- BitTorrent was a top daily gainer on 21st August, up +20%.

- However, the rally hit a Q3 supply zone; can bulls push forward?

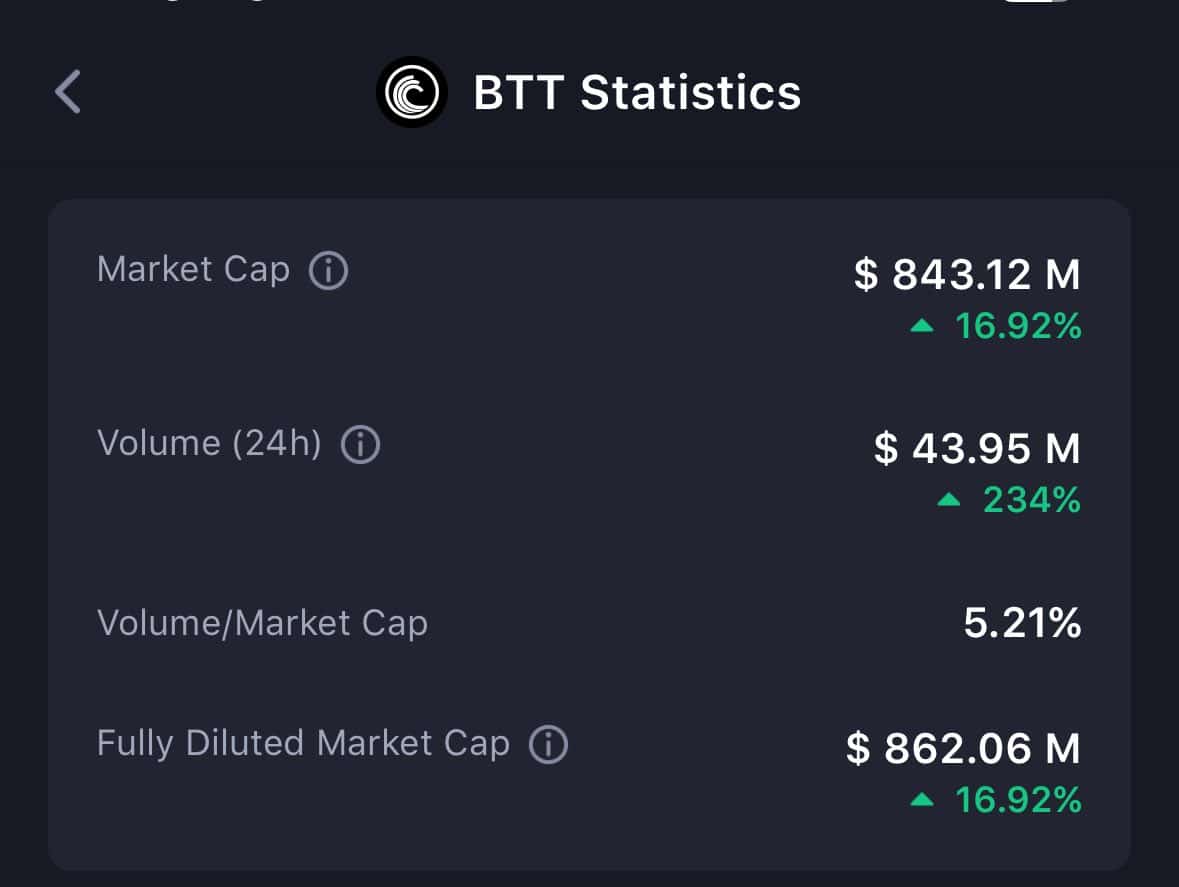

BitTorrent [BTT], the native token that enhances the capabilities of the file-sharing platform, BitTorrent protocol, was the top daily gainer on 21st August, per CoinMarketCap.

Its daily trading volume was up +230% while its price exploded +20% on daily charts.

Source: X

At the time of writing, the token’s +20% upswing saw the token outperform the rest of the market, including Bitcoin. However, it hit a key Q3 supply zone at $0.00000095. Will the rally continue?

