- Fantom price rebounds 3.5% after a 22% drop, showing signs of bullish momentum.

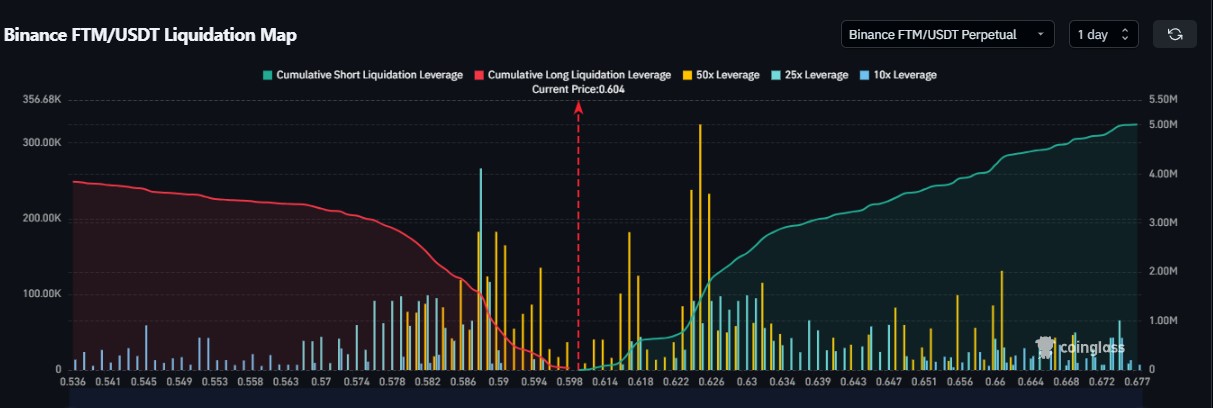

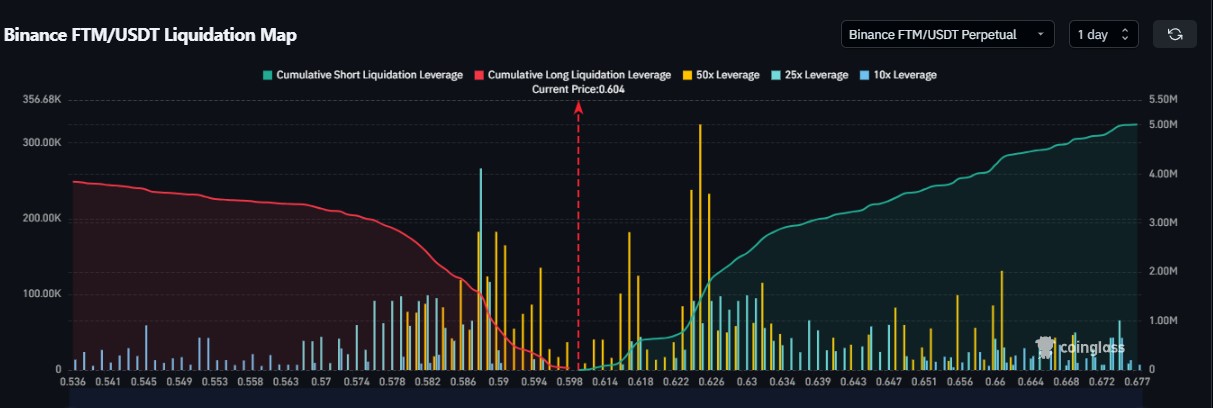

- The liquidation data presents a bullish bias with $324K worth of FTM to be leveraged at the $0.625 psychological level.

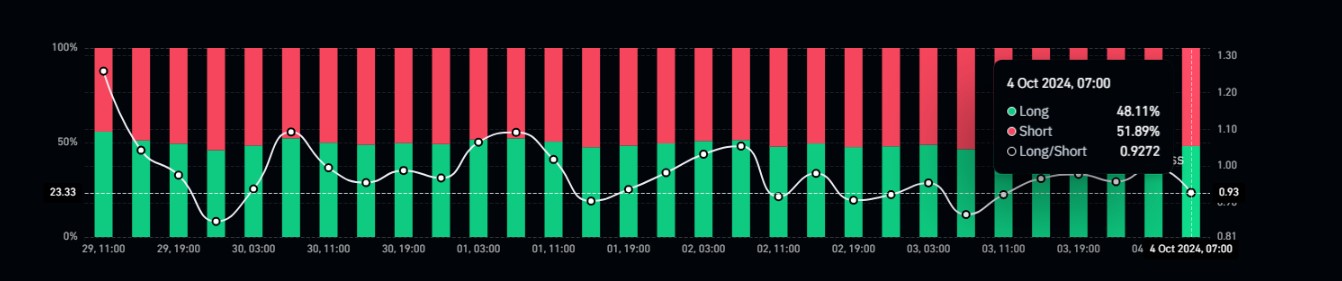

Fantom [FTM] has witnessed a shift in market sentiment, with the long/short ratio falling to 0.93, according to data from Coinglass. The ratio indicates that market participants are taking short positions in the near term, signaling a relatively conservative outlook for the asset.

