The chart reflects a classic divergence: whales are buying the dip while retail hesitates.

This behavior often precedes directional shifts in market momentum — either a breakout backed by institutional support or prolonged compression if retail stays sidelined.

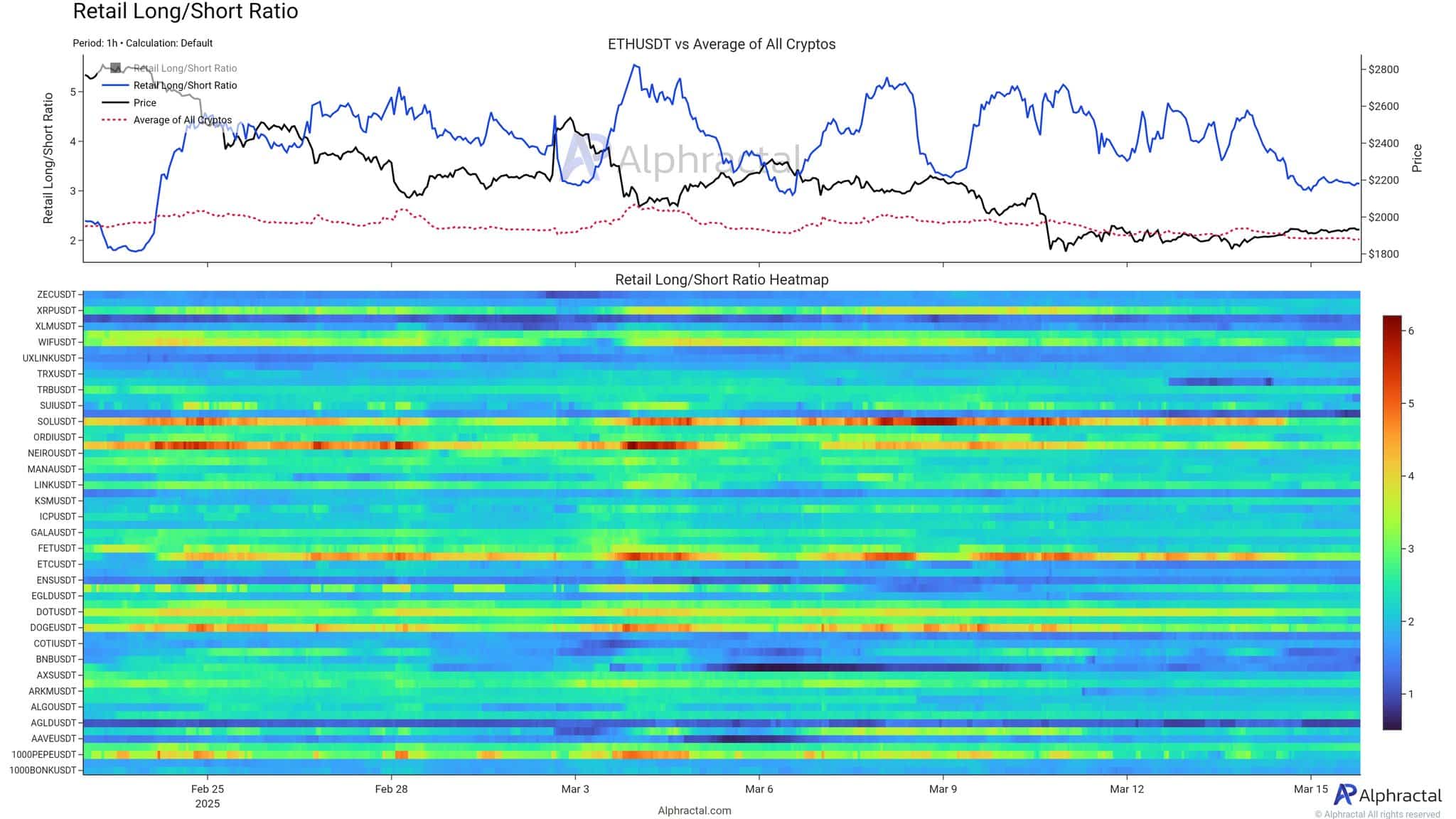

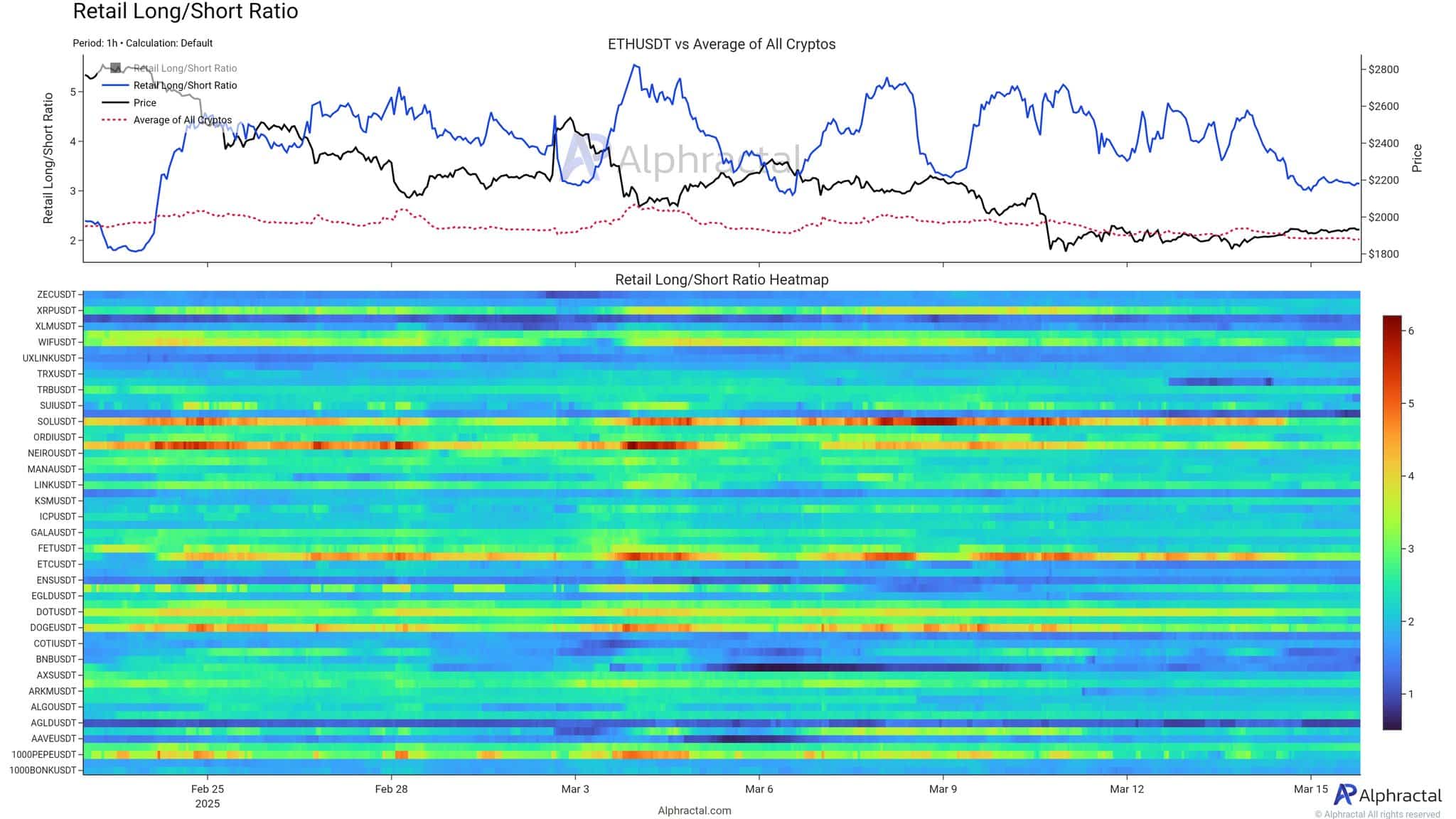

Retail deleveraging and the narrowing long/short ratio

Retail traders, once confidently positioned for upside, are retreating.

The retail long/short ratio for ETHUSDT – which reached highs above 5.5 in early March — has steadily declined to around 3, pointing to clear deleveraging.

Source: Alphractal

As volatility faded, so did retail enthusiasm. The ratio’s decline toward 3 suggests that a significant portion of retail traders are closing positions or adopting a more neutral stance.

Compared to late February — when the ratio hovered around 2.5 and climbed with price momentum — this recent pullback signals fading conviction among smaller holders.

While this reset may be healthy, unwinding overly aggressive longs, it also highlights the lack of fresh demand from retail participants.

Market neutrality and trader fatigue

Taken together, these trends paint a picture of broad market neutrality. Whales are buying — but cautiously. Retail isn’t bearish — just disengaged.