BitTorrent price hits Q3 supply zone

Source: BTTC/USDT, TradingView

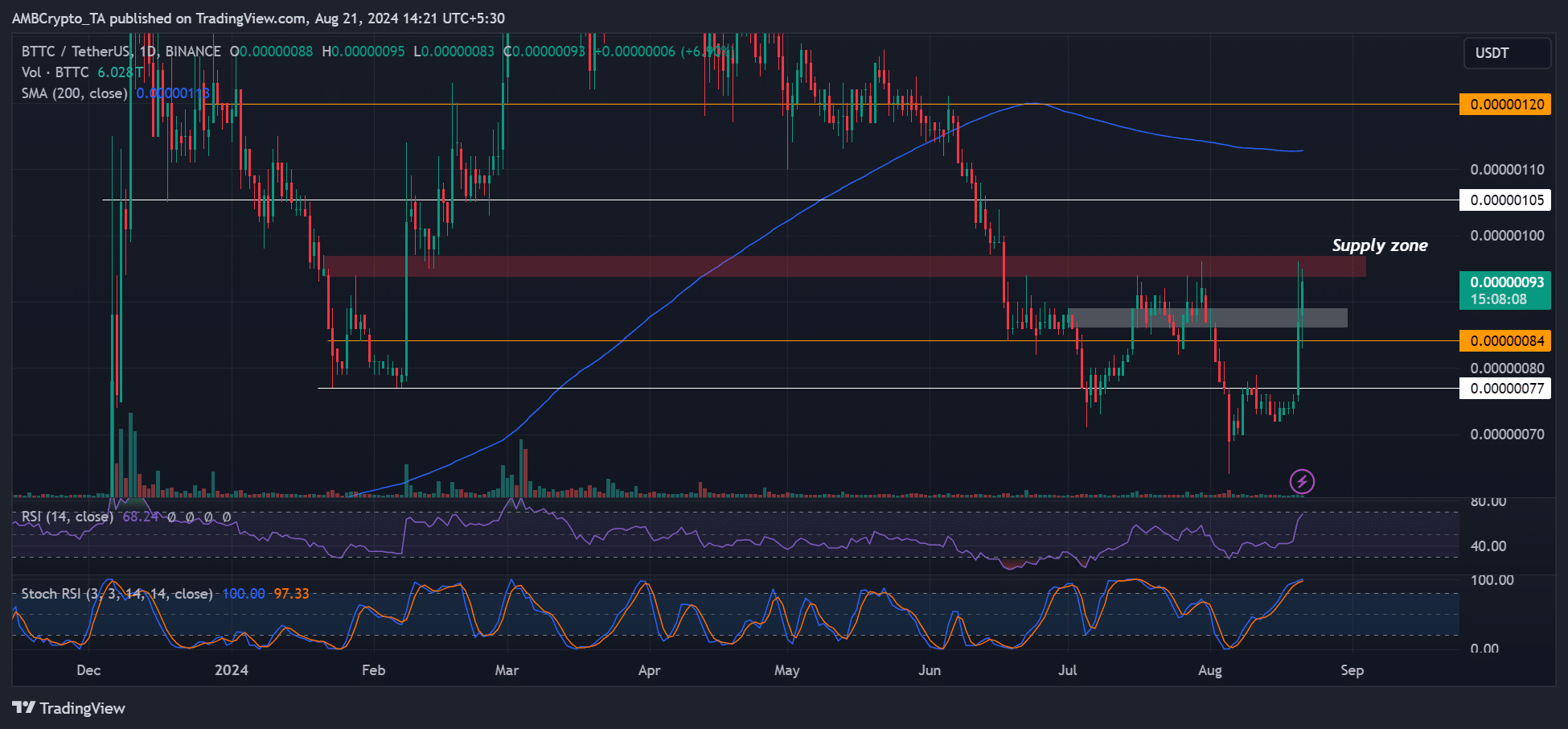

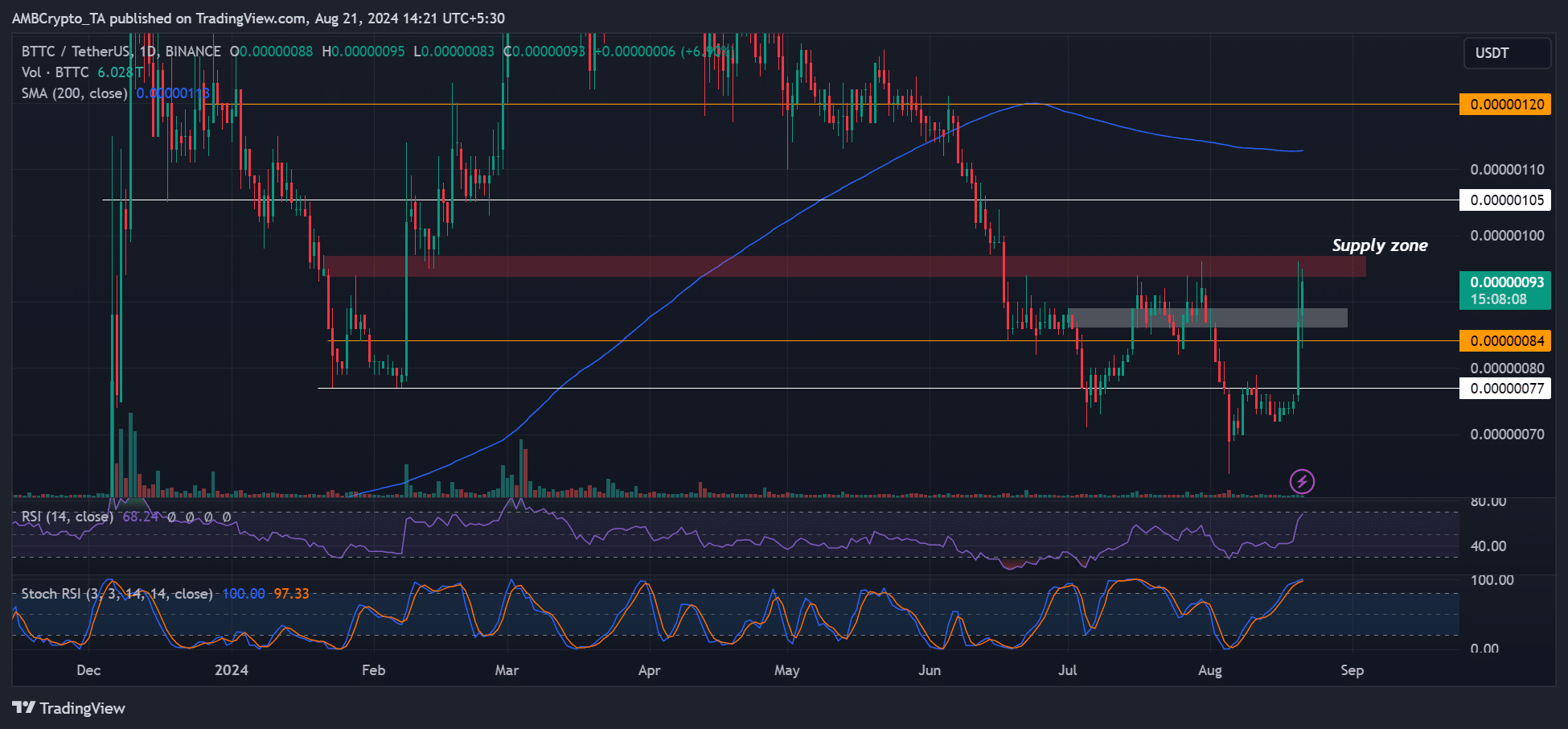

The slump in early August saw BTT drop to a yearly low, breaking the record of $0.00000077 set in February.

However, the massive pump on 20th August tipped BTT to reverse all the early August losses. But the price hit the Q3 peak and supply zone at $0.00000095 (marked red). Can bulls push forward for extra gains?

Based on chart indicators’ readings, the supply zone could prove challenging. The Stochastic RSI (Relative Strength Index) was in the oversold zone, which tends to signal price reversals.

Collectively, the indicators revealed high buying pressure, but a trend reversal was also likely.

If so, selling at the supply zone could push BTT towards $0.00000084.

Conversely, BTT could eye an extra 8% or 16% if the token rallies further to the overhead targets at $0.000001 or 200-day SMA (Simple Moving Average), respectively.

