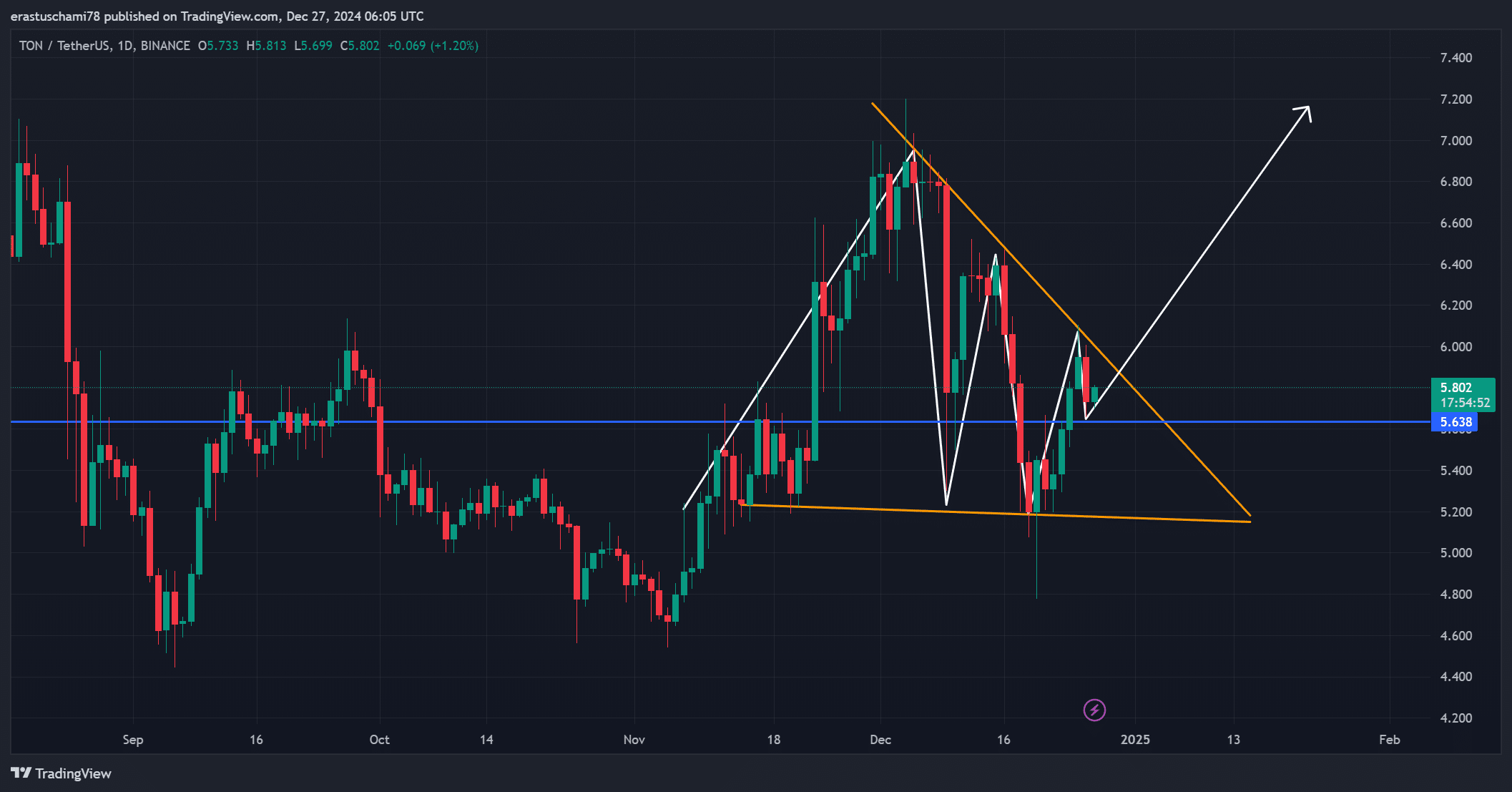

- The bullish pennant pattern signaled a potential breakout, with a target price of $7.2

- On-chain metrics and technical indicators were in line with each other, showing strong momentum and rising adoption

Toncoin’s [TON] market has been heating up lately, with the altcoin gearing up for a potential breakout from a bullish pennant flag pattern. At press time, TON was trading at $5.79, down 1.21% in the last 24 hours, with the token still above the critical $5.6 resistance level.

