- Shiba Inu revisits levels that led to 300% gains.

- More traders are pro-long compared to shorts.

Shiba Inu [SHIB] remains the second most dominant memecoin, with a market cap exceeding $7.8 billion, about half of Dogecoin’s market cap.

SHIB was down 3.13% over the past 24 hours as at press time. However, the current price action signals potential opportunities for the last quarter of the year.

SHIB was trading at levels that previously led to a 300% surge at the beginning of the year, sparking hope for a similar rally.

While it’s uncertain whether SHIB can replicate its first-quarter success, the patterns formed during its correction phase offer valuable insights for the upcoming months.

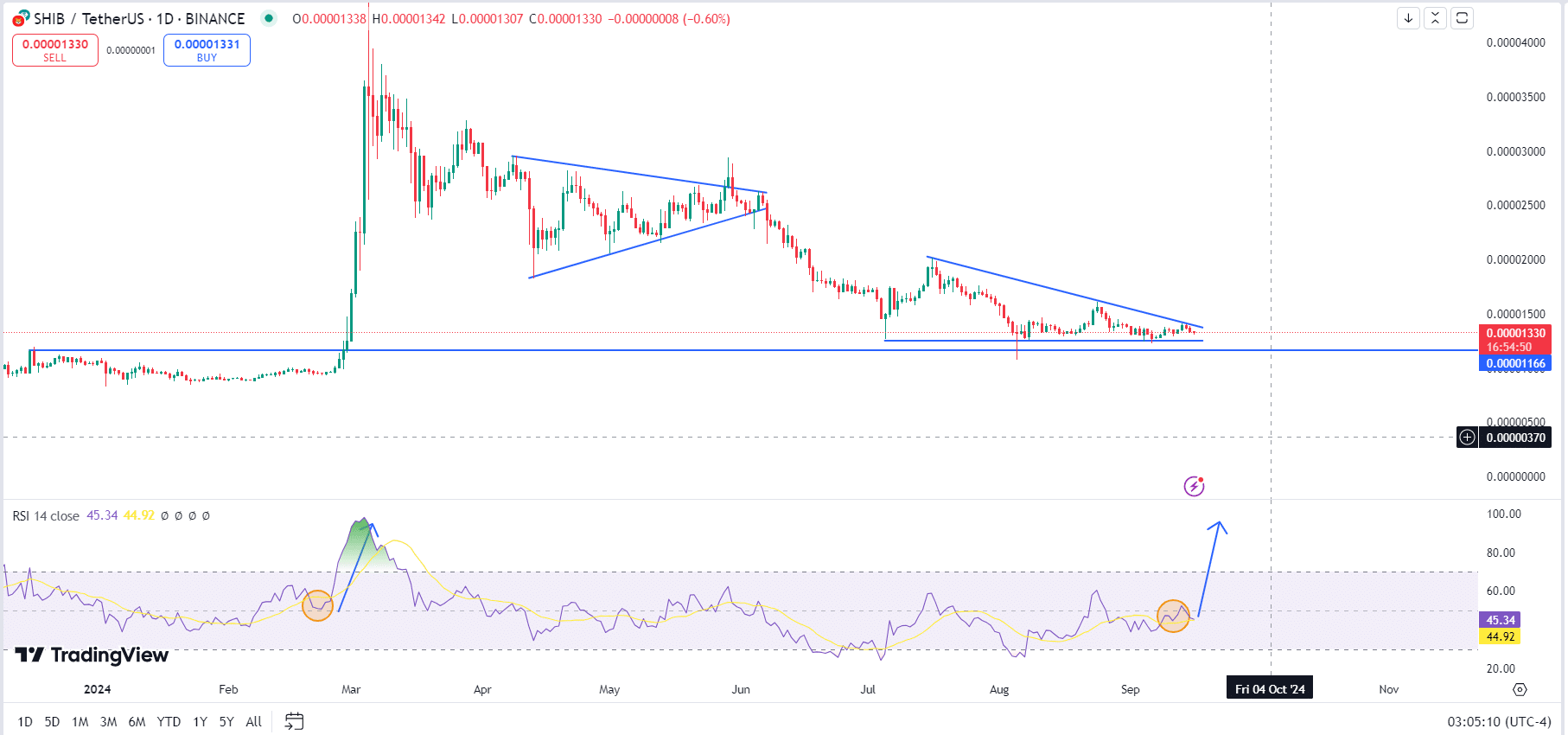

The consolidation phase resulted in a symmetrical triangle pattern on the daily chart. The price eventually broke downward, hitting a low of $0.00001264, which was thought to be the bottom.

Source: TradingView

However, the August 5th market crash led to a new low of $0.00001081. This crash low was swiftly corrected, and SHIB/USDT continued consolidating within the tightening triangle pattern.

