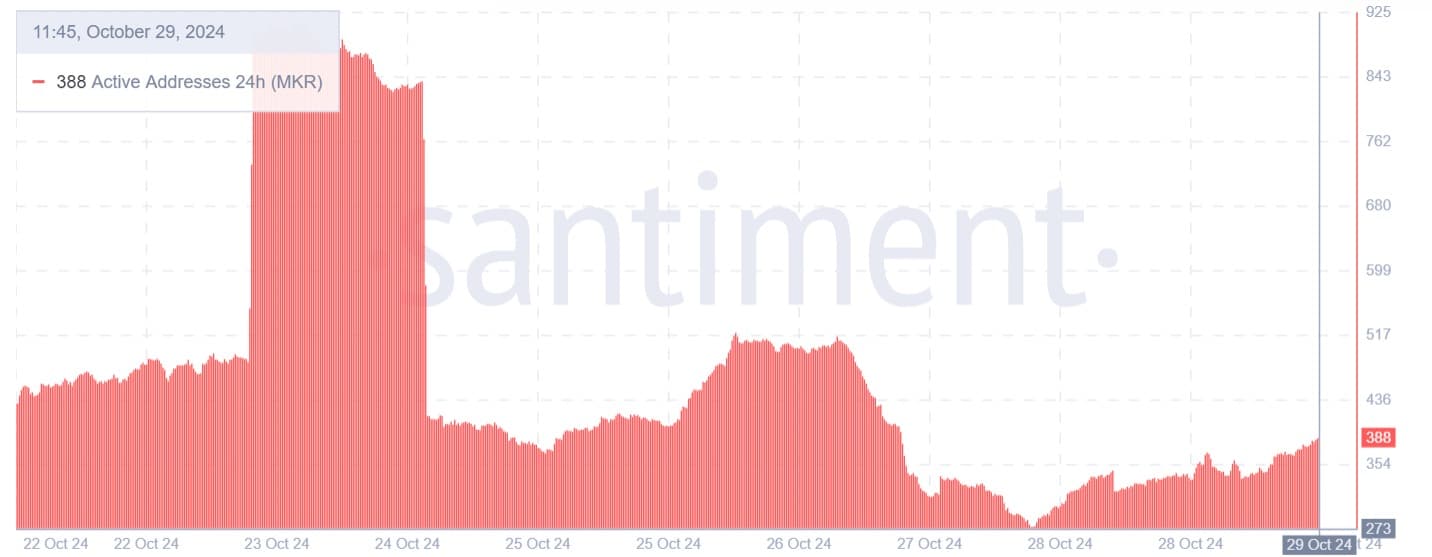

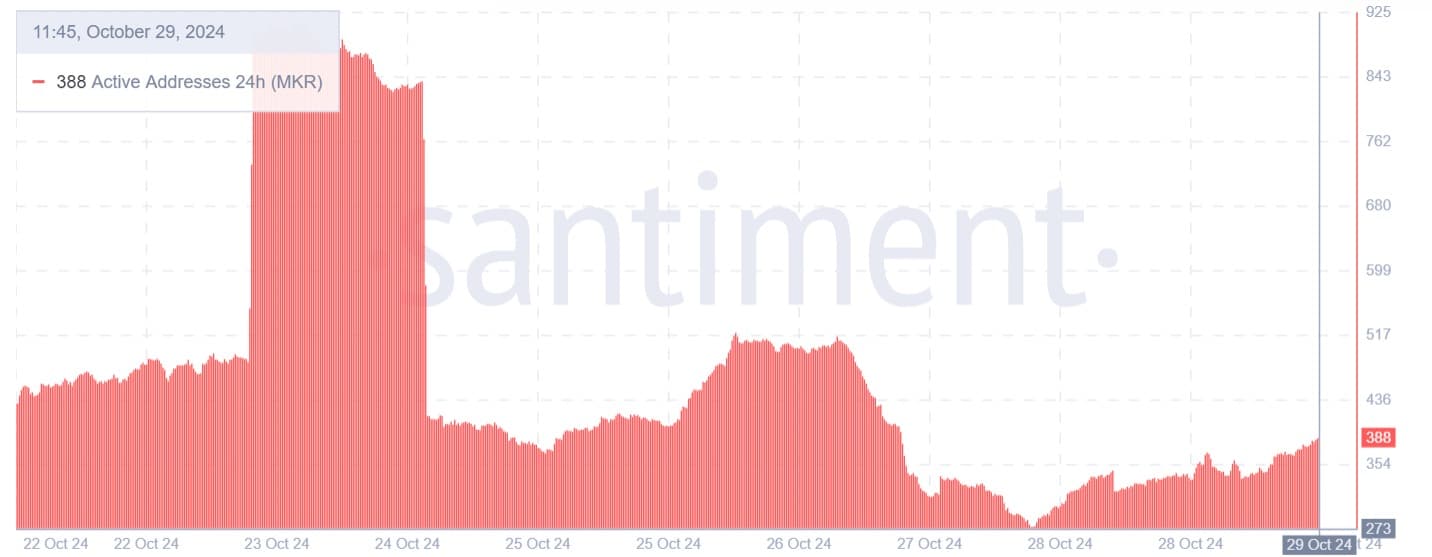

Source: Santiment

For starters, Maker’s Daily Active Addresses have experienced a strong decline over the past week.

Active addresses have dipped from 916 to 388. Such a drop in active users shows less demand for the altcoin, and investors lack confidence.

