- Bitcoin’s long percentage started to rise as the price fell, trapping longs

- Bitcoin’s demand surged as the Funding Rates remained positive, despite the dip

Bitcoin (BTC) saw a hike in long positions even as its price fell sharply, suggesting that its traders were caught in a long trap. In fact, the percentage of longs on Binance and OKX escalated significantly when BTC’s price fell to lows near $92k.

This trend hinted at an impending pivot, one where the excessive bullish sentiment could reverse itself, prompting a potential price recovery as shorts enter and longs exit.

Source: Hyblock Capital

These cycles often precede significant market reversals. The downturn would position BTC for a certain rebound if the long percentages reach their peak and begin to decline.

This would signal a shift in sentiment, possibly trapping shorts in the process. Here, it’s worth noting that apart from the long percentage hike, BTC also showed other signs of rebound on the charts.

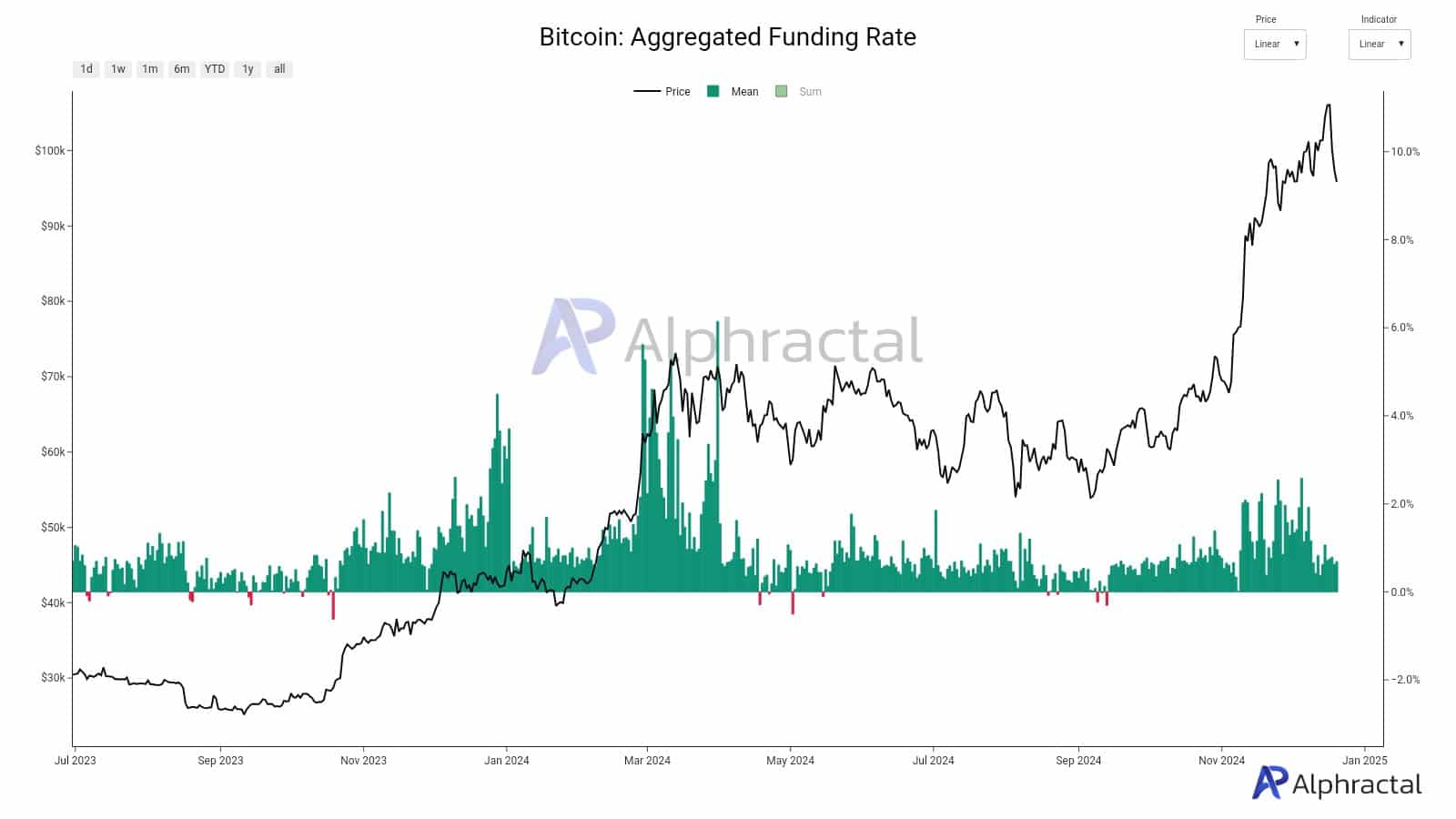

Bitcoin’s Funding Rate

The aggregated funding rate saw a sharp hike as the price escalated – A sign of strong bullish sentiment. Subsequently, the funding rate remained elevated while Bitcoin’s price began a descent – Pointing to an overextended market.

