- BTC saw an outflow of over 45,000.

- BTC has declined in the last 24 hours but remained around $62,000.

The recent volatility in Bitcoin’s [BTC] price has led to increased activity among traders and holders.

While Bitcoin has managed to maintain its position around the $60,000 level, the fluctuations in the last few days have caused some holders to reconsider their positions, leading to sell-offs.

Bitcoin sees sell-offs from short-term holders

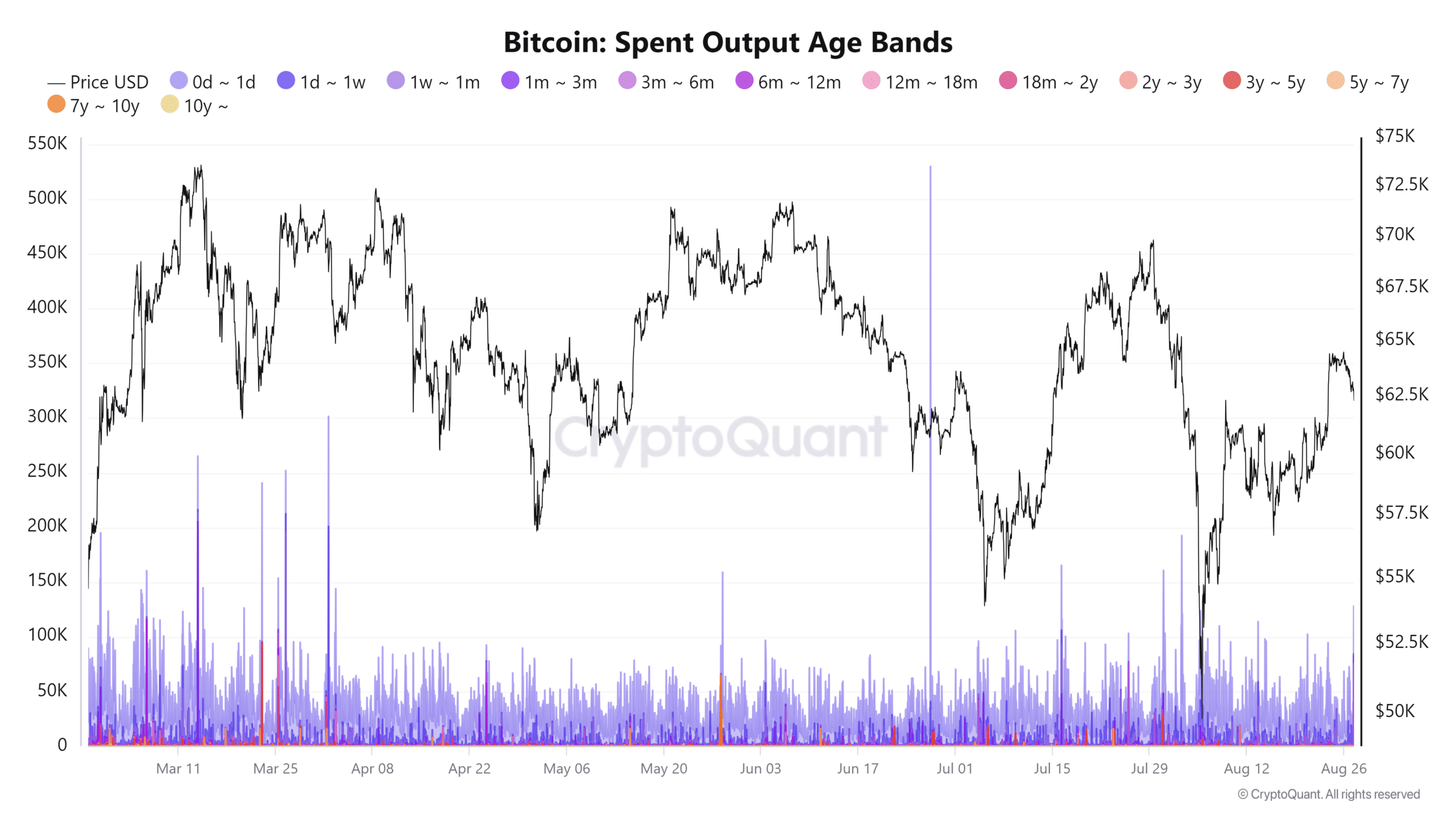

Recent data from CryptoQuant indicated that some previously dormant Bitcoin networks have started to show renewed activity.

