- An FTX/Alameda staking address has unstaked $28M worth of Solana, which will likely be deposited to exchanges.

- However, despite this possible sale, SOL bulls are defying the bearish sentiment as price targets $172.

Solana [SOL] has rebounded alongside the broader cryptocurrency market. After Bitcoin [BTC] bounced to levels above $66K, SOL, like many altcoins, followed suit and reached weekly highs.

Solana traded at $154 at press time after a 1.47% gain in 24 hours. Spot trading volumes also spiked by around 45% during this period, according to CoinMarketCap.

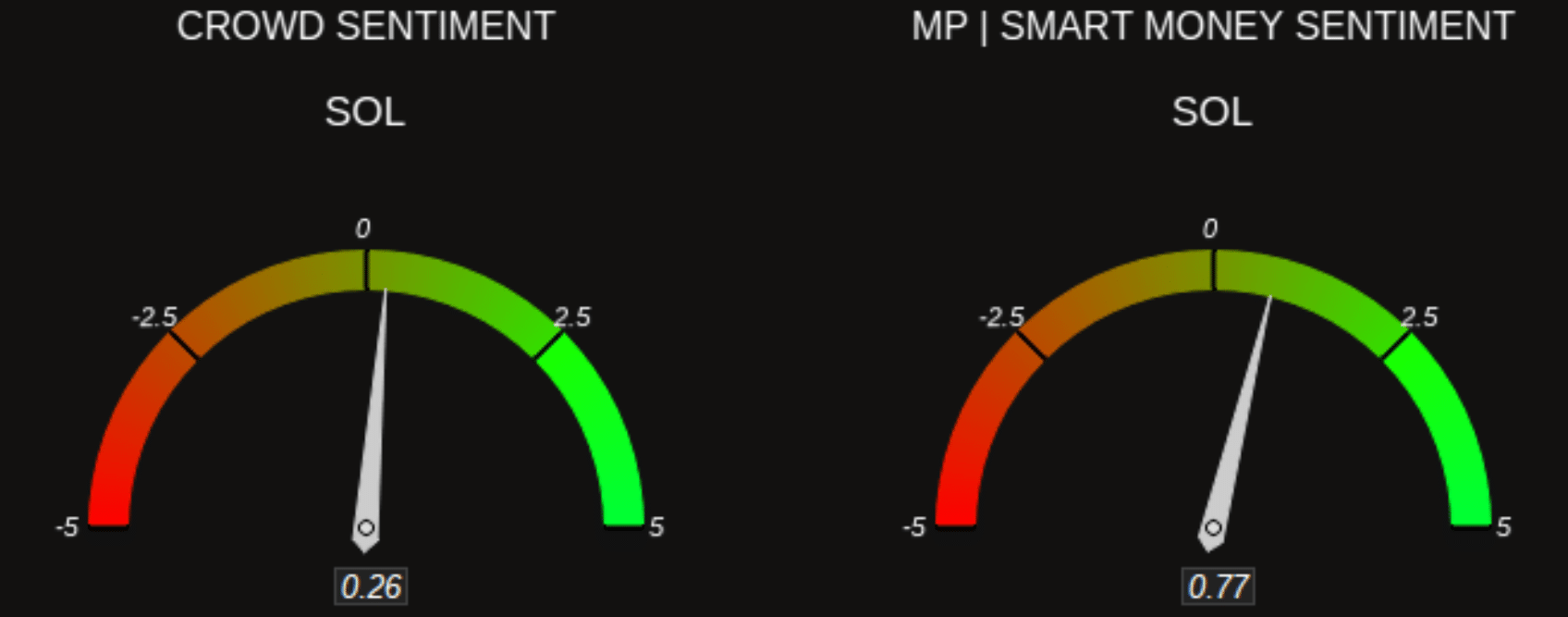

These gains have flipped the crowd and smart money sentiment around Solana to bullish.

Source: Market Prophit

The positive narrative comes despite concerns around a possible sale of millions of dollars worth of Solana by defunct crypto firms FTX and Alameda Research.

FTX unlocks Solana worth $28M

Data from Solscan showed that on the 15th of October, a staking address associated with FTX and Alameda unlocked 178,631 SOL, valued at around $28M at the current Solana price.

According to on-chain researcher EmberCN, these tokens will likely be sent to exchanges. This staking address redeems around 170,000 SOL between the 12th and the 15th of every month, which is later sent to Binance or Coinbase.

If the recently unstaked tokens are sold, it will likely increase the selling pressure on Solana. However, a look at the one-day chart shows that bulls are taking charge and overpowering the bearish sentiment.

