- BTC’s network activity has signaled a troubling downturn, reflecting weakened investor sentiment.

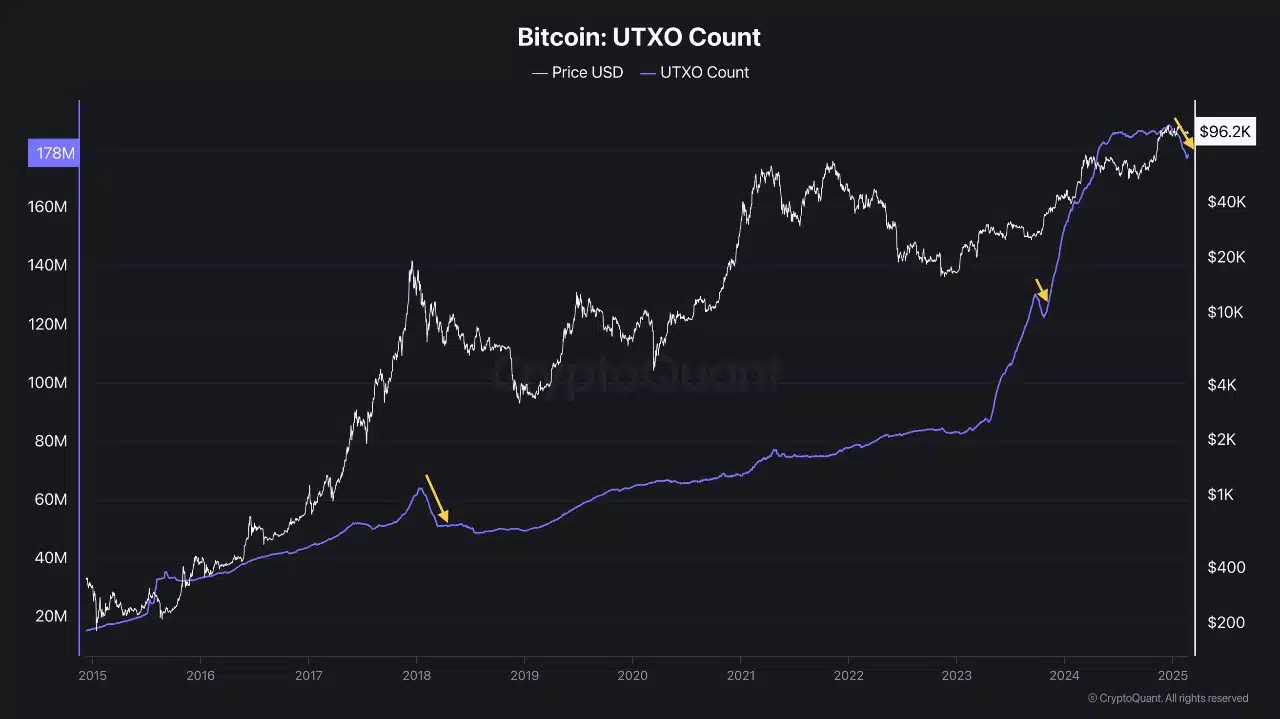

- Bitcoin’s UTXO count, recorded from 2015 to 2025, declined notably in early 2025, falling to levels comparable to the September 2023 correction.

