- Analysts forecast Litecoin’s breakout to $105-$110, backed by strong technical indicators and growing market momentum.

- Over 90% of Litecoin holders are profitable, signaling positive sentiment and sustained interest in the crypto.

Litecoin [LTC] has shown promising strength recently, with analysts predicting a potential price surge.

Crypto analyst World Of Charts has stated that Litecoin is preparing for a significant breakout, with expectations that it could rise to the $105–$110 range if the breakout is successful.

The analyst noted,

“$LTC showing strength here and preparing for breakout. In case of successful breakout, expecting a move towards $105-$110.”

Source: X

In addition, another analyst, ZAYK Charts, provided a similar forecast, identifying a descending channel formation on Litecoin’s daily timeframe.

The chart’s analysis suggested that while the pattern was typically bearish, a breakout above the upper trendline could indicate a bullish reversal.

According to ZAYK Charts,

“When a breakout happens, next target will be $100.”

This prediction aligns with technical analysis principles, where a breakout from a bearish formation often leads to a significant price increase.

Source: X

Current price movement

As of the time of writing, Litecoin was trading at $65.52, reflecting a 0.28% increase over the last 24 hours and an 8.59% rise over the past seven days.

Litecoin’s market capitalization now stands at $4.88 billion, with a 24-hour trading volume of $438 million.

With a circulating supply of 75 million LTC, traders are closely monitoring Litecoin’s performance for potential upward momentum.