This contraction suggests an impending breakout, as the market tends to alternate between contraction and expansion phases.

Traders expect SHIB to maintain support at the triangle’s base. If the price breaks below and stays there, it could signal a shift in market sentiment, though this outcome is less likely.

Still, traders should remain cautious, as market movements can be unpredictable in the short term, but trends become more predictable over longer periods.

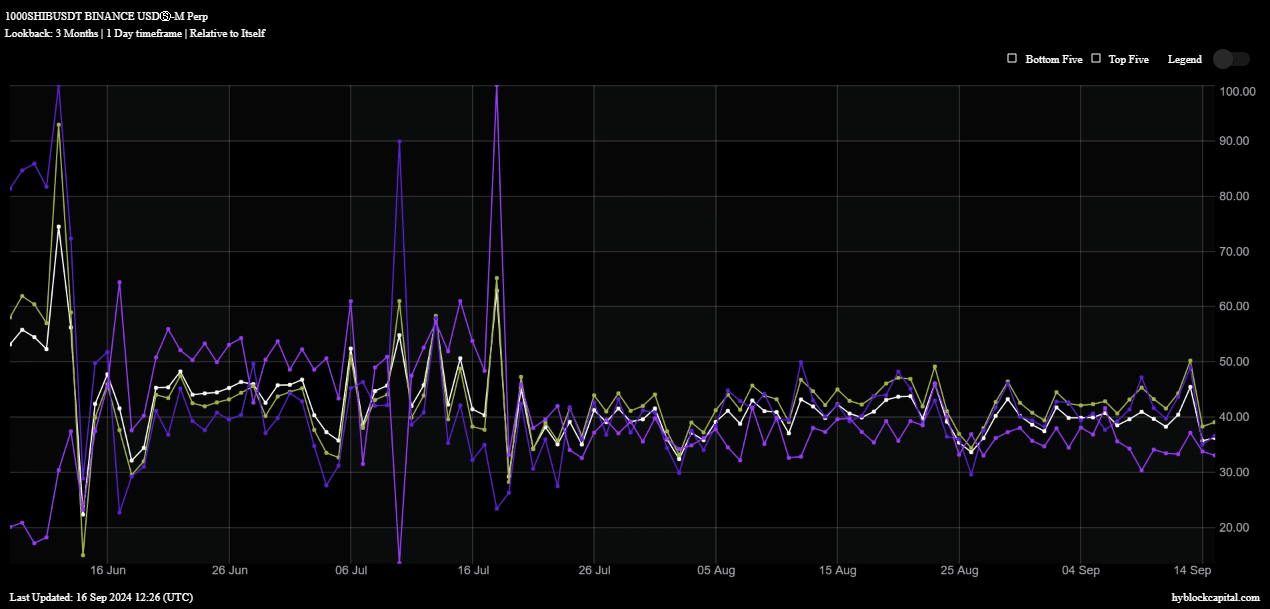

Total liquidations heatmap

Examining Shiba Inu’s total liquidations chart reveals an increasing number of long traders compared to short traders, despite the crypto market’s general decline since April.

SHIB’s futures market assessment is bullish, with net long positions at 38% compared to net shorts at 32%, resulting in a net longs/shorts delta of 36%.

Although these figures are relatively low, they align with levels where SHIB previously saw price surges.

