- DeFi is shifting from token incentives to fee-based rewards, promoting sustainability and stability

- Transition to fee-based earnings signals DeFi’s maturity, attracting long-term investors and institutional interest

Decentralized finance is evolving rapidly, with a notable transformation in how liquidity providers are rewarded. While token incentives have long been the primary draw for liquidity, recent trends suggest a shift towards a more sustainable model.

Liquidity providers are now earning more from protocol fees than from external token rewards. This change signals a promising new phase for DeFi, one that prioritizes stability and long-term growth over short-term incentives.

As the sector matures, this shift could reshape the economic landscape of decentralized finance, paving the way for a more resilient ecosystem.

The traditional DeFi model

In DeFi’s early days, platforms relied on token incentives like airdrops, governance tokens, and yield farming to attract liquidity. This strategy helped bootstrapped liquidity and rapid growth, with platforms like Uniswap, Sushiswap, and Compound gaining traction.

However, this approach led to unsustainable growth. Once incentives faded or token prices dropped, liquidity providers moved on, leading to “farm-and-dump” behavior. While effective short-term, this model raised concerns about long-term stability and reliable liquidity in DeFi ecosystems.

Transition to fee-based earnings

The DeFi landscape is seeing a shift from token incentives to fee-based earnings for liquidity providers.

Source: X

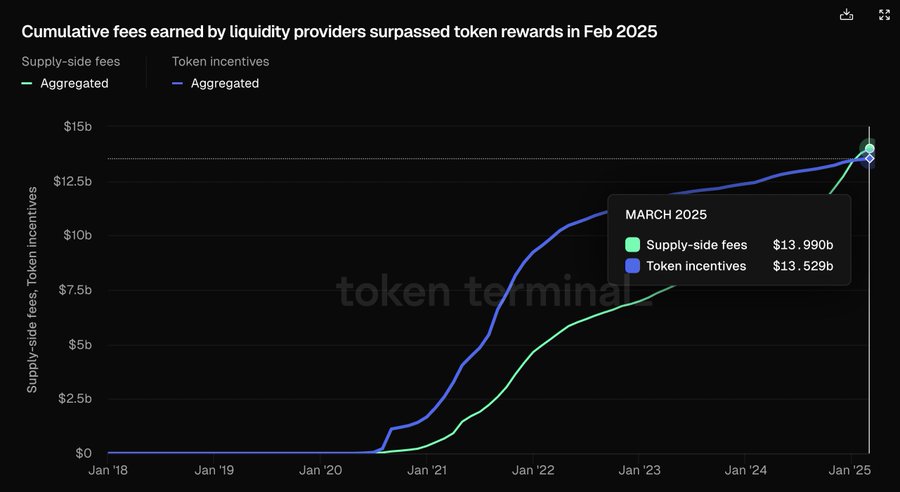

The data showed that cumulative supply-side fees surpassed token rewards in February 2025, with supply-side fees climbing to $13.99 billion, compared to $13.53 billion in token incentives by March 2025. This marks a significant change from the traditional model where token incentives dominate earnings.

Now, platforms increasingly generate revenue through protocol fees, including transaction fees, staking rewards, and yield farming driven by protocol activity. This transition is a sign of DeFi protocols moving towards a self-sustaining model, rather than relying on short-term external rewards.

Why this shift signals DeFi maturity

As DeFi protocols rely more on transaction fees, staking rewards, and yield farming, the ecosystem becomes more stable and sustainable. Unlike token-driven models that cause volatility, fee-based structures offer more consistent returns. This shift reflects DeFi’s maturity, with protocols better able to handle market fluctuations and provide reliable returns for liquidity providers.

Platforms with strong fee structures are attracting long-term participants, reducing speculative behavior and “farm-and-dump” risks. As protocols build self-sustaining revenue streams, they become more attractive to institutional investors seeking predictable returns.