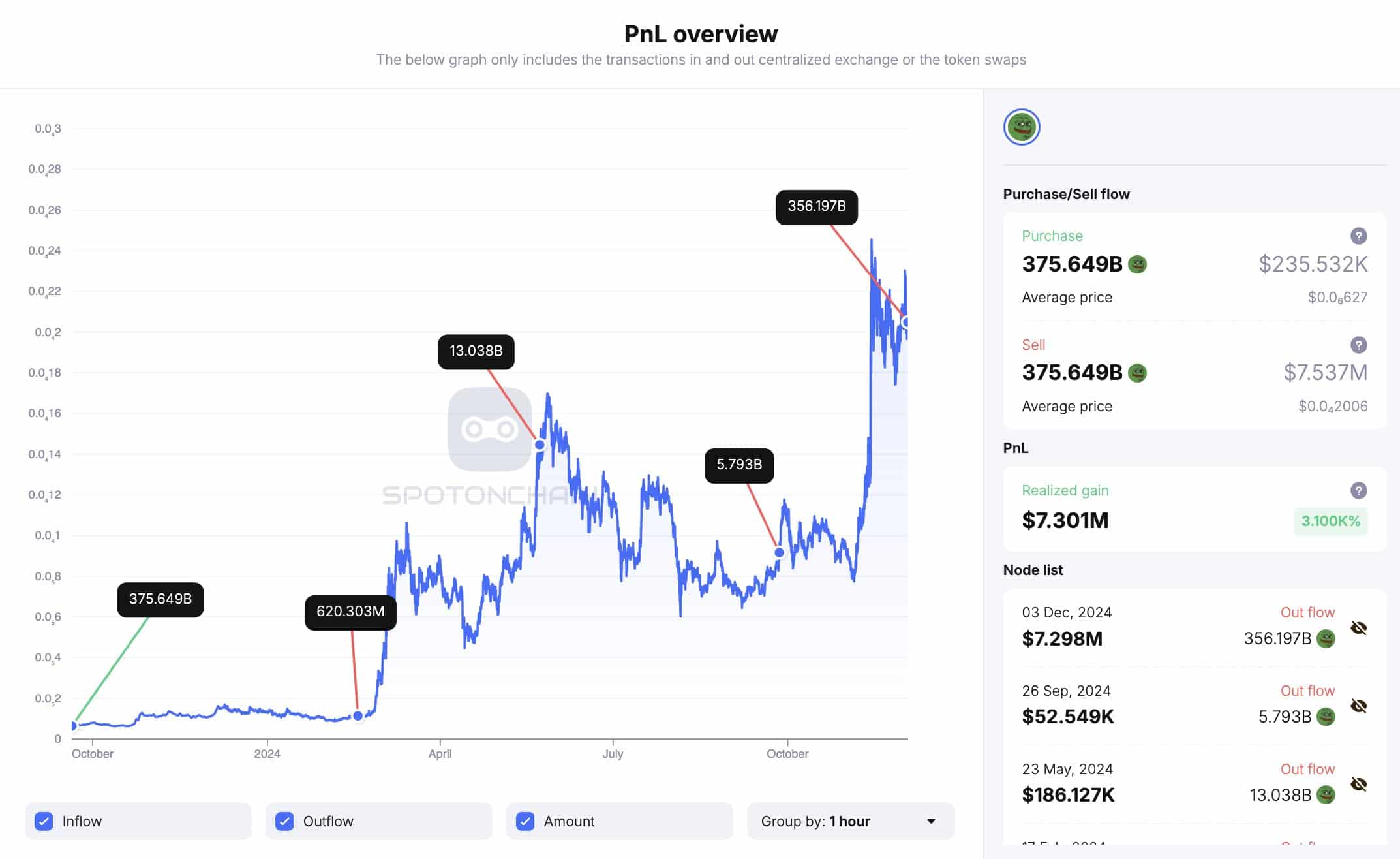

- A Pepe whale sold 356.2 billion tokens worth $7.3 million.

- Pepe has remained stuck in a consolidation range over the past two weeks.

Since reaching an ATH of $0.00002524 nearly three weeks ago, Pepe [PEPE] has struggled to maintain an upward momentum. As such, the memecoin has continually consolidated within the $0.000022 and $0.000018 range.

Despite the witnessed market correction, the recent rally to ATH left long-term holders experiencing massive profits.

With the memecoin now struggling to make more gains, these long-term holders especially whales have turned to sell to maximize their profits.

Pepe whale sells 356.2B tokens

According to Spot On Chain, A PEPE whale has started to offload their holdings. Over the past day, this whale has deposited 356.2 billion Pepe tokens worth $7.3 million to Kraken.

