- Bitcoin rallied to $64,000, but the U.S. market’s absence raises concerns about the rally’s sustainability.

- Metrics show a decline in Bitcoin’s Open Interest and retail activity, signaling potential caution for investors.

The global crypto market has experienced a significant boost in the past few days, with a rise of over $60 billion in valuation.

This increase comes as Bitcoin’s price surged once again to the $64,000 mark, reigniting optimism among investors.

While this rally has grabbed the attention of many, some analysts are questioning the sustainability of this growth, noting certain unusual trends behind the scenes.

Market driven by Asian capital, not U.S. buyers?

A CryptoQuant analyst, using the pseudonym BQYoutube, has recently highlighted a critical observation on the CryptoQuant QuickTake platform.

In a post titled “We are going up. But Coinbase Ain’t Buying,” the analyst pointed out that the U.S. market, represented by Coinbase, has not been participating in the recent rally.

BQYoutube noted that while Bitcoin’s price was climbing, Coinbase Premium, a metric that tracks the difference between Bitcoin prices on Coinbase and other exchanges, has been falling into negative territory.

This drop in the Coinbase Premium indicates that the U.S. market might not be as enthusiastic about the rally, potentially weakening the overall bullish sentiment.

Source: CryptoQuant

One of the key reasons behind Bitcoin’s recent rally could be attributed to capital flows from Asia, according to BQYoutube. The analyst suggested that the China rate cut and inflow of Asian capital might be driving prices upward.

However, this rally lacks full support without significant U.S. participation.

The U.S. market has traditionally played a crucial role in sustaining long-term Bitcoin price rallies, and its absence might signal potential vulnerabilities in the current price movement.

BQYoutube cautioned that the rally could be risky if the U.S. market remains disengaged, as sustained price momentum often relies on broader global participation.

Retail interest in Bitcoin rebounds slightly

Aside from these observations, it is essential to look at Bitcoin’s key on-chain metrics to understand the broader picture.

