- Bitcoin’s recovery triggered a rally in crypto stocks.

- Amid growing popularity, the Minneapolis Fed President considered BTC worthless.

After the “Uptober” prospects appeared to dwindle following Bitcoin’s [BTC] decline below the critical $60,000 mark last week, the king coin has now made a remarkable comeback.

On the 14th of October, BTC hit a high of $66,500, the highest price since July.

This price hike catalyzed a double-digit rally for publicly traded crypto-linked firms in the U.S.

CleanSpark (CLSK)—a Bitcoin mining company, posted the highest gains of 12.72% as per Google Finance. This was closely followed by Coinbase (COIN), which appreciated by 11.32%.

Other notable gainers were LM Funding America (LMFA) up by 10.94%, TeraWulf (WULF) rising 6.65%, and Marathon Digital Holdings (MARA) climbing 5.60%.

At press time, Bitcoin was trading at $65,657, gaining 9.04% over the past month and more than 144% in the last year.

Why is BTC going up?

The crypto stocks rally comes as Bitcoin benefits from heightened investor interest, fueled in part by anticipation surrounding the upcoming U.S. presidential elections.

Notably, both the Republican and Democratic parties have adopted a pro-crypto stance.

This, in turn, has increased the possibility of further upside for Bitcoin regardless of whether Donald Trump or Vice President Kamala Harris secures the presidency.

Trump, who previously expressed skepticism about cryptocurrency, has rebranded himself as a pro-crypto candidate and even launched his crypto-related project, as reported by AMBCrypto.

On the other hand, Harris is increasingly positioning herself as a crypto advocate. Her recent proposal centered on cryptocurrency playing a key role in fostering economic empowerment.

Questions arise over BTC’s value

Despite the growing acceptance and support from the larger community, BTC continues to face skepticism from traditional financial leaders and institutions.

On the 14th of October, Minneapolis Federal Reserve Bank President Neel Tushar Kashkari said that Bitcoin remains worthless after 12 years.

Kashkari emphasized that despite the longevity of digital assets, crypto has not been able to establish itself as a viable currency.

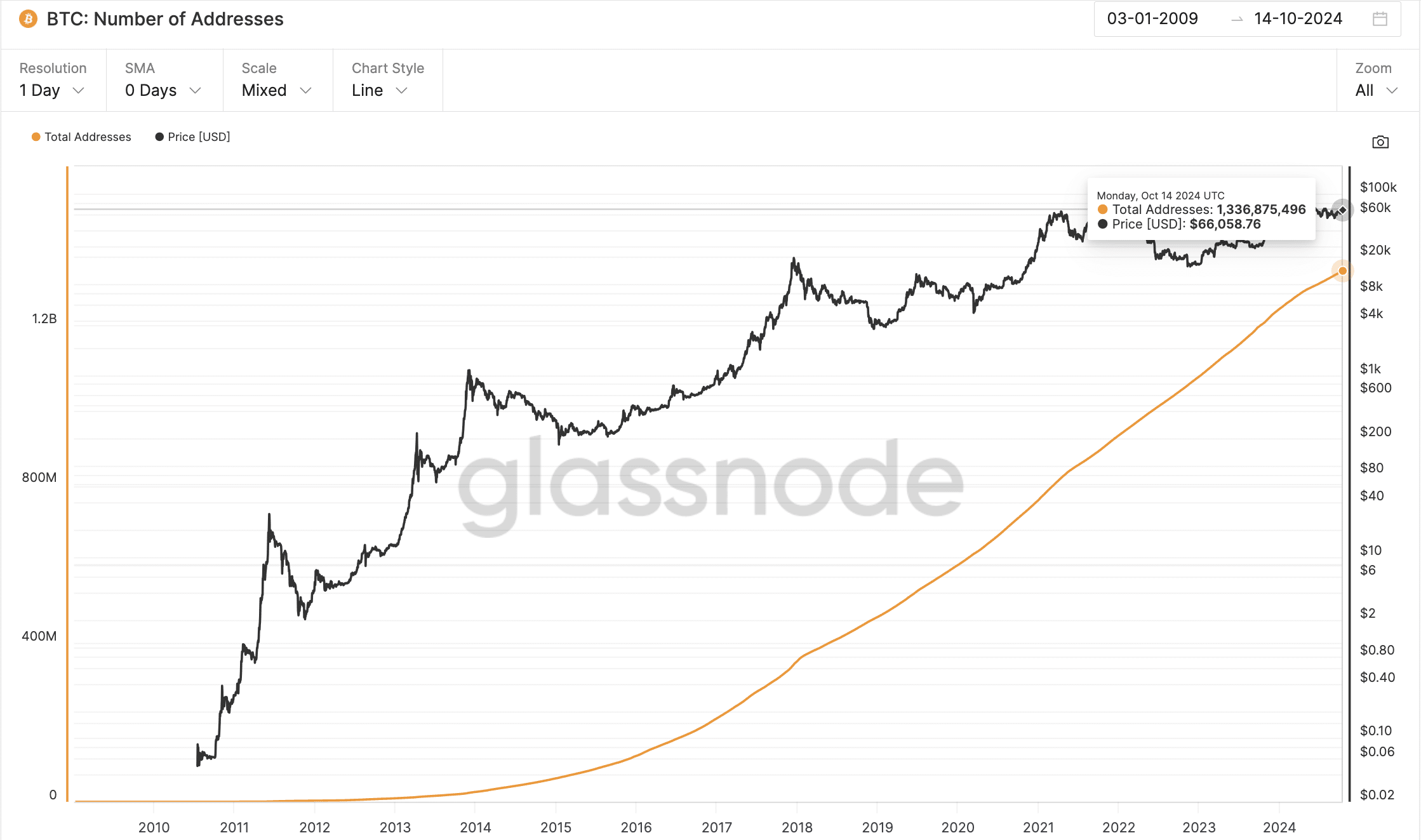

However, Bitcoin’s performance tells a different story—its $1.3 trillion market cap and 1.3 billion addresses, as per Glassnode, highlight its broad adoption, market confidence, and recognition as a valuable digital asset despite criticisms.

Source: Glassnode