- Spot Ethereum ETFs flipped positive on 28th August after two weeks of consecutive outflows.

- ETH price has also made a strong rebound, with the RSI bouncing from oversold levels.

US spotEthereum [ETH] exchange-traded funds (ETFs) posted inflows on Wednesday, 28th August, after two weeks of consecutive outflows. The ETFs have had only nine days of positive flows since they started trading on 23rd July.

Per SoSoValue data, inflows to these products hit $5.84M on Wednesday, coinciding with a strong rebound in Ethereum prices. They currently hold $6.9 million in net assets.

Source: SoSoValue

The BlackRock iShares Ethereum Trust (ETHA) largely accounted for the recent positive inflows. The ETF had consecutive zero flows for five days since the 21st of August. It broke the streak on Wednesday with $8.4M inflows.

Fidelity also posted $1.26M in inflows, while the Grayscale ETF had $3.81M in outflows.

The positive flows stirred gains for ETH, which is up by nearly 3% in the last 24 hours to trade at $2,541 at the time of writing.

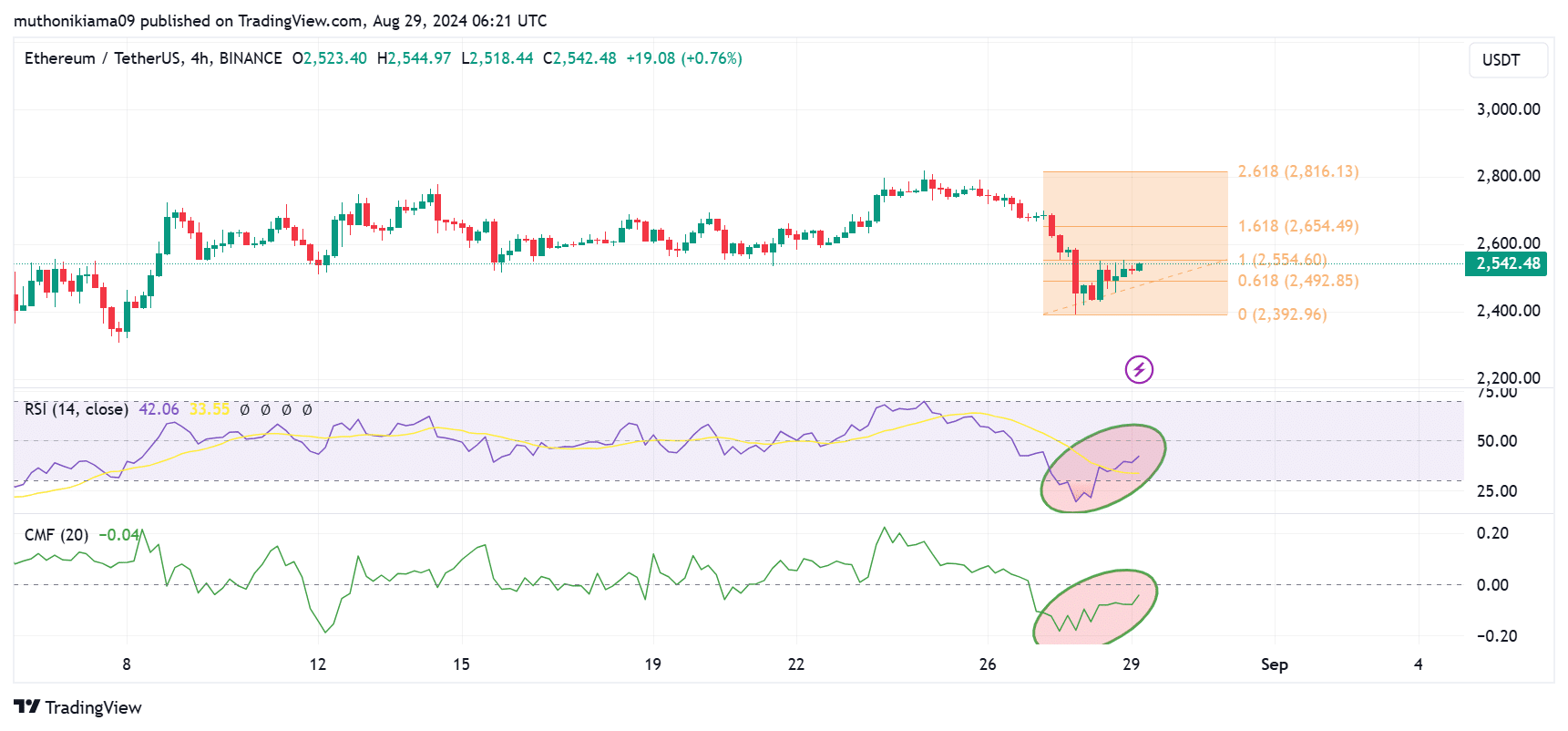

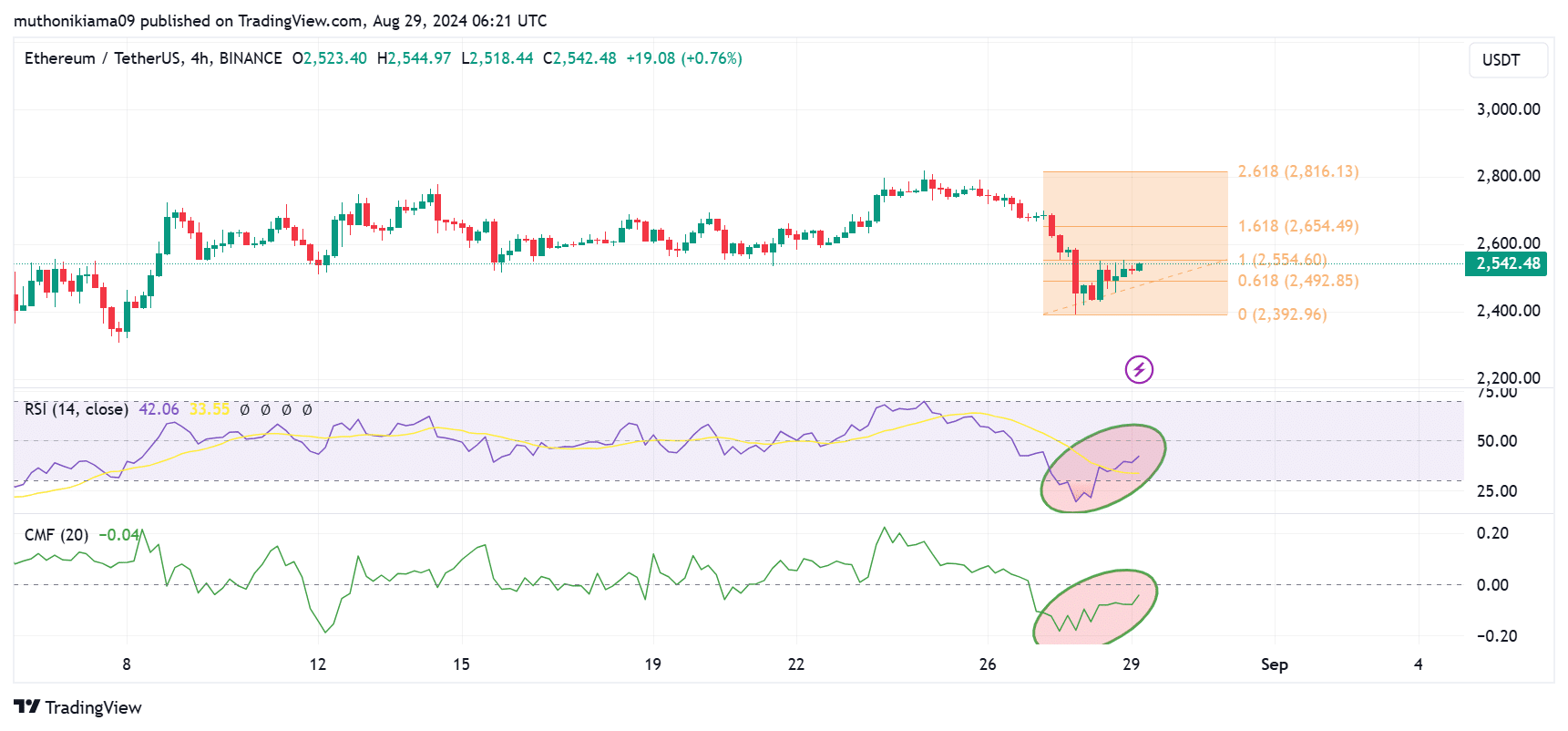

RSI shows a strong bounce

ETH’s recent rebound appears to come from buyers. The Relative Strength Index (RSI) has bounced from the oversold region below 30.