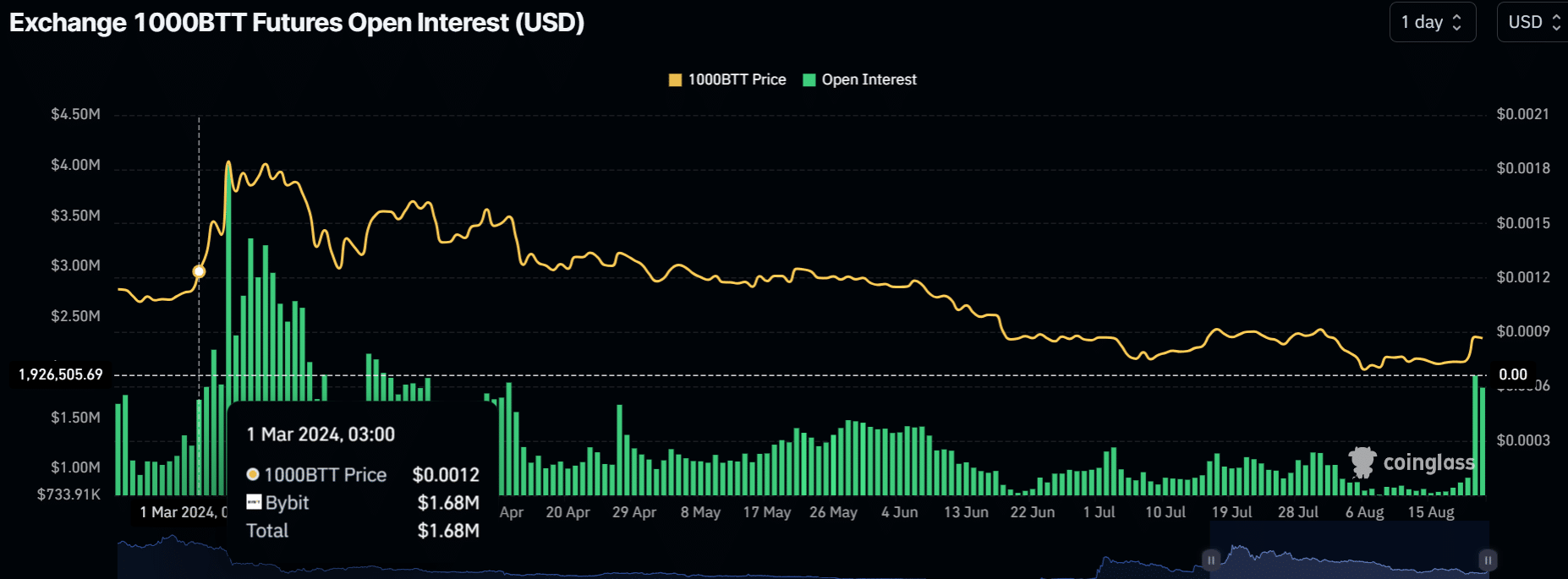

BTT’s interest surge to early 2024 levels

Source: Coinglass

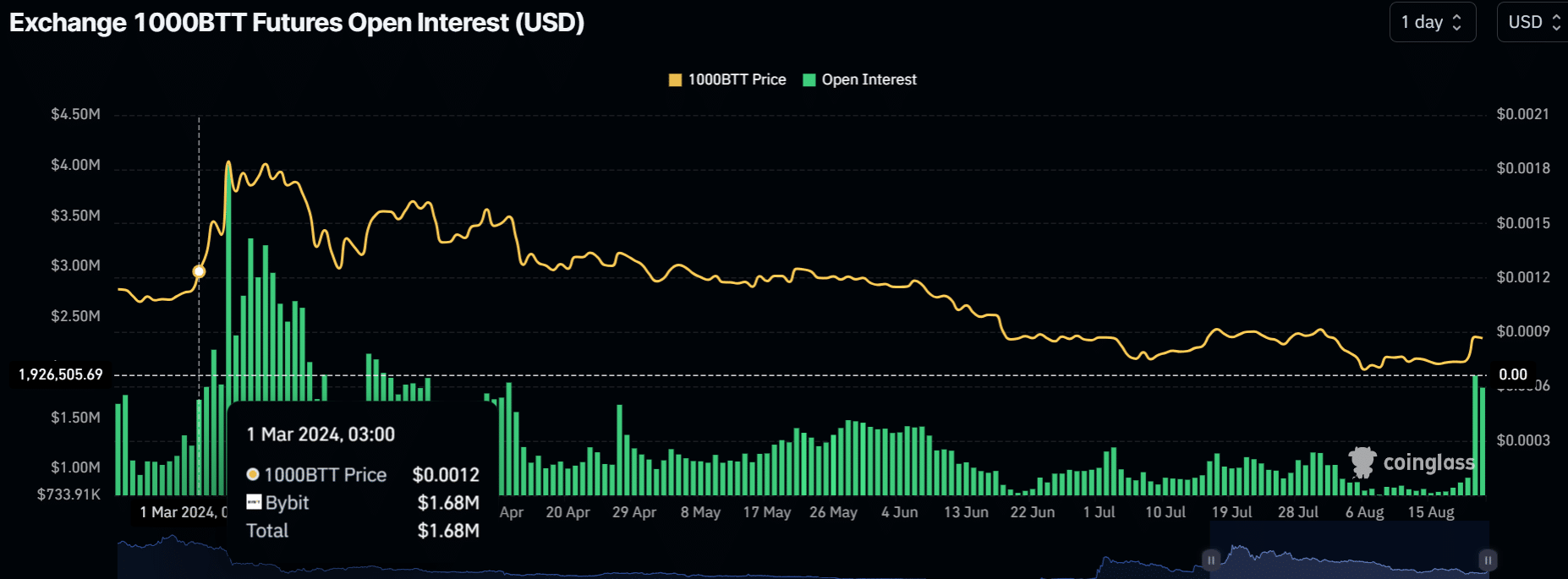

The liquidity flowing into BTT’s derivatives market, tracked by Open Interest (OI) rates, surged to over $1.5 million, levels last seen in March when BTT hit a yearly high of $0.0000022. This underscored bullish sentiment in the futures market.

