[ad_1]

- The DOGE futures market has seen more activities in the last few weeks.

- Its funding rate has remained positive despite increased liquidations.

Dogecoin’s [DOGE] futures open interest has reached an all-time high, signaling heightened market activity and sparking speculation about the potential trajectory of the popular cryptocurrency.

The surge in derivatives positions coincides with DOGE’s impressive price rally over recent weeks, raising questions about whether this marks a pivotal moment for the asset.

Dogecoin futures open interest and market sentiment

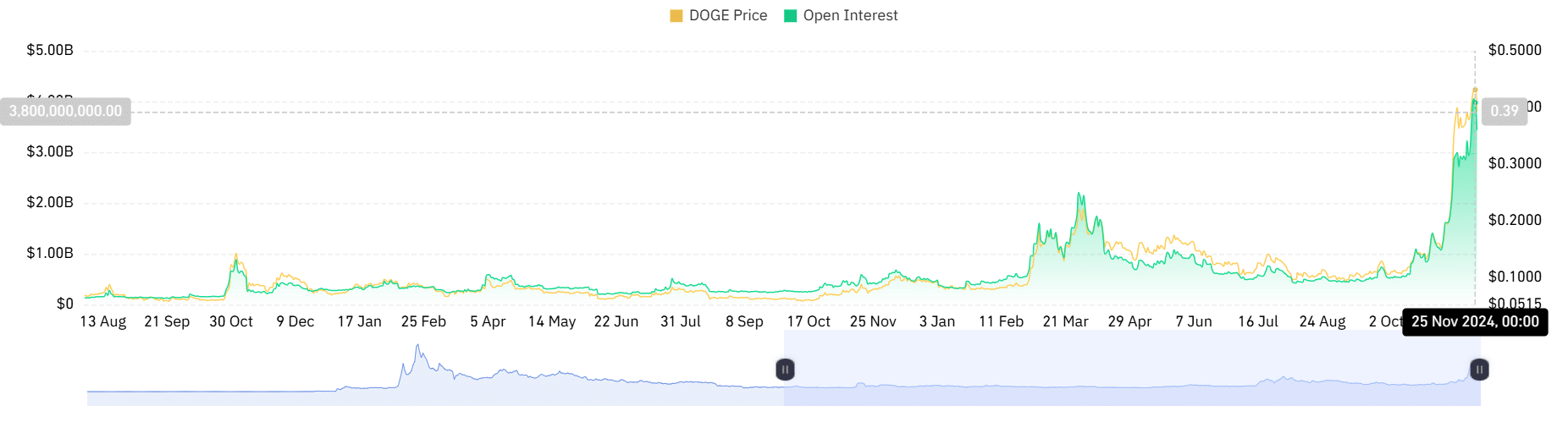

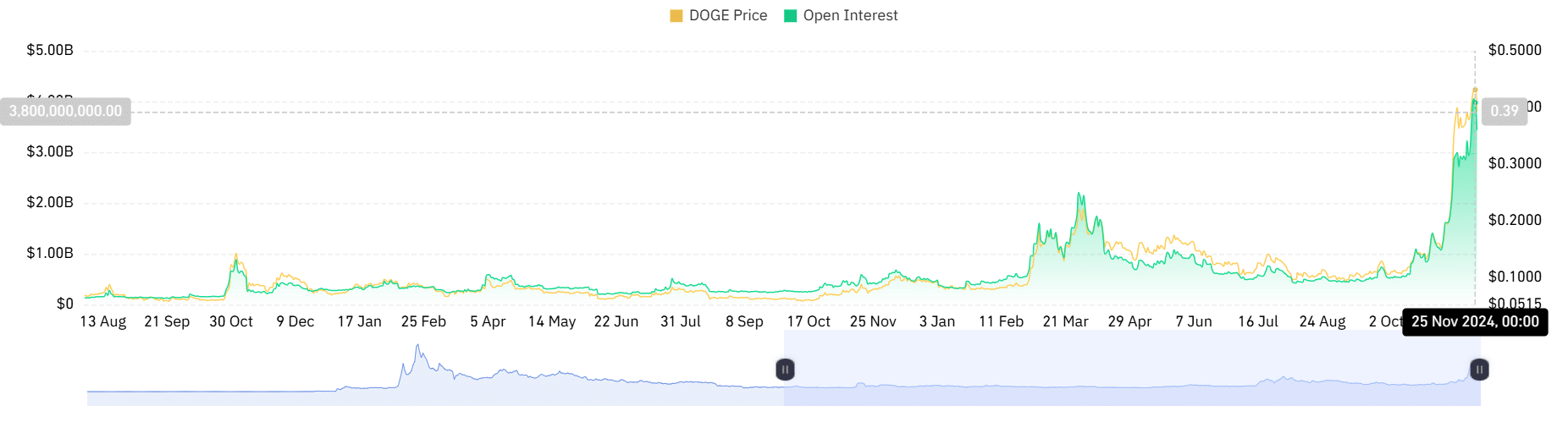

Data from Coinglass highlights the unprecedented levels of open interest in Dogecoin futures, driven by increased participation from retail and institutional traders.