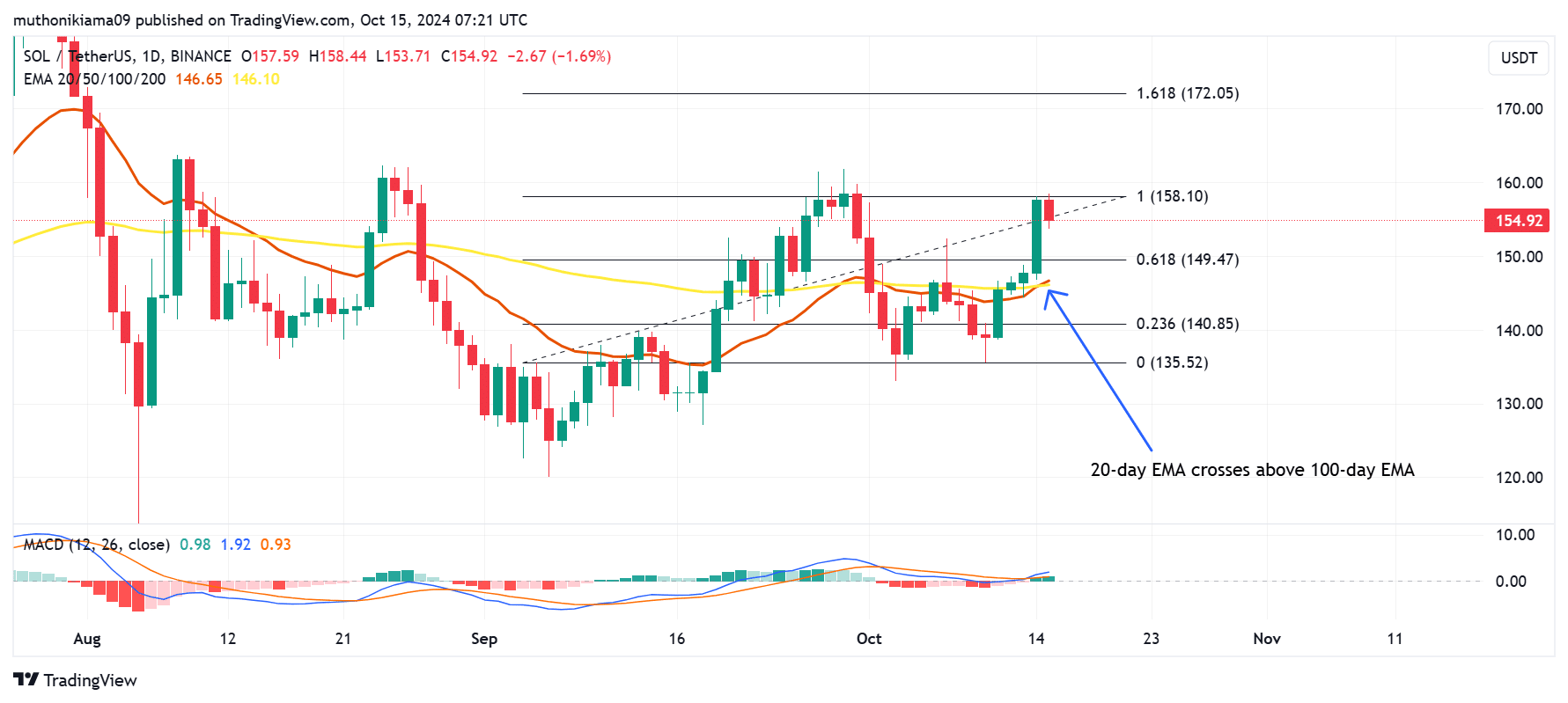

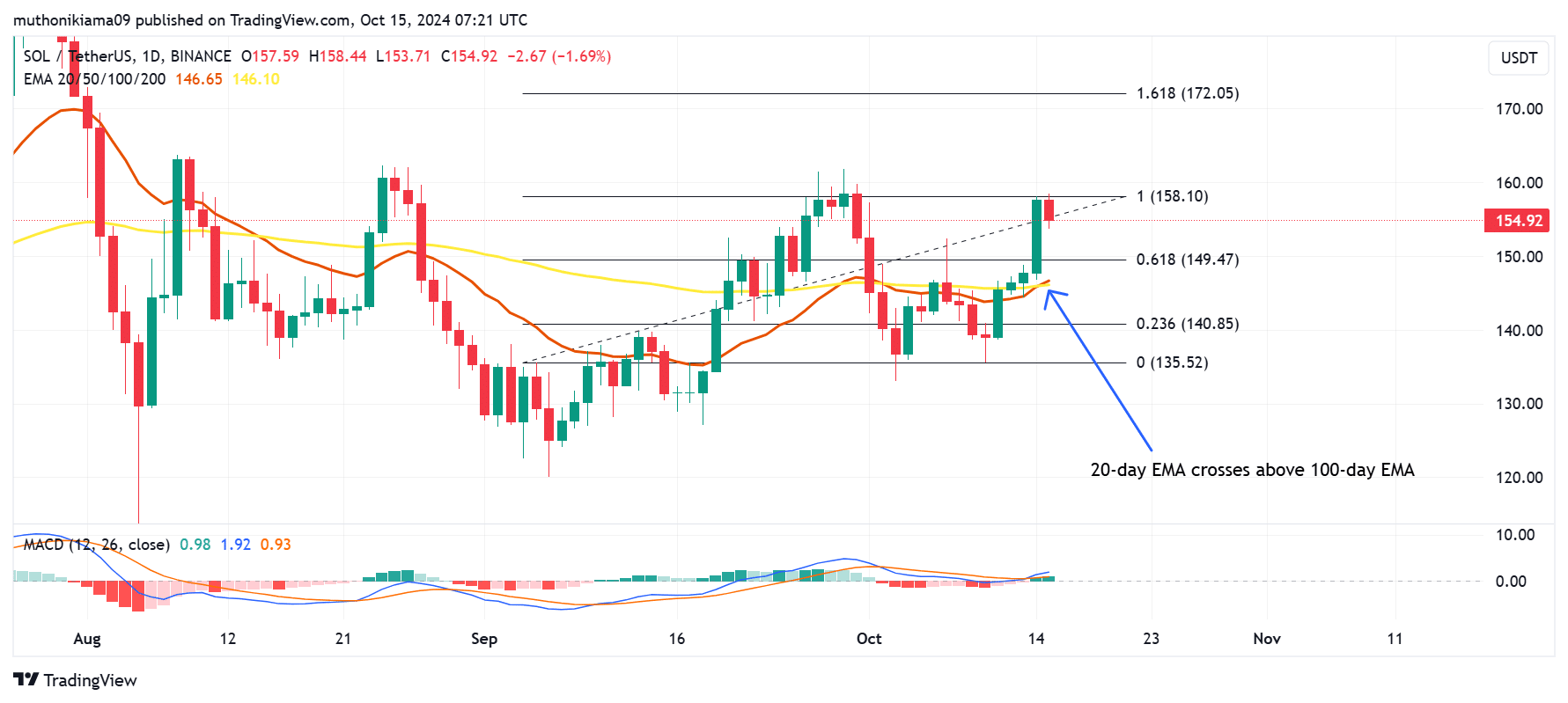

Solana price analysis

Solana has formed a bullish crossover after the 20-day Exponential Moving Average (EMA) crossed above the 100-day EMA.

This crossover suggests that the market sentiment is shifting in favor of buyers, which could lead to further upward momentum.

A rise in buying pressure is also seen on the Moving Average Convergence Divergence (MACD) histogram bars that have flipped green. Additionally, the MACD line has turned positive and shifted above the signal line.

Source: TradingView

A continuation of this bullish trend could see SOL rally towards the next resistance level at $172.

A drop to the support level of $149 could create another buying opportunity for SOL if the broader market continues to gain and sentiment around SOL remains positive.

