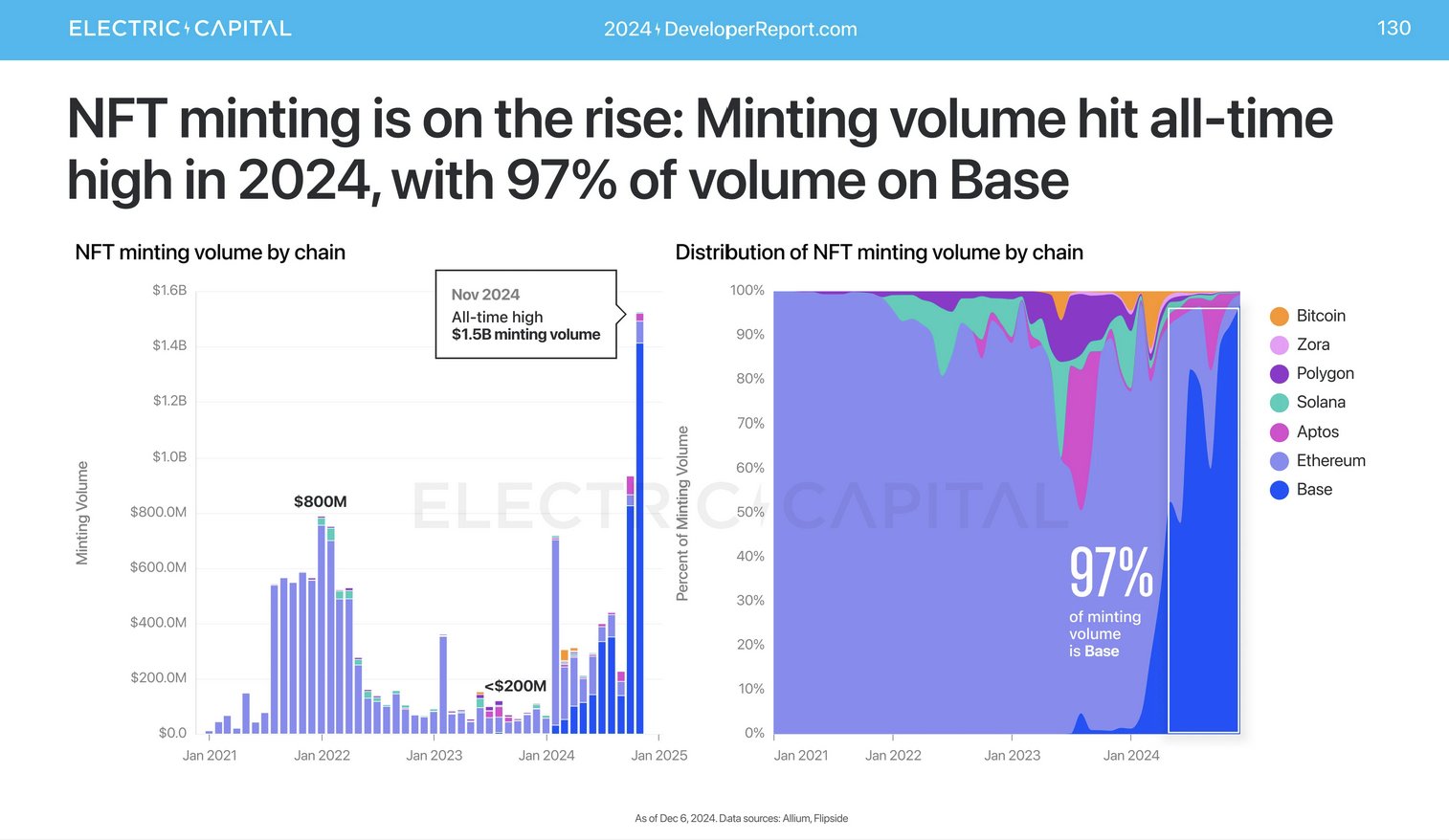

- NFT minting hit an all-time high of $1.5B in November, with 97% of the volume on Base.

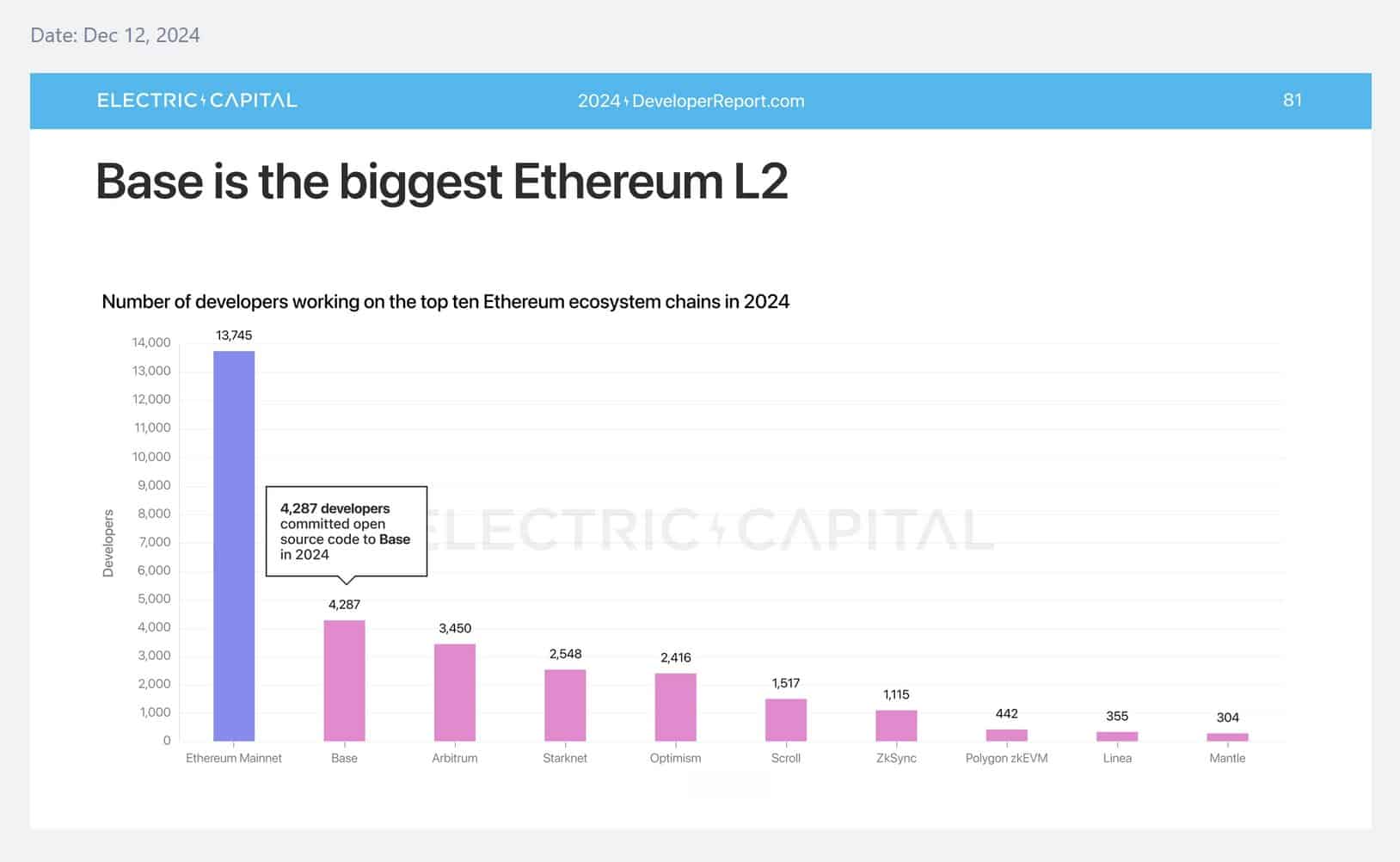

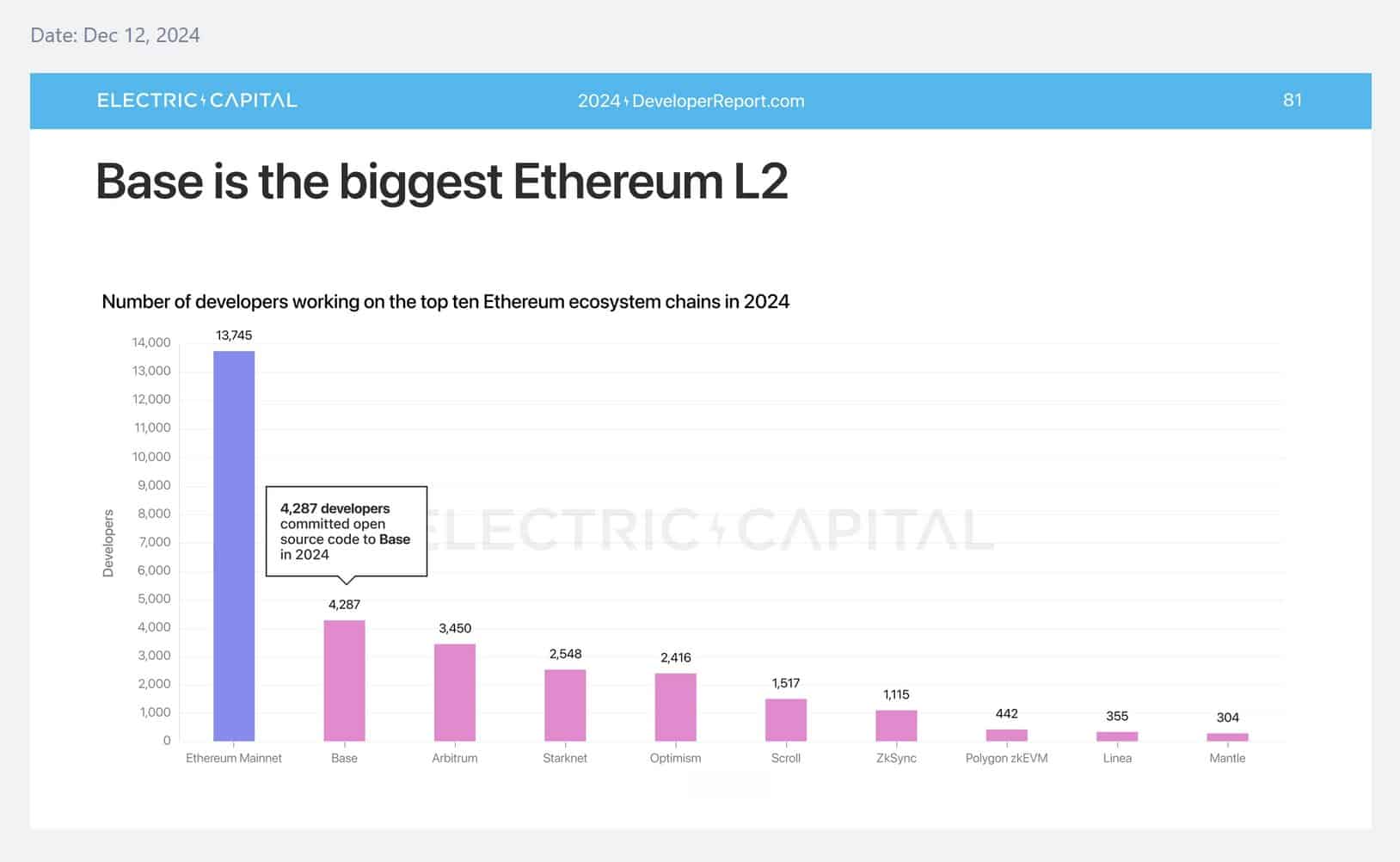

- Base being the largest Ethereum Layer 2 could be why it is dominating NFT minting.

NFT minting soared to a record $1.5 billion in November 2024, with a remarkable 97% of that volume processed on Base. This surge reflected a revival, but can NFTs mirror the peak of 2021-2022?

The extensive adoption of Base for minting indicated its potential to incubate major NFT projects into 2025, suggesting the market could still have room to grow, but not to previous levels.

Base could be poised to catalyze the next wave of major NFT ventures, possibly igniting a new era of market enthusiasm and investment in digital assets.

Source: Electric Capital/X

This trend signaled not just a small recovery, but an evolution of the NFT market dynamics, with Base at the forefront of this transformation.

Why NFTs on Base?

Base emerged as the most dominant Ethereum [ETH] L2 platform, engaging over 4,287 developers. This made the L2 the primary hub for NFT minting, surpassing other networks like Arbitrum [ARB], Starknet [STRK] and Optimism [OP].

The substantial developer presence on Base suggested a conducive ecosystem significant to the NFT market expansions and innovations.

Source: Electric Capital/X

As more companies adopt Base, mirroring Coinbase’s approach, the quality and accessibility of NFTs could rise, setting the stage for another NFT market surge driven by technological integration and utility in 2025 and beyond.

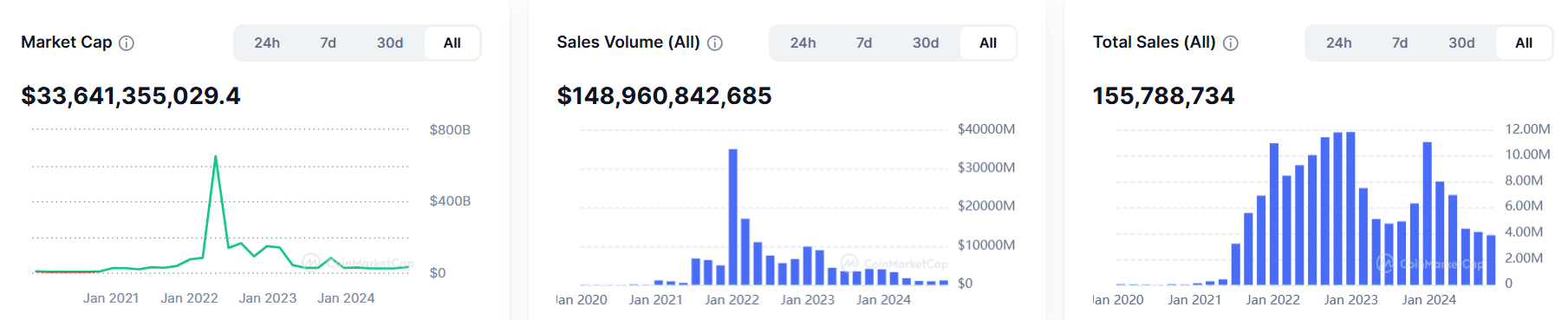

Top collections by market cap

Looking at the total NFT market cap showed that it peaked at over $652 billion in May 2022 before sharply declining to around $33.6 billion.

Sales volume mirrored this trend, reaching a high of $148 billion, then tapering off. Total sales fluctuated, now stabilizing at lower levels.

This raised questions about the NFT market’s potential to revisit its peak. Recent data indicated a plateau, with modest recoveries rather than a full resurgence to prior highs.

New developments could drive periodic increases in activity, suggesting possible growth, but not to past peak levels.

Source: CoinMarketCap

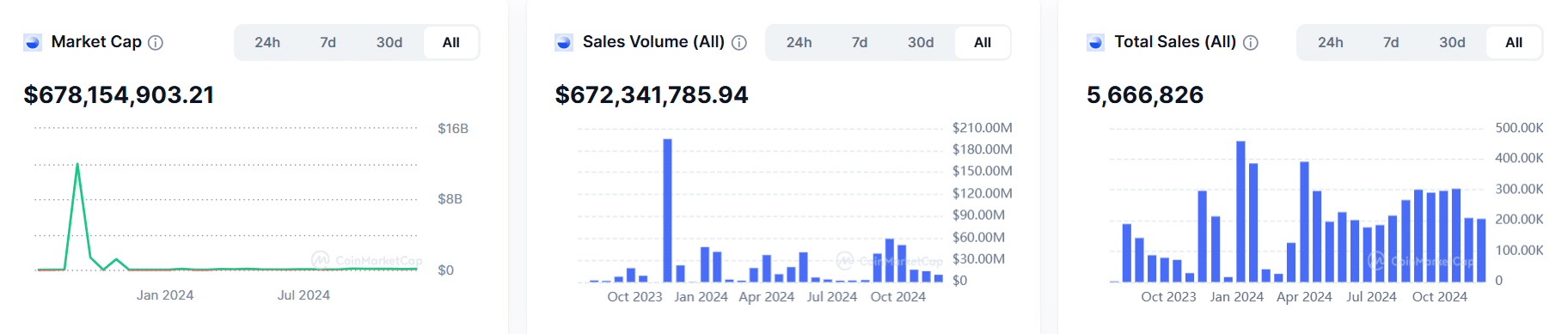

As for the Base NFT market, it peaked in September 2023, reaching a market cap of nearly $12 billion, before a swift decline to around $678 million.

Sales volume saw a spike, topping $672 million, reflecting a fleeting resurgence in activity. Total sales varied, peaking in January 2024 with significant volume but has since showed a gradual decrease.

This volatility indicated the uncertainty of a return to the heights of 2021/22. While there’s a semblance of recovery, it lacks the momentum to suggest a full revival to previous peak levels.

Source: CoinMarketCap

The top NFT collection on Base by gains in the last 30 days was ‘Oracle Patron NFT’ with a 113,231% surge and volume of 1,132 ETH as per CoinMarketCap.

‘Chonks’ and ‘GENESIS by PlayerZero’ followed with 16,181% and 13,987% price increases respectively.

Despite these spikes, the overall market was still far from its 2021/22 highs, indicating a cautious optimism in the recovery phase of this cycle.