Source: Spot On Chain

After starting hoarding Pepe in 2023 with a 375. 65 billion tokens after a withdrawal from Gemini, the whale turned to sell in February 2024. In total, the whale has cashed out $7.54 million.

When whales turn to sell, it implies that they are either trying to maximize profits after a rally or fearing to see all their gains turn to losses after an uptrend losses momentum.

In so much so, it reflects a lack of confidence in the market. Often, sustained offloading by whales causes prices to decline through oversupply.

Impact on price charts?

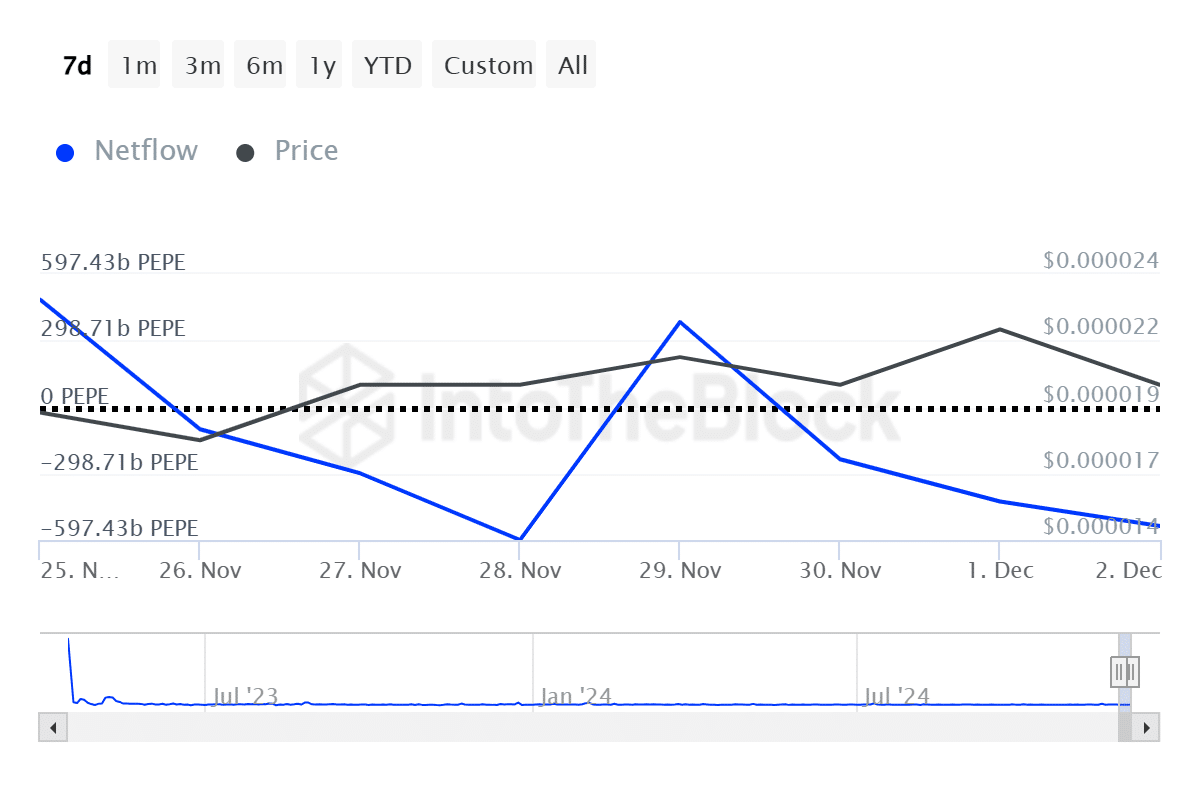

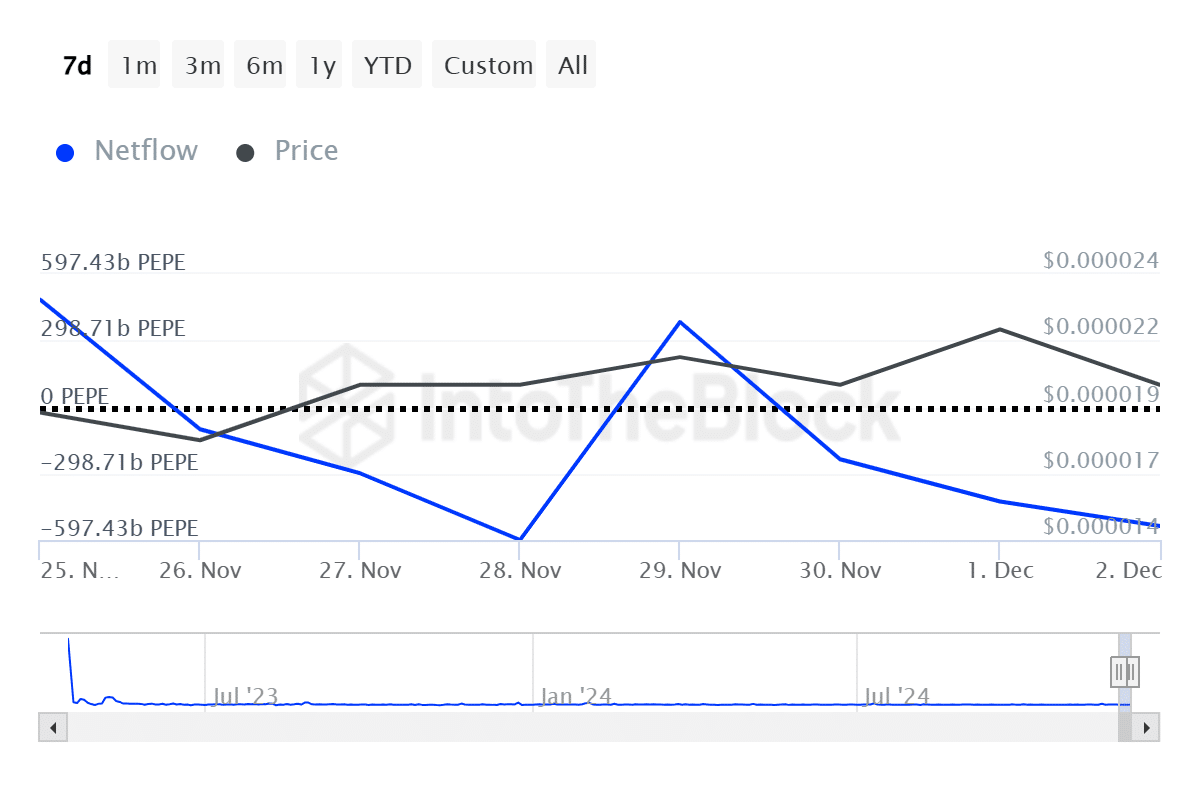

According to AMBCrypto’s analysis, this whale dump arises from the overall market sentiment among large holders, which is highly bearish.

Source: IntoTheBlock

This is seen through increased outflow among large holders compared to inflow. IntoTheBlock data showed that the large holder’s netflow has remained negative over the past four days.

This has declined from 381.86 billion tokens to -534.57 billion Pepe tokens, signaling that most whales were actively selling.

