- Per analysts, SOL could rally amid renewed memecoin craze on its chain.

- But SOL was at a key short-term supply area at press time; will it clear it?

The renewed memecoin speculation on Solana [SOL] could boost the altcoin’s long-term value.

Ryan Watkins, co-founder of crypto VC firm Syncracy Capital and former Messari researcher, claimed that Solana’s memecoin moat could boost its rally, citing a recent craze around the AI-spawned GOAT token. He stated,

“I don’t really care whether memecoins are neo-religions or if AI agents are really launching on-chain cults, all I know is all roads lead back to $SOL.”

Solana’s memecoin mania

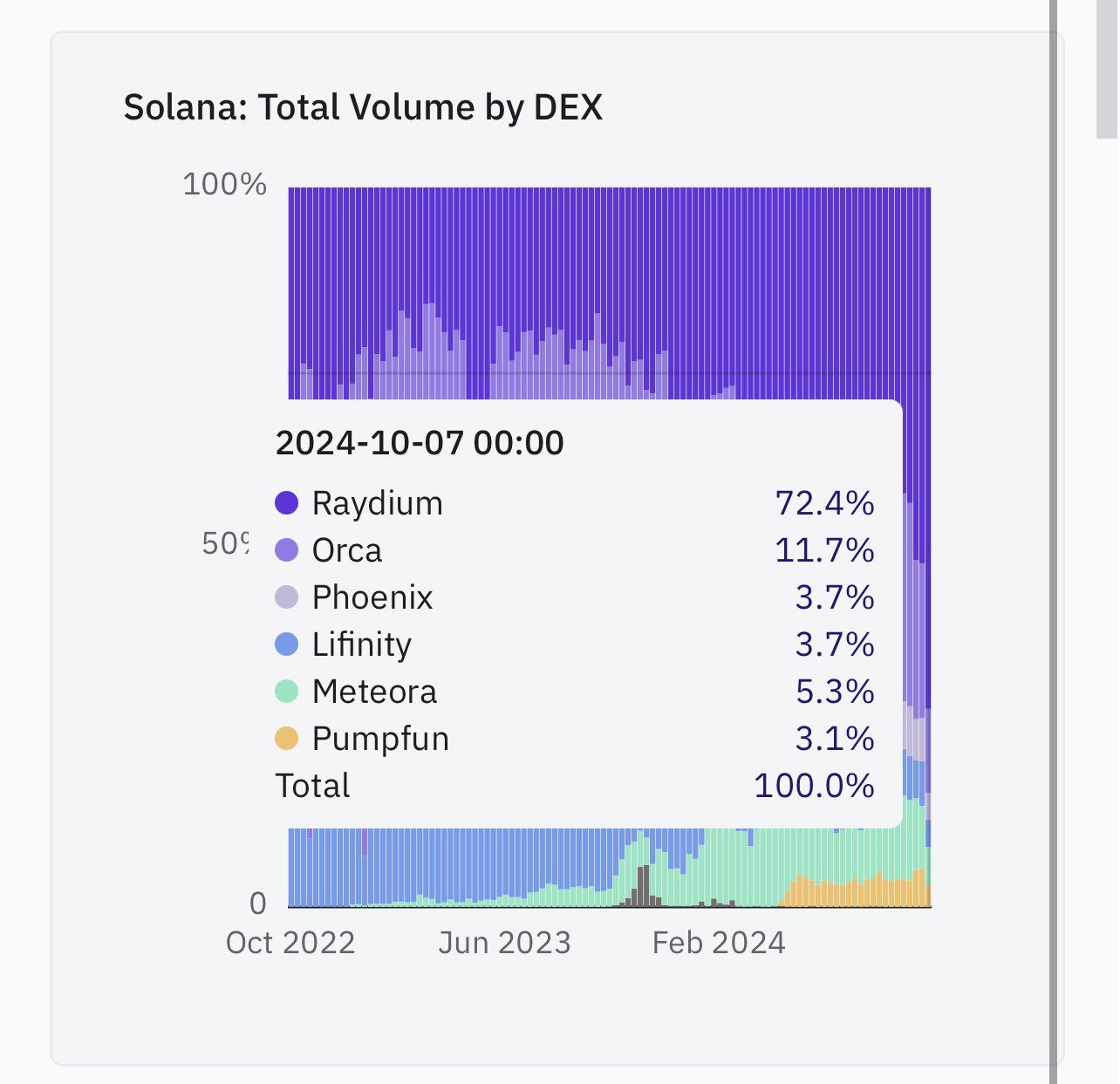

To support his claim, the executive noted that the chain was the hotbed ‘for all speculative experiments this cycle,’ which was evident on Raydium, a Solana-based decentralized exchange (DEX).