Traders likely entered long positions during the hike, and the market’s inability to sustain higher buying pressure resulted in a correction.

Source: Alphractal

The pullback might have spurred profit-taking or incited shorts to capitalize on the high funding rate, introducing selling pressure.

Despite this, however, the sustained positive funding rate hinted at underlying market confidence, albeit caution might be warranted. If the funding rate sustains or reverses itself, it could signal potential market moves. Stabilization or a reversal in the funding rate could define Bitcoin’s near-term trajectory.

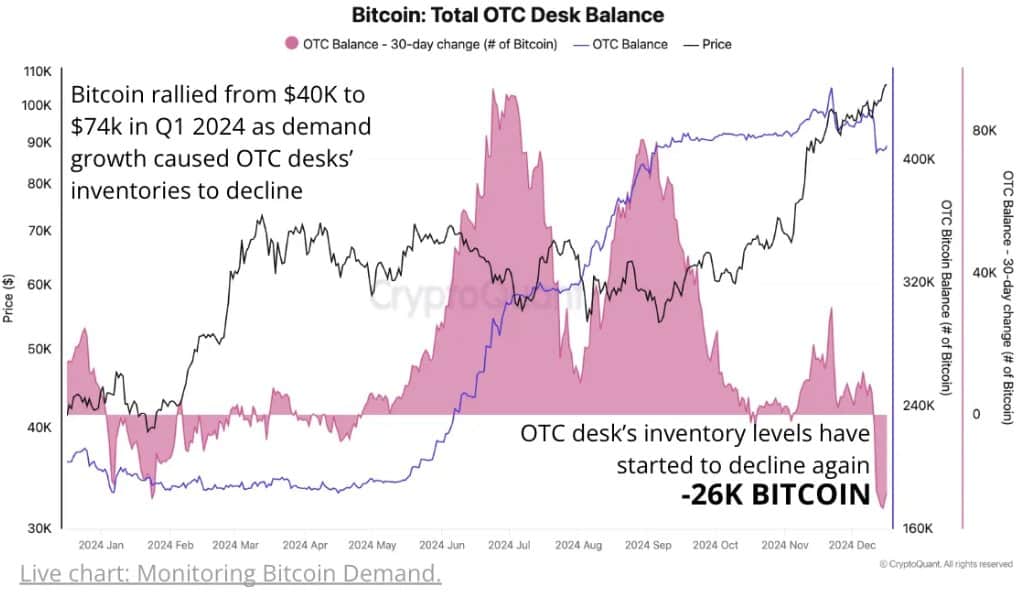

Demand meets brick wall

Bitcoin noted a significant rally, rising from $40k to $74k by the end of the first quarter of 2024.

This surge was driven by increasing demand, as the substantial fall in inventory at over-the-counter (OTC) trading desks indicated. During this period, OTC desks reported their largest monthly inventory drop of the year, with a decline of 26,000 BTC – A sign of tightening of supply.

Source: CryptoQuant

Total balances at OTC desks fell by 40,000 BTC from November 2020 too, further suggesting a dwindling supply amid growing demand.

The decline in OTC balances alongside the price rise can be seen as a strong sign of strong momentum. The relationship also indicated that if OTC inventory levels continue to fall, Bitcoin’s price could further escalate. Especially if the demand persists.