For many traders, especially in perpetual futures markets, this low-action environment is frustrating. Conditions are neither bullish enough to justify aggressive longs nor bearish enough to warrant meaningful shorts.

ETH’s price has mirrored the broader decline across crypto assets (as seen in both charts’ red dotted lines), reinforcing the view that this isn’t an Ethereum-specific lull; it’s part of a wider market cool-down.

Still, such neutrality often precedes volatility expansion. The market is coiling; the only uncertainty is the direction.

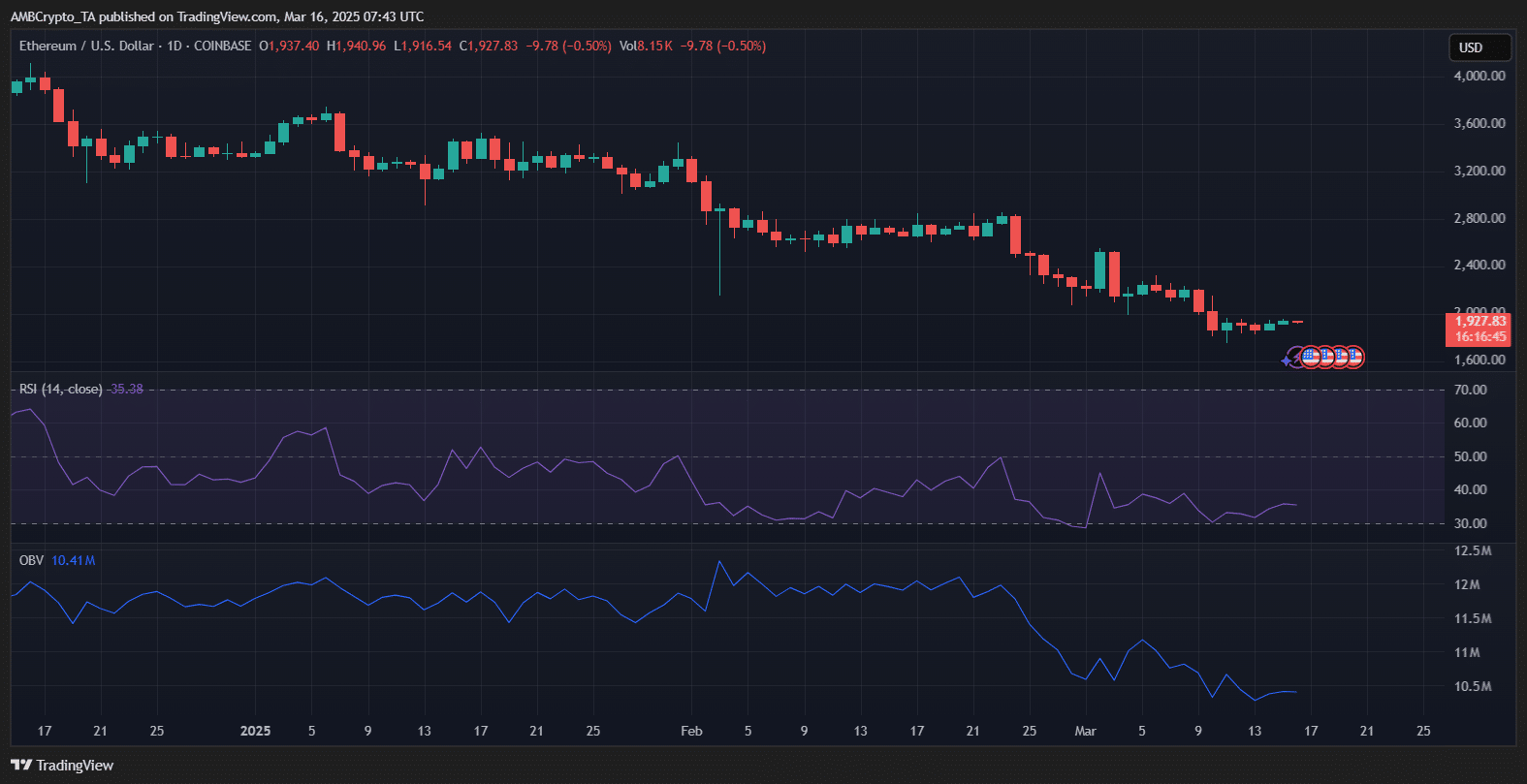

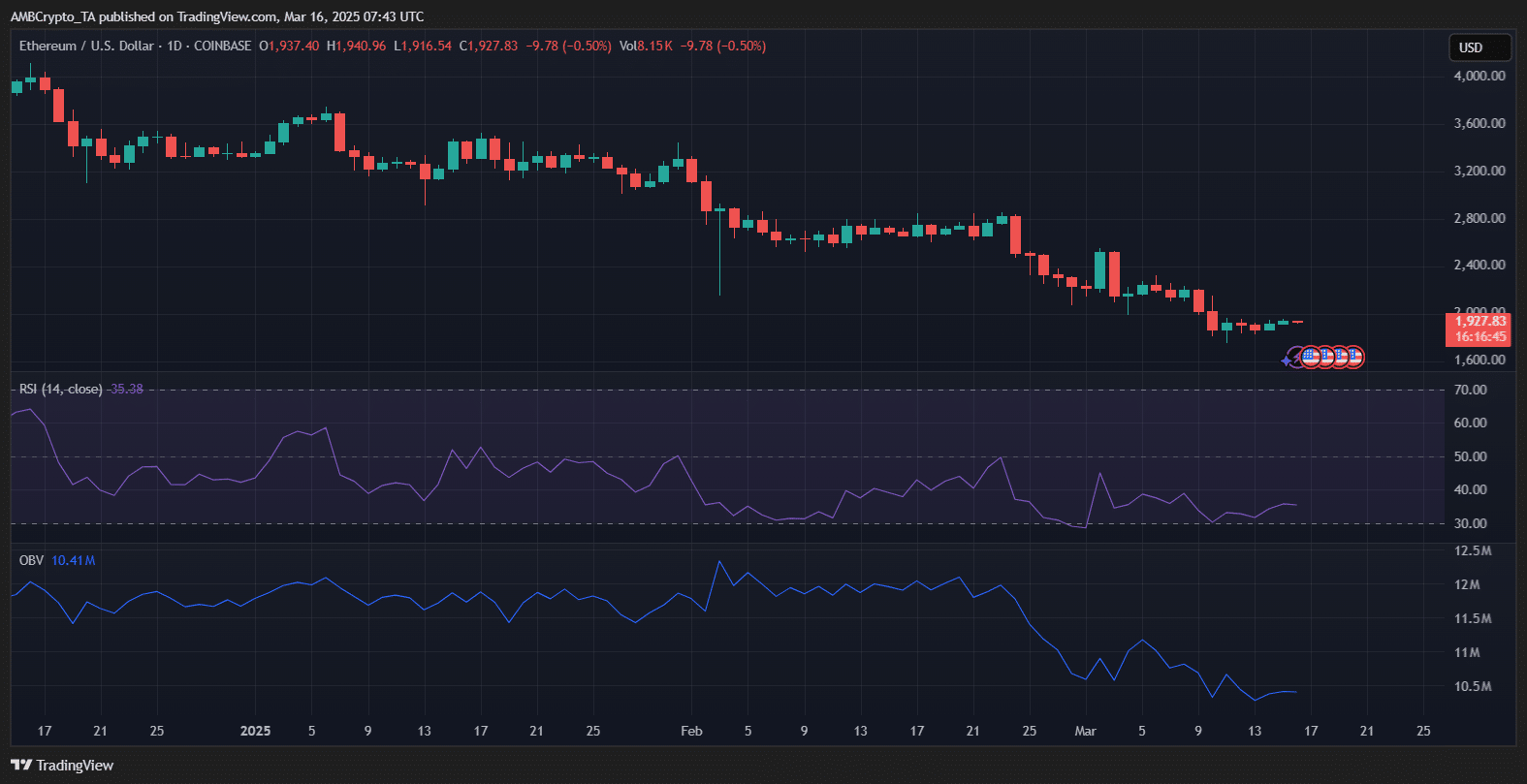

Ethereum price outlook

Ethereum is showing signs of stagnation just below $2,000. The RSI hovers at 35, keeping ETH in bearish territory without being deeply oversold — suggesting limited upside momentum in the short term.

Meanwhile, the OBV continues its downward trend, signaling weak buying pressure despite recent price consolidation.

Source: TradingView

The declining volume and muted RSI hint at a continued sideways grind or a minor pullback unless buying activity picks up. For now, Ethereum lacks the technical strength for a breakout.

Without a clear catalyst, ETH is likely to remain range-bound between $1,850 and $2,000.