- FLOKI crypto pumped nearly 12% on the 14th of October.

- A slight retrace after the pump triggered an accumulation spree.

After the post-Monday rally, Floki [FLOKI] saw a renewed accumulation spree that could signal a potential rally in the near term.

On the 14th of October, FLOKI jumped about 12% but faced sharp retracement after hitting a key roadblock.

But with ongoing memecoin dominance and apparent investor appetite for FLOKI, should you join the trend?

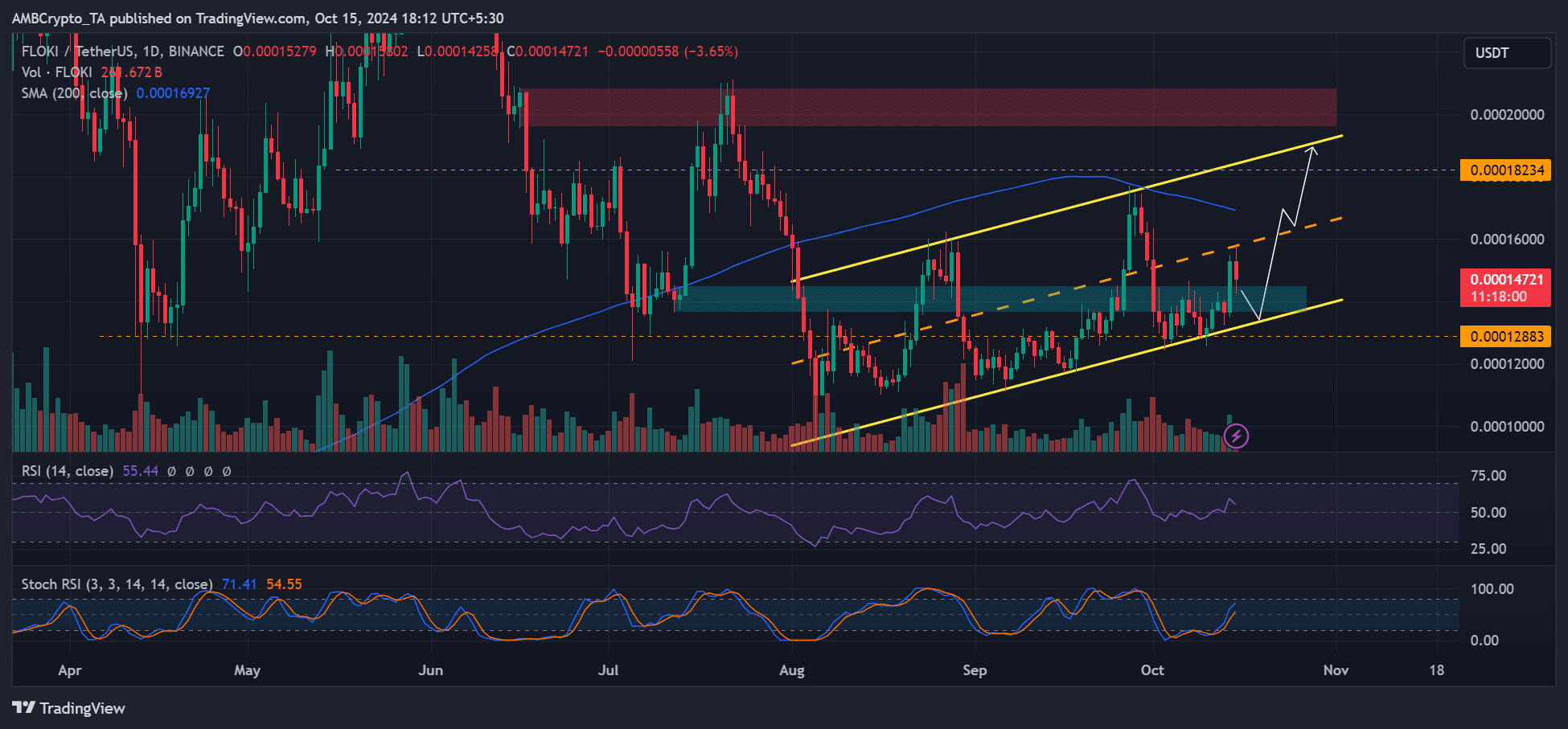

FLOKI’s chart position

Source: FLOKI/USDT, TradingView

On high timeframe chart, FLOKI’s market structure was bullish after Monday’s higher high. But the upswing faced a roadblock at the mid-range of the ascending channel (yellow).

