- Popcat, Artificial Superintelligence Alliance, and SATS were the biggest winners in the past week.

- Helium, Toncoin, and Notcoin were the biggest losers in the past week.

Recent developments surrounding Telegram have significantly impacted the performance of Toncoin (TON) and Notcoin (NOT), placing them among the biggest losers in the crypto market.

In contrast, Popcat has seen a strong performance over the past week, emerging as a leader among memecoins.

Biggest winners

Popcat [POPCAT]

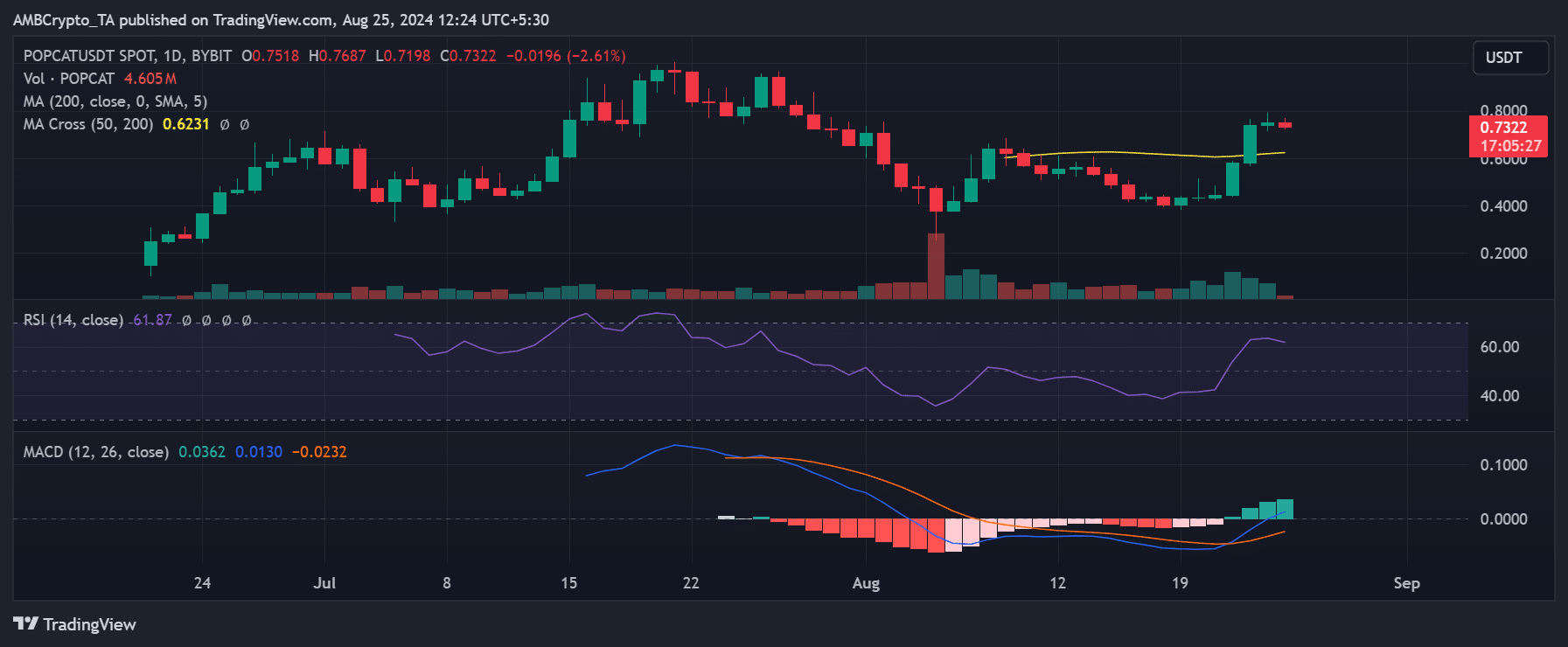

Analysis of the Popcat [POPCAT] daily price chart indicates significant spikes in the past week, making it the biggest winner. According to data from CoinMarketCap, POPCAT gained an impressive 77.43% over the week.

