- BNB, after surging by 10.45% in the last 24 hours, started testing the $491 resistance at press time.

- Netflow data suggested bullish holding behavior.

The cryptocurrency market has been a wild ride in recent weeks, with Binance Coin [BNB] experiencing large price swings.

Binance Coin has shown exceptional resilience after going down by 32% during the wider crypto crash.

In less than 24 hours, BNB recorded an impressive surge of 10.45%, which is why it should not come as a surprise to see traders and investors showing increased interest.

The $491 battleground

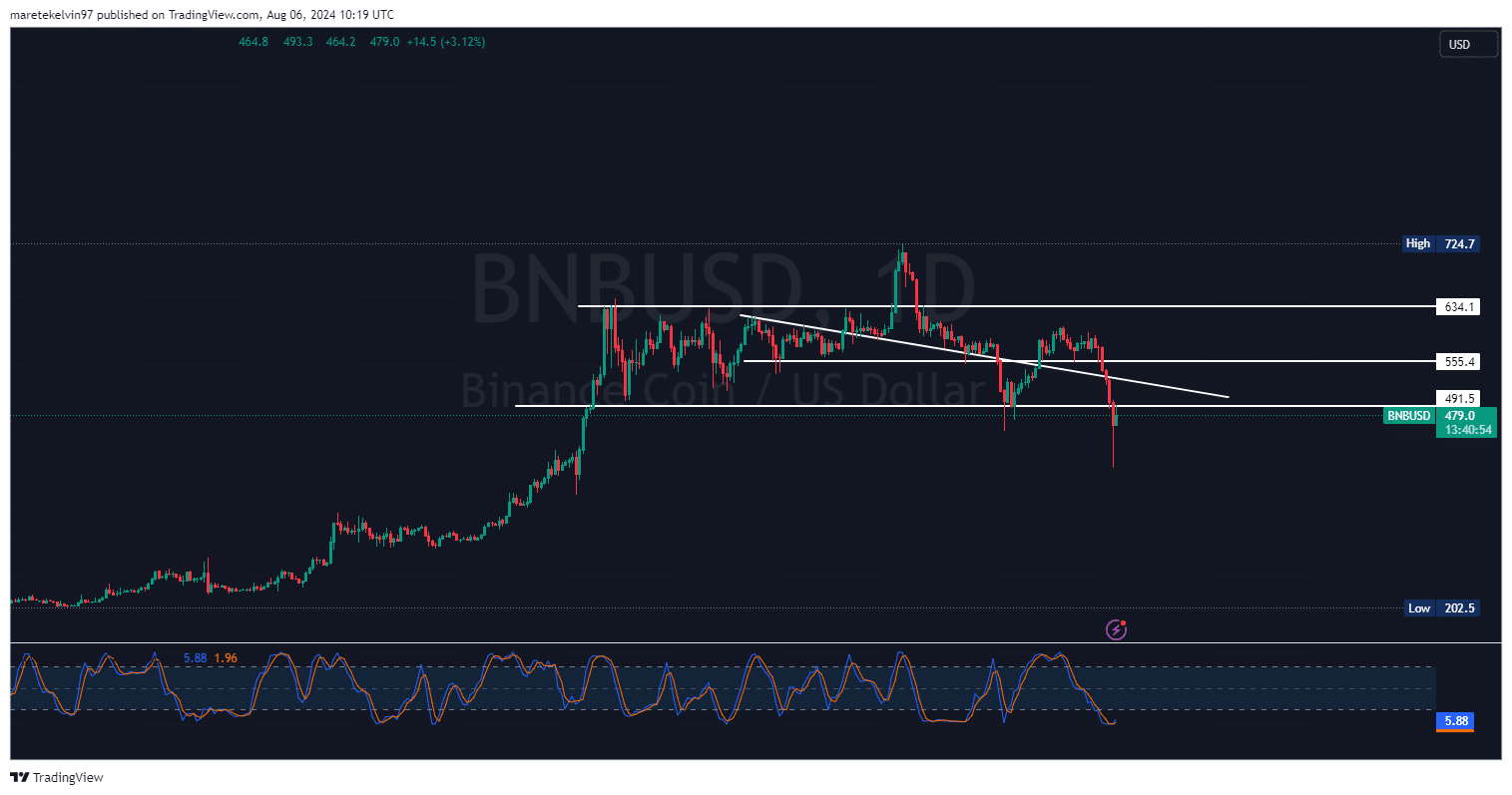

As of writing, BNB was testing the $491 key resistance level. This level is vital since a breakout above it could suggest further upside momentum.