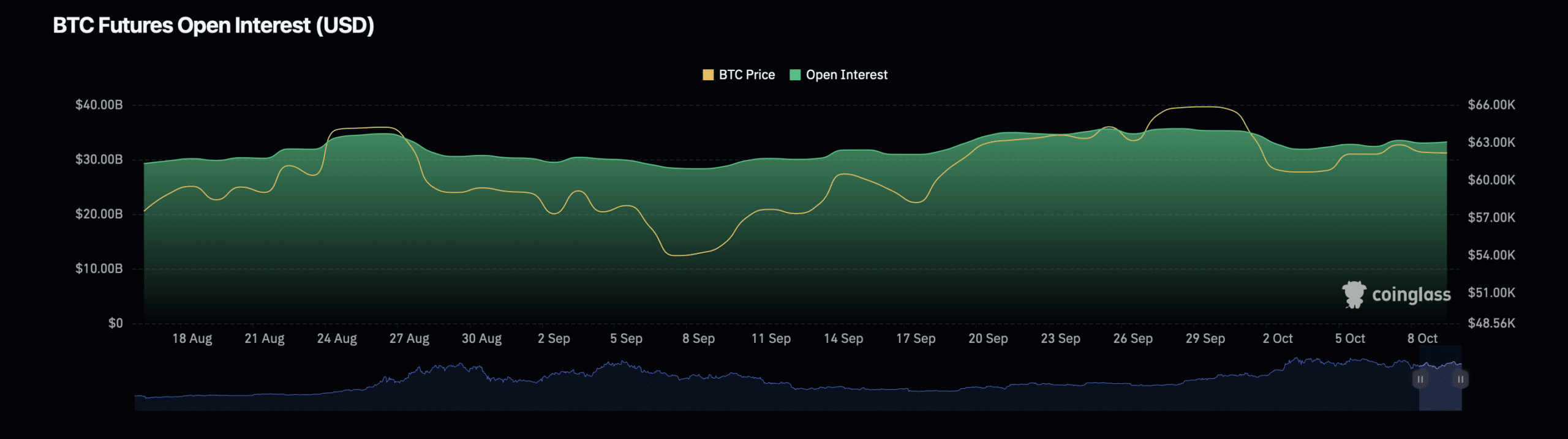

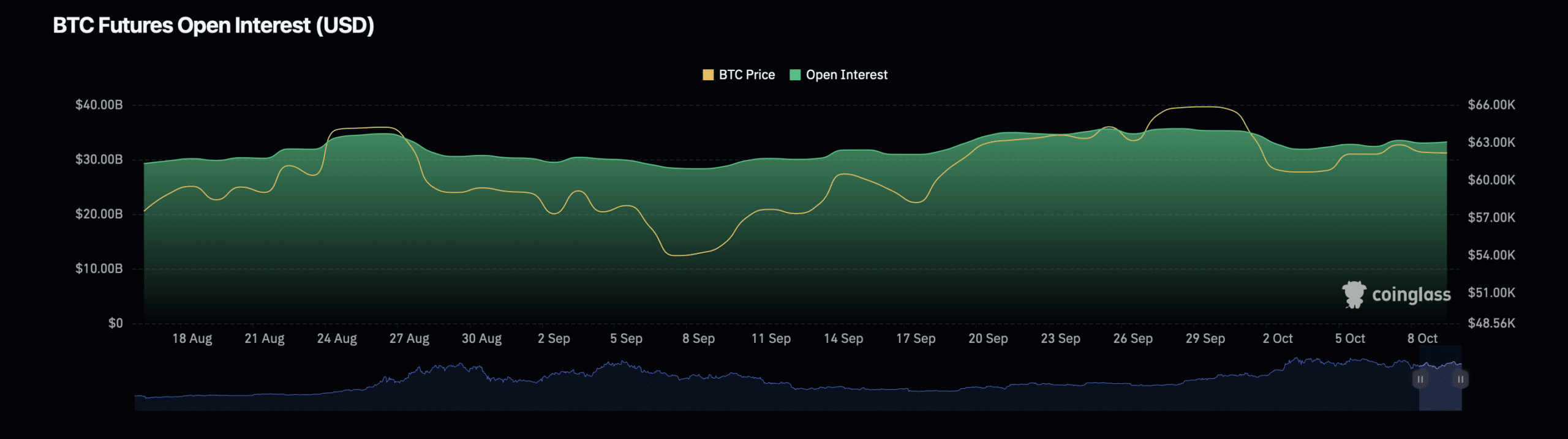

Data from Coinglass shows a decline in Bitcoin’s Open Interest, which refers to the total number of outstanding derivative contracts.

Source: Coinglass

This metric has dropped by 0.83%, bringing its value to $33.25 billion.

Similarly, Bitcoin’s Open Interest volume, which reflects the total number of trades, has also seen a sharp decline of 31.04%, standing at $45.49 billion at press time.

These declines could indicate that traders were less optimistic about the asset’s future movement in the short term.