Source: TradingView

The price trend analysis reveals that POPCAT began the week trading at around $0.40, initially experiencing a decline of over 7%. However, this trend quickly reversed, starting with a more than 7% increase the following day.

The most notable uptrends occurred on Thursday, 22nd August, and Friday, 23rd August, where the price surged by 30.79% and 27.16%, respectively.

By the end of the week, POPCAT’s price had risen to approximately $0.75 after an additional increase of over 1%.

These significant spikes shifted the overall trend to bullish, as reflected in the Relative Strength Index (RSI), which spiked above 60, signaling a strong bullish momentum.

Popcat’s market capitalization is around $718 million as of this writing. However, its trading volume has declined by over 40%, now at approximately $91.3 million.

Artificial Superintelligence Alliance [FET]

Artificial Superintelligence Alliance [FET] emerged as one of the week’s top performers, recording the second-largest gains.

Despite a slow start, with its price around $0.8 at the beginning of the week, FET experienced significant uptrends in the following days. By the end of the week, its price had climbed to approximately $1.2, marking a substantial gain.

According to data from CoinMarketCap, FET saw a 46.81% increase over the week, driven by these positive trends. This growth also had a notable impact on its market capitalization.

At the start of the week, FET’s market cap was around $2.1 billion. However, by the end of the week, it had risen to approximately $3.1 billion, which remains as of this writing.

Despite the impressive price and market cap growth, FET’s trading volume has declined. Currently, its volume stands at around $213 million, a decrease of over 20%.

SATS [1000SATS]

SATS (1000SATS) was the third-highest gainer of the week, posting a 46.81% increase, according to data from CoinMarketCap. The price trend analysis shows that SATS had a strong start to the week, trading at around $0.00028.

Throughout the week, its price saw steady gains, culminating in a significant spike on 23rd August. By the end of the week, SATS was trading at approximately $0.0004.

This price surge also had a notable impact on SATS’s market capitalization, which reached around $826 million as of this writing. Despite the strong performance, trading volume has seen a decrease.

Currently, SATS’s volume is around $176 million, reflecting a decline of over 20%.

Biggest losers

Helium [HNT]

After enjoying two strong weeks, Helium (HNT) experienced a significant downturn, becoming the biggest loser of the past week with a 17.66% decline.

The analysis shows that HNT began the week negatively, starting at around $7.8 and dropping to approximately $7.4 by the end of the first day. The downward trend continued throughout the week, ultimately falling to around $6.5.

This decline also had a noticeable impact on Helium’s market capitalization. At the start of the week, its market cap was around $1 billion, but it has since decreased by over 6% as of this writing.

Additionally, HNT’s trading volume has also seen a significant drop, currently standing at approximately $12.7 million—a decline of more than 30%.

Toncoin [TON]