Source: Hyblock Capital

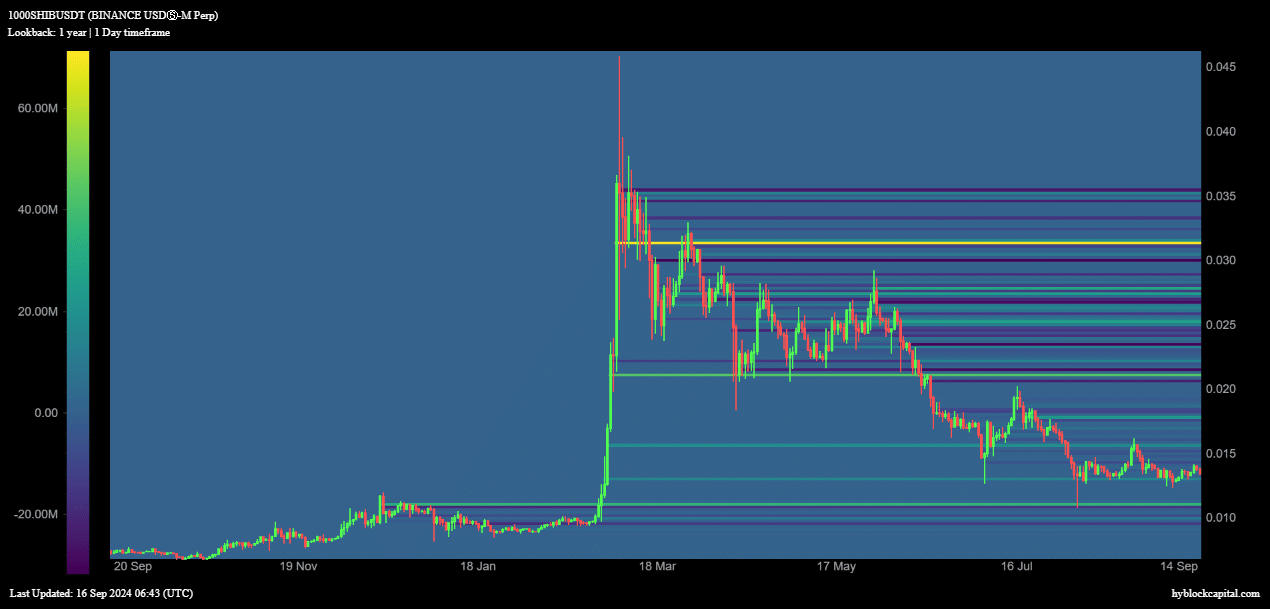

Shiba Inu open interest suggest…

Furthermore, open interest data highlights the potential for upward movement.

Currently, SHIB’s open interest just below its price level stands at $35.866 million, indicating that traders are willing to invest heavily if the price hits $0.000011.

This could lead to a quick reversal due to the buying pressure triggered at this level. Another significant cluster of open interest is at $0.000021, holding $43.933 million, signaling that more conservative traders are targeting this level for a possible price rise.

