- Dogecoin’s popularity increased sharply during the bull rally.

- The last 24 hours were bearish as the memecoin witnessed a slight correction.

Dogecoin [DOGE] experienced a comfortable bull rally last week as the coin’s price surged in double digits. Thanks to that, the world’s largest memecoin’s popularity skyrocketed in the past few days.

But will that popularity be enough for DOGE to sustain the bullish momentum?

Decoding Dogecoin’s bullish rally

As per CoinMarketCap, Dogecoin bulls pushed hard last week. The memecoin’s price soared by more than 27% during the past seven days.

The recent bull rally has pushed more than 5 million DOGE addresses in profit, which accounted for over 80% of the total number of DOGE addresses, according to IntoTheBlock’s data.

Meanwhile, Emperor Osmo, a popular crypto analyst, recently posted a tweet revealing an interesting update. As per the tweet, DOGE’s popularity was rising as the coin raked #1 in terms of mindshare across memes.

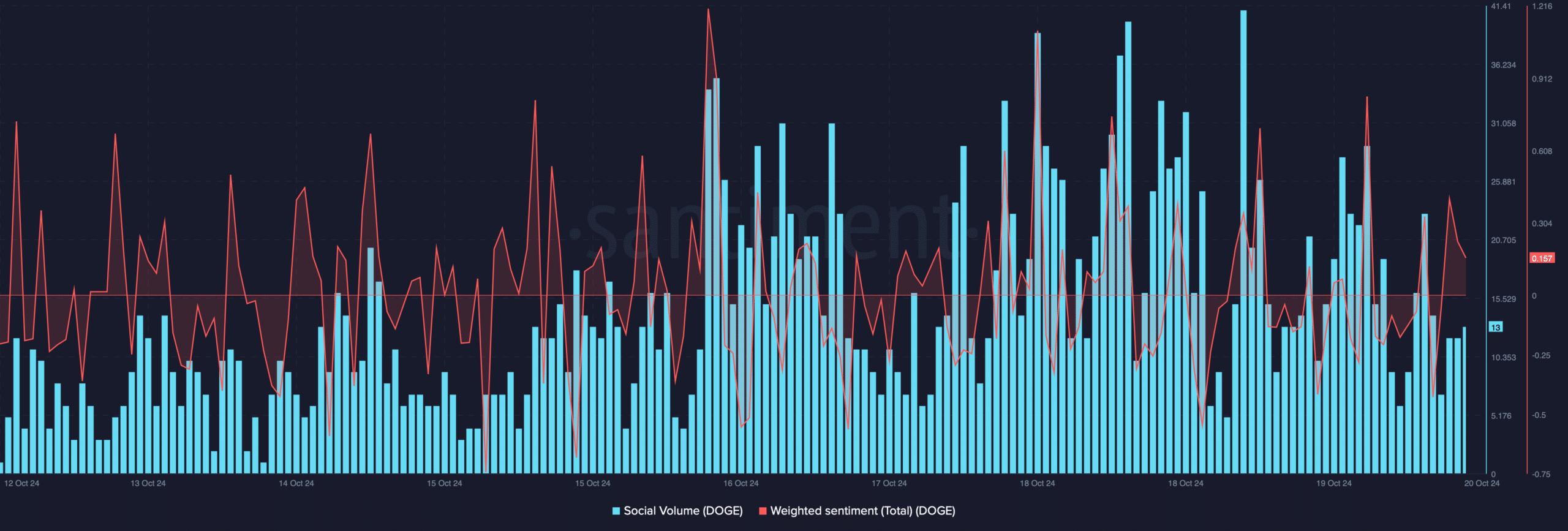

AMBCrypto’s analysis of Santiment’s data also pointed out a similar development.

We found that Dogecoin’s social volume increased last week. Additionally, the coin’s Weighted Sentiment remained in the positive zone during the majority of the days last week.

This clearly meant that bullish sentiment around DOGE was high, as investors expected the coin’s price to rise further.