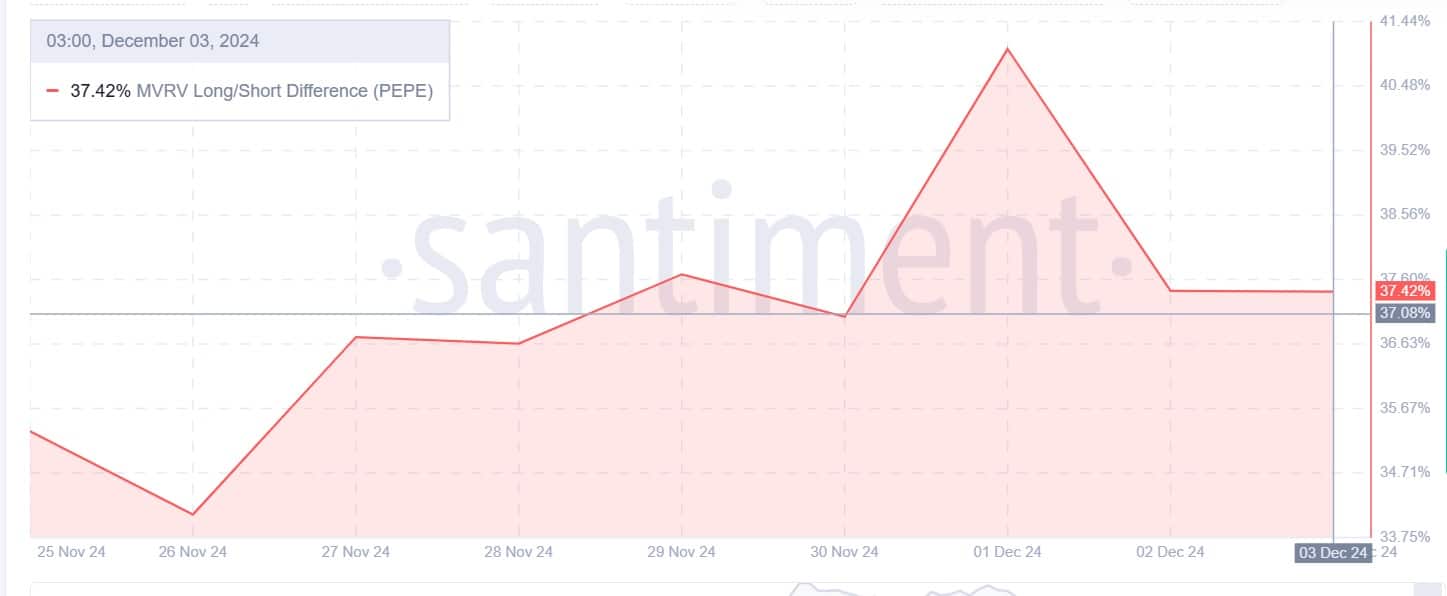

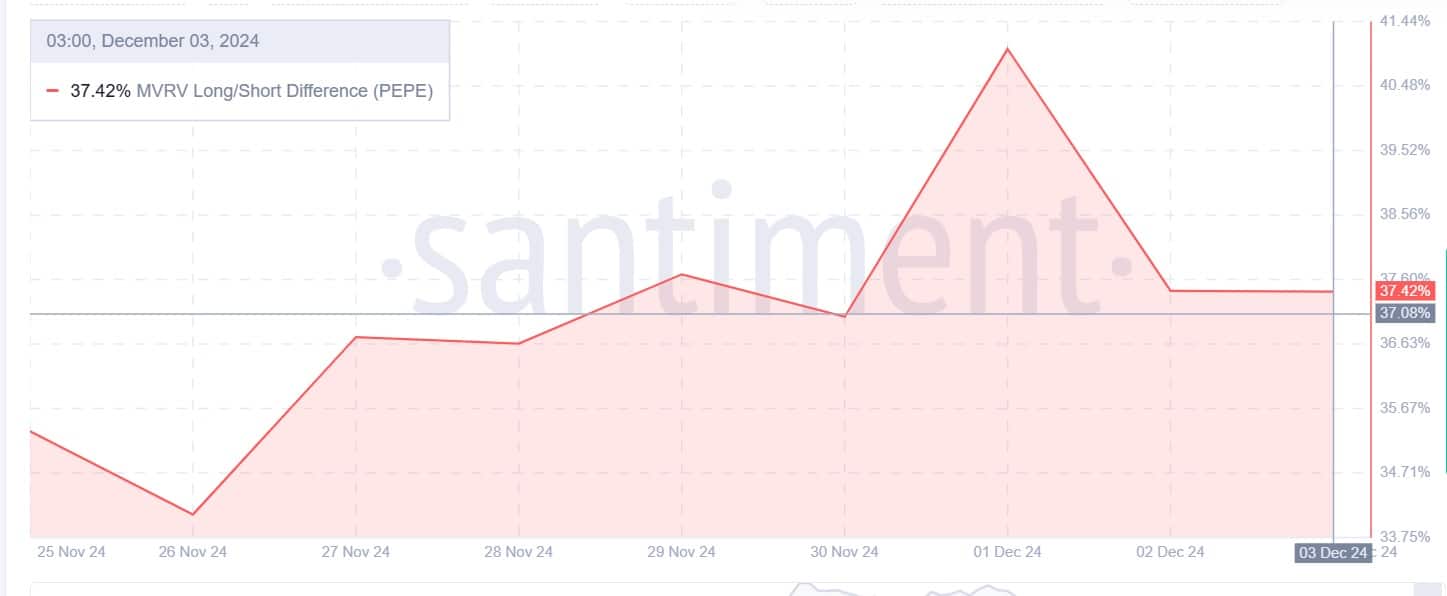

Source: Santiment

This sentiment was further witnessed by the declining MVRV Long/Short Difference, which declined after reaching 41% to 37%.

When MVRV Long/Short Difference drops, it implies that long position holders are losing confidence in the market as their profit margins continue to decline.

What next?

While whale selling is expected to negatively impact an asset’s price, this has yet to be reflected. On the contrary, Pepe has made moderate recovery on price charts.

In fact, as of this writing, Pepe was trading at $0.00002056. This marked a 0.09% increase on daily charts. Equally, the altcoin has gained on weekly and monthly charts, increasing by 10.69% and 145.11% respectively.

In conclusion, with whales turning bearish while short-term holders are turning to higher profit margins, it seems Pepe will continue to consolidate.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Thus, with the market seeing a tangle between bulls and bears, Pepe will remain stuck within a consolidation range.

Therefore, if the current gains on price charts gain momentum, we could see Pepe reclaim $0.0000227 resistance level. Consequently, if bears outpace the market, Pepe will find support around $0.00001885.