The RSI line has also made a strong upward move with higher lows and shifted above the signal line, indicating bullish momentum. The crossover also suggests a buy signal and a continuation of the uptrend.

However, despite this bounce, the RSI remains at 41. Therefore, buyers should wait until it enters the neutral level at 50.

The Chaikin Money Flow also shows an uptick in buying pressure. However, given that this metric remains in the negative region, a flip to the positive is needed to confirm the uptrend.

Source: Tradingview

The recent gains saw ETH bounce from the support level at $2,492 and tested resistance at $2,554. If the uptrend continues and ETH breaks above $2,600, the next target will be $2,800.

ETH’s recent gains have also seen the altcoin outperform Bitcoin (BTC). However, according to trader DaanCrypto on X, this could trigger a correction.

“ETH is doing that thing again where it is somewhat “stronger” than BTC for a few hours. I’m a bit scared as that has usually led to more pain this year,” the trader said.

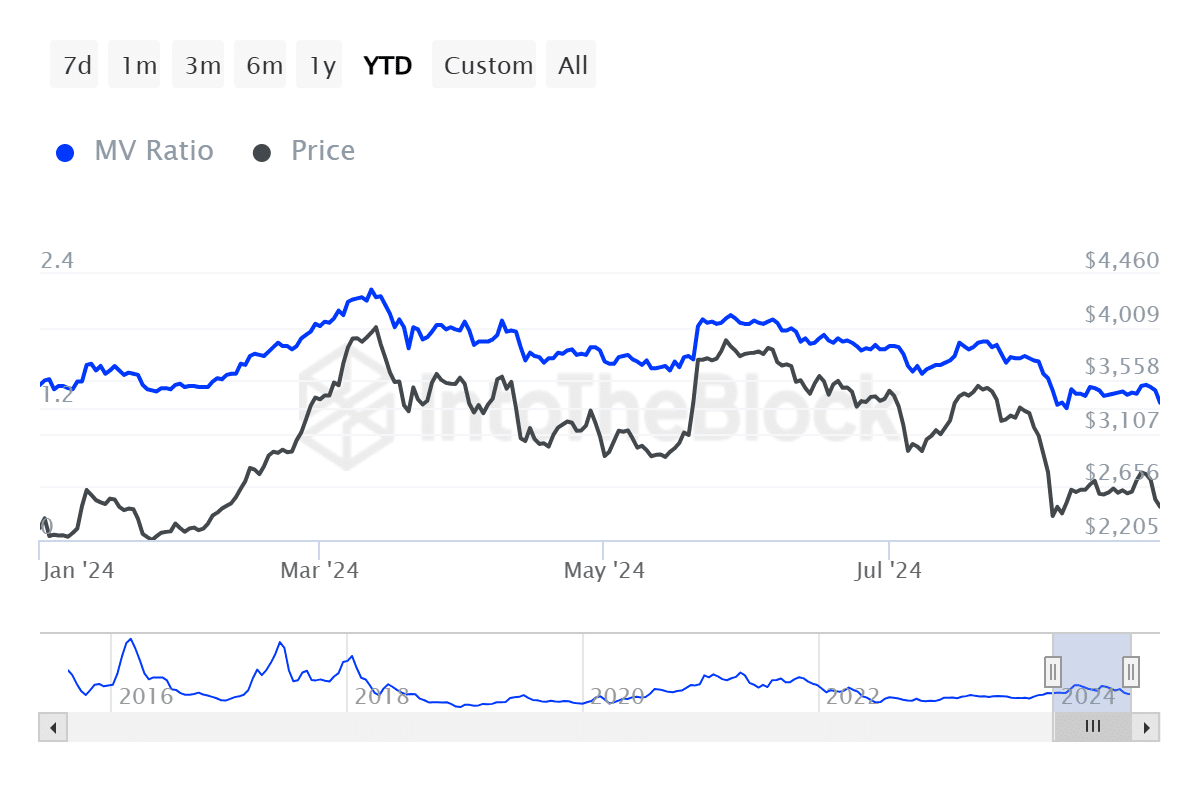

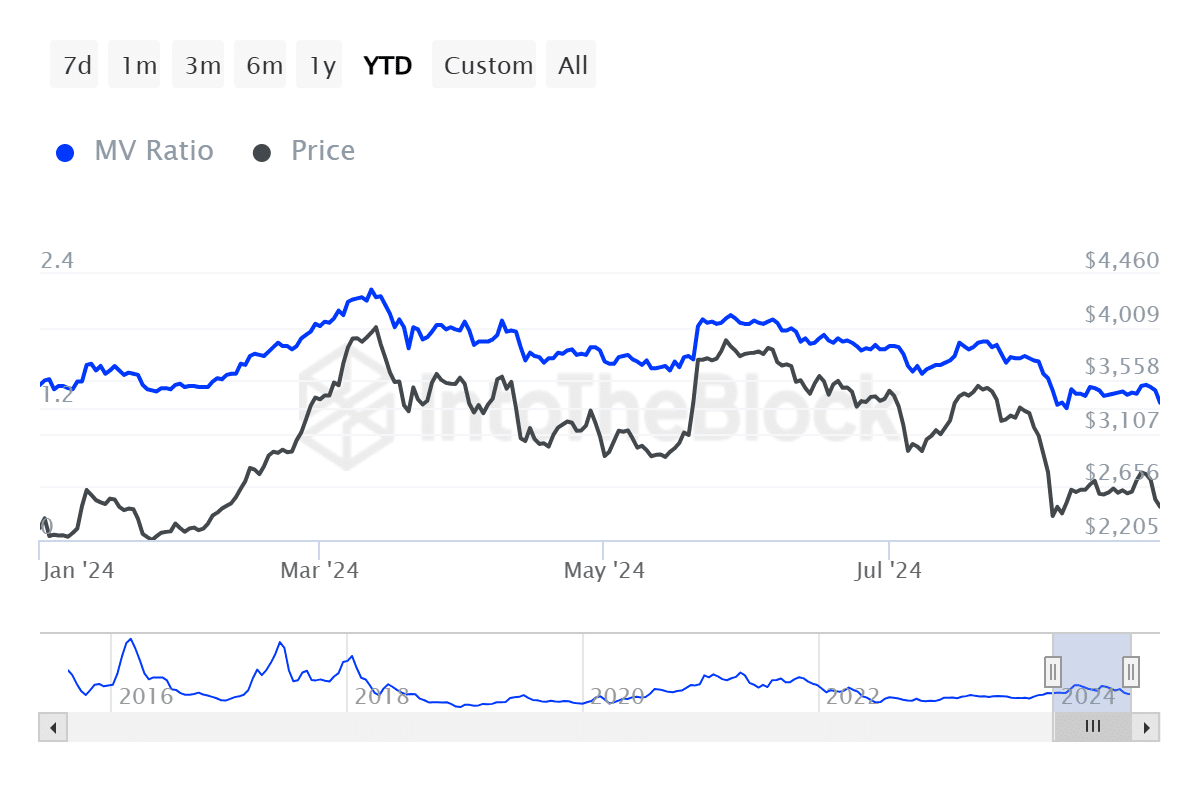

The Ethereum Market Value to Realized Value (MVRV) ratio has dropped to notably low levels. This can suggest that ETH is becoming undervalued, making it a suitable time for long-term investors to purchase the asset.

Source: IntoTheBlock

Read Ethereum’s [ETH] Price Prediction 2024 – 2025

The declining MVRV ratio could also suggest market capitulation after a prolonged bearish sentiment around ETH.

Data from Coinglass shows that Ethereum funding rates have flipped positive. This suggests an increase in long positions and budding bullish sentiment.