- Rebound from the support level at $1.35 could be key to WIF’s next move as price tests resistance near $1.80

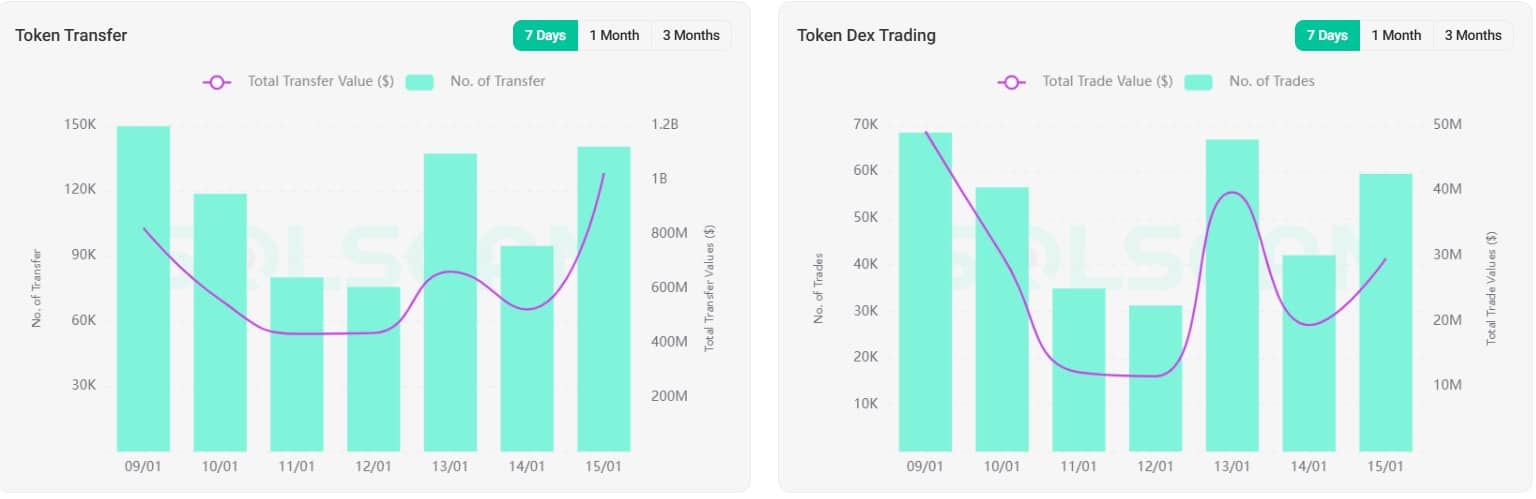

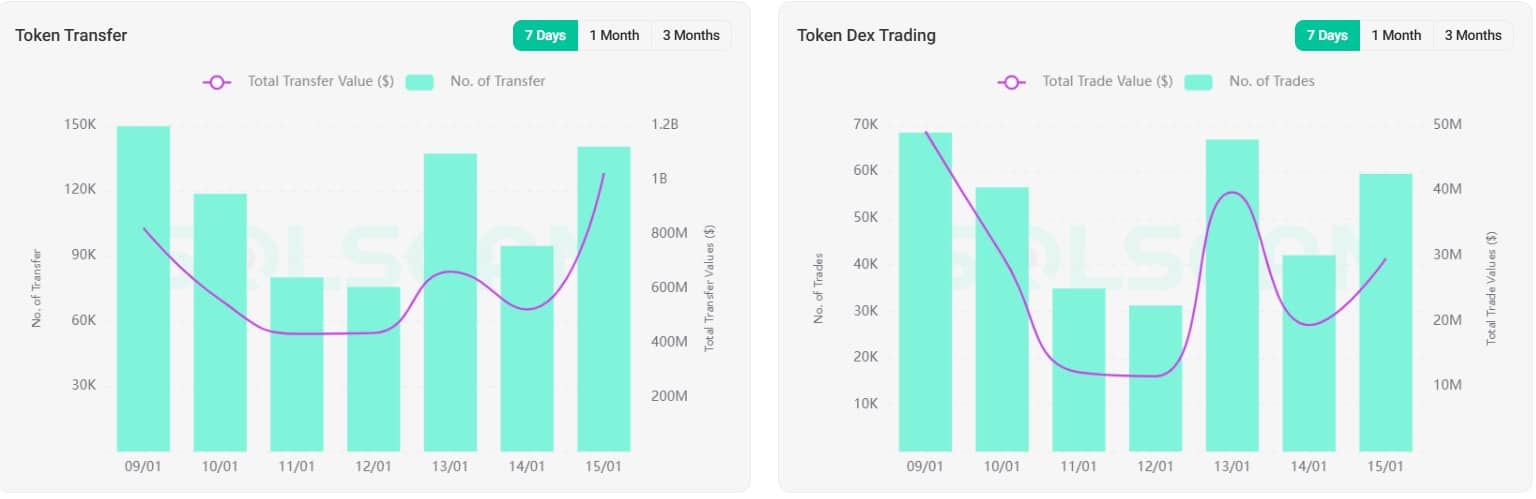

- WIF token transfer has been on the rise, as well as its DEX trading volume since the rebound

On the daily chart, dogwifhat (WIF) registered a distinct rebound off the $1.06 support level – A sign of robust buying interest at this price juncture. In fact, the price seemed to be testing the $1.738 zone which acted as immediate resistance.