The DEX recently hit an all-time high market share (72%) amid this week’s renewed meme coin craze.

“Worth noting too that Raydium, the leading DEX where memecoins on Solana trade reached new highs in market share this week, too.”

Source: X

Interestingly, according to Kaito data, GOAT ranked first among meme coins in mindshare, further reinforcing its role in this week’s traction.

Over the same period, it had nearly 12% mindshare compared to others, with Dogecoin [DOGE] being its closest rival.

Source: Kaito

Another market analyst, Gumshoe, shared Watkins’ sentiment and noted SOL’s outperformance over the weekend. He stated,

“Onchain degeneracy happens on Solana, the market will soon start pricing in the paradigm shift.”

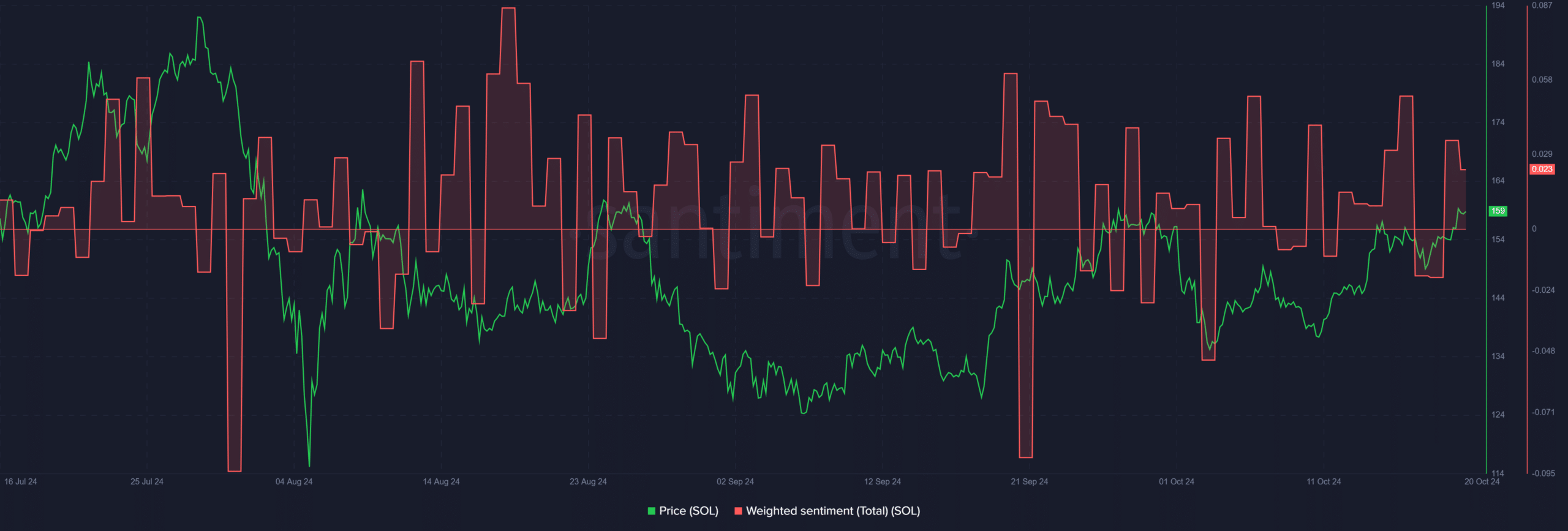

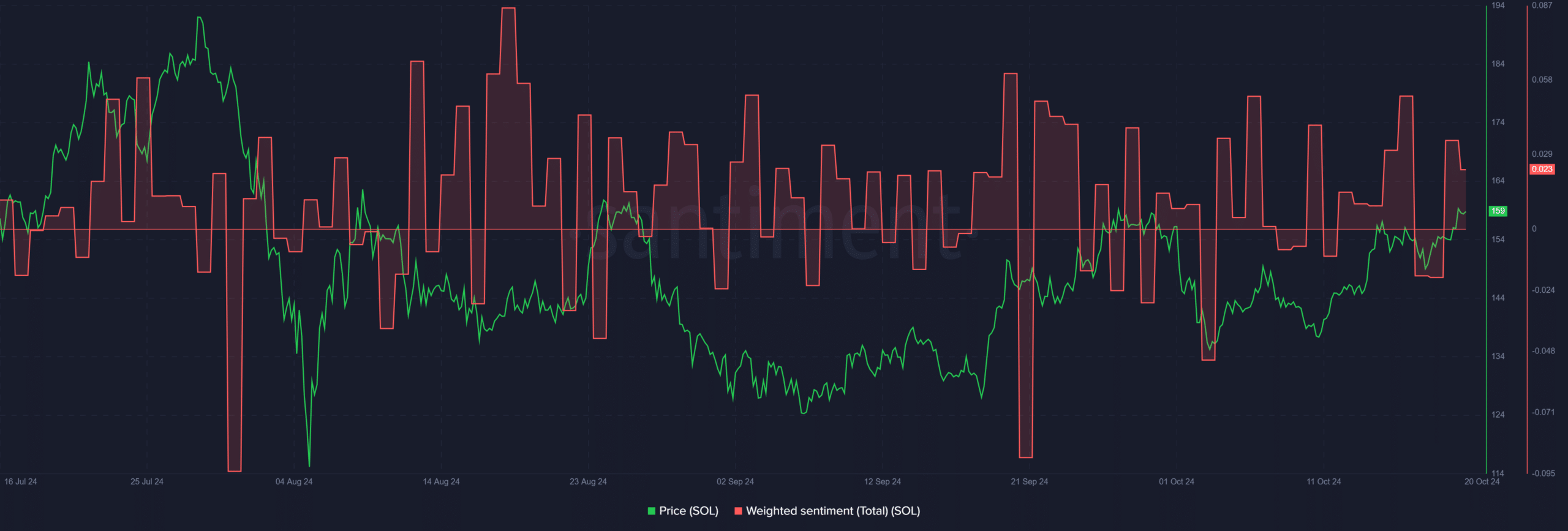

Source: Santiment

Santiment’s data supported the above projections, as SOL’s sentiment was relatively positive last week.

However, whether the positive sentiment was linked to the Bitcoin [BTC] rally or the renewed meme coin craze wasn’t known.

