- Bitcoin demonstrated resistance against the downside despite leveraged longs liquidations.

- The show of strength continues as Bitcoin ETFs accumulate, raising chances of a $70,000 price.

Bitcoin [BTC] is on the verge of pushing above $70,000. While this may seem bold to state. It was just a few weeks that the cryptocurrency struggled to stay above $60,000.

A clear shift has occurred in the market, making it easier for the bulls to push higher.

Bitcoin demonstrated robust demand in the last six days, a sign that the bulls are back in control once again, after cooling off in the first 10 days of October.

In other words, it appears that BTC is once again building on the same momentum that was present in September.

There are a few reasons why a $70,000 Bitcoin price tag may occur in a matter of days or weeks.

Bitcoin demonstrated a lot of volatility in the last 24 hours, including a wave of sell pressure, pulling it back just shy of the $68,000 price level.

However, this was followed by a demand resurgence, pushing price back up and avoiding more downside.

Bitcoin snaps back despite leverage shake off

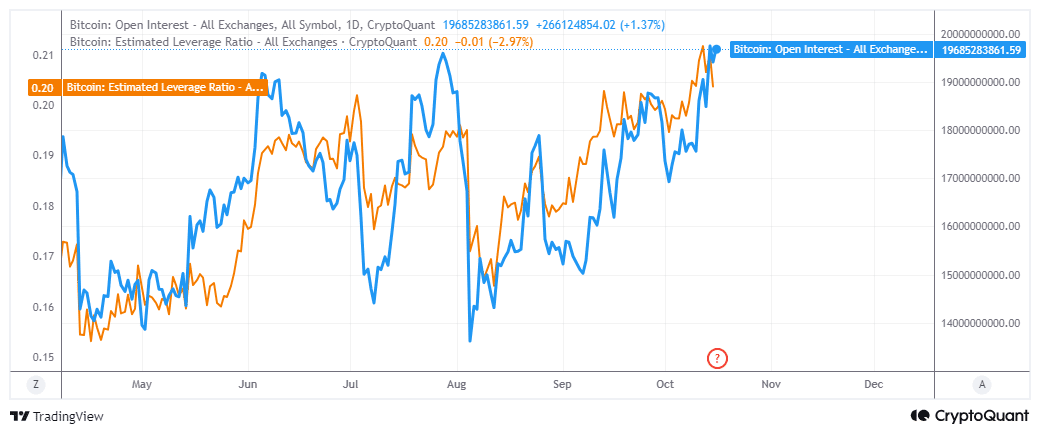

BTC’s extreme volatility during Tuesday’s trading session had the makings of a leverage shake-off. This is because its Open Interest was the highest that it has been in history.

On top of that, the estimated leverage ratio also soared to a new local high.

Source: CryptoQuant

High leverage with corresponding open interest are usually a set-up for liquidations. Especially during times of extreme optimism and once the pullback occurs, it dents the sentiment in most cases.

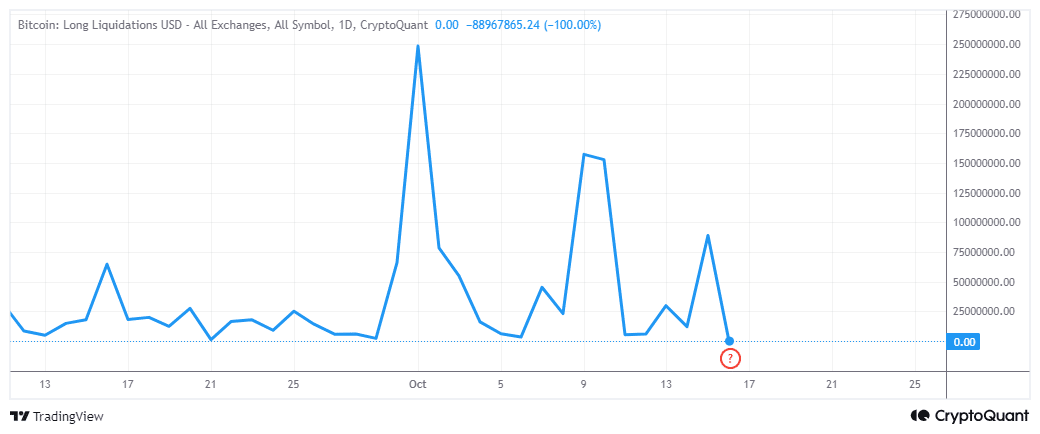

However, that was not the outcome that played out during Tuesday’s trading session.

Long liquidations peaked at $88.9 million on 15 September. However, demand quickly snapped back, pushing price back above $67,000.

Source: CryptoQuant

The above outcome confirmed the growing optimism in Bitcoin’s ability to capture more gains. On top of that, the recent demand resurgence was characterized by heavy accumulation by Bitcoin ETFs.

Recent reports revealed that Bitcoin ETFs accumulated over $500 million worth of BTC in the last 24 hours.

Similarly, ETFs accumulated over $500 million worth of BTC on the 14 of October. These findings indicated that institutional demand was also leaning on the bullish side.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This further explains why the cryptocurrency is now resisting the downside. It also backs the expectations that the bullish will likely push above $70,000 very soon.

On top of that, a major catalyst (the U.S. elections) may add more fuel to the rocketing BTC prices depending on the outcome.