Source: Santiment

This is the catch!

However, the memecoin’s massive rise in popularity couldn’t help it maintain the bull momentum. This was the case as the memecoin’s price dropped by more than 1% in the last 24 hours.

At the time of writing, Dogecoin was trading at $0.141 with a market capitalization of over $20 billion, making it the eighth-largest crypto.

Therefore, AMBCrypto planned to take a closer look at the coin’s current state to better understand what to expect from it.

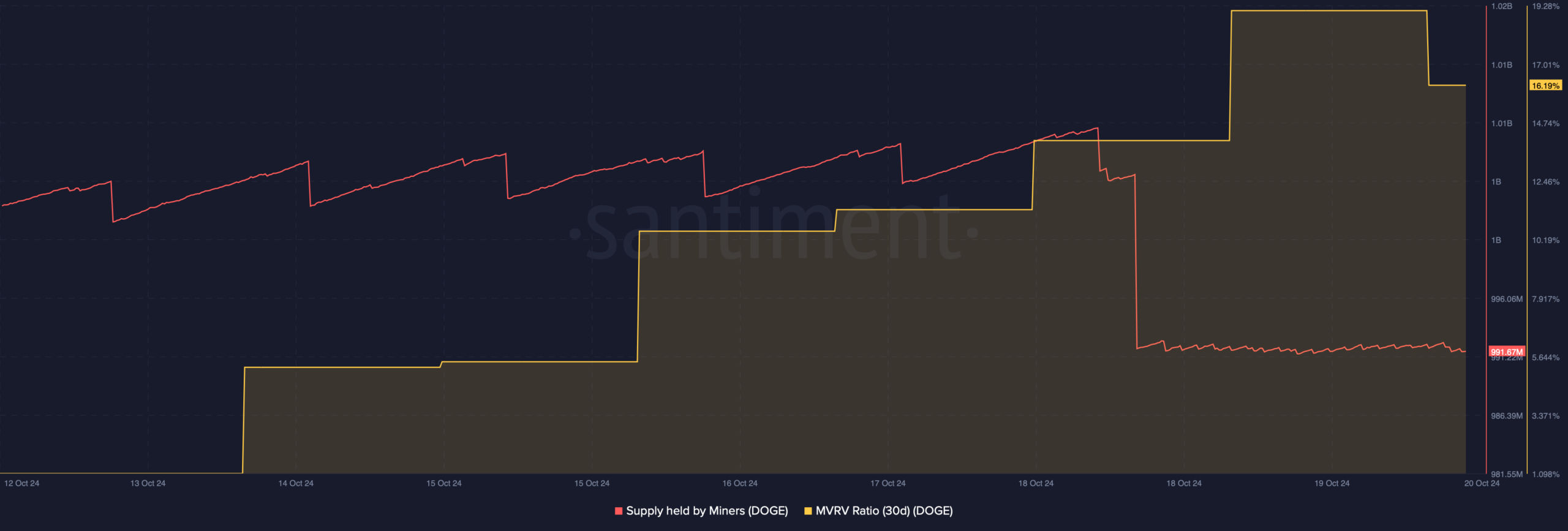

As per our analysis, DOGE’s MVRV ratio remained high, which can be considered a bullish signal. However, Dogecoin miners were not confident in the coin.

This was evident from the massive drop in the supply held by miners, meaning that they sold DOGE when its price was rising, as they were expecting the trend to change.