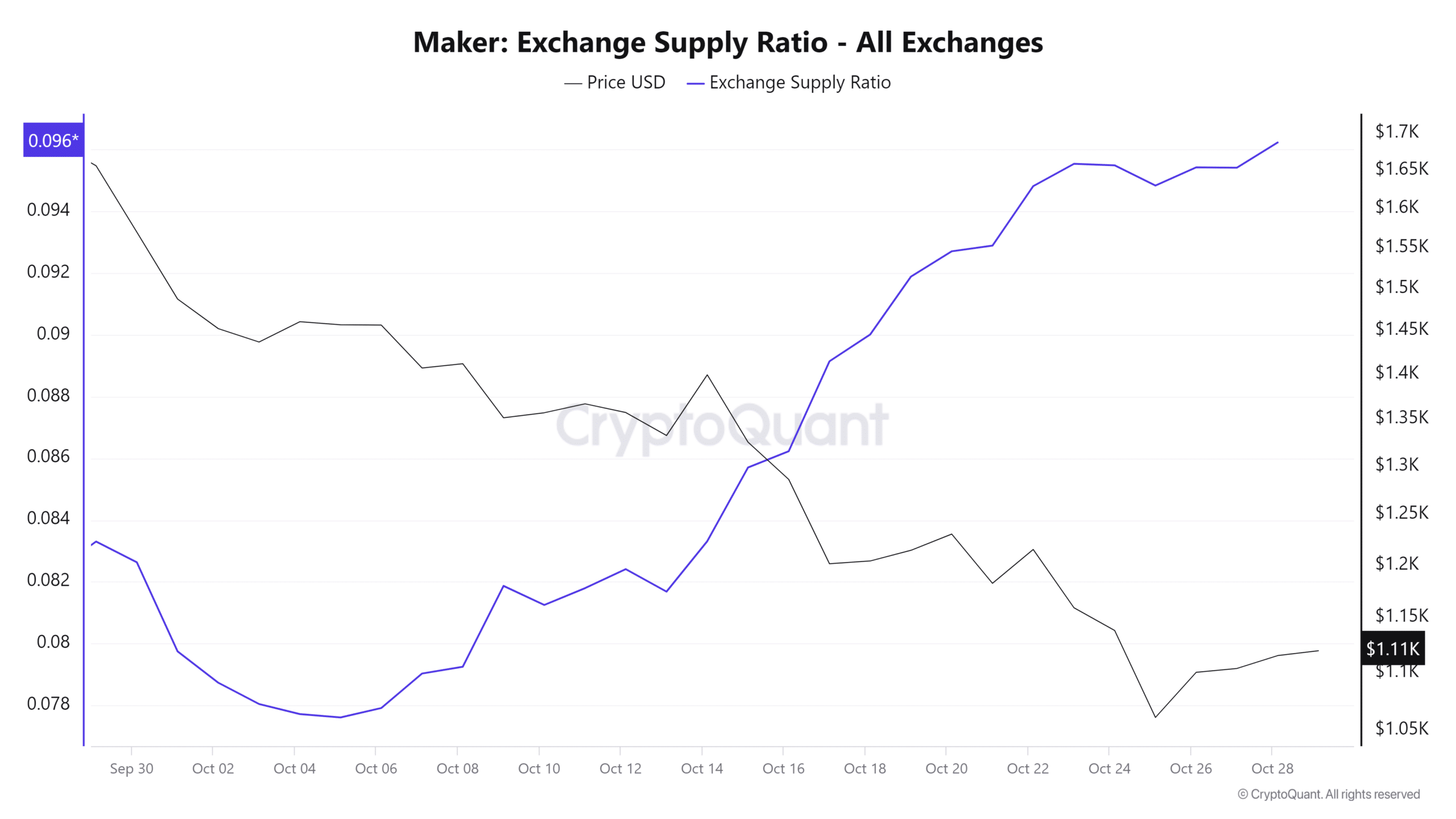

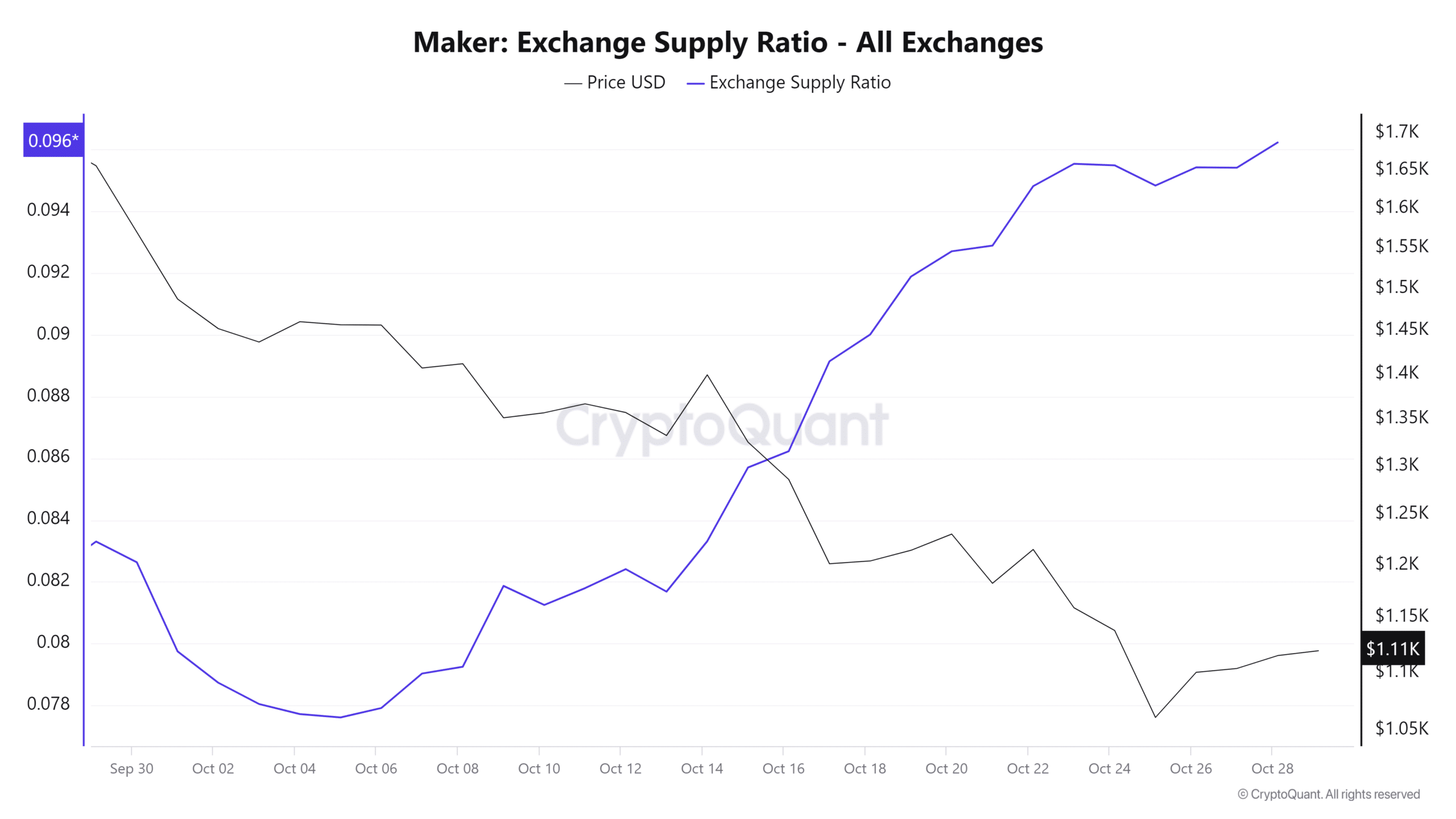

Source: Cryptoquant

Additionally, Maker’s Exchange Supply Ratio experienced a sustained increase over the past month.

This suggested that investors are actively transferring their MKR tokens into exchanges and preparing to sell.

Reduced holdings among investors signal their indifference to the market.