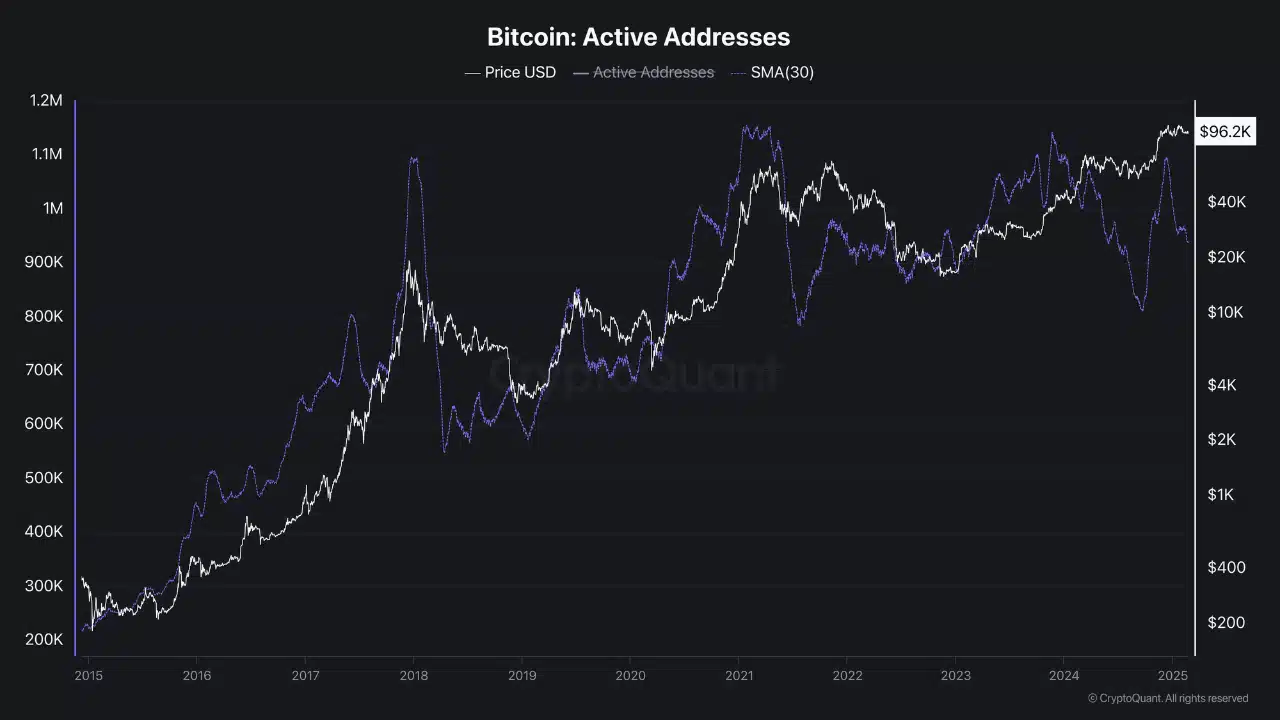

Bitcoin’s[BTC] network activity has signaled a troubling downturn, reflecting weakened investor sentiment. Active wallets, transactions, and UTXO counts trended downward, mirroring past correction periods.

The accumulation rate of Bitcoin spot ETFs also slowed, with recent capital outflows noted.

Fewer hands in the market

Consequentially, Bitcoin’s active addresses declined sharply in early 2025, with the metric peaking near 1.2 million in 2021 and falling to 900,000 by 2025.

Source: CryptoQuant

This drop in trading volumes indicated reduced network participation, raising concerns about a potential investor exodus, similar to the peak of the market cycle in 2017.

Additionally, the decline suggested waning confidence, driven by geopolitical tensions and the lack of Bitcoin-friendly legislative action.

If this trend continues, Bitcoin’s price, currently at $96,200, could face prolonged consolidation similar to March 2024, unless new catalysts emerge.

Bitcoin: A temporary dip or a market shift?