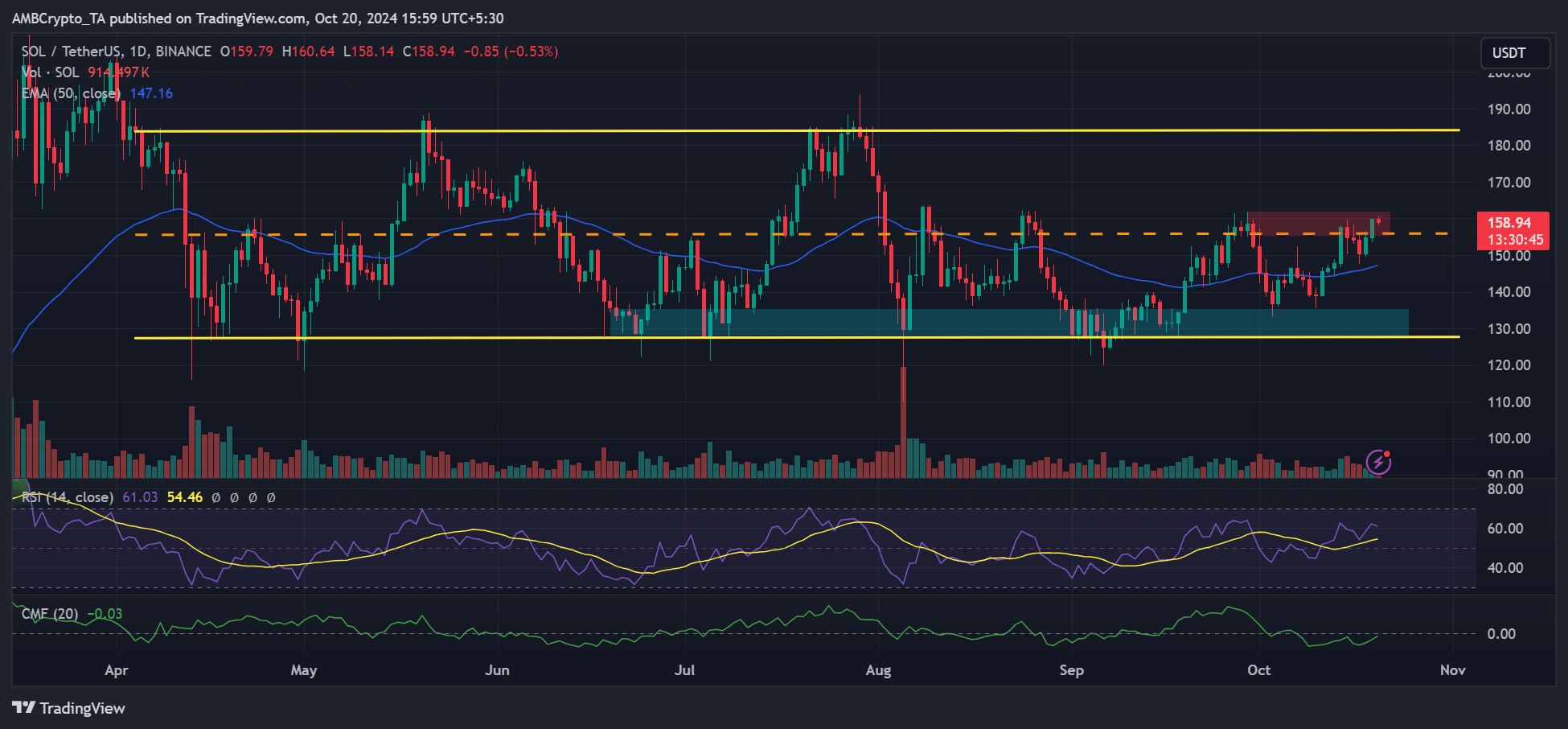

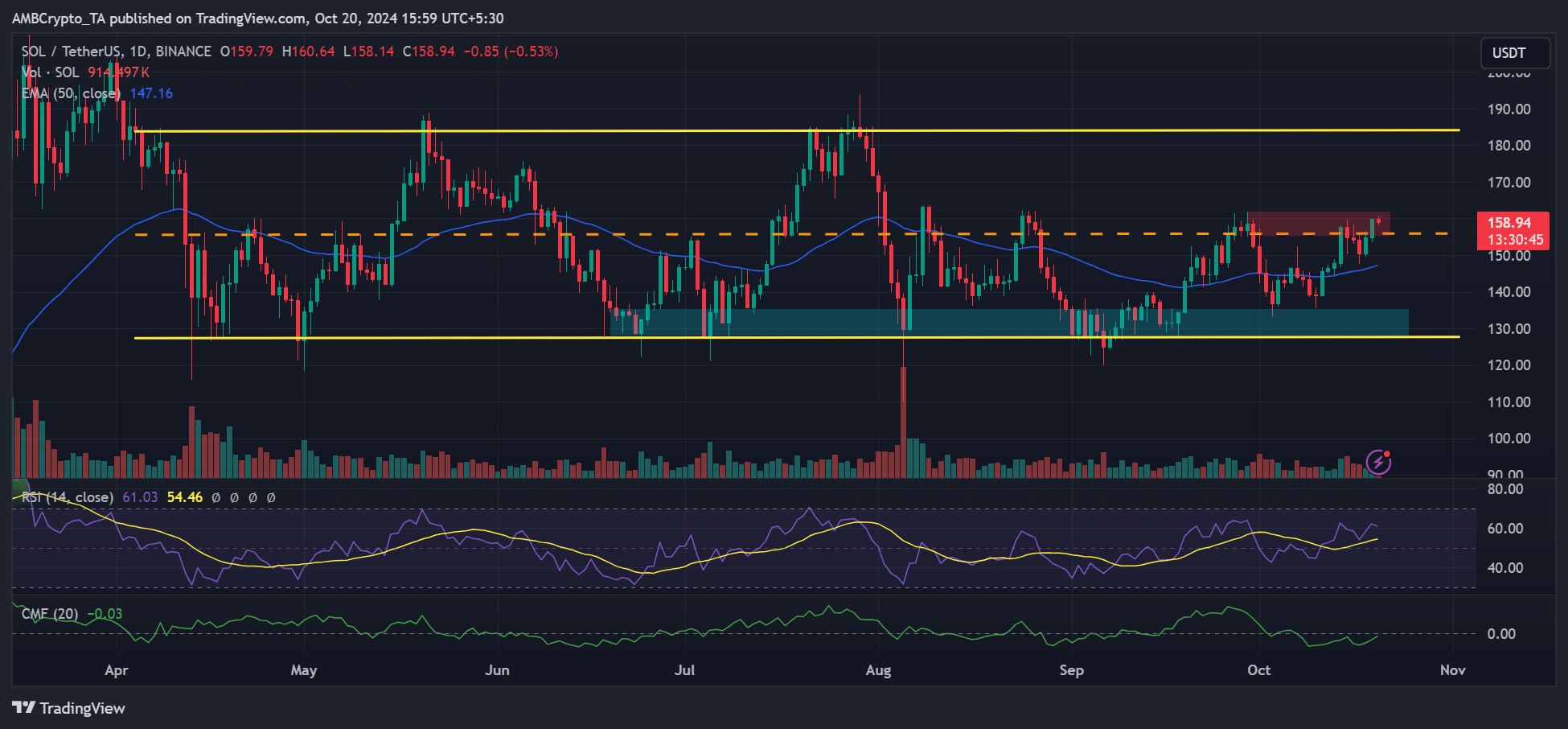

At press time, SOL hovered around $160, which happened to be a mid-range level and bearish order block (OB). In short, the area was a key supply zone that, if cleared, could push SOL to $180 in the short term.

However, a price rejection at the supply zone could still drag the altcoin to a 50-day EMA (exponential moving average) at $147 or back to range lows.

Source: SOLUSDT, TradingView