- Miners were selling BTC to cover costs or secure profits, acting as resistance.

- A much stronger dip-buying was needed to absorb this pressure.

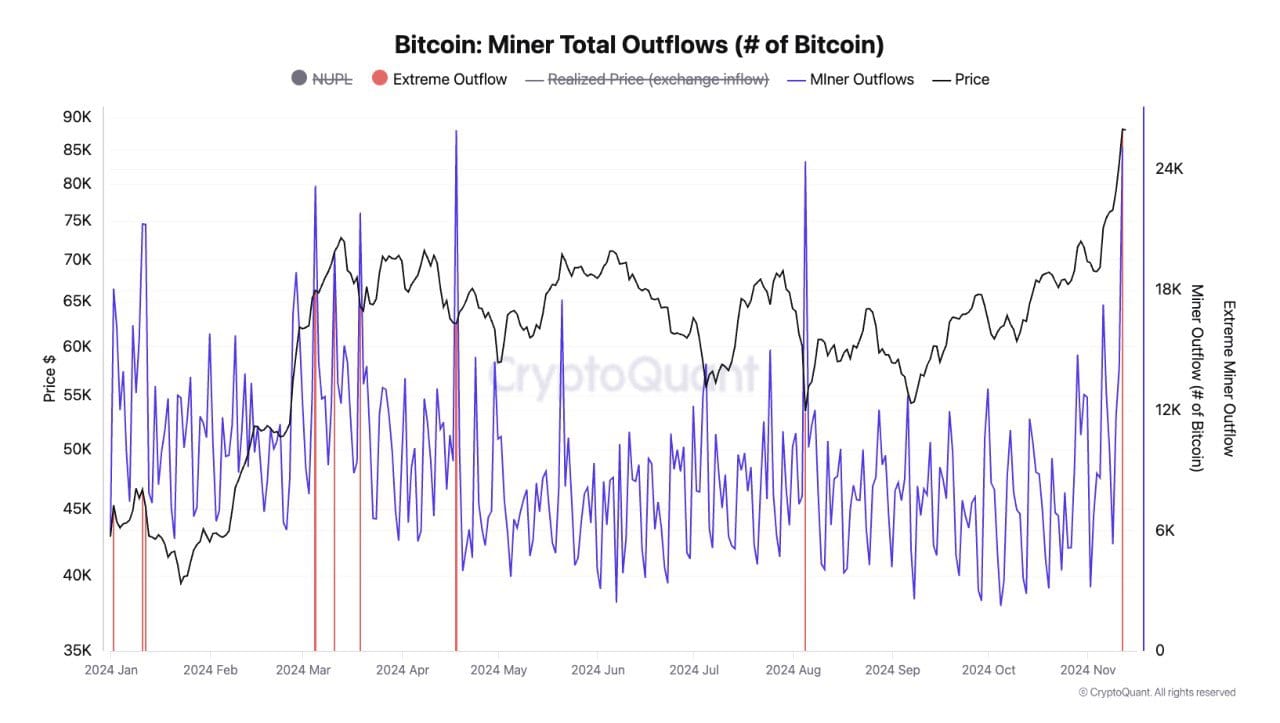

The interplay between bullish market sentiment and selling pressure from miners is a classic dynamic in cryptocurrency cycles. Over the past three days, since Bitcoin [BTC] reached an all-time high of $93K, miners have been offloading to cover operational costs or secure profits.

Such events often present opportunities for bears to short Bitcoin, as demonstrated two days ago when BTC dipped to $86K, recording a 3% decline.

However, the bulls remained resilient, pushing Bitcoin back near its ATH, as BTC was trading at $91,389, at press time.

From an economic standpoint, high liquidity in the market combined with miner selling creates an ideal “dip” buying opportunity for savvy investors. If they capitalize effectively, the market could absorb selling pressures, potentially setting Bitcoin up for a new all-time high.

Are miners slowing down BTC?

Bitcoin stakeholders are at a crossroads, torn between selling or holding for the long term. This uncertainty is understandable, as BTC sits in a ‘high risk’ zone. Even a small shift could trigger panic in the market.

However, miners are facing a different challenge. The recent halving reduced miner rewards to 3.125 BTC, making it harder to cover expenses and lock in profits.

As a result, driven by both necessity and profit-taking, miners’ reserves have hit an all-time low, with daily outflows following a historical pattern seen during previous Bitcoin market tops.