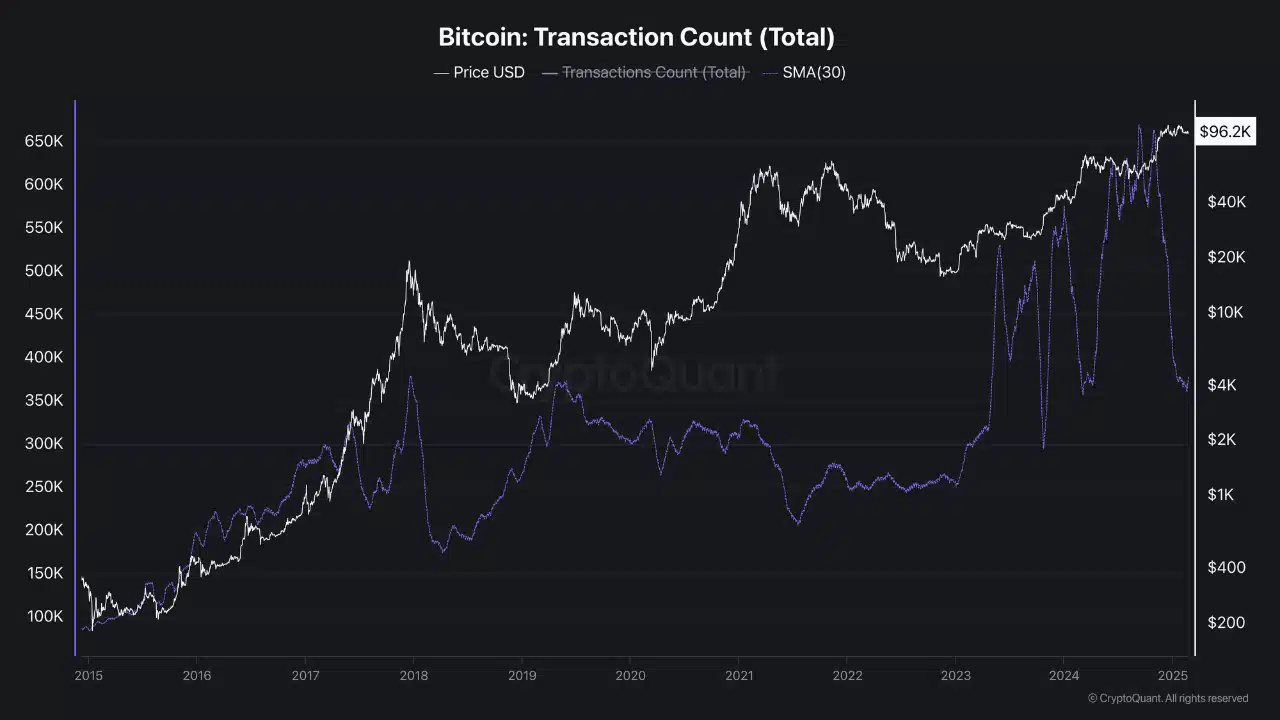

Further, Bitcoin’s transaction count also displayed a significant decline. Transactions, which once peaked at 650,000 daily in 2021, dropped below 400,000 by early 2025.

Source: CryptoQuant

This reduction in trading activity indicated weakened investor sentiment, resembling the September 2023 correction when transaction counts fell during market downturns.

Persistent declines could put additional pressure on Bitcoin’s price, particularly amid risk-off sentiment related to uncertainties in trade policy. A reversal would require renewed market optimism or stability in macroeconomic factors.

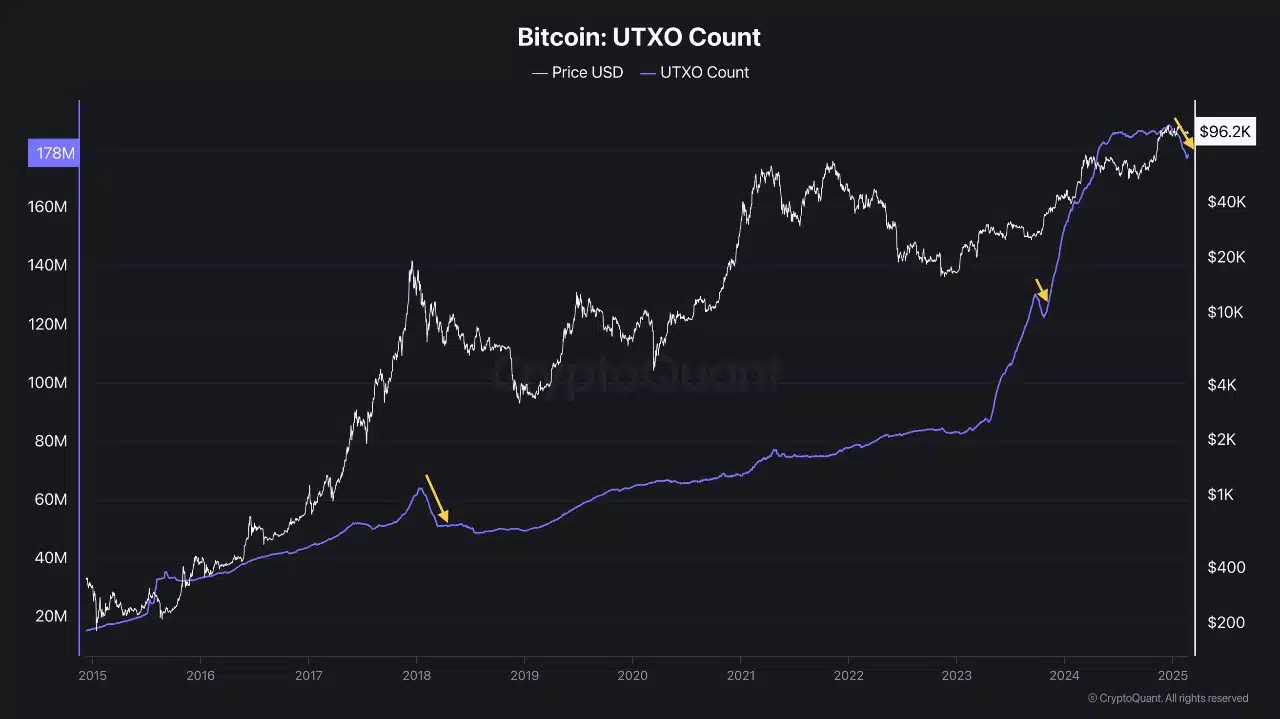

Are unspent BTC shrinking?

Bitcoin’s UTXO Count, recorded from 2015 to 2025, declined notably in early 2025, falling to levels comparable to the September 2023 correction.

The metric, which steadily increased to 178 million by early 2025, experienced a sharp drop, reflecting fewer unspent transaction outputs.

Source: CryptoQuant

This trend raised concerns that the market might be nearing the end of a cycle, although this conclusion is not yet definitive. The pattern indicated reduced network activity and lower investor accumulation, leading to worries about potential price stagnation.

However, some bullish indicators suggested a possible recovery, dependent on new market catalysts.