This technical setup has captured traders’ attention, as a successful breakout could propel the price towards $7.2. With strong on-chain metrics supporting the bullish outlook, the momentum behind TON seems to be steadily increasing too.

Analyzing TON’s price movement and breakout potential

TON’s price action revealed a clear bullish pennant flag pattern, signifying consolidation before a likely upward move. The $5.6 resistance level has served as a critical threshold, and its recent successful retest strengthened the case for a breakout.

If TON climbs above this level with significant buying pressure, the next target could be the $7.2 range, offering significant returns. However, traders must watch for volume and momentum to confirm the breakout as a failure to sustain these could reverse the trend.

Source: TradingView

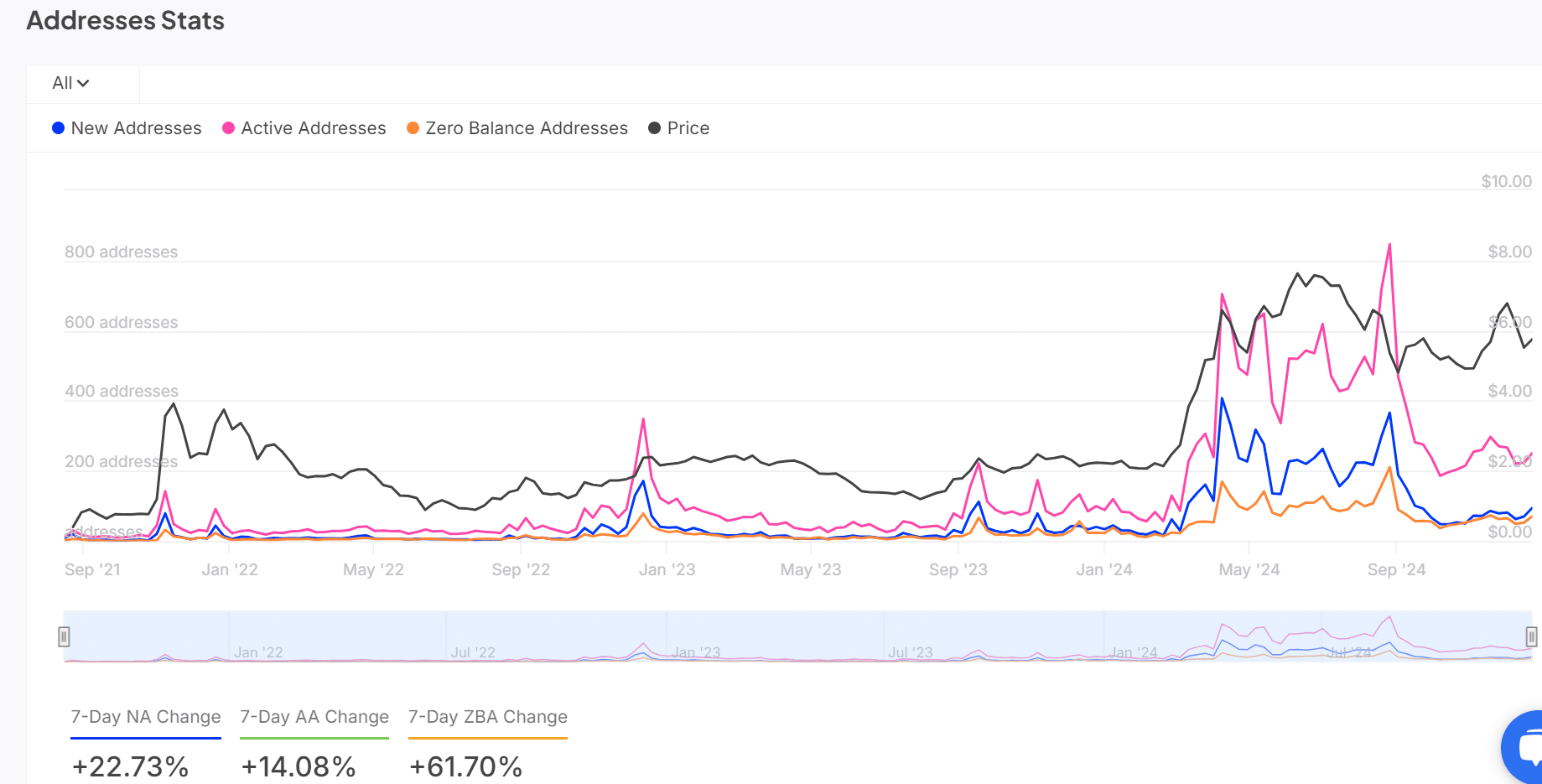

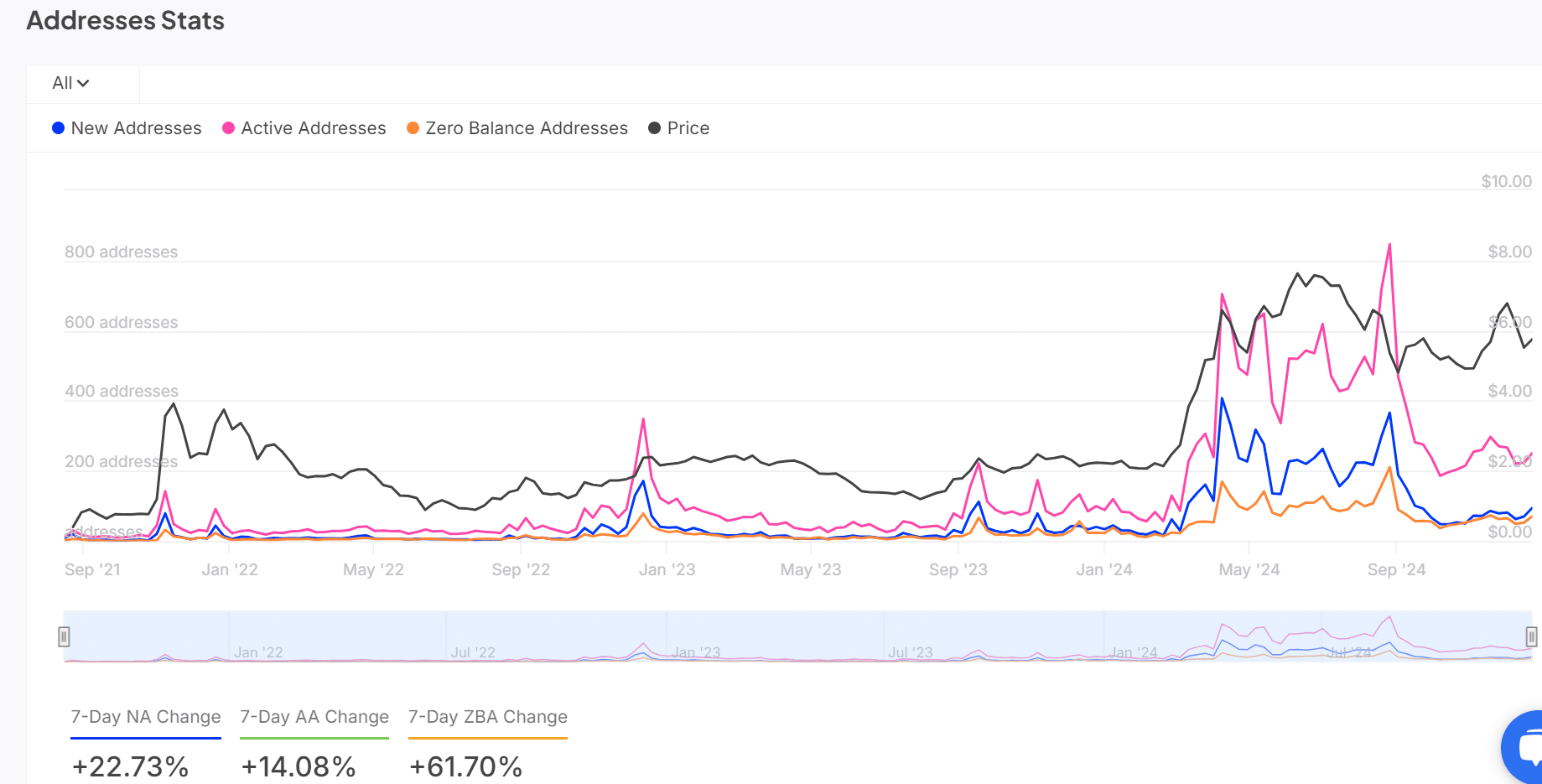

On-chain metrics show growing network activity

On-chain data highlighted increasing activity across TON’s network. Over the past week, new addresses rose by 22.73%, jumping from 167 to 205, while active addresses grew by 14.08% – Hiking from 178 to 203.

Additionally, zero-balance addresses saw a massive 61.7% spike, rising from 330 to 534 – A sign of an influx of new participants.

These metrics suggested that TON’s adoption has been accelerating. However, sustained growth will be essential to maintain investor confidence and support further price appreciation on the charts.