Source: Santimenbt

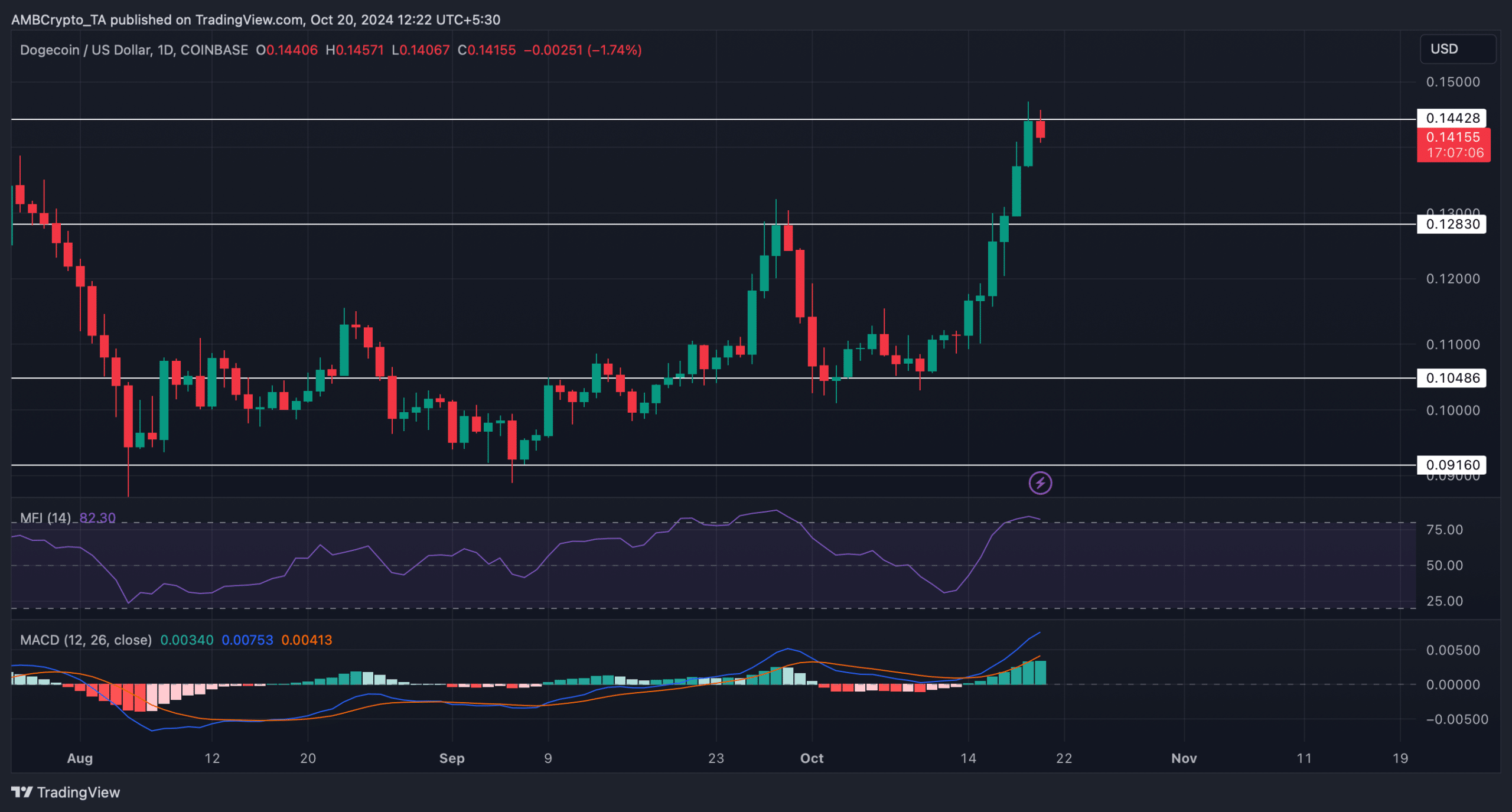

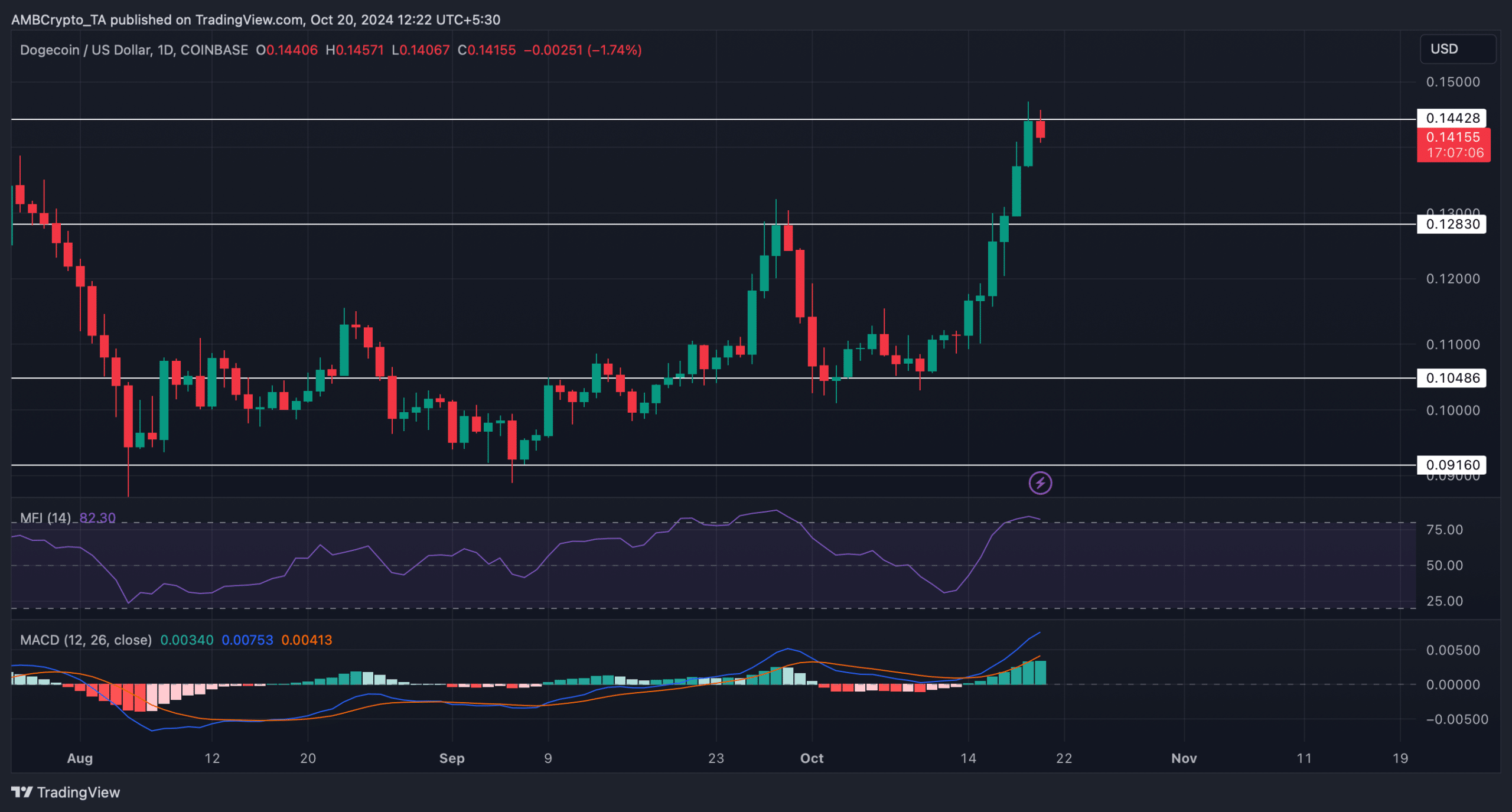

Our assessment of DOGE’s daily chart revealed that the coin got rejected at its resistance near $0.14428. A possible reason behind this might be the rise in selling pressure.

Realistic or not, here’s DOGE market cap in BTC’s terms

Dogecoin’s Money Flow Index (MFI) entered the overbought zone, which could have triggered a sell off. However, the MACD continued to display a bullish advantage in the market.

This could allow the memecoin to go above the resistance in the coming days.

Source: TradingView