Specifically, analysis of the 1w-1m spent output age bands revealed that short-term Bitcoin holders have transferred a significant amount—33,155 BTC.

This uptick in short-term holders’ activity could signal immediate market selling pressure.

Source: CryptoQuant

The current market volatility and uncertainty likely drive the decision to transfer and sell these holdings.

Investors may seek to lock in profits after Bitcoin’s recent price movements or mitigate potential losses if they anticipate further declines.

Additionally, some may be rebalancing their portfolios in response to the changing market dynamics.

This increased activity among short-term holders could add downward pressure on Bitcoin’s price, particularly if these transfers lead to significant selling on exchanges.

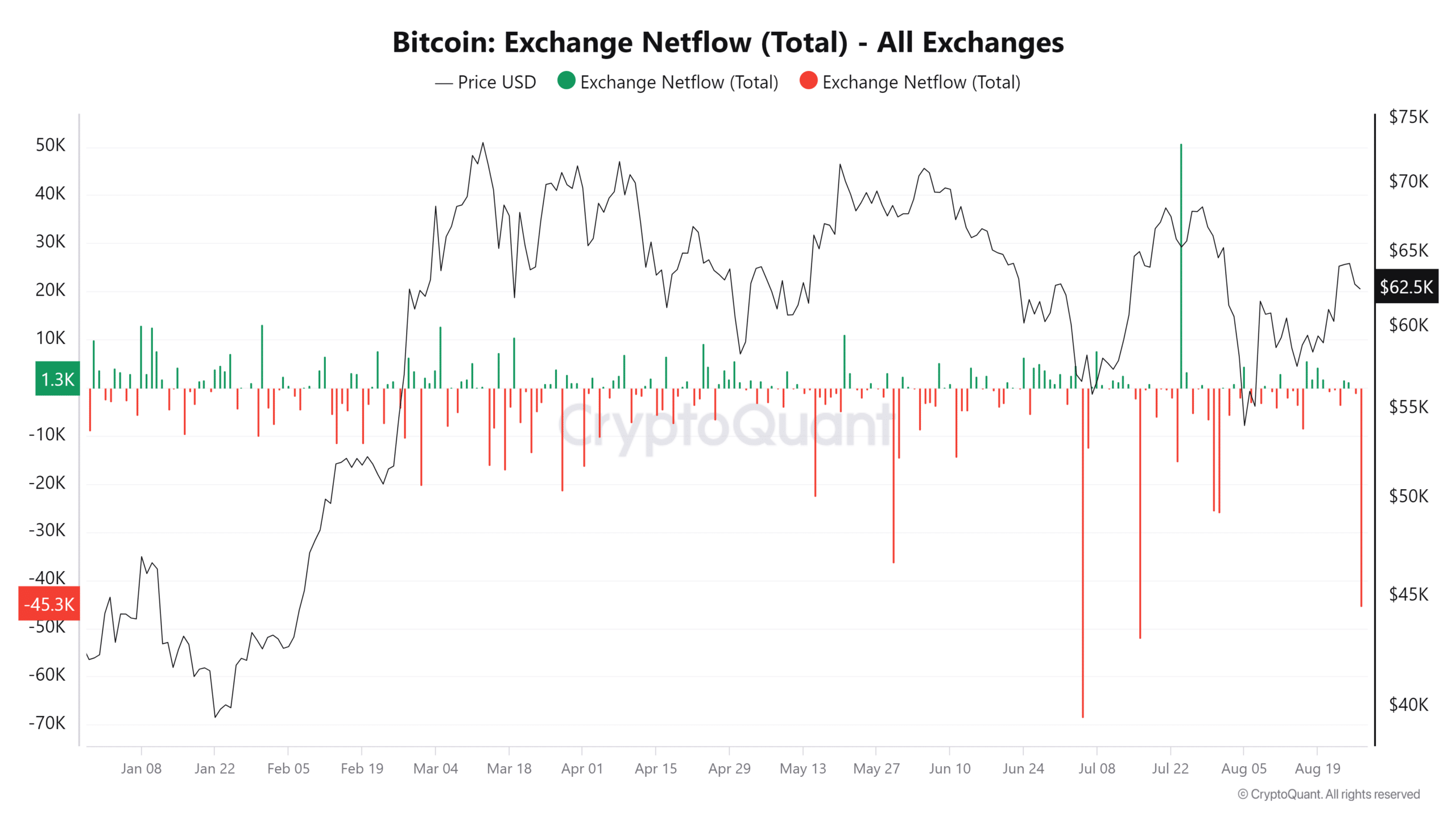

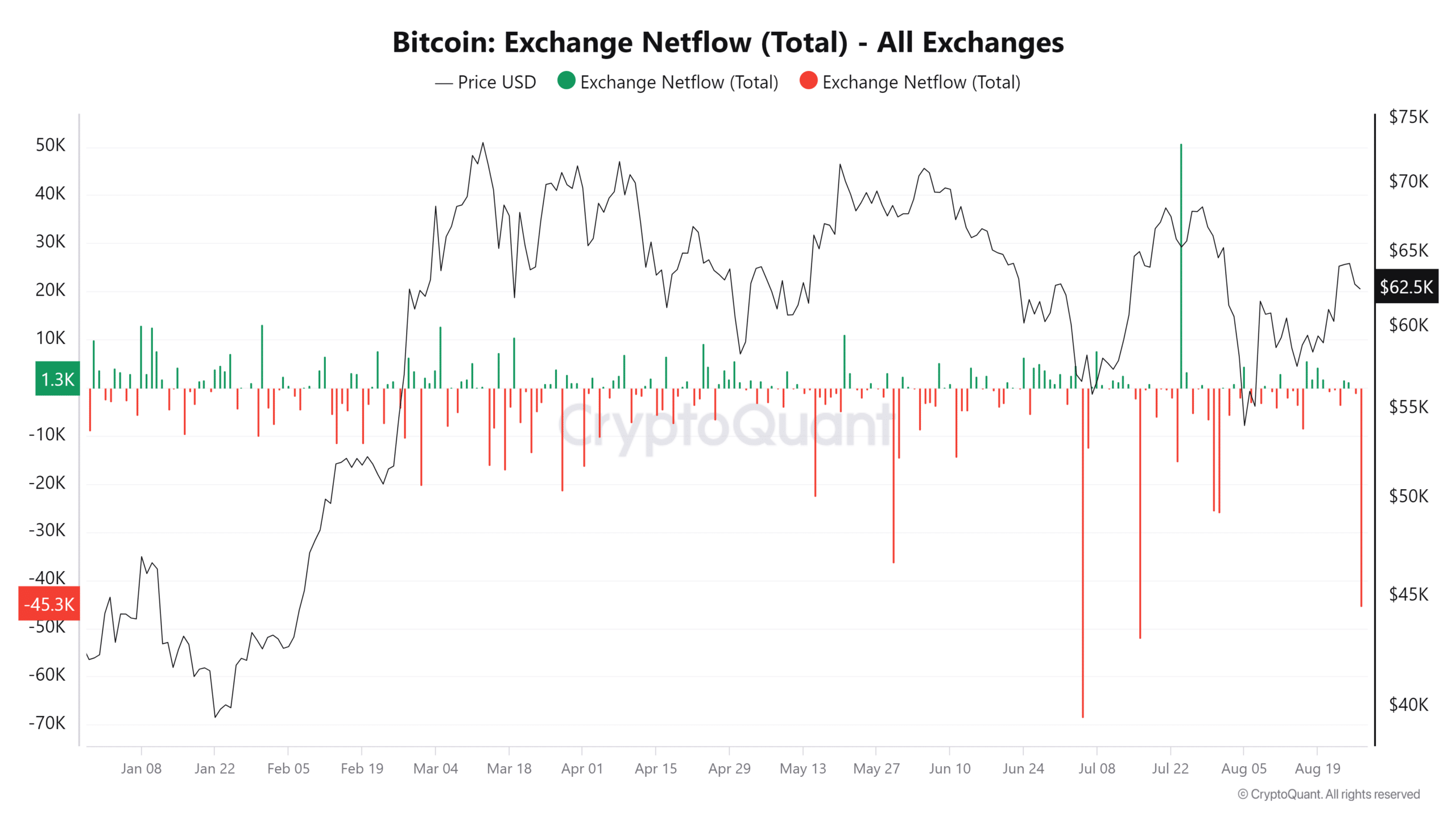

Bitcoin records its biggest outflow of the month

Despite the recent sell-off activity from short-term holders, Bitcoin recorded its largest outflow on the 26th of August, indicating a significant shift in market behavior.