The analysis showed that the DOGE open interest hit $4 billion recently for the first time. Although it has declined to around $3.4 billion as of this writing, it is one of its highest points in history.

Source: Coinglass

This heightened activity has closely paralleled DOGE’s price growth, currently trading near $0.407. Open interest surges often indicate growing speculative interest, but they also increase market fragility, particularly if accompanied by over-leveraged positions.

Long liquidations dominate Dogecoin market

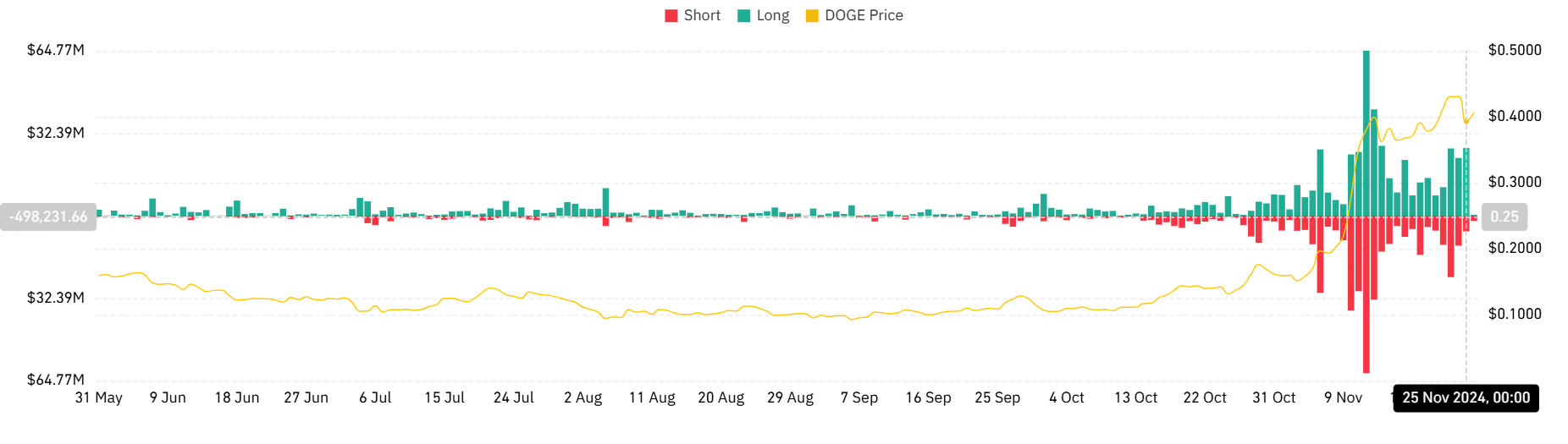

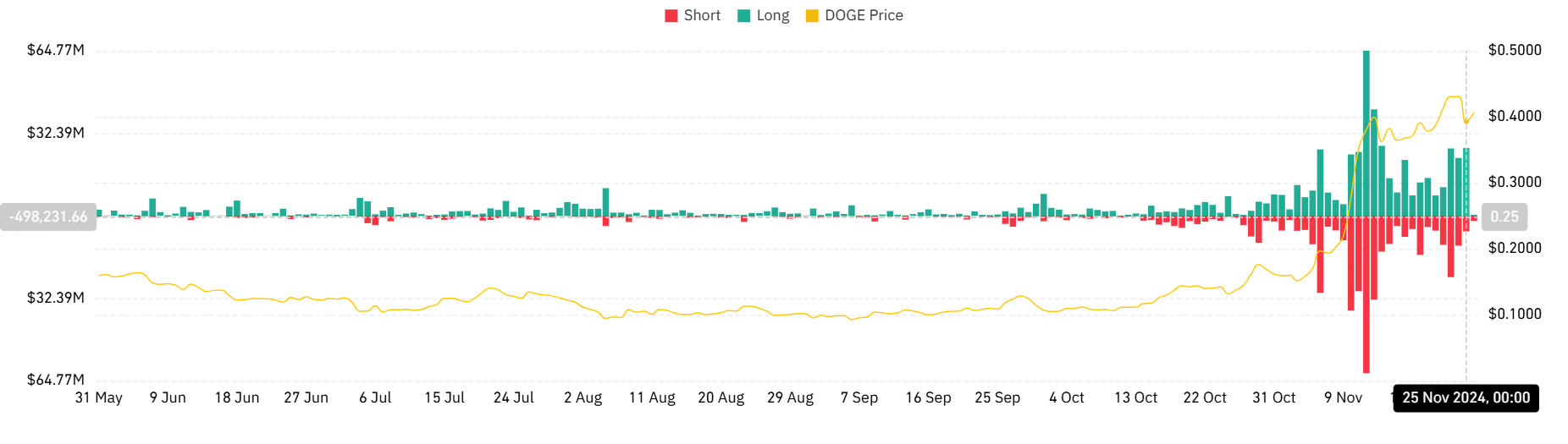

While the Dogecoin open interest has surged, the past few days have seen more liquidation of long positions than shorts. On 23rd November, long liquidations amounted to $26.38 million compared to $24.16 million for shorts.

The disparity widened on 24th November, with $22.65 million in long liquidations versus $11.79 million for shorts. On 25th November, the gap grew even larger, as long liquidations reached $26.59 million, while shorts accounted for only $6.16 million.