Source: IntoTheBlock

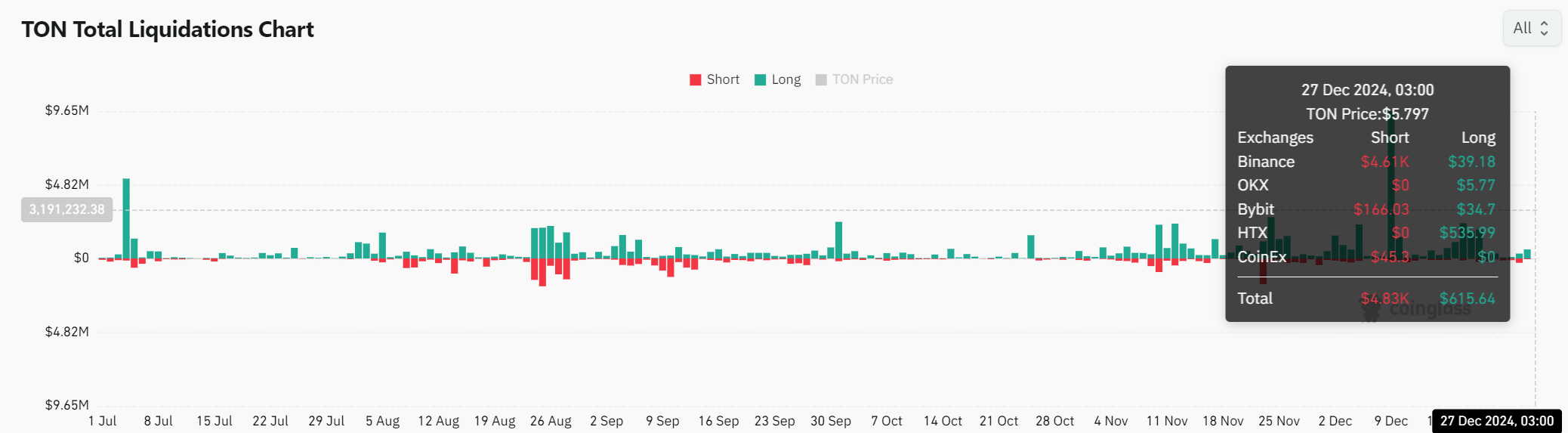

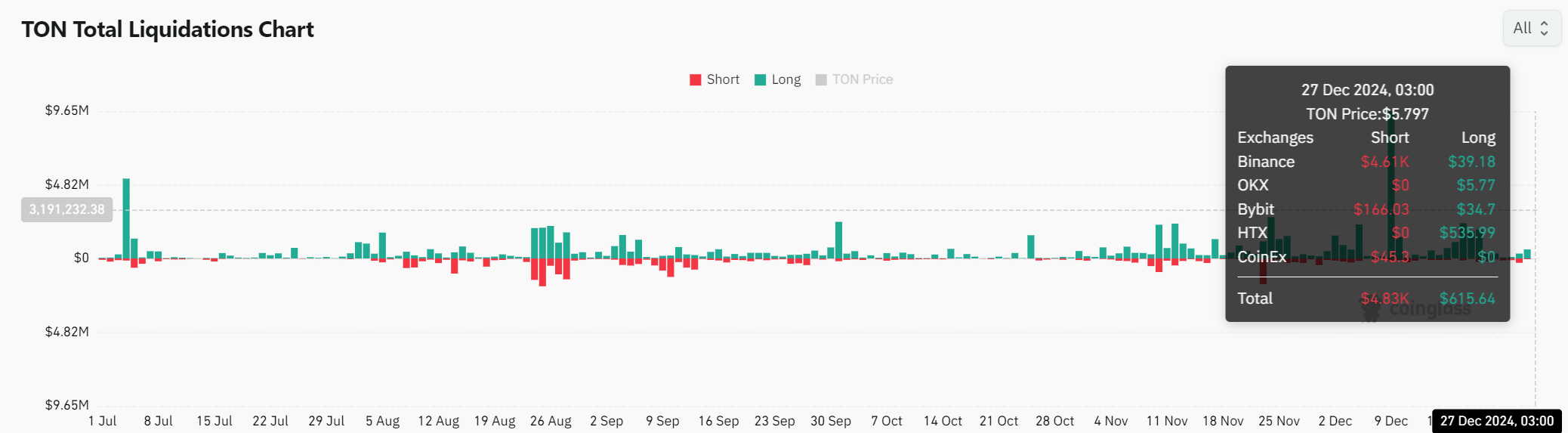

TON’s liquidation data hints at cautious optimism

Liquidation trends revealed a cautious, but optimistic sentiment among traders. Short liquidations totalled $4.83k, compared to $615.64 in longs, showing that market participants remain hesitant to leverage long positions heavily.

However, a confirmed breakout above $5.6 could trigger a cascade of short liquidations, which may amplify upward momentum. Therefore, traders should closely monitor these liquidation levels as a key indicator of market shifts.