According to the analysis of CryptoQuant’s exchange netflow, it was strongly negative, around -45,432 BTC. The last time Bitcoin experienced a negative outflow of this magnitude was in June, nearly two months ago.

A negative exchange netflow indicates that more BTC was withdrawn from exchanges than was deposited.

This trend is generally considered bullish, suggesting that holders are moving their Bitcoin off exchanges. When investors withdraw their assets from exchanges, it typically reflects confidence.

Source: CryptoQuant

Also, this movement contrasts with the selling pressure seen from some short-term holders.

This implies that while some market participants are locking in profits or mitigating risks, a larger group of investors is choosing to hold their BTC off exchanges.

BTC’s volatility stretches

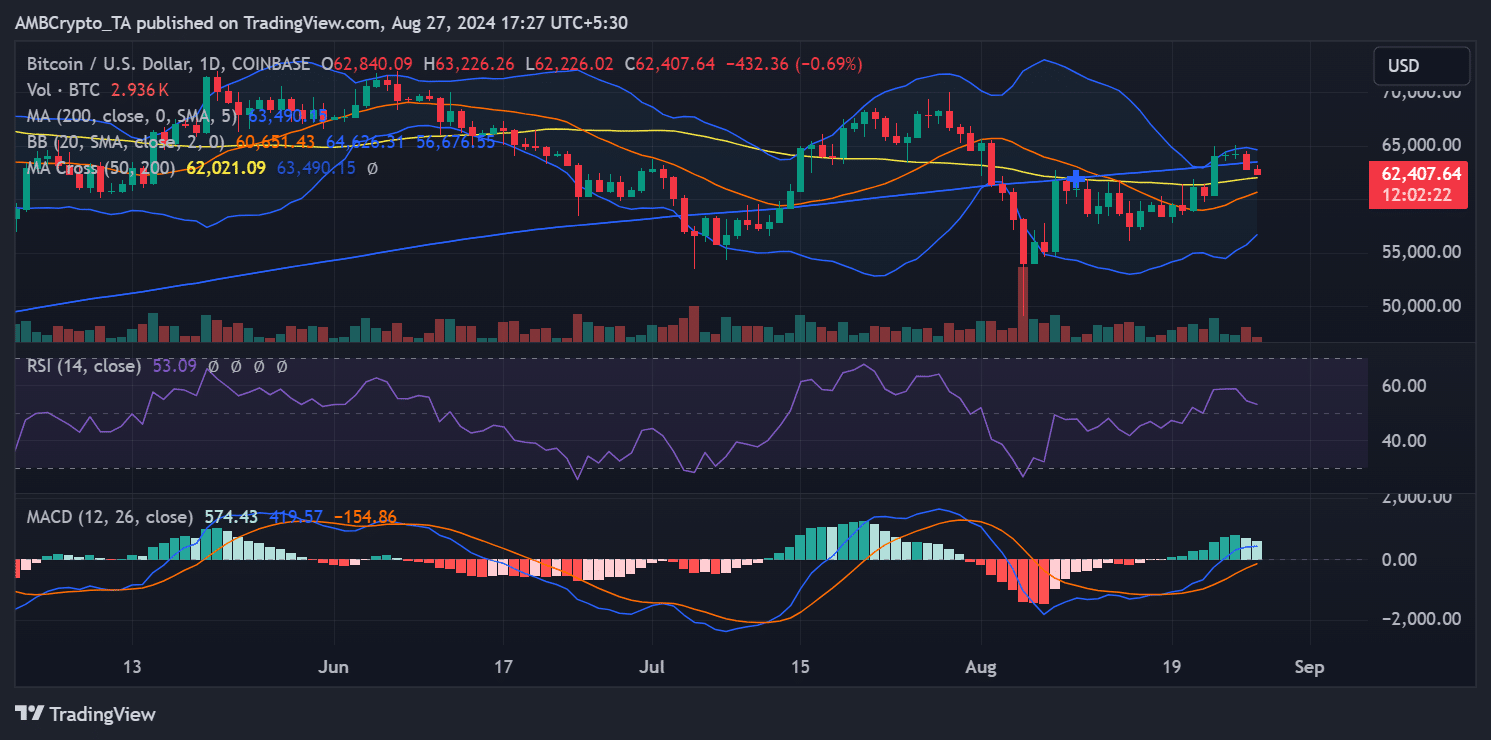

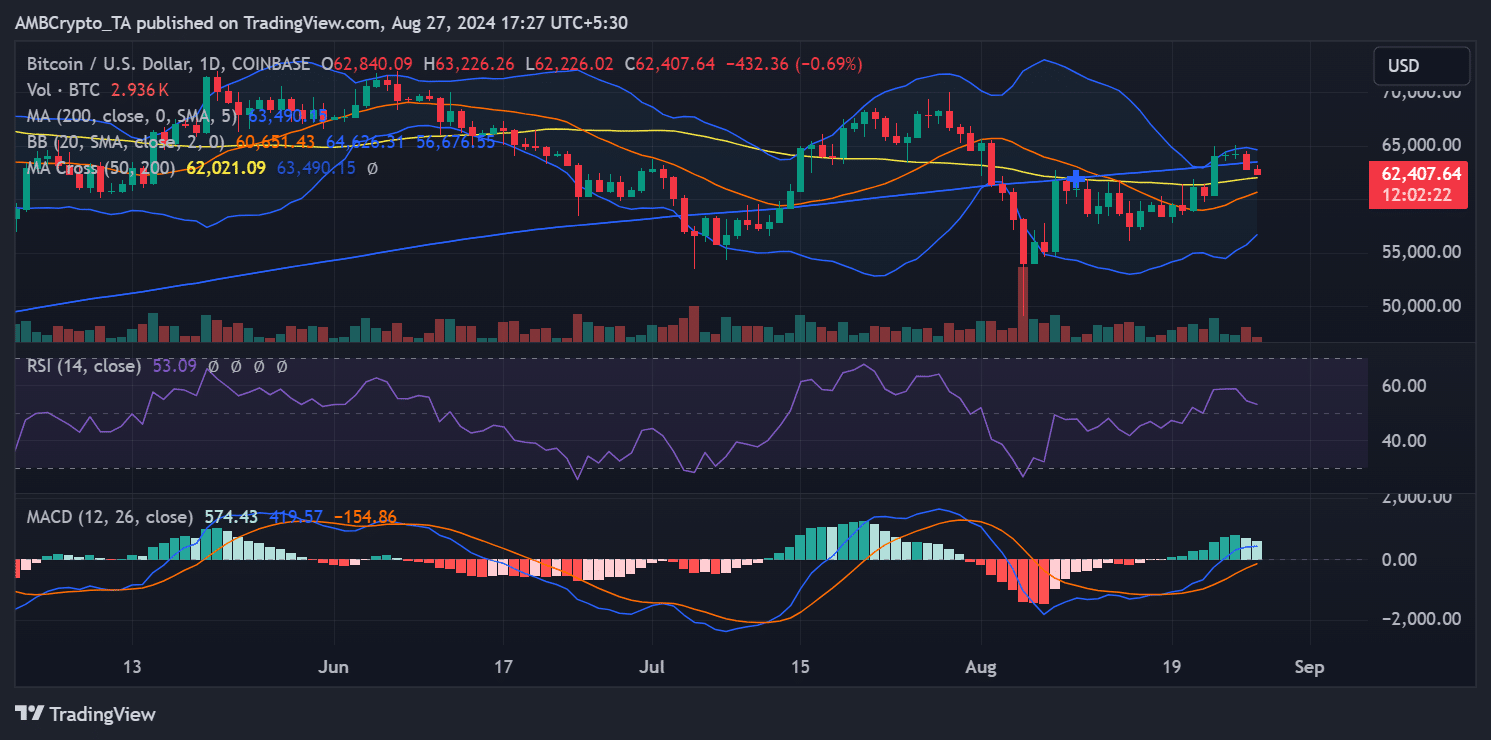

AMBCrypto’s analysis of Bitcoin’s daily trend highlights the ongoing volatility that Bitcoin has been experiencing.

The study of its Bollinger Bands—a technical indicator that measures price volatility—shows that the bands have stretched in recent days, reflecting the increased price fluctuations.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-25

In the last trading session, Bitcoin lost over 2% of its value and has continued to decline by almost 1% in the current session.

As of this writing, Bitcoin was trading at approximately $62,401. The widening of the Bollinger Bands indicated that the market has experienced higher volatility, with price movements becoming more pronounced.