Source: Coinglass

This pattern suggests that traders betting on further upward momentum may have over-leveraged themselves, leaving the market vulnerable to corrections.

The imbalance also highlights a degree of uncertainty, as bullish traders face increasing pressure amidst volatile price movements.

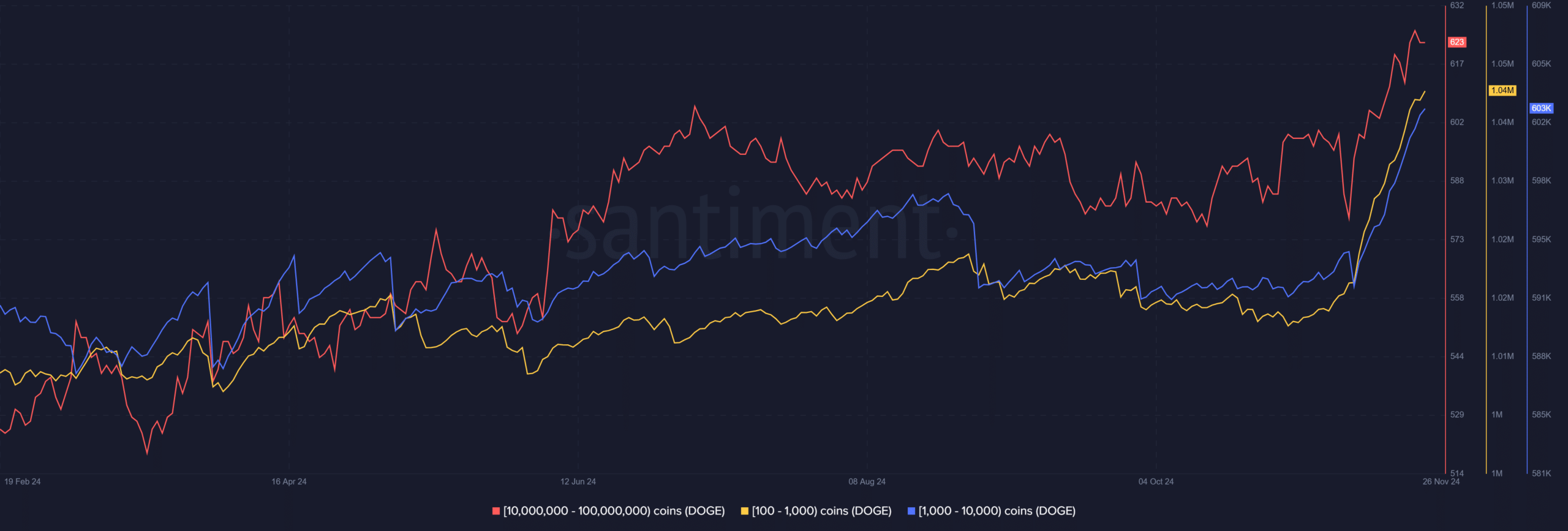

How the whales are moving

Despite the challenges posed by long liquidations, Dogecoin’s price has remained resilient, trading near $0.407 at the time of writing.

Tracked through Santiment data, Whale activity shows continued accumulation by addresses holding between 10 million and 100 million DOGE.

This suggests that large holders remain confident in Dogecoin’s long-term potential, providing some stability amid market turbulence.

Source: Santiment

The interplay between whale accumulation and elevated futures activity is creating a dynamic market environment. While whales support the price, leveraged traders add to volatility, amplifying both gains and losses.