Source: Coinglass

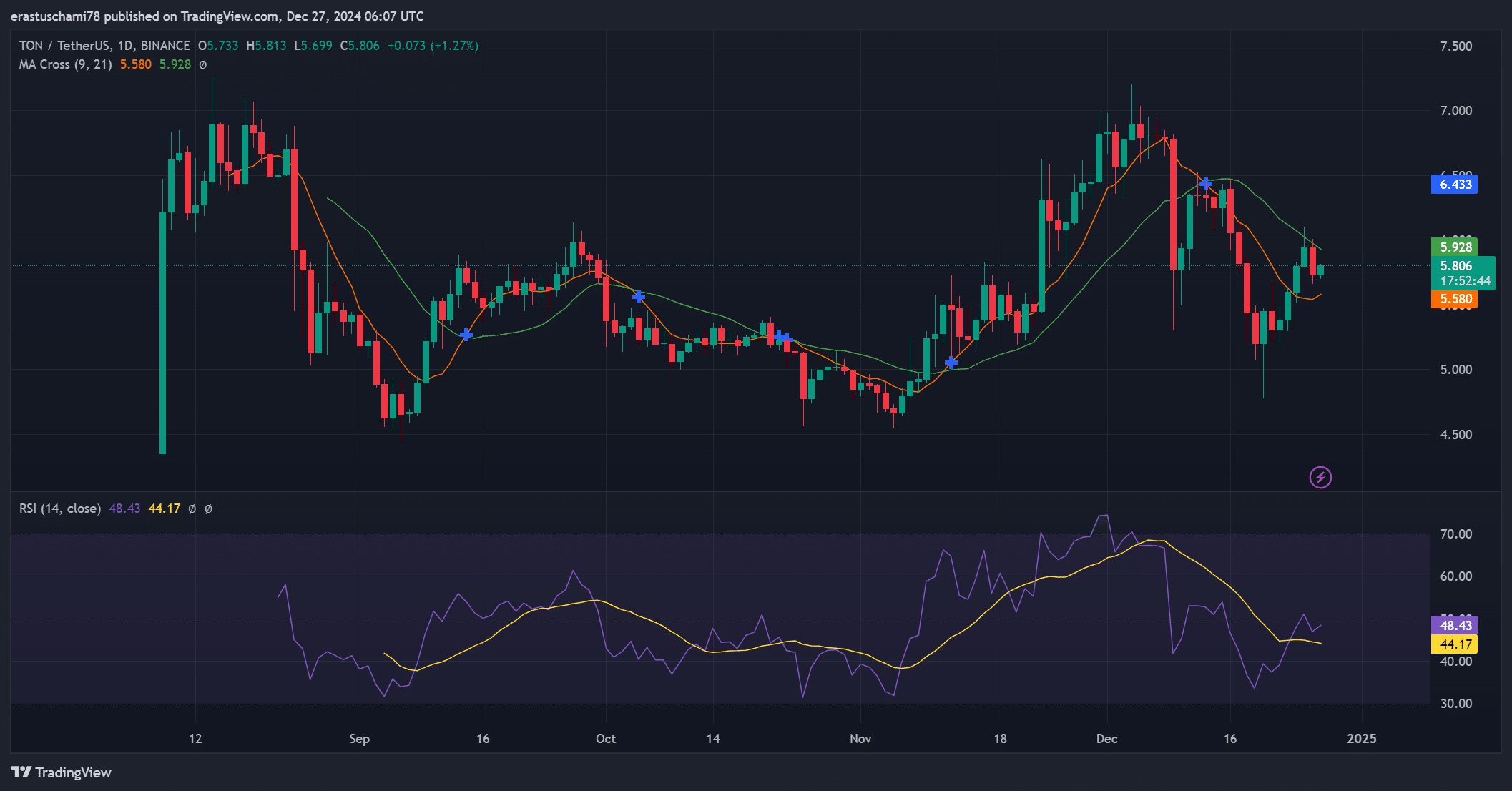

Technical indicators signal bullish momentum

Technical indicators supported the bullish case for TON. The RSI had a value of 48.43, indicating neutral momentum but with room for growth. Furthermore, the 9-day moving average at $5.80 was above the 21-day moving average at $5.58 – A sign of a favorable trend.

Combined with the pennant flag setup, these indicators seemed to hint at a market primed for a breakout. However, consistent buying pressure will be critical to sustaining this momentum.