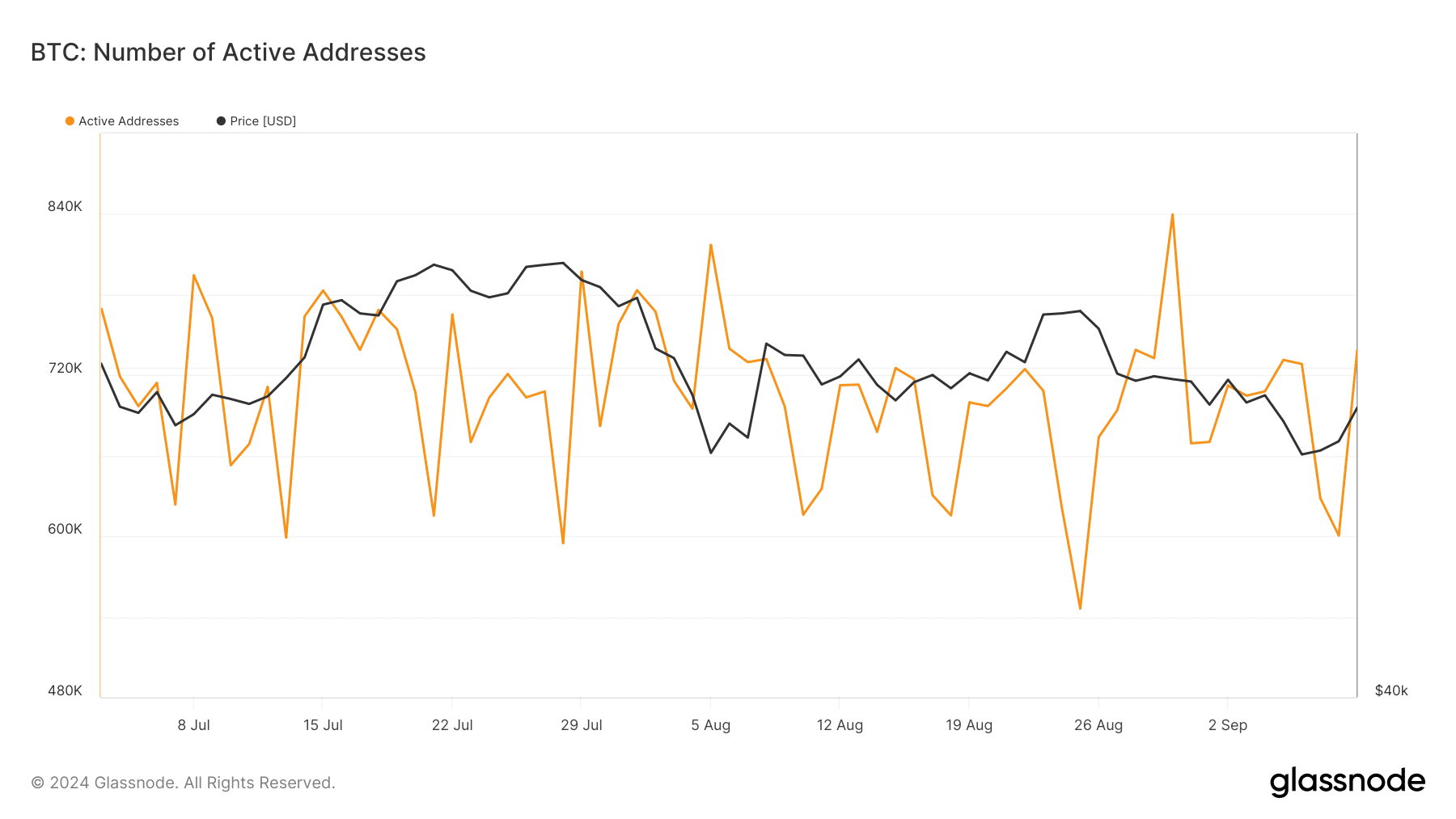

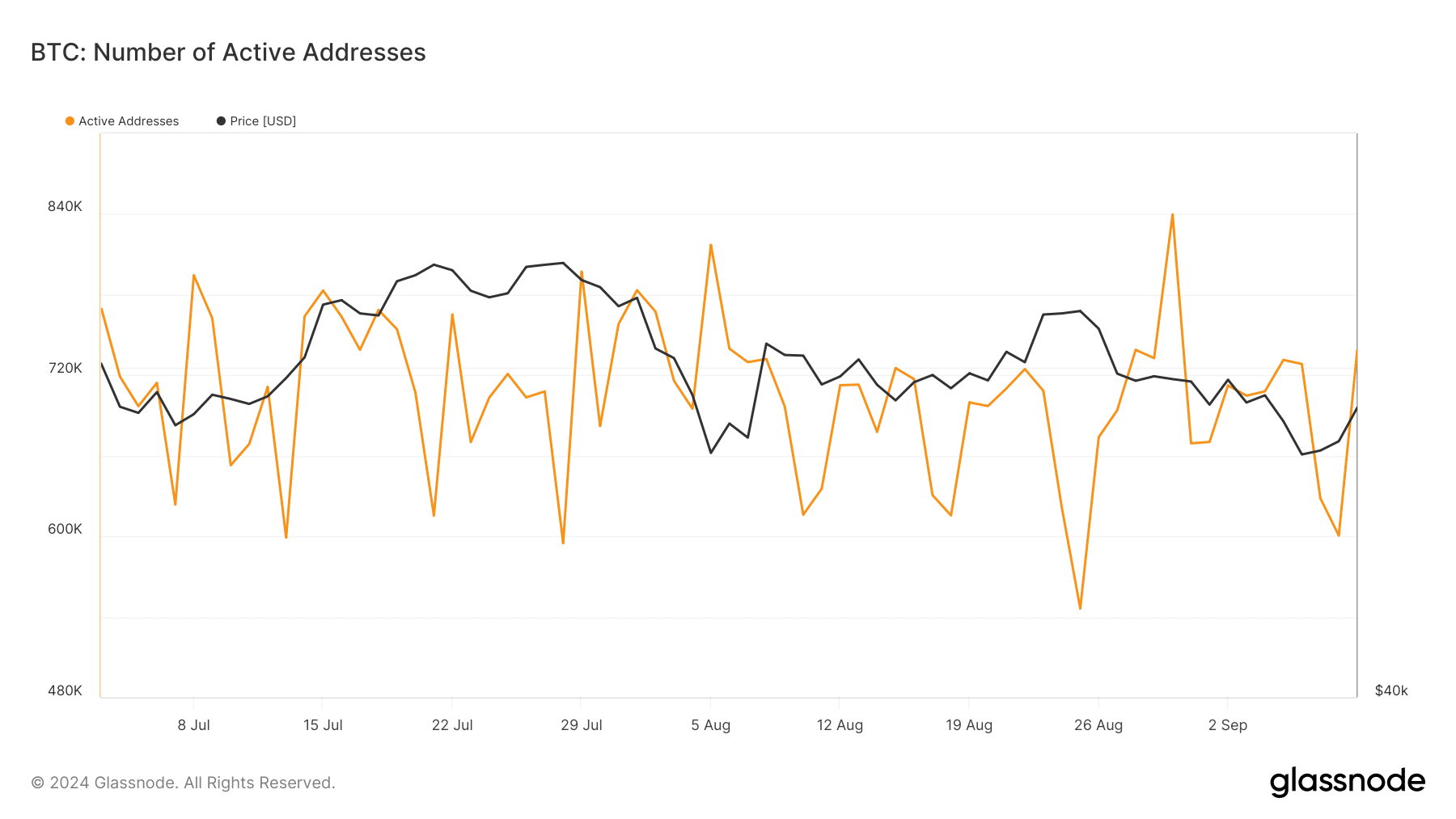

Another significant metric to monitor is Bitcoin’s active addresses, which serve as a key indicator of retail interest.

Data from Glassnode revealed a substantial drop in active Bitcoin addresses over the past few months, particularly after peaking at 839,000 on the 30th of August.

Source: Glassnode

This drop saw active addresses plunge to around 600,000 by the end of September, reflecting a decline in retail interest.

However, recent data suggested a minor recovery, with active addresses climbing back above 700,000 in recent days.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Notably, while the current rally has sparked excitement, the lack of U.S. participation and declining open interest may present challenges for Bitcoin’s short-term prospects.

However, the rebound in retail interest could signal renewed confidence in the market.