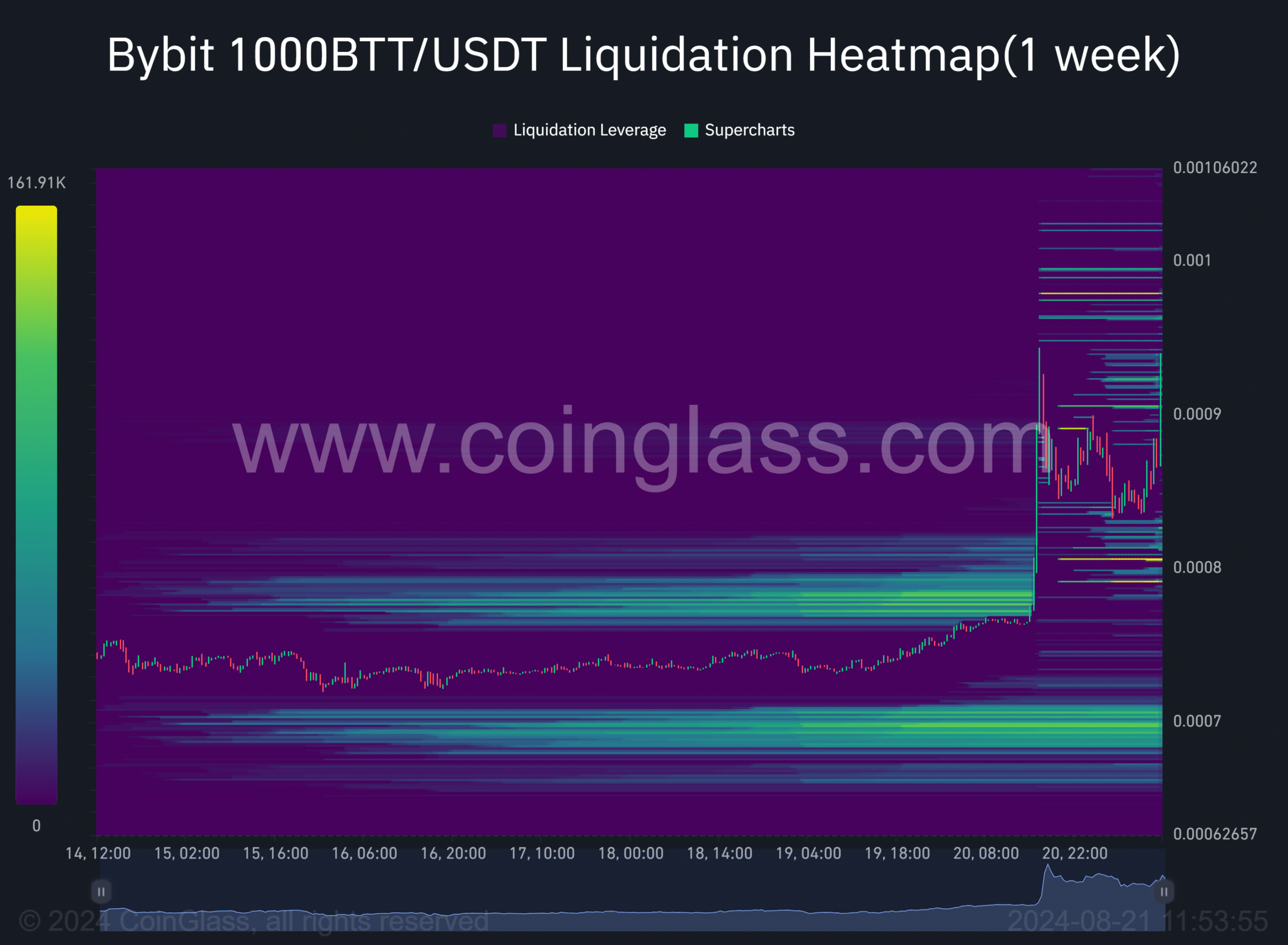

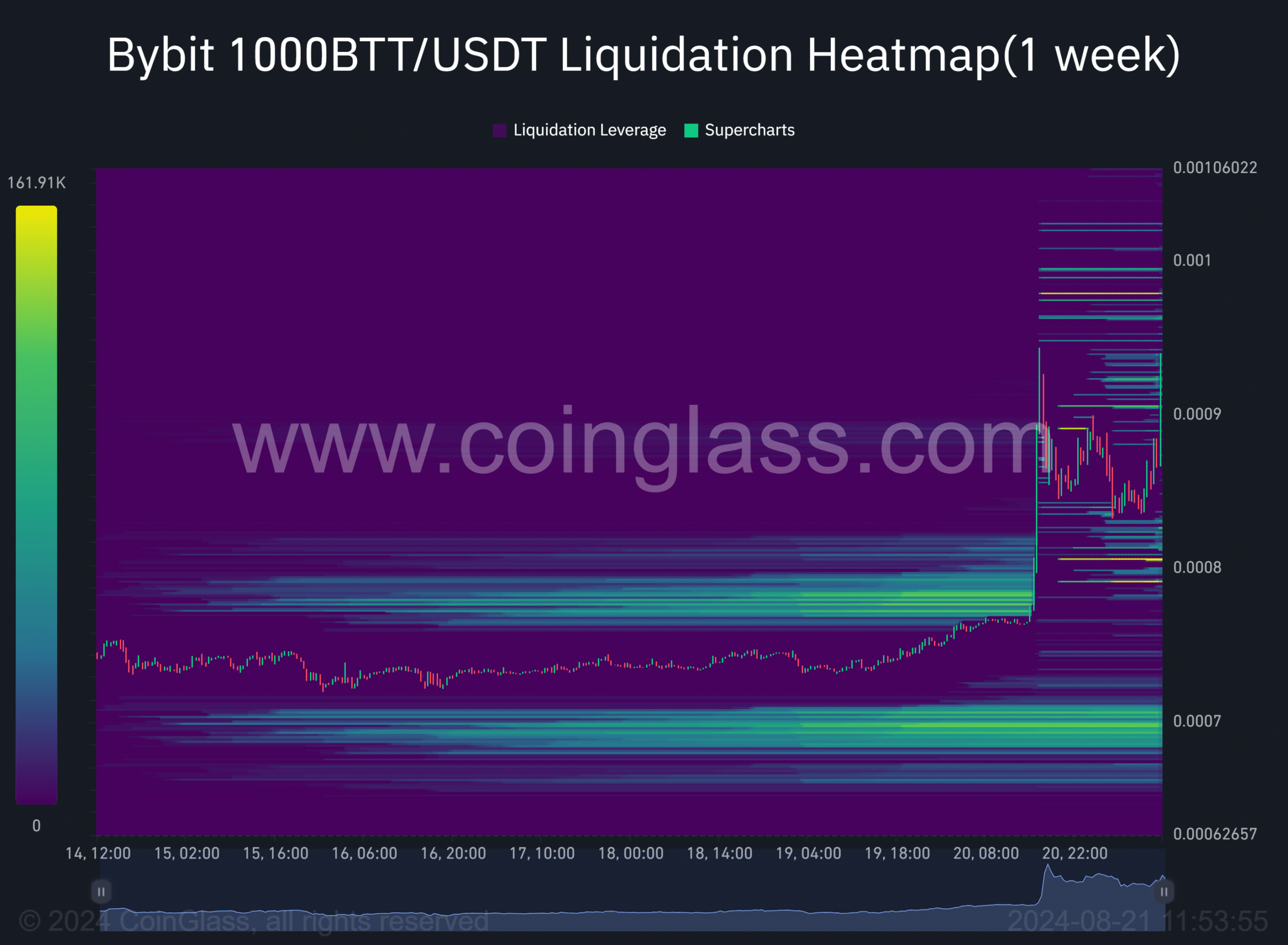

However, based on the liquidation heatmap, which tracks key possible inflection points for price, the $0.00000097 was a crucial level on the upside.

Read BitTorrent [BTT] Price Prediction 2024-2025

On the lower side of price action, the $0.0000008 was crucial. These levels coincided with the supply zone and the support level on the price charts.

In short, BTT could be constricted below the Q3 supply zone, especially if the overall market sentiment remains weak.

Source: Coinglass