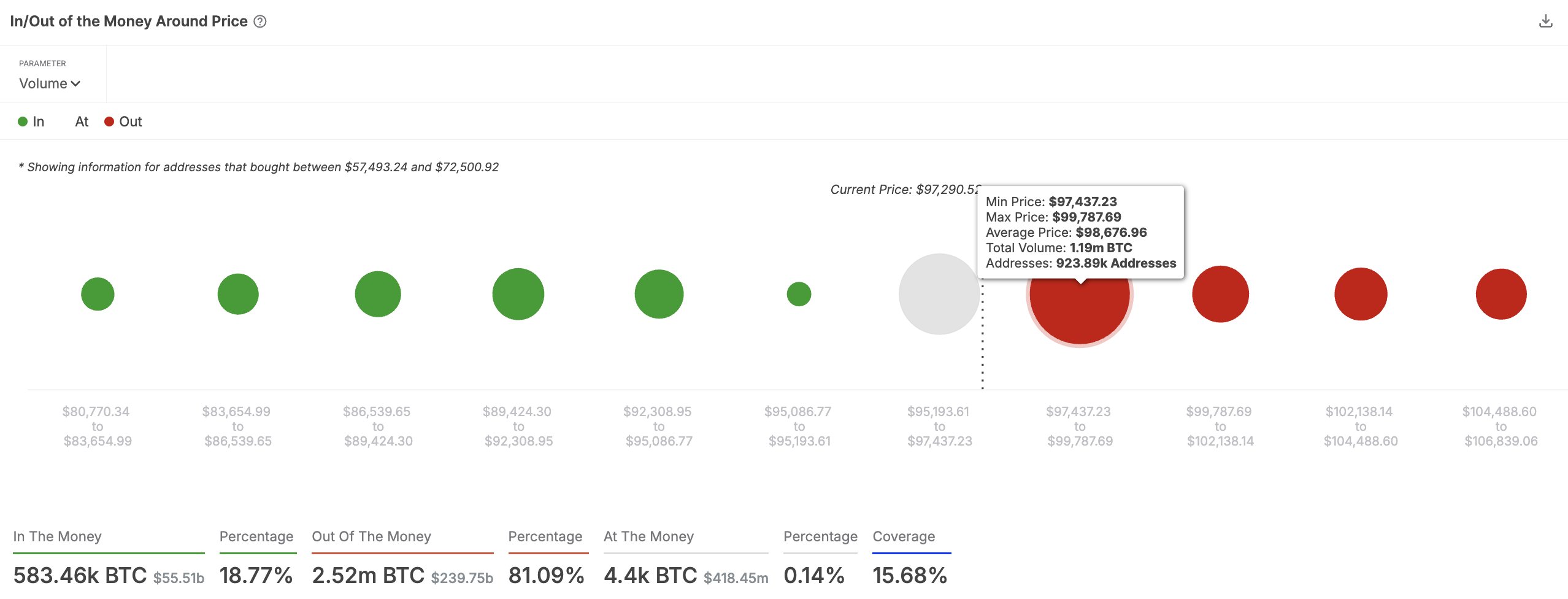

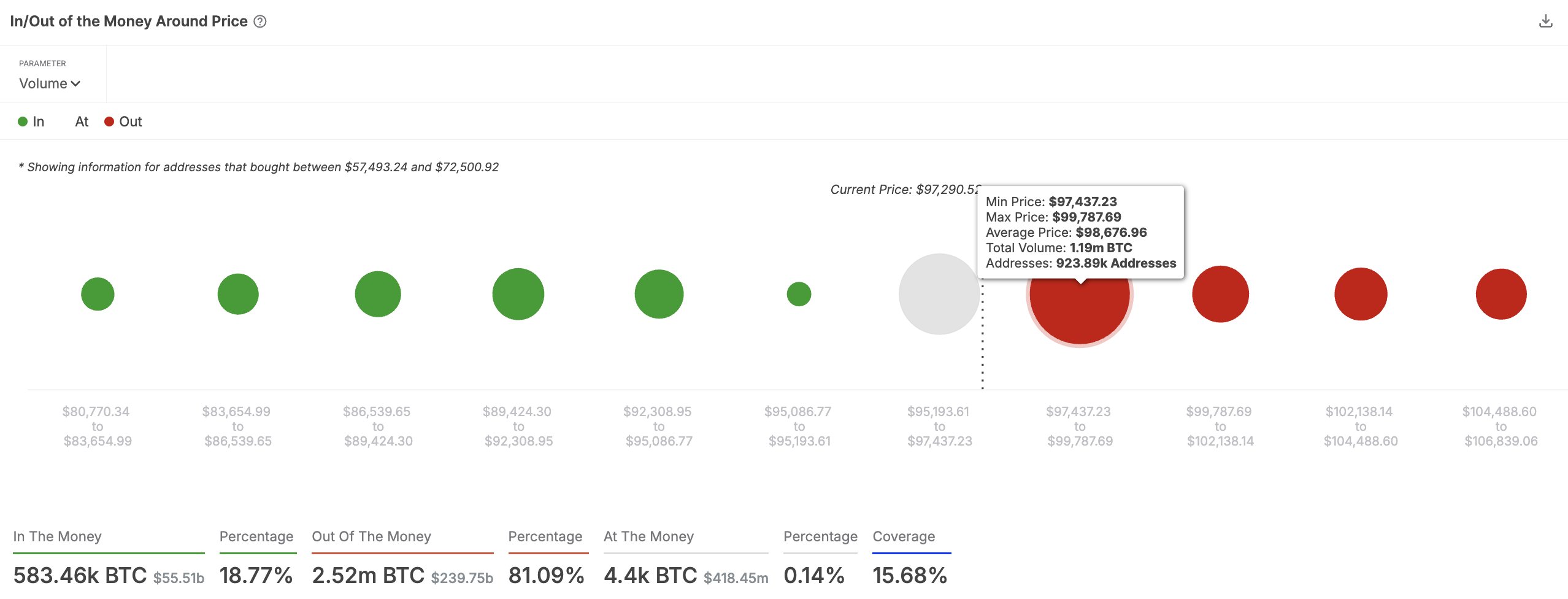

However, the demand would face a key resistance between $97,500 and $99,800, where 924,000 wallets hold over 1.19 million BTC.

Source: IntoTheBlock

If Bitcoin breaks above this resistance, there may be potential for reaching new ATHs. Surpassing the barrier would mean strong buying momentum, possibly shifting the balance from bearish to bullish sentiment.