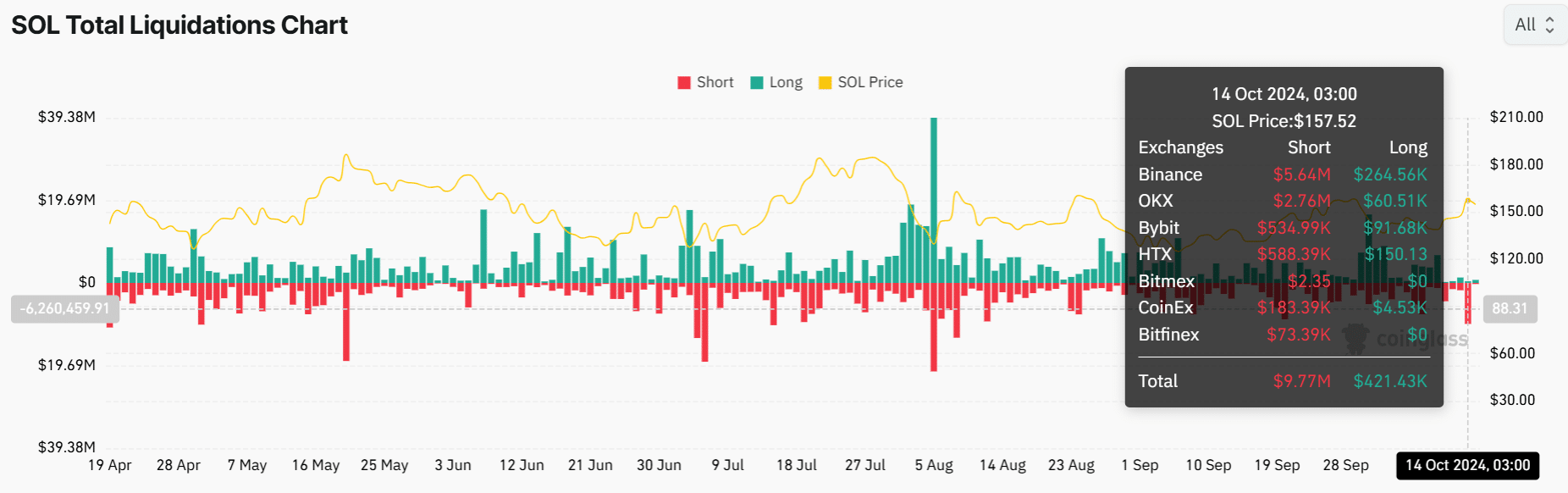

Solana’s recent gains were likely driven by a surge in funding rates to a seven-day high as shorts came under pressure.

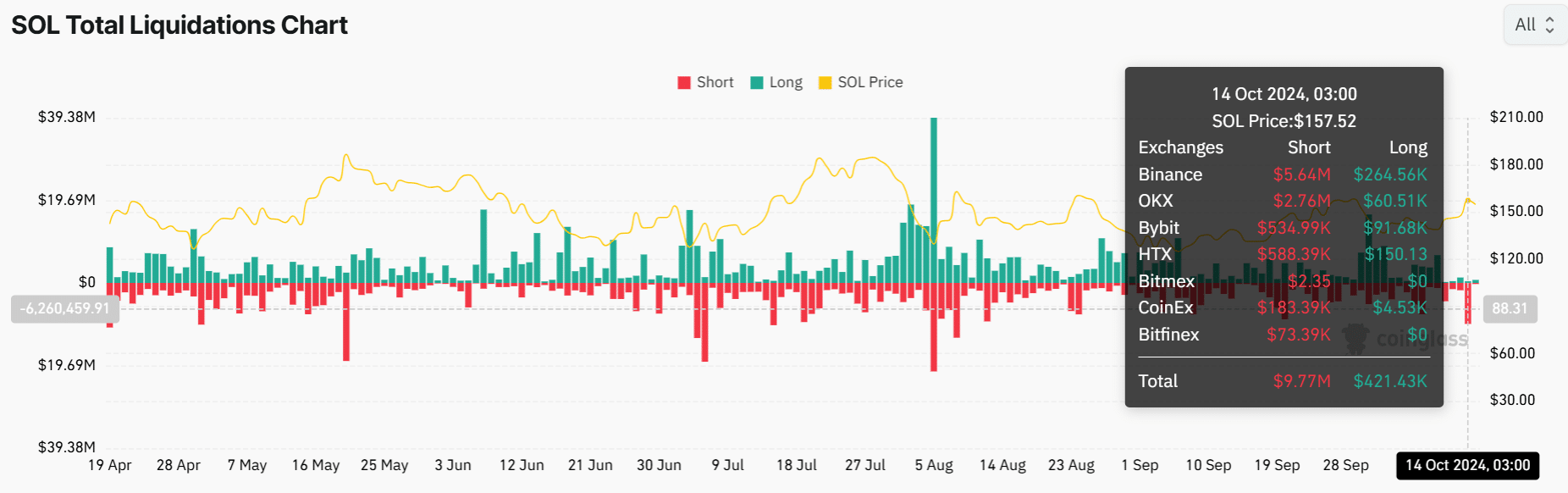

On the 14th of October, $9M worth of Solana shorts were liquidated, marking the highest level of short liquidations since early August.

These liquidations forced short sellers to become buyers to close their positions.

Source: Coinglass

Read Solana’s [SOL] Price Prediction 2024, 2025

Besides the buying pressure coming from short traders, the growth of Solana-based meme coins is also driving gains.

According to CoinGecko, the market capitalization of Solana memecoins has surged by 17% in the last seven days to $11 billion.