- Sui Network ranks second in 2024 transaction volume, reaching 4.64 billion.

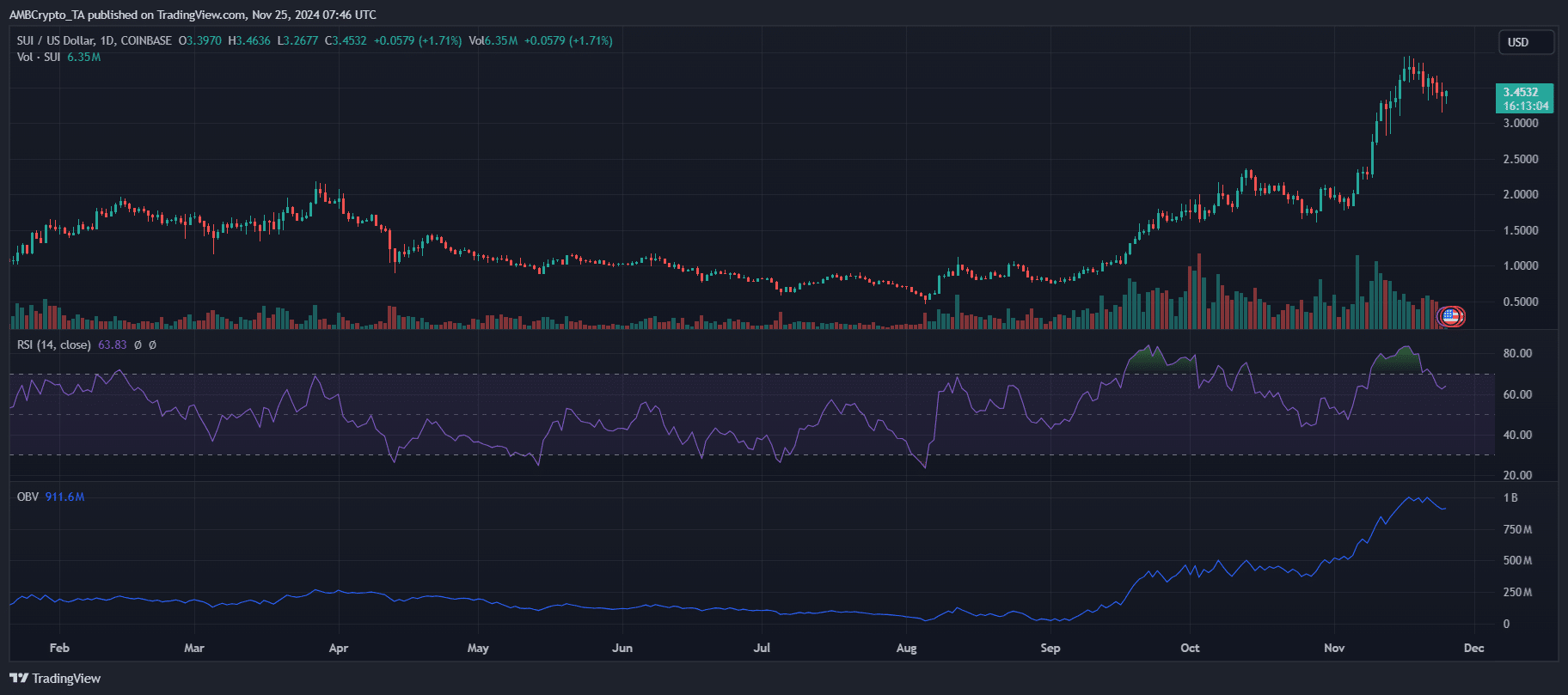

- Its price surges to $3.42, driven by high demand and network utility.

Sui [SUI] has been making headlines in 2024, securing the second spot in total transaction volume and solidifying its position as one of the most promising blockchain platforms in the space.

This surge in activity highlights the network’s growing adoption and potential, but what does it mean for the price of its native token, SUI?

As transaction volume often serves as a key indicator of network health and investor confidence, the recent rise could signal a new phase of growth for the token.