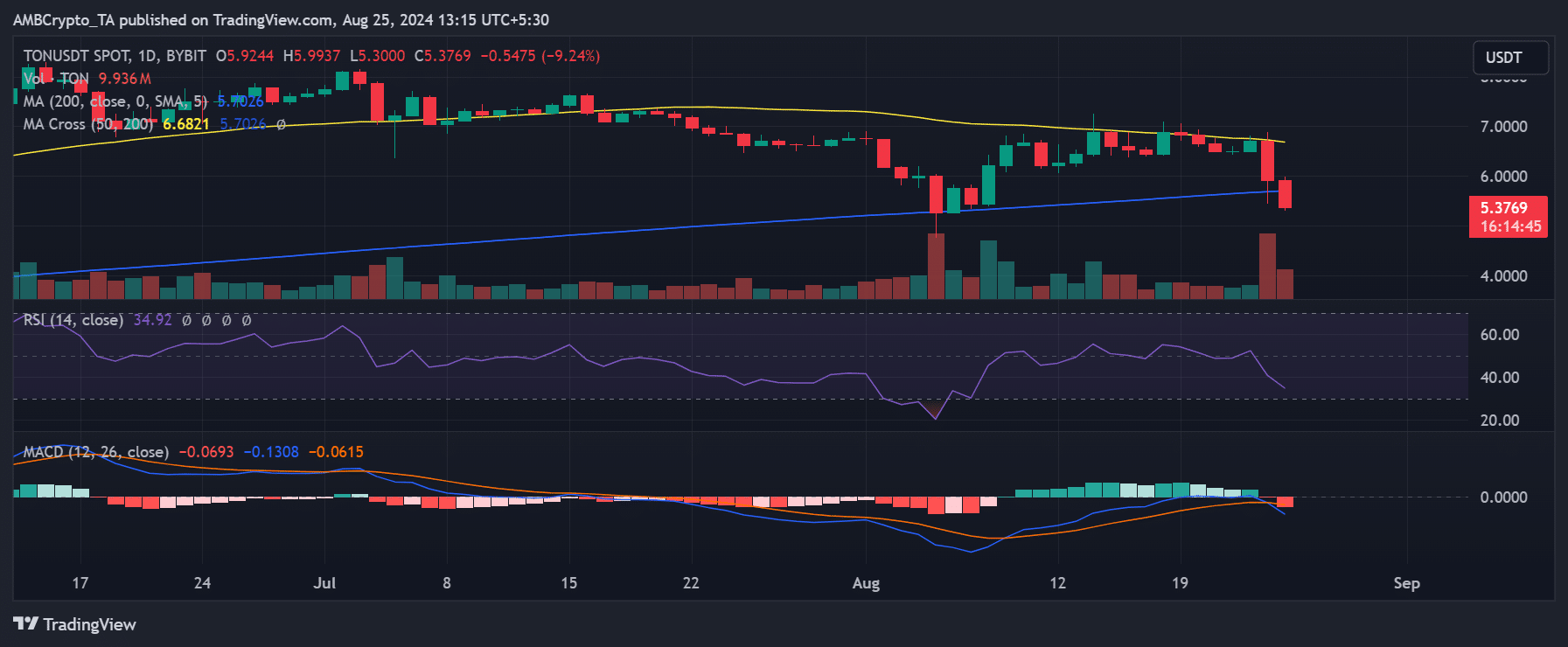

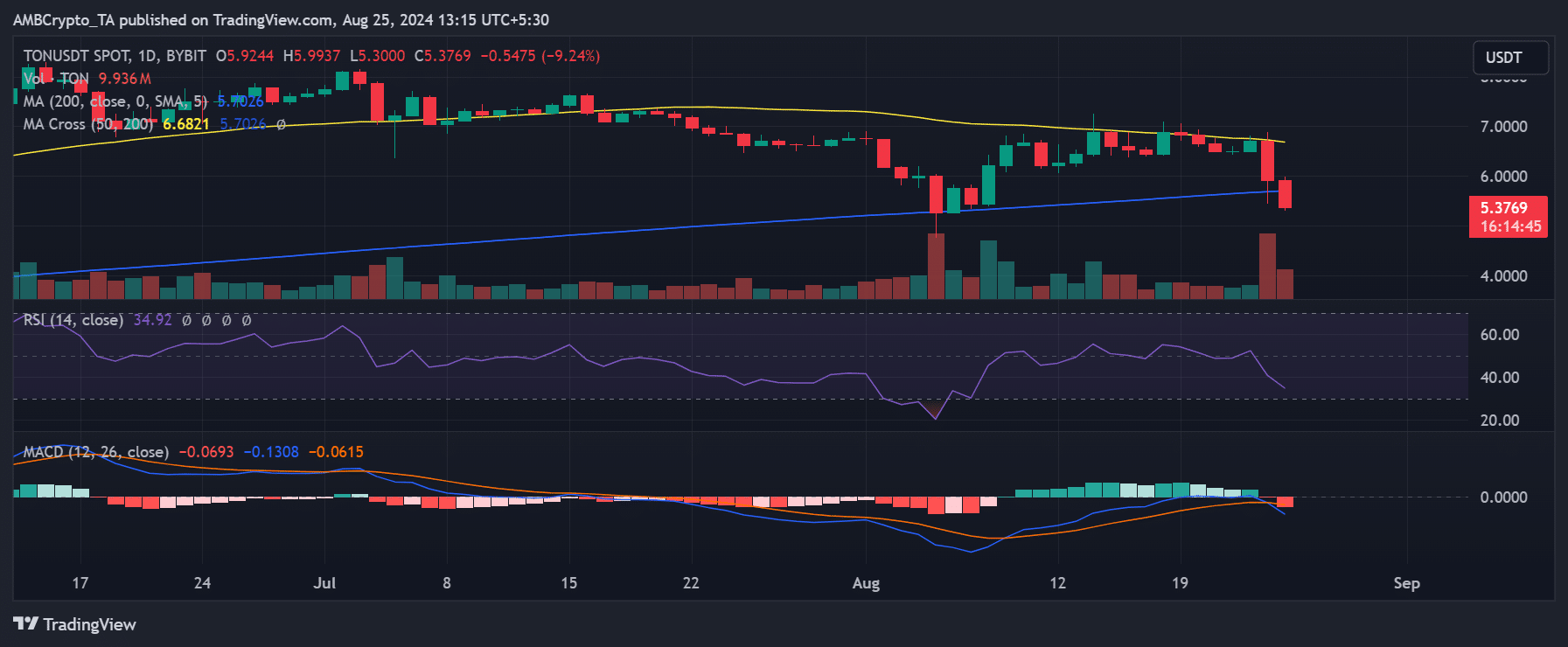

Analysis of Toncoin [TON)] on a daily chart reveals a tumultuous week marked by significant price volatility. The week began positively for TON, with an almost 7% increase, bringing its price to around $6.8.

However, this initial upward momentum was sharply reversed by the end of the week.

Source: TradingView

The chart shows an over 11% decline at the week’s close, with TON trading around $5.9, making it the second-highest loser of the week with a total decline of over 14%, according to additional data from CoinMarketCap.

This steep decline coincided with news surrounding the arrest of Telegram’s founder, which likely contributed to the negative sentiment and sell-off. As of this writing, Toncoin’s price has continued to fall, declining by over 9% to approximately $5.3.

Toncoin’s market capitalization has also been significantly impacted, dropping by around 17% to approximately $13 billion. Despite the price decline, trading volume has surged dramatically, increasing by over 600% to around $1.9 billion.

This spike in volume suggests heightened trading activity, likely driven by the news and subsequent market reactions. Additionally, an analysis of Toncoin’s Relative Strength Index (RSI) indicates that it is on a bearish trend and has entered the oversold zone.

Notcoin [NOT]

Notcoin [NOT], another Telegram-related cryptocurrency, was significantly impacted by the recent developments surrounding Telegram. According to CoinMarketCap data, Notcoin was the third-largest loser of the week, with a decline of around 12.19%.

The analysis of Notcoin’s price trend shows that it began the week with an uptrend, trading at approximately $0.011. However, similar to Toncoin, Notcoin’s performance took a sharp downturn later in the week.

On 24th August, Notcoin experienced an over 8% decline, which brought its price down to around $0.010. As of this writing, NOT has fallen further, with a decline of over 12%, and is currently trading at around $0.009.

This price drop has also significantly impacted Notcoin’s market capitalization, which has decreased by more than 20% in the last 24 hours, now standing at approximately $937 million.

Despite the price decline, Notcoin’s trading volume has surged, similar to Toncoin’s, increasing by nearly 150%. As of this writing, the volume is over $600 million, indicating heightened trading activity, likely in response to the recent news and market conditions.