A convincing breakout above this level could target the next significant resistance at $2.00. This was indicated by the Volume Profile Visible Range noting a fall in trading activity above this zone until $2.50.

The MACD reinforced this potential upward trajectory with increasing bullish momentum, as the histogram was rising and the MACD line seemed poised to cross above the Signal line.

Source: Trading View

However, any retracement from its press time levels should find support at $1.06, where there was previous substantial trading activity – A sign of a robust defense by bulls. On the contrary, a sustained move above $1.80 could validate the bullish outlook and set the stage for a rally towards $2.50 and potentially higher. This would mark a significant recovery phase for WIF.

Conversely, a failure to breach this resistance might lead to consolidation or a retest of lower supports.

Token transfer and DEX volume

Analyzing the WIF token data revealed a dynamic trend in both transfer and decentralized exchange (DEX) activities. The ‘Token Transfer” saw an upswing in the total transfer value, increasing from around $400 million to over $1 billion, alongside a fluctuating but generally upward-moving number of transfers.

This alluded to growing liquidity and possibly higher demand for WIF across the market.

The charts complemented this by presenting an interesting pattern in trading volume and number of trades.

Source: Solscan

Notably, 15 January saw a peak in DEX trading volume at approximately $60 million, coinciding with a substantial number of trades.

Such peaks are crucial as they point to potential support levels. When these levels hold, they reinforce the token’s price stability. If support is maintained around the $1.738-mark, WIF could record a bullish trend while also possibly challenging the resistance near $2.

Breaches above this threshold would mean an uptrend propelled by sustained trading volumes and positive market sentiment, influencing WIF’s price positively in the near term.

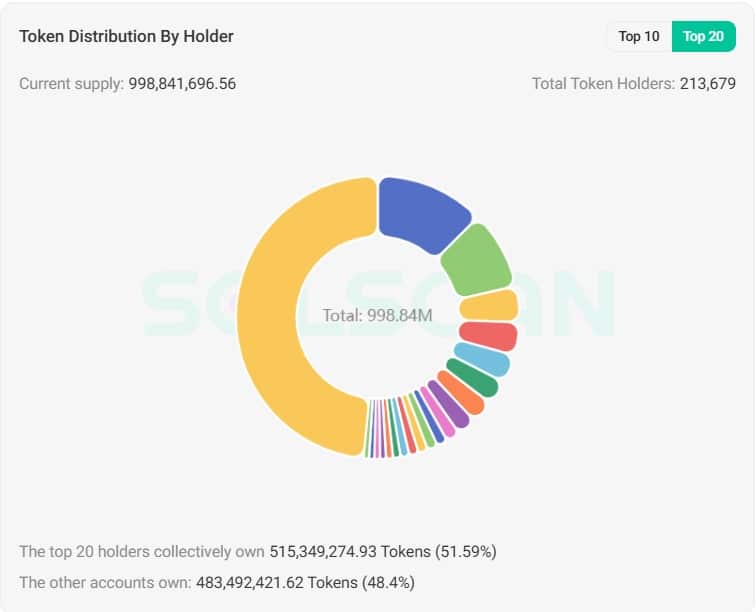

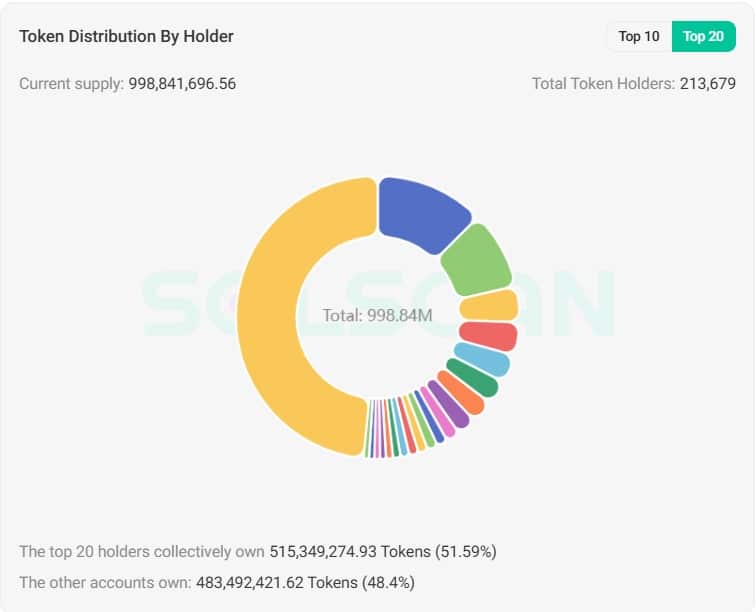

WIF distribution by holders

Finally, WIF tokens among holders where the top 20 holders collectively controlled 51.59% of the supply. This totalled over 515 million tokens revealing distinct distribution.

This concentration suggested significant market influence by a few participants, which can lead to price volatility if these holders decide to buy or sell large amounts.

Source: Solscan

Conversely, the remaining 48.41% of tokens were spread across other accounts, alluding to a broader base of smaller holders.

This distribution pattern is crucial for understanding potential resistance or support levels. If the major holders shift their positions, it could potentially impact WIF’s price stability and market dynamics.