Despite this bearish indication, Fantom changes hands at a key support test after falling 22% over the last three days. This dip has put pressure on the asset, but signs of a reversal are beginning to emerge.

Source: Coinglass

Source: Coinglass

A potential rebound is brewing for Fantom

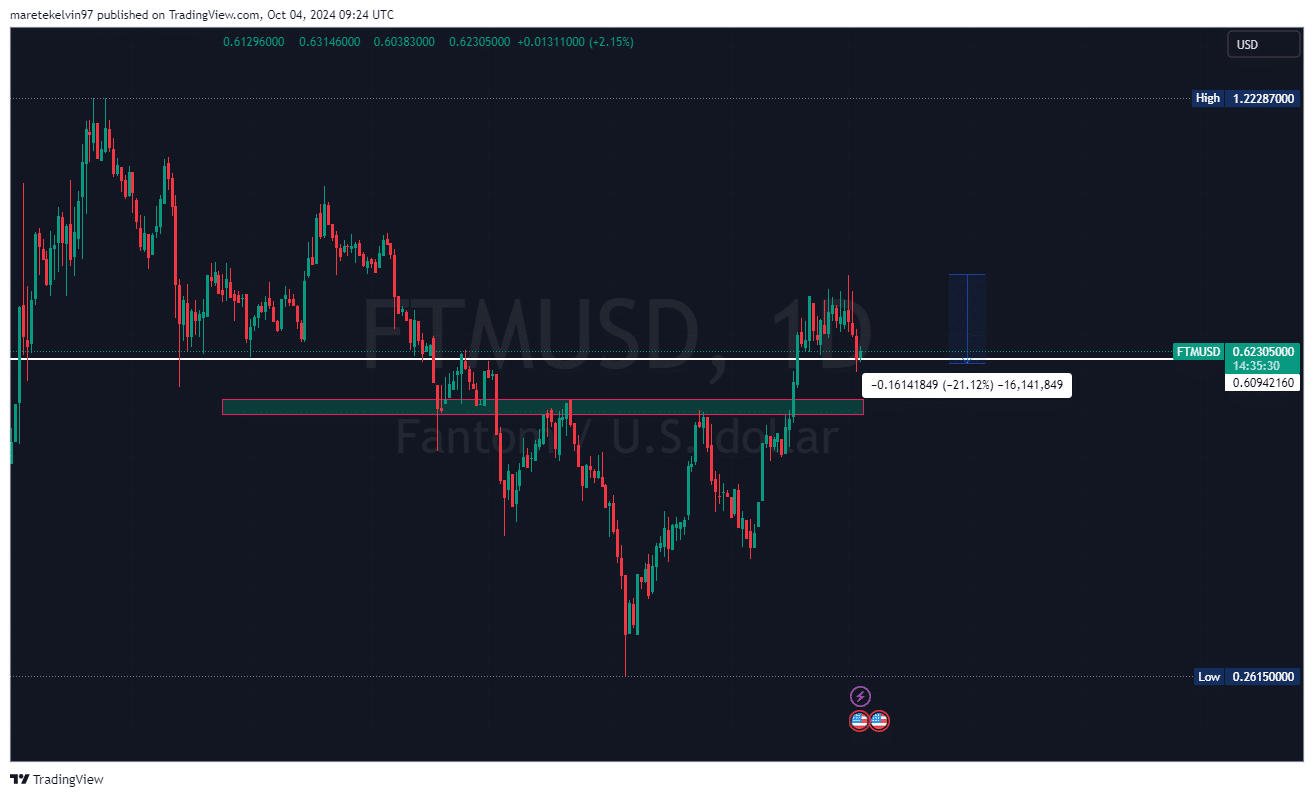

According to CoinMarketCap, Fantom has seen a 3.5% increase in price over the last 24 hours. That suggests that the asset is accumulating some bullish momentum, especially as it retests its support at $0.609.