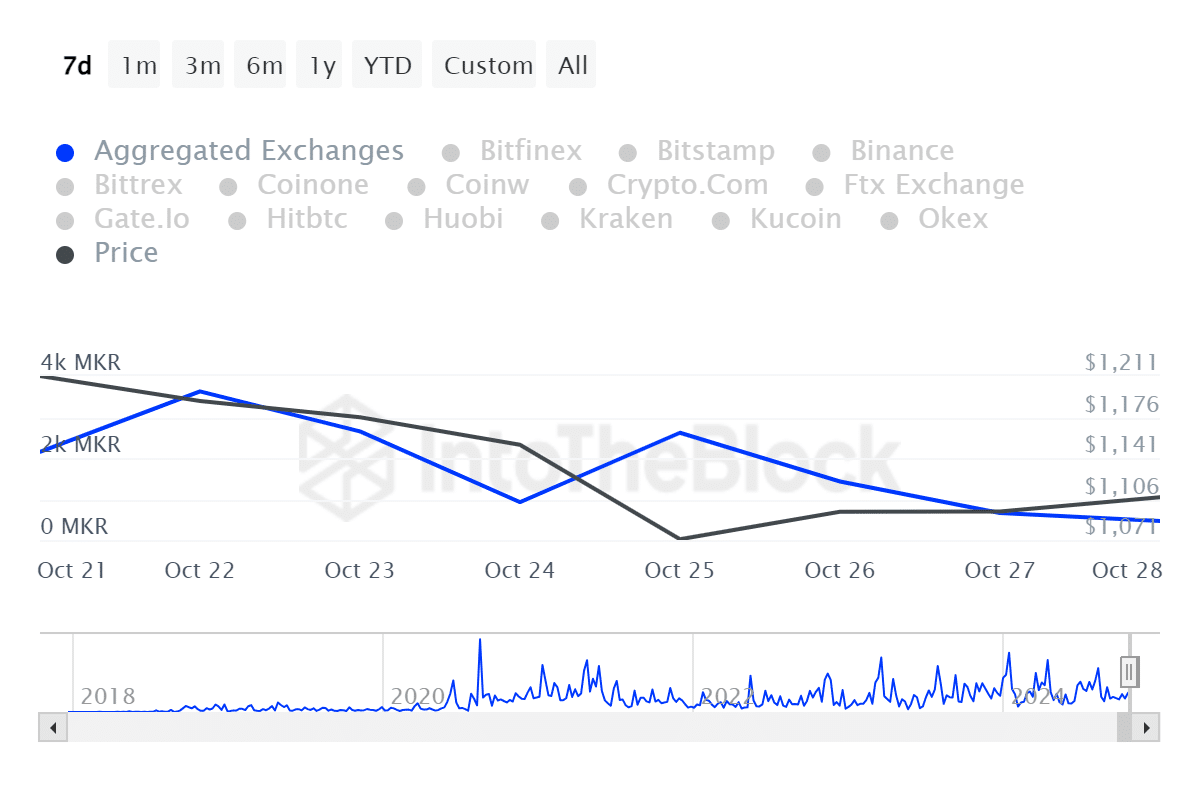

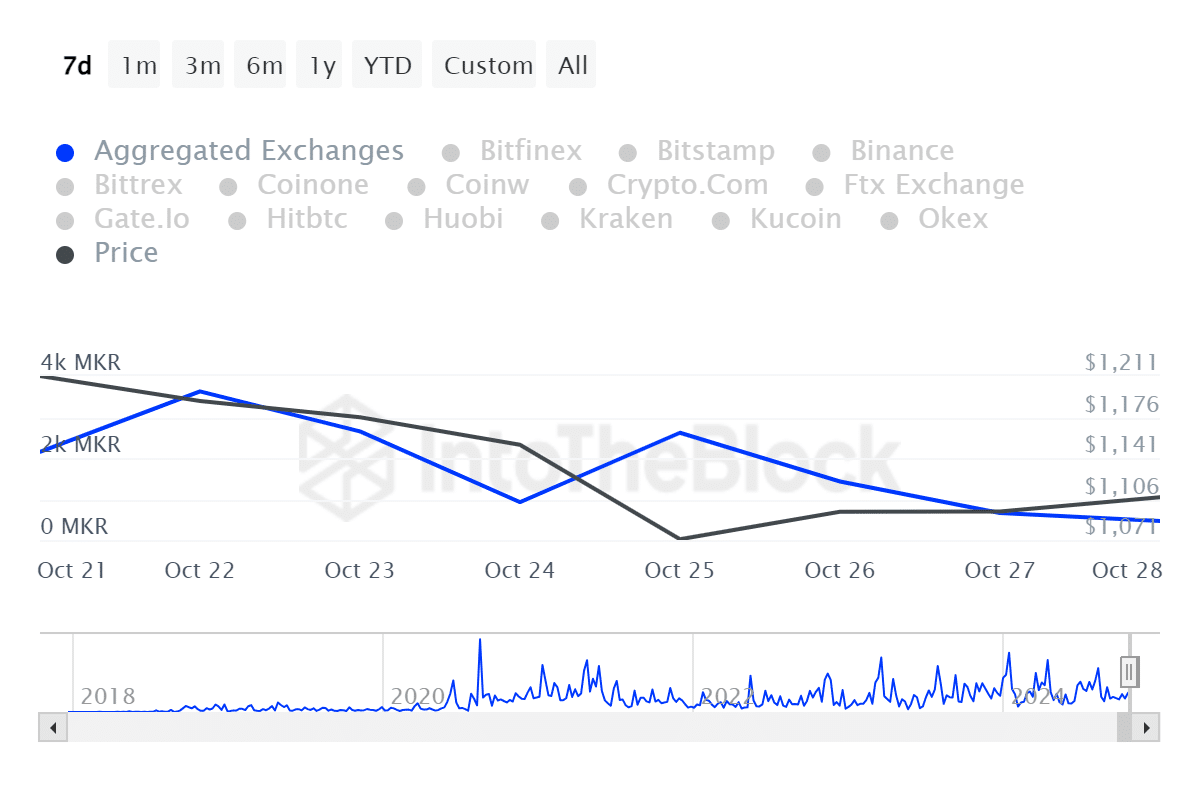

Source: IntoTheBlock

This is further evidenced by a decrease in Maker’s Outflow volume. The amount of MKR moving out of exchanges has declined from 3.63k to 463. This implies that investors are not withdrawing their tokens to store in cold wallets, anticipating further price gains.

Read Maker’s [MKR] Price Prediction 2024–2025

Simply put, although Martinez was seeing a trend reversal, on-chain metrics suggest that the downtrend is still strong. As such, if these conditions are maintained, MKR could see some more decline before attempting another uptrend.

Thus, the altcoin will find its support at $1000. However, if the reversal materializes, Maker will reach $1250 in the short term.