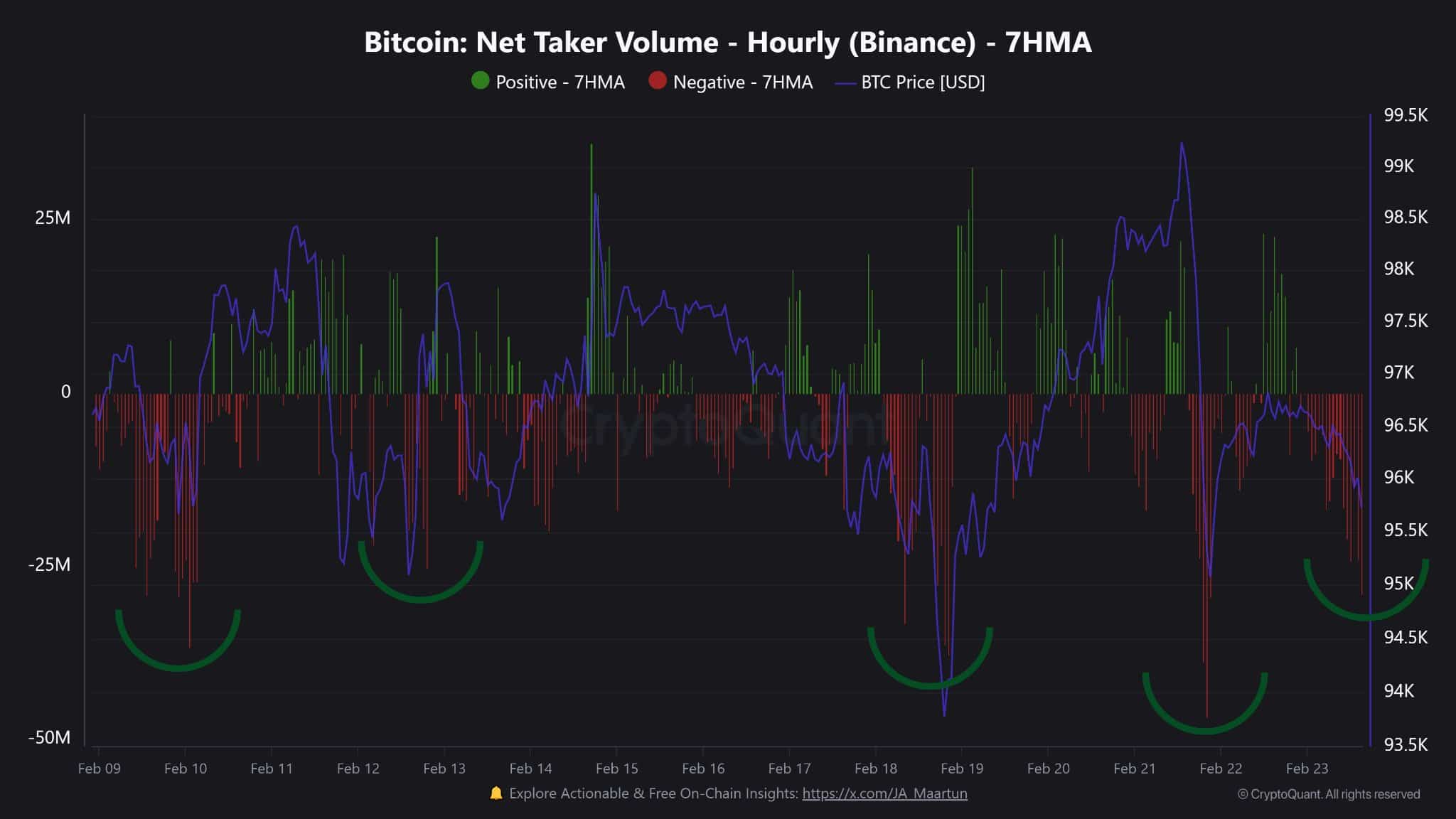

Buyers or sellers: Who’s really in control?

Bitcoin’s net taker volume on Binance, tracked from February 9 to 23, 2025, revealed low 7HMA values, with negative spikes dominating.

Source: CryptoQuant

This indicated bearish pressure, as taker sellers outpaced buyers, reinforcing weak market sentiment. The pattern was similar to March 2024 when low net taker volumes preceded a consolidation phase.

A resurgence in long positions depended on taker buyers regaining control. This relied on geopolitical stabilization or new bullish catalysts. If sentiment improved, Bitcoin’s price could recover from $96,200. Otherwise, a longer consolidation period seemed likely.

In conclusion, BTC’s declining network activity, shrinking transaction volumes, and reduced UTXO count signaled weakened investor confidence and a potentially extended consolidation phase.

The slowdown in spot ETF accumulation and net taker volumes underscored current market uncertainty. While historical patterns suggest that BTC could recover, any sustained upward movement would require a shift in macroeconomic sentiment.

It would also need the resolution of geopolitical tensions or renewed institutional demand.