The support level seems to be holding firm, and traders are looking toward the $0.625 psychological resistance level, which could be the next target if this bullish momentum piles on well.

Its strength around these levels will be pivotal for any further price action in the instrument.

Source: Tradingview

Source: Tradingview

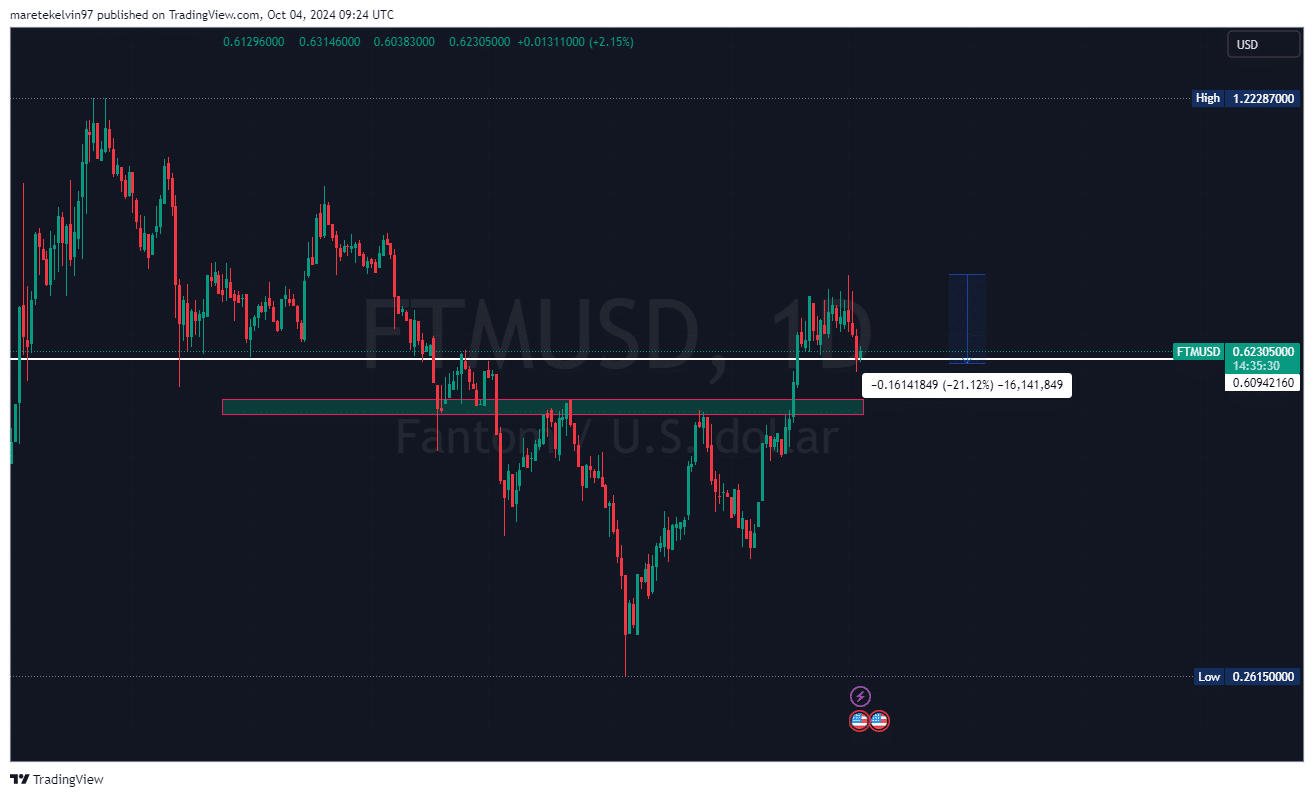

Fantom liquidation data hints at bullish sentiment

AMBCrypto took a closer look at the liquidation heatmap data for more proof of a probable bullish trend. This data indicated that over $324K worth of Fantom could be liquidated at the $0.625 level. This liquidation zone indicates a strong buying pressure.

This liquidation zone is significant, as it indirectly means that market participants are preparing for liquidations at this key psychological level. This fuels further the likelihood of a potential breakout.

The bullish bias in the liquidation heatmap adds weight to the case for an upward move.

Source: Coinglass

Source: Coinglass

Read Fantom’s [FTM] Price Prediction 2024-25

As Fantom slowly shows signs of recovery, the market sentiment may now shift to its side.

The convergence of a 3.5% price increase, along with bullish liquidation data and support holding at $0.609, presents a possible move toward the psychological level at $0.625.