Source: Hyblock Capital

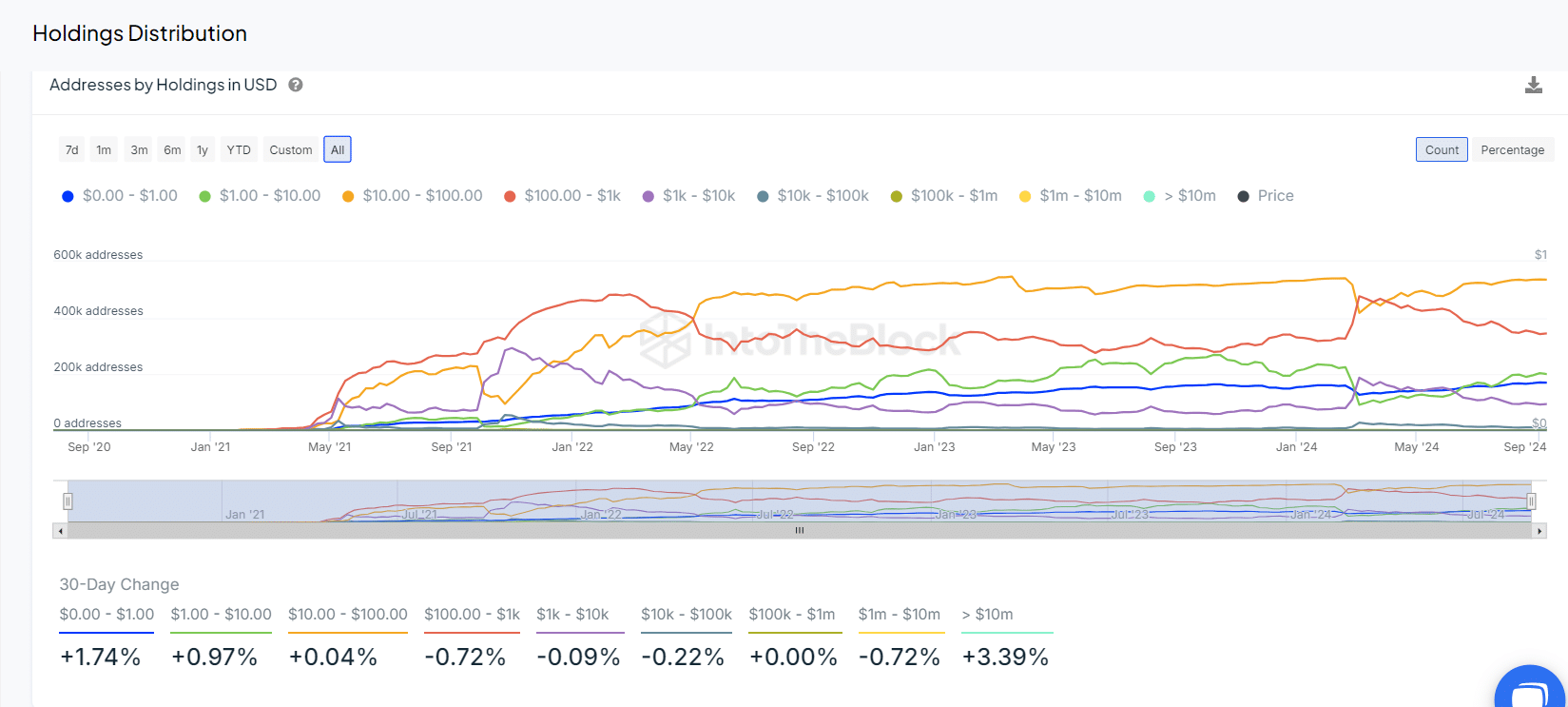

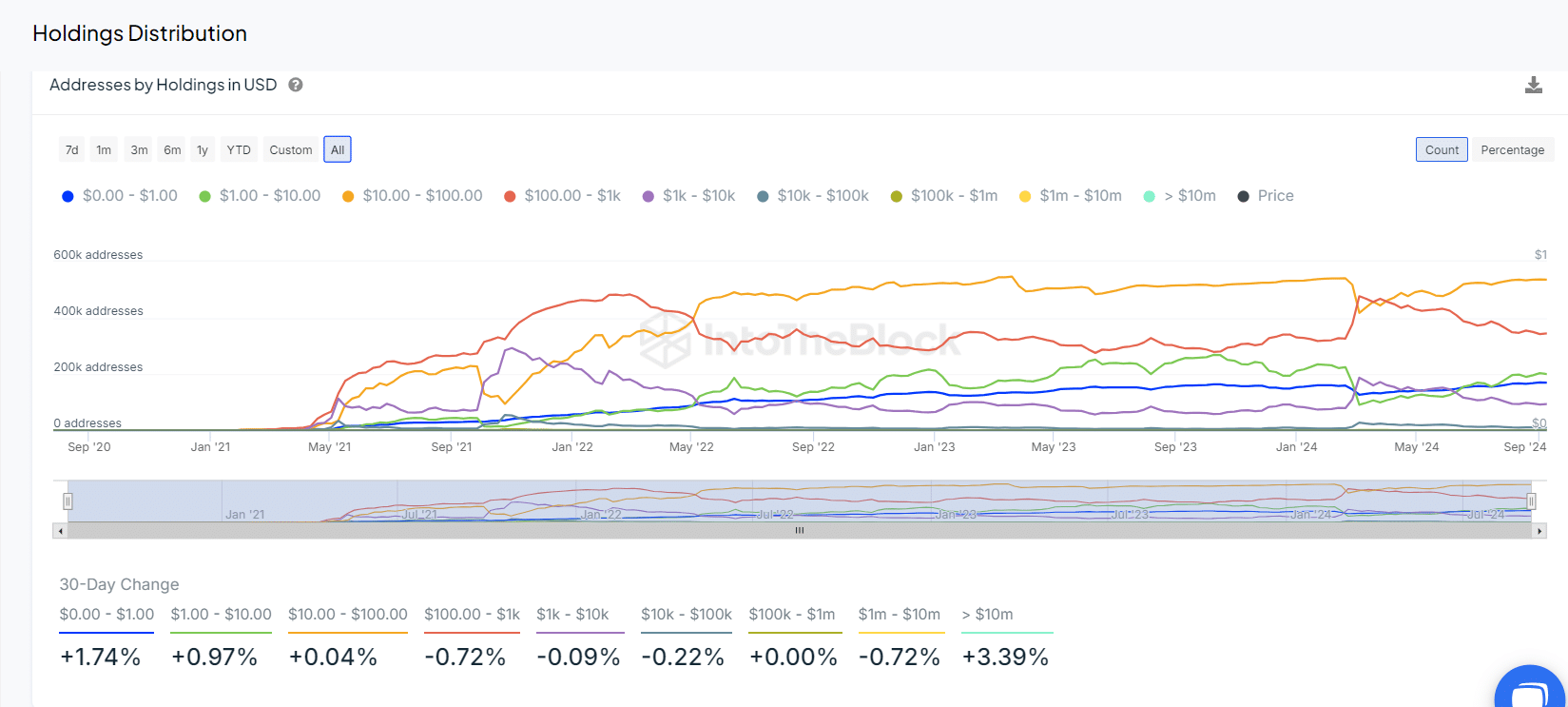

Holding distribution

In terms of holding distribution, Shiba Inu whales—those holding more than $10 million in SHIB—have increased their holdings by 3.39% over the last 30 days, reflecting accumulation despite the recent price decline.

Is your portfolio green? Check out the SHIB Profit Calculator

Retail traders, on the other hand, have shown a mix of slight increases, decreases, or no change, balancing the overall distribution.

Despite the current price dip, the data suggests that SHIB is gearing up for potential higher price movements as accumulation continues, particularly among large holders.

Source: IntoTheBlock