- Over 28,000 BTC have been accumulated by whales and sharks in the last three months

- Bitcoin, at press time, was trading above $60,000, despite recent declines

Bitcoin [BTC] successfully crossed the critical $60,000 psychological resistance, resulting in a significant volume of short liquidations over the past 24 hours. In the build-up to this price breakthrough, accumulation patterns from key addresses intensified over the last three months.

Additionally, BTC supply on exchanges steadily declined too, with more Bitcoin leaving exchanges.

BTC crosses the psychological barrier

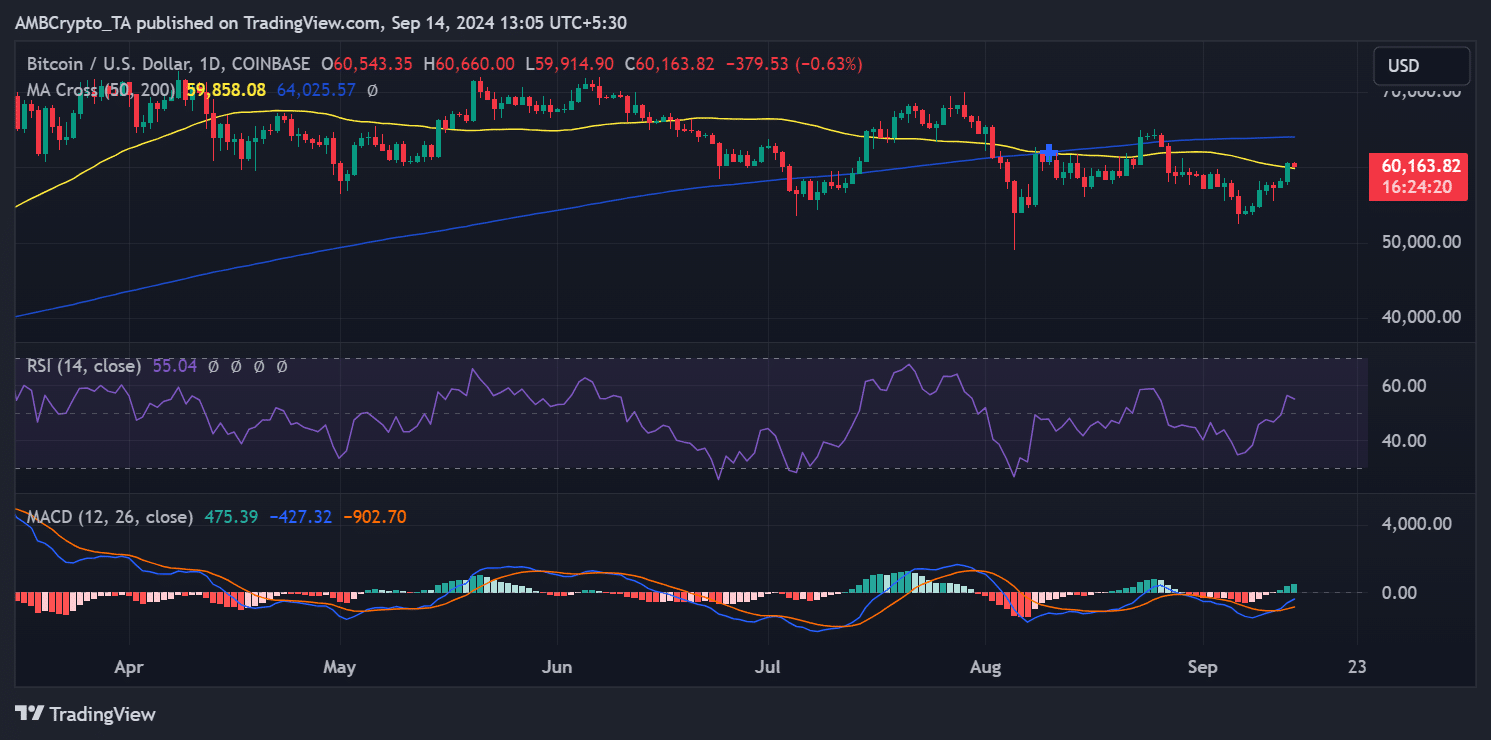

An analysis of Bitcoin’s price action on 13 September revealed a strong upswing, one that pushed BTC above its psychological resistance of $60,000. In fact, at one point, it was trading at $60,543, up by 4% in just 24 hours. This surge allowed Bitcoin to break above its short-moving average (yellow line), which had previously acted as resistance.