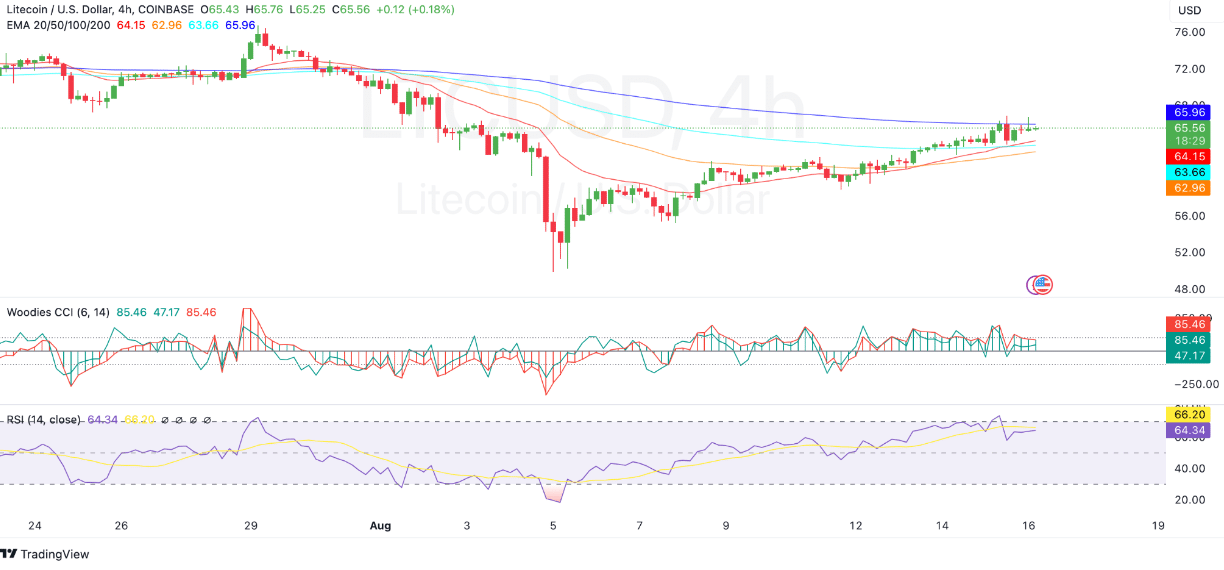

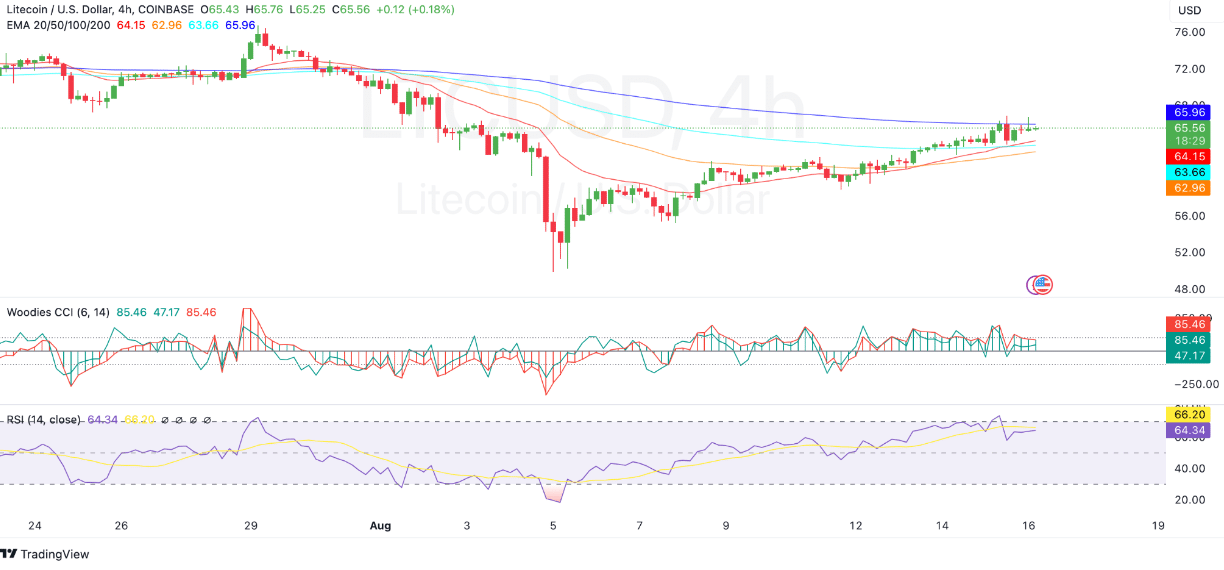

The 4-hour chart shows that Litecoin is steadily moving upwards, supported by the 20, 50, and 100-period exponential moving averages (EMAs).

The price is nearing resistance at the 200-period EMA at $65.96, which could act as a challenge for further gains.

If Litecoin breaks through this level, it could trigger more bullish momentum and increase the likelihood of reaching the $100 target forecasted by analysts.

Despite the positive outlook, some indicators suggest caution. The Woodies Commodity Channel Index (CCI) is reading 87.82, placing Litecoin in overbought territory.

This suggested the possibility of short-term selling pressure and a potential pullback if the price failed to surpass key resistance levels.

Source: TradingView

Additionally, the Relative Strength Index (RSI) sat at 66.21, indicating healthy bullish momentum but still shy of the extreme overbought zone of 70.

If the RSI rises above 70, Litecoin could face increased selling pressure, which might hinder its upward movement.

Traders are advised to closely monitor these technical signals, as they could influence Litecoin’s next move.