Since August, the channel’s lower range has been a crucial support and market entry level for bulls. The support also aligned with a bullish order block (OB) near $0.000014, making it a key demand zone.

Ergo, the retracement could be a buying opportunity, with bullish targets at the mid-range, 200-MA (Moving Average) or the range high. The stochastic RSI fronted a reversal, which supported the upside projection.

But a crack below the channel’s range-low would dent the above bullish thesis.

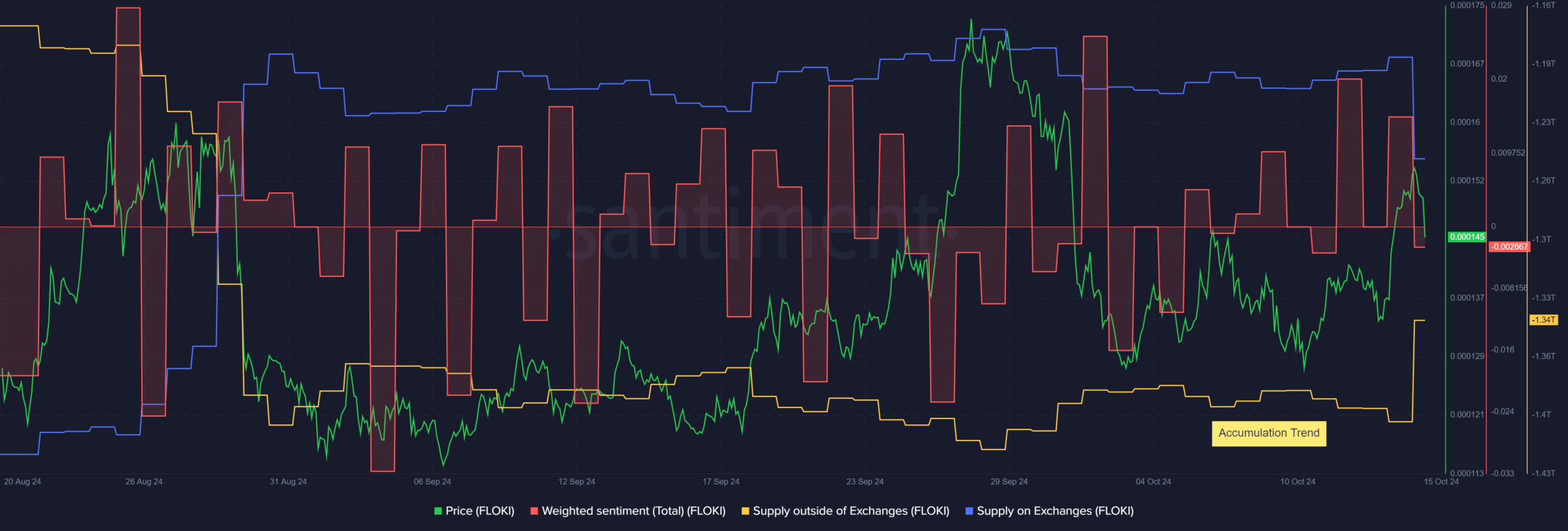

FLOKI accumulation surge

Source: Santiment

Perhaps one of the most bullish data was the rising accumulation trend, as denoted by the spike in supply outside of exchanges.

This meant that more users moved their meme coins off centralized exchanges (CEXes) for self-custody. This meant a high conviction of a price rally in the future.

Similarly, supply on exchanges dipped at press time. It suggested reduced sell-pressure on CEXes, a perfect condition for FLOKI to rally.

However, the overall Weighted Sentiment sat near a neutral position, suggesting that speculators were neither bullish nor bearish at the time of writing.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

In short, FLOKI price showed no preferred direction as investors remained cautious after the Monday pump.

That being said, the pullback to key support levels could offer new entry points for FLOKI speculators, especially if the uptrend momentum picks pace again.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion