- Altcoin’s social volume dropped, which indicated a decline in its popularity

- Technical indicators revealed that selling pressure on XRP has been rising

XRP has registered a price drop over the past week – A bad sign for investors. Will this latest drop restrict the token from competing with top coins like Bitcoin [BTC] and Ethereum [ETH]?

How is XRP affected?

CoinMarketCap’s data revealed that XRP was down by more than 6% in the last seven days. At the time of writing, the altcoin was trading at $2.15 with a market capitalization of over $123 billion, making it the 4th largest crypto. Here, it seemed interesting to note that despite the price decline, market sentiment around the token had improved.

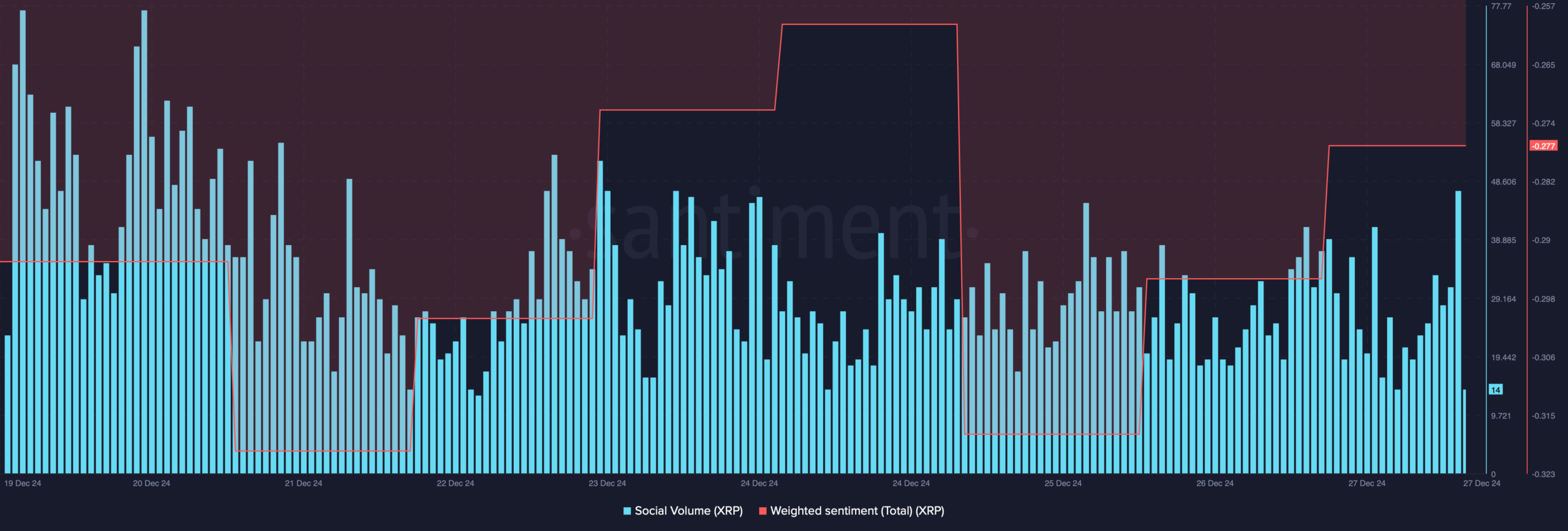

XRP’s weighted sentiment registered an uptick over the past few days, meaning that bullish sentiment around the token rose. However, its social volume declined—A sign of XRP’s dropping popularity in the crypto market.

Source: Santiment

Going forward with the token…

While XRP’s price dropped, EGRAG CRYPTO, a popular X handle that posts updates related to blockchains, recently shared a tweet, revealing the possibility of XRP tackling BTC and ETH in the coming days.

“With BTC dominance decreasing and ETH dominance rising steadily, XRP has the explosive potential to outperform both. Currently at 3.93% dominance (above Fib 0.382), if XRP closes above Fib 0.5 (5.57%), we could see double-digit dominance ahead!”

EGRAG CRYPTO’s tweet also mentioned that the VRVP showed a void above 4.30%, meaning less resistance and a smoother road to an all-time high (ATH) and beyond. The KABOOM Green Zone starts at Fib 0.50, signaling a big move ahead!

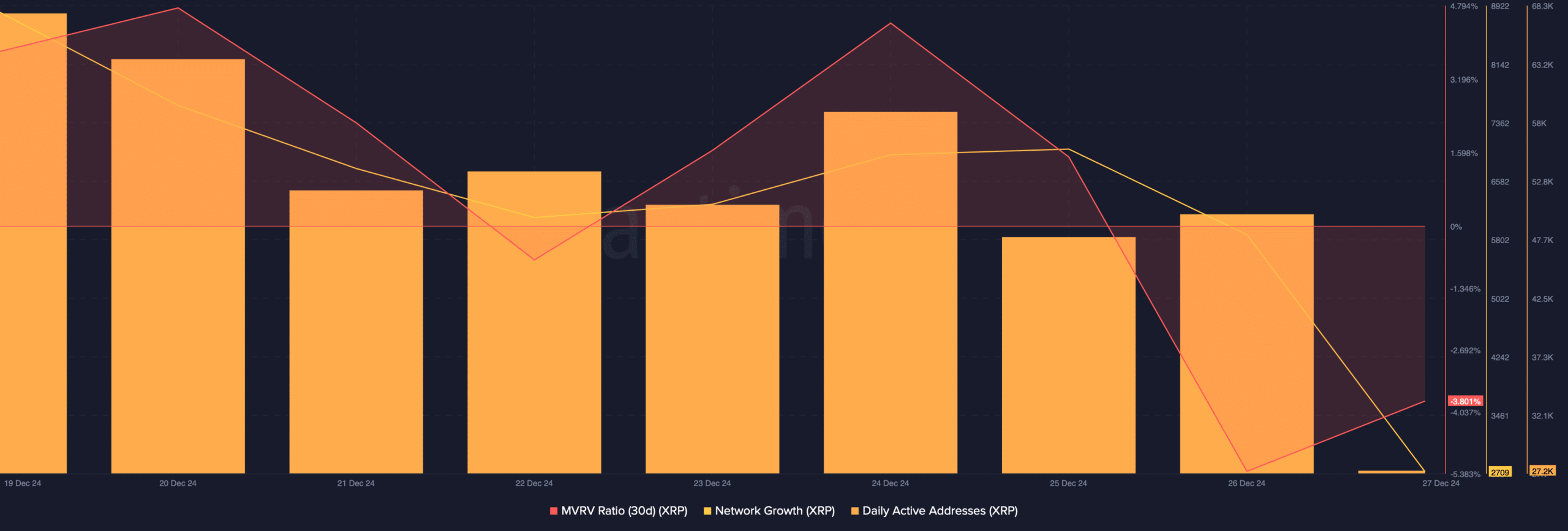

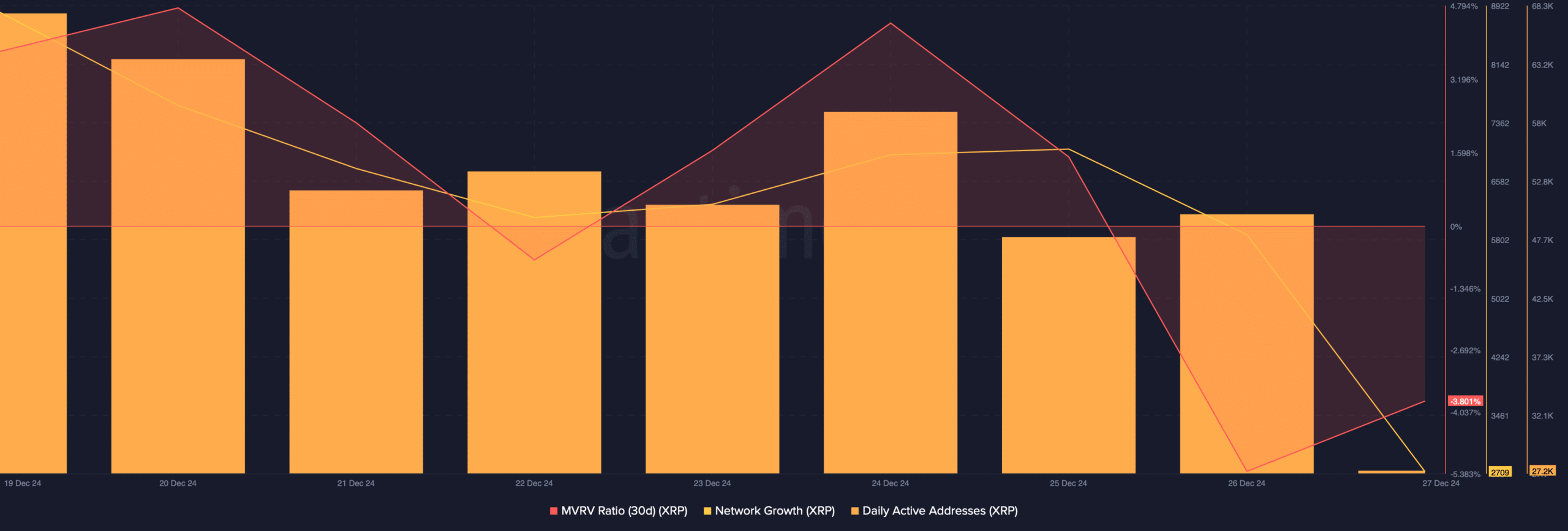

AMBCrypto then assessed the token’s on-chain data to find out whether the token can dominate the top cryptos in the coming days. As per our analysis, after a sharp dip, the token’s MVRV ratio registered a slight uptick.

An increase in the metric indicates that the market cap is growing faster than the realized cap. This means that there is a greater incentive for people to sell in the market.

However, not everything was working in the token’s favor. For instance, the token’s daily active addresses dropped last week, signaling declining network activity. This fact was further proven by XRP’s declining network growth—Meaning that fewer addresses were created to transfer the token in a set time frame.

Source: Santiment

The possibility of XRP dominating BTC and ETH seemed thin as technical indicators were also in the bears’ favor.

Read XRP’s Price Prediction 2024–2025

Finally, the MACD flashed a bearish upper hand in the market. The Chaikin Money Flow (CMF) also registered a downtick, indicating a rise in selling pressure, which can push the token’s price further down the charts.

Source: TradingView