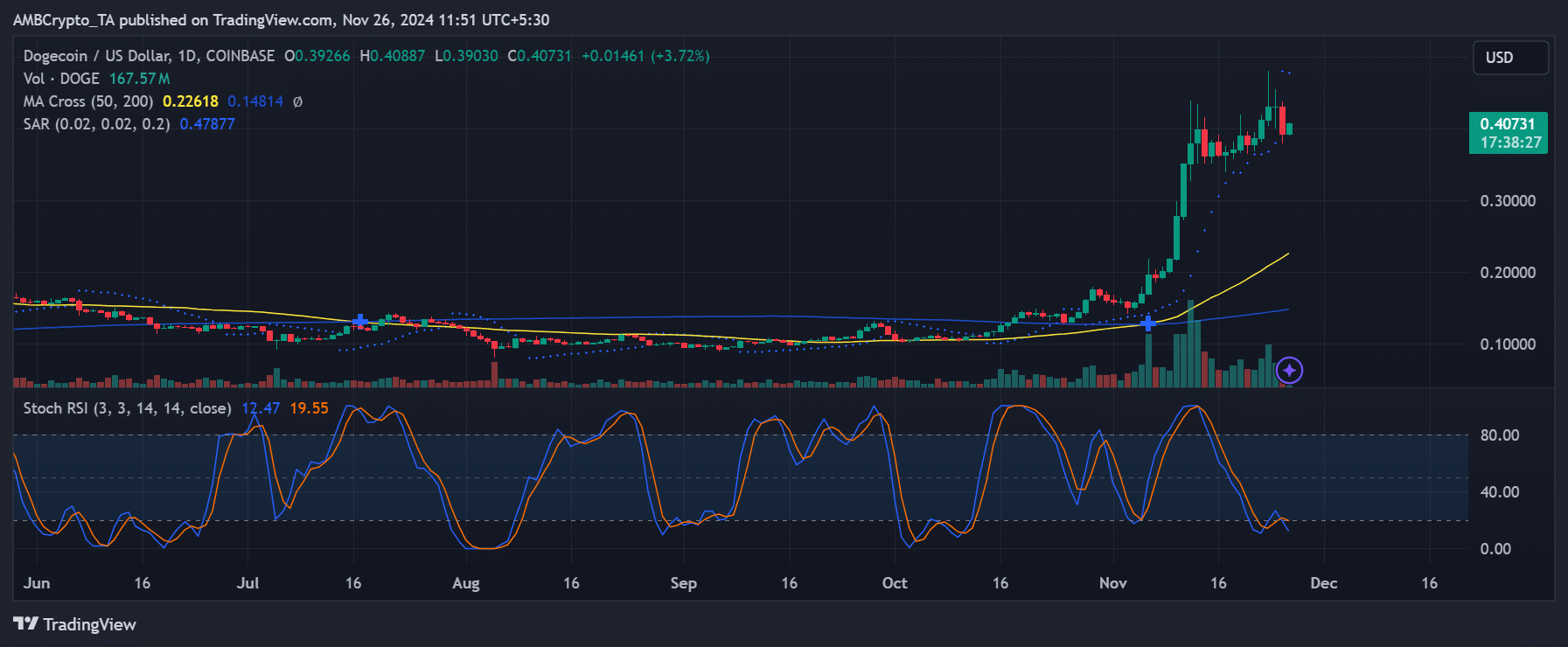

DOGE technical indicators signal mixed outlook

Dogecoin’s momentum remains strong, as confirmed by the Parabolic SAR, which indicates a continuation of the uptrend. However, the Stochastic RSI suggests that DOGE is approaching overbought territory, raising the possibility of a short-term pullback.

Source: TradingView

The liquidation data, coupled with technical signals, paints a mixed picture. While the dominance of long liquidations suggests that bullish sentiment remains strong, it also indicates that the rally could be running out of steam.

Traders should be cautious, as sustained long liquidations could trigger broader market weakness if key support levels are breached.

The DOGE outlook

Dogecoin’s record-breaking futures open interest reflects strong speculative interest, but the surge in long liquidations raises concerns about market fragility.

The confidence shown by whales offers a counterbalance, yet technical indicators and liquidation trends suggest caution is warranted.

Is your portfolio green? Check out the Dogecoin Profit Calculator

As DOGE navigates this critical juncture, its price trajectory will depend on whether bullish traders can maintain momentum or if mounting liquidations will lead to a broader correction.

The coming days will provide crucial insights into the sustainability of Dogecoin’s recent rally.

[ad_2]

Source link