Active addresses and profitability

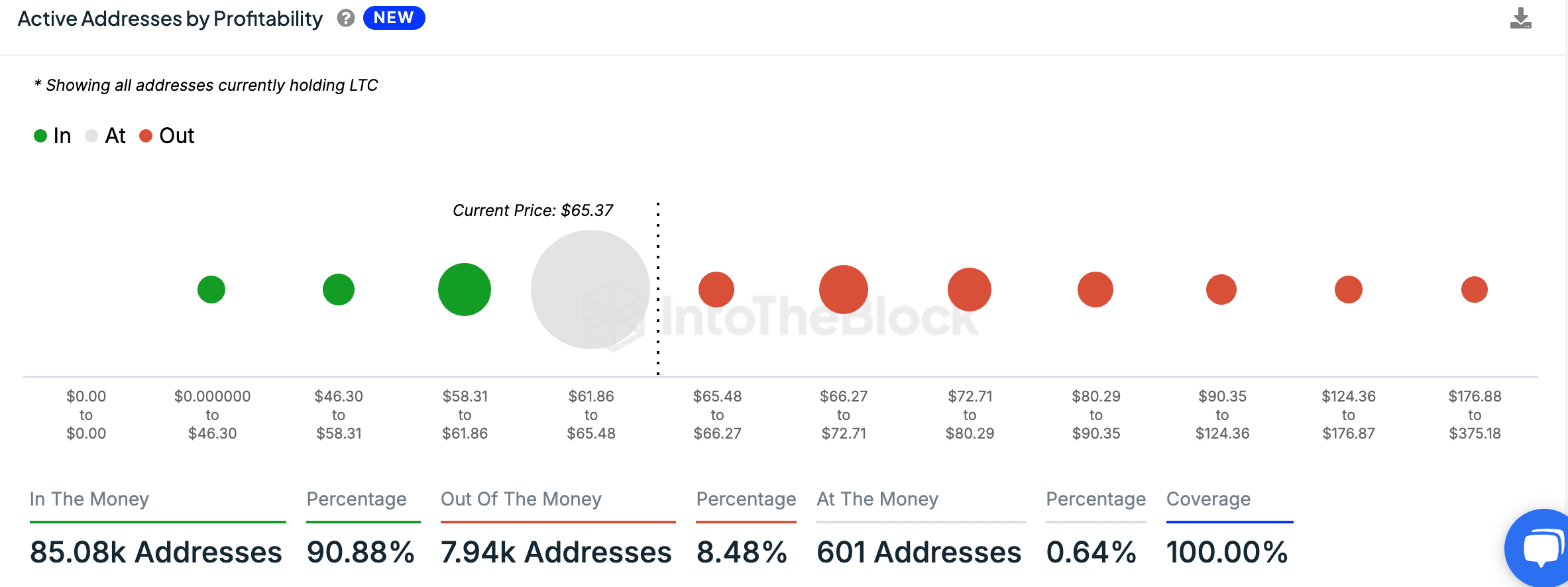

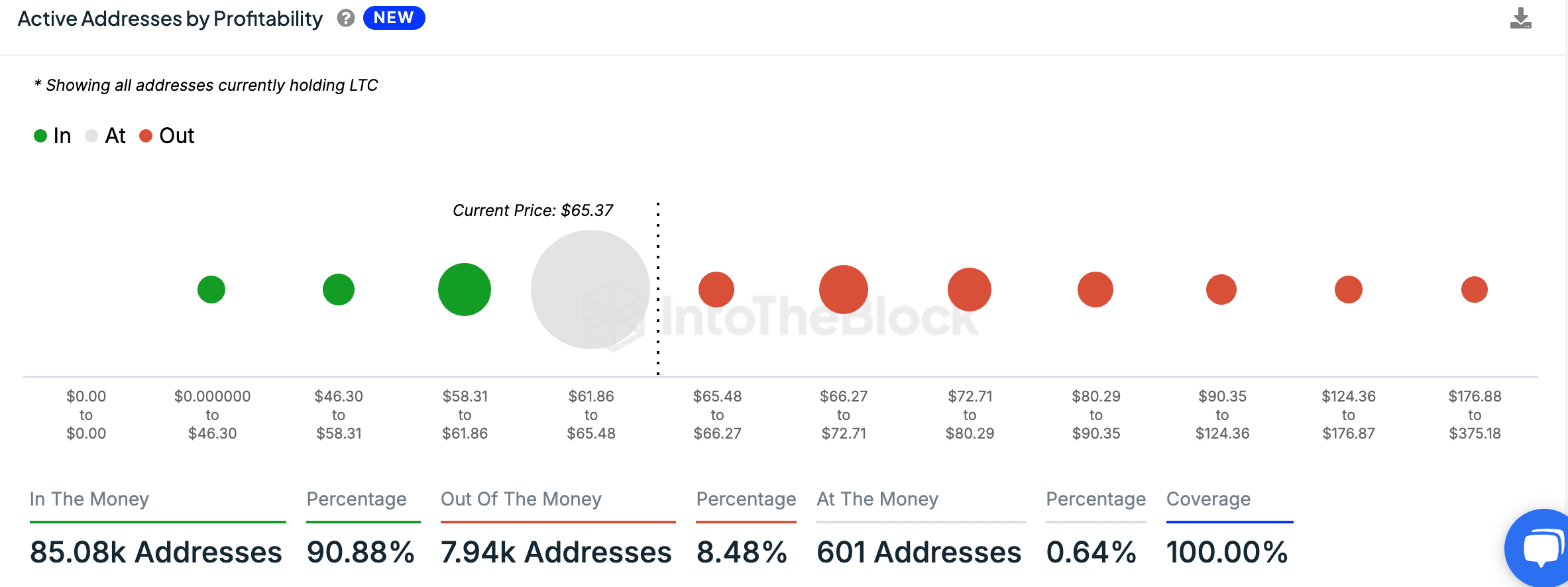

Recent data from IntoTheBlock showed that Litecoin remained profitable for the majority of its holders.

About 90.88% of all LTC addresses, or 85.08k addresses, were “In the Money,” meaning their LTC was purchased at a lower price than the current market price.

Meanwhile, 8.48% of addresses are “Out of the Money,” holding LTC bought at a higher price than its current value of $65.37.

A small fraction, 0.64%, or 601 addresses, are “At the Money,” with holdings purchased near the current price.

Source: IntoTheBlock

This data suggested that the majority of Litecoin holders were seeing profits at press time, further supporting positive market sentiment.

According to DefiLlama, Litecoin’s Total Value Locked (TVL) was reported at $3.41 million, with fees generated over the past 24 hours amounting to $1,342.

Is your portfolio green? Check out the LTC Profit Calculator

Additionally, there were 435,508 active addresses within the network.

This combination of profitability and activity indicates sustained interest in the cryptocurrency and continued engagement from its user base.