Now, while the cryptocurrency declined soon after to $60,177, BTC remains bullish. The same was confirmed by its Relative Strength Index (RSI), with the same hovering at around 55 – A sign of positive market momentum.

Source: TradingView

The movement above the short-term moving average and the sustained bullish RSI suggested that Bitcoin may still be on an upward trajectory. The slight pullback may be temporary, with the potential for further gains if buying pressure continues to build.

Bitcoin’s sustained accumulation and withdrawal

Recent data also highlighted that Bitcoin accumulation and exchange withdrawals have been significant over the past few months – A bullish trend.

According to data from Santiment, addresses holding 10 BTC or more have accumulated over 28,000 BTC in the last three months. These large holders now control more than 16 million BTC, showing increased confidence in the asset.

Additionally, Bitcoin dropped below $60,000 on 29 August, meaning these addresses have accumulated BTC at various price levels. This strategic accumulation during price fluctuations suggests that these holders are preparing for potential future gains.

The supply of BTC on exchanges decreased significantly too, with 75,000 BTC withdrawn over the past three months. This has left approximately 1.8 million BTC remaining on exchanges. The reduced exchange supply is a clear bullish signal as it means that holders are opting for long-term storage, rather than selling. Consequently, this tightens the available supply for trading.

Source: Santiment

If Bitcoin’s price maintains its current level or moves higher, the combination of accumulation and supply reduction on exchanges could further strengthen the bullish momentum. This will drive the price higher on the charts.

Short positions take a massive loss

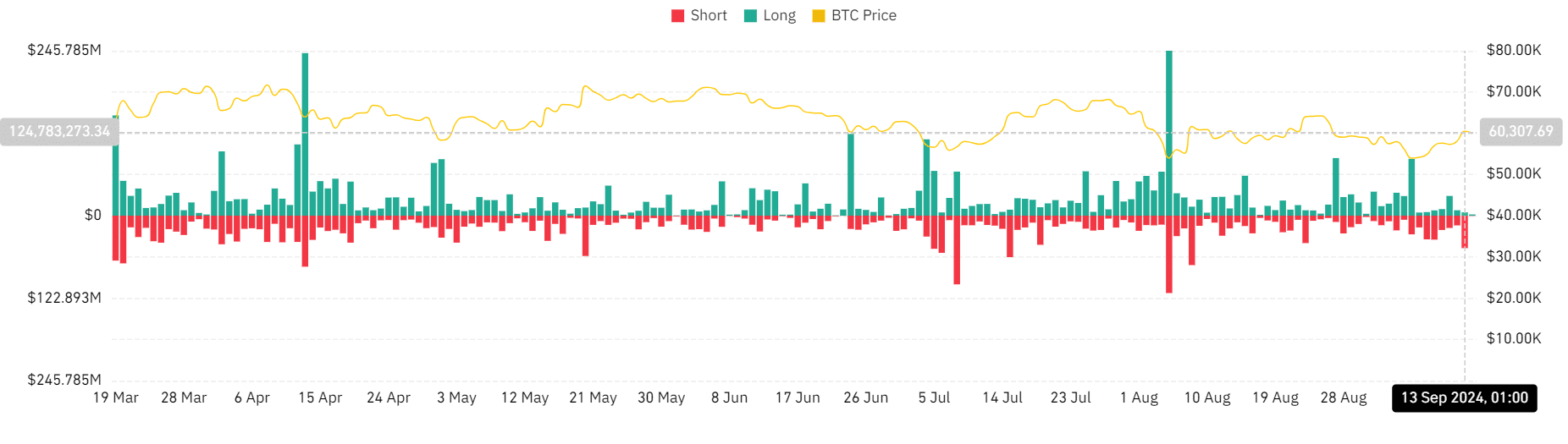

The 4% hike in Bitcoin’s price during the last trading session led to a major liquidation of short positions.

According to the Coinglass liquidation chart analysis, short positions faced more than $48 million in liquidations by the end of trading on 13 September. On the contrary, long positions saw only $5 million in liquidations.

Source: Coinglass

– Read Bitcoin (BTC) Price Prediction 2024-25

This mirrored a similar event on 8 August, when Bitcoin’s price jumped from $55,000 to over $61,000, leading to a comparable spike in short liquidations.

This liquidation event and broader bullish signals could fuel further upward momentum in the short term.