Source: TradingView

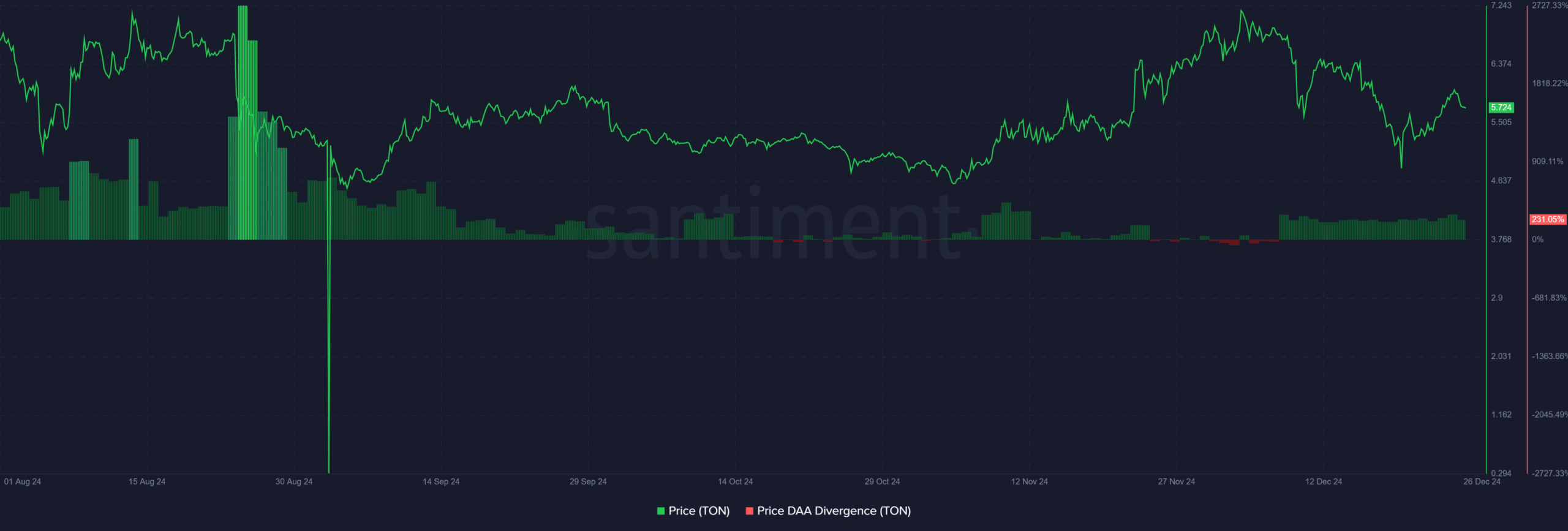

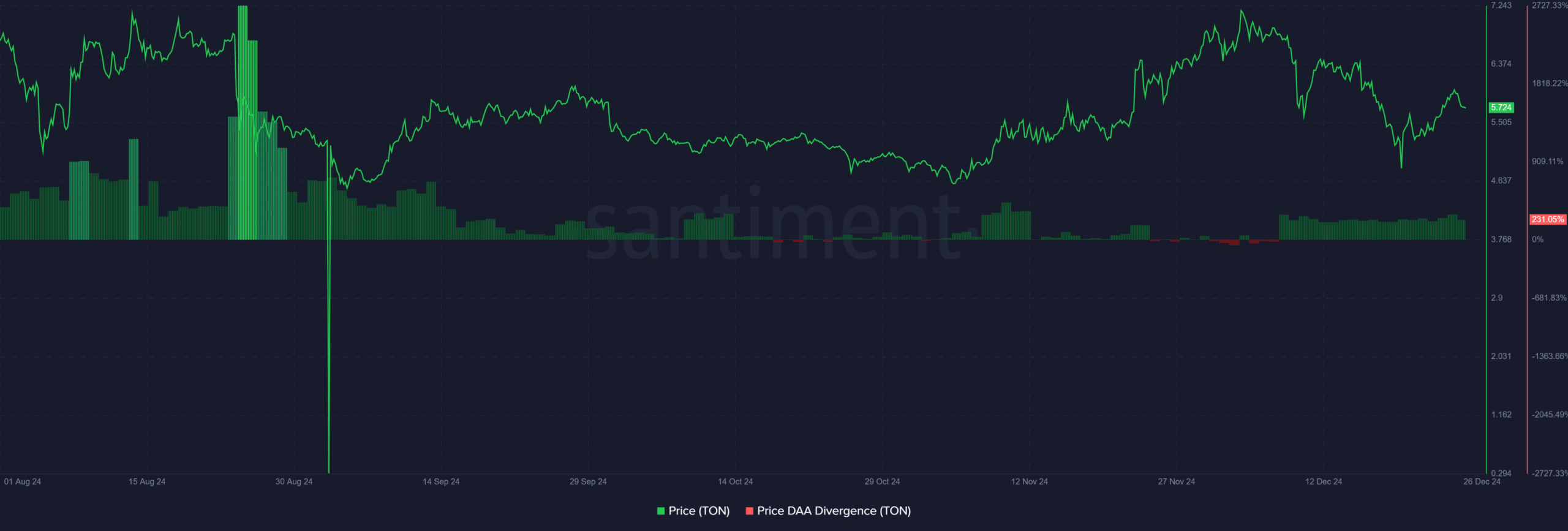

Daily active addresses divergence reflects strength

The price and daily active addresses (DAA) divergence offered some additional optimism. In fact, the DAA at 231% aligned closely with TON’s price action at $5.7.

This narrowing divergence highlighted improving fundamentals, suggesting that TON’s network may be growing stronger alongside its price movement.

Source: Santiment

Read Toncoin’s [TON] Price Prediction 2024–2025

TON is well-positioned for a breakout, with strong technical indicators and rising on-chain activity. A decisive move above $5.6 would likely push the price towards $7.2, confirming the start of a strong rally.

Simply put, TON’s outlook remains highly promising as it continues to gain momentum.