The recent price action shows an accumulating bullish sentiment, but the question remains if BNB can maintain this momentum and break through resistance.

Source: TradingView

The stochastic RSI is in an oversold zone, suggesting a potential bullish reversal.

Liquidation landscape

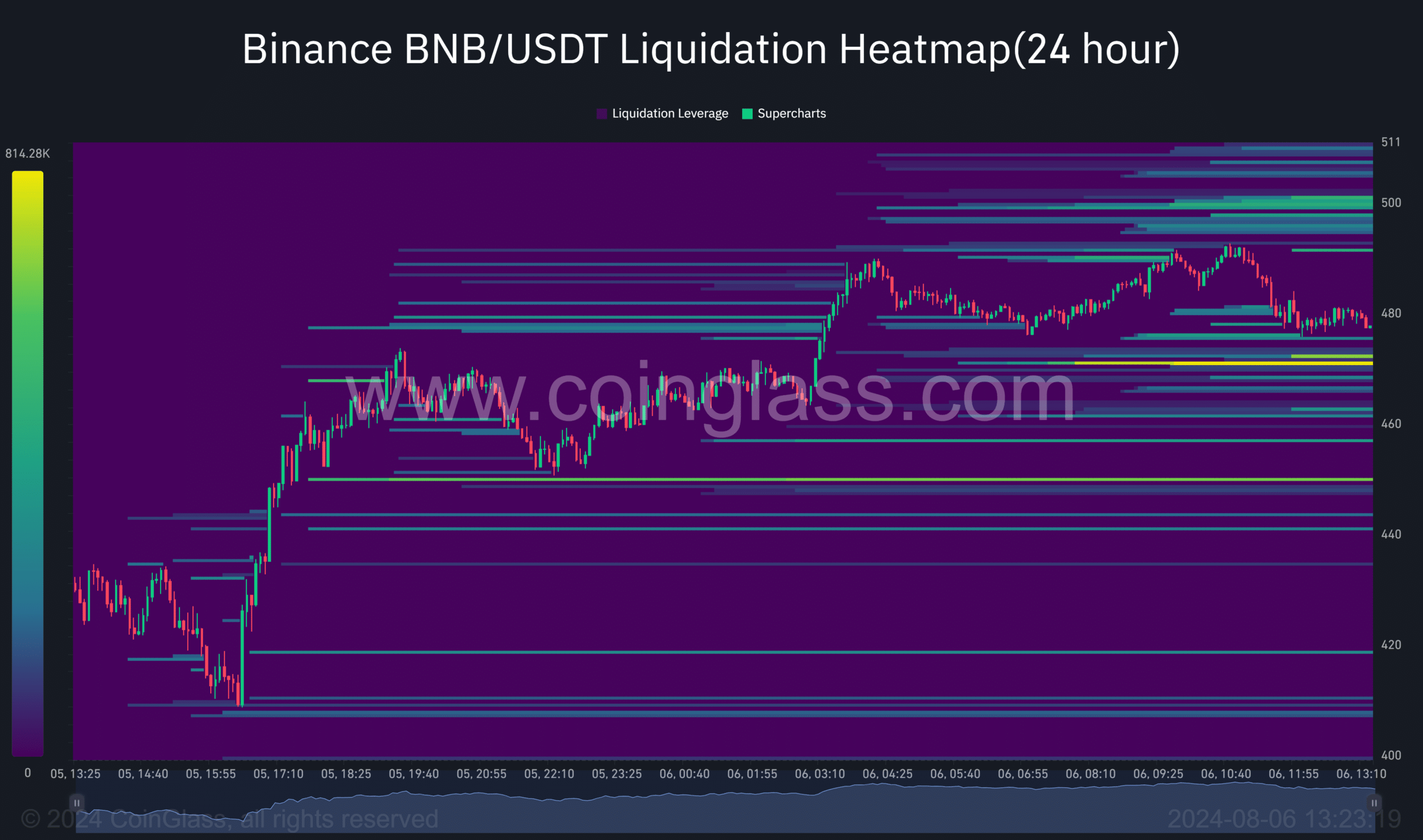

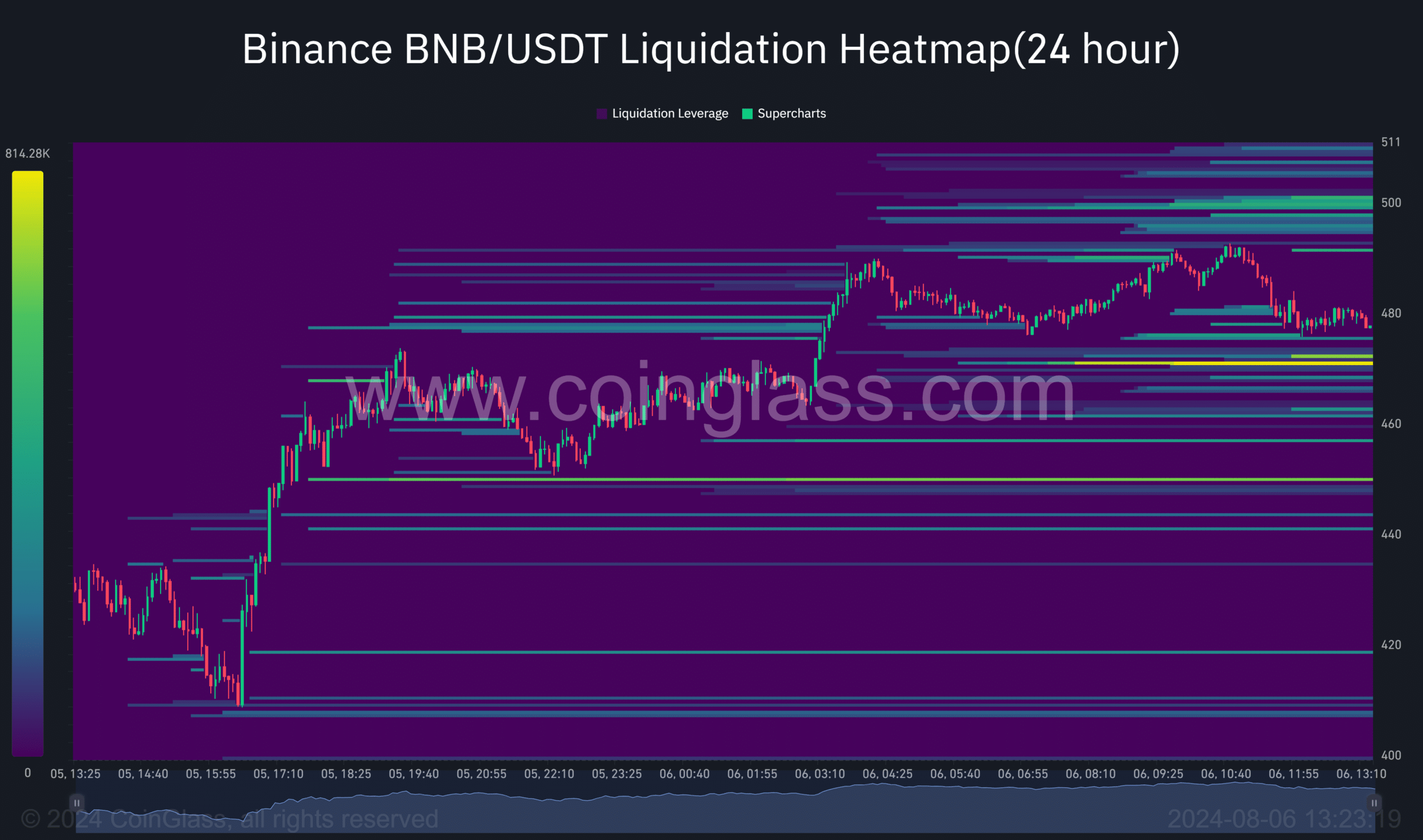

According to AMBCrypto’s analysis of Coinglass liquidation data, there are some significant liquidation levels visible, which shows that investors are actively positioning themselves around key price points.

Such heightened activity may increase volatility when prices approach critical levels.

The liquidation pool of $584k at $472 may act as a price magnet, potentially pulling the price down for a short-term correction.

Source: Coinglass

BNB netflow whispers

AMBCrypto further analyzed the Coinglass netflow exchange data. The data revealed huge outflows, implying that investors are moving away from taking their BNB off exchanges.

This behavior normally points to a holding mentality when people transfer assets to private wallets for longer-term storage.

In most instances, this kind of action is supportive of bullish sentiment, since it diminishes selling pressure on exchanges.

Source: Coinglass

Although the present momentum looks bullish, breaking through the $491 resistance level is crucial for confirming a long-term uptrend.

Read Binance Coin’s [BNB] Price Prediction 2024-25

A successful breakout may provide an opportunity for more gains, hitting towards the previous highs.

However, failure to breach this level could lead to consolidation or a short-term pullback.