A new milestone for Sui Network

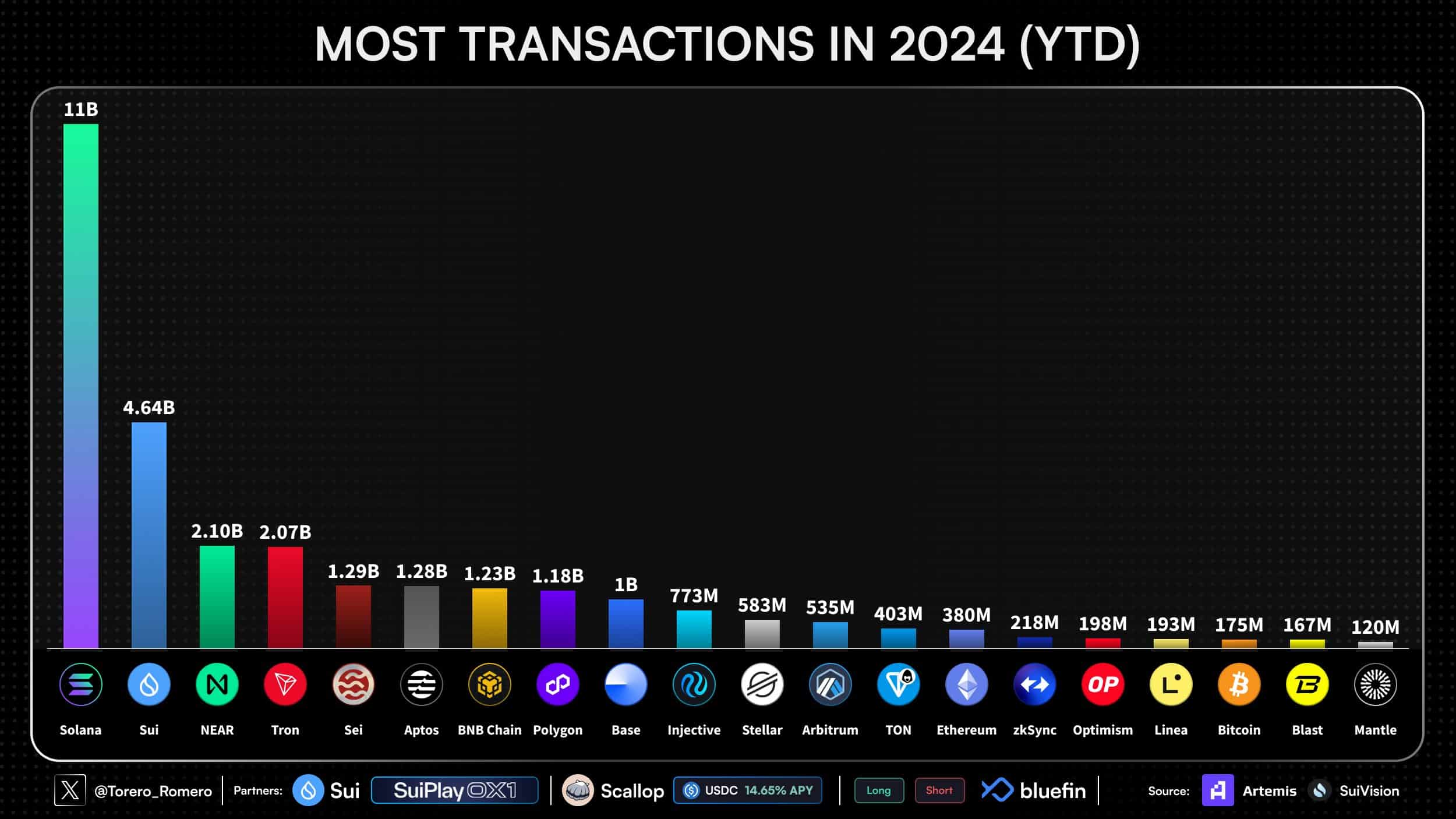

The milestone of reaching 4.64 billion transactions so far in 2024 marks a turning point for the Sui Network. This achievement secures its place just behind Solana, which leads with 11 billion transactions, and ahead of established competitors like NEAR and Tron.

Transaction volume serves as a crucial indicator of blockchain activity, demonstrating both user engagement and the viability of dApps on the platform.

Source: X

A high transaction volume often reflects growing demand for a blockchain’s services, from simple token transfers to more complex smart contract interactions.

In Sui’s case, this significant milestone suggests a thriving ecosystem that is drawing developers and users alike. The network’s performance could potentially position it as a strong contender for enterprise use cases, NFT marketplaces, or DeFi applications.