Source : CryptoQuant

In other words, if miners keep offloading their holdings each time Bitcoin hits a new ATH, which happened three times in under ten trading days, it could delay Bitcoin’s rise above $93K and jeopardize a potential parabolic run to $100K.

Yet, there is a silver lining. Tether’s treasury has resumed printing new USDT tokens, fueled by the surge of investors flocking to Bitcoin in the post-election cycle. This signals rising demand in the market, boosting liquidity.

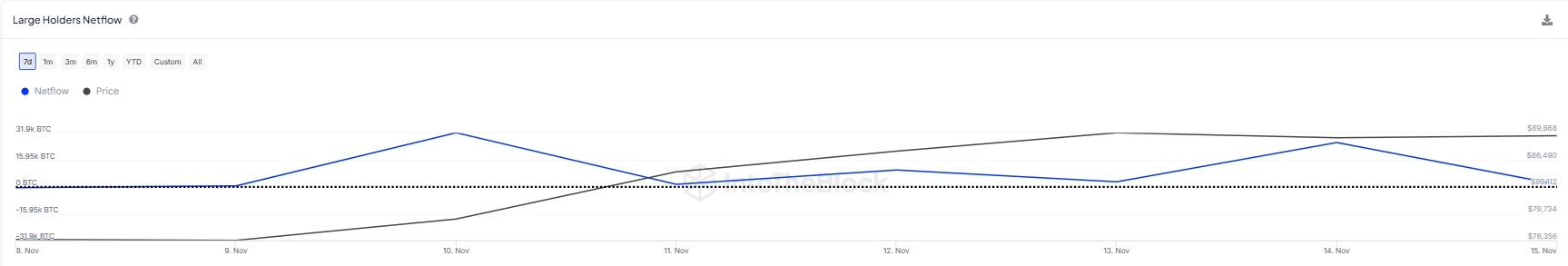

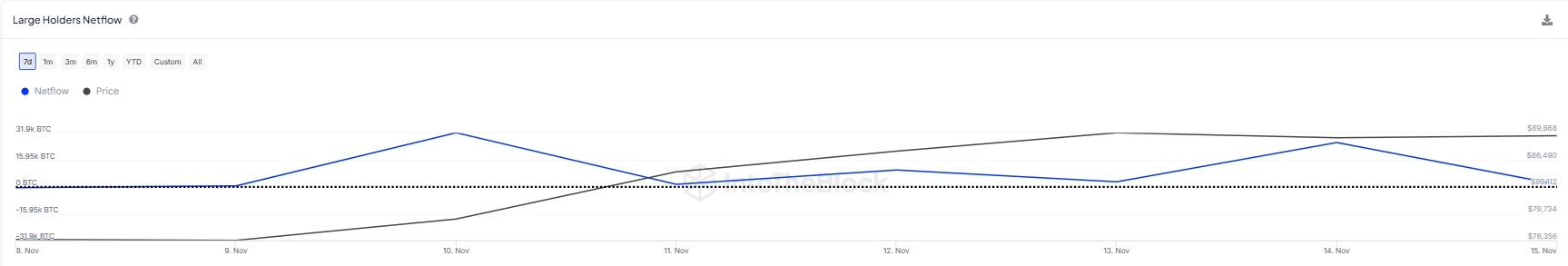

As mentioned earlier, higher liquidity means more Bitcoin is up for grabs. However, if the retail market finds a better “dip” than $91K, much of the responsibility could fall on institutional investors and big holders.

Thus, their next moves will be crucial in determining whether Bitcoin can reach a new ATH before the weekend.

Bitcoin needs fresh incentives for long-term growth

Unsurprisingly, the crypto market often moves on speculation. Bulls are banking on what they expect might happen, even if it hasn’t materialized yet.

Although the United States building a reserve of Bitcoin is currently just a concept rather than a concrete plan, it remains one of the key factors that bulls are eyeing to avoid offloading their holdings.

Other factors fueling this optimism include the U.S. positioning itself as the next crypto hub. Notably, there’s a resurgence of FOMO in the market, expected Fed rate cuts next month, and a massive influx of billions into ETFs.

Together, these factors have helped prevent Bitcoin from experiencing a major pullback. However, they haven’t stopped a minor correction, with BTC recently dipping to $86K, largely driven by miners’ selling. Therefore, pushing BTC above $100K won’t be an easy task—there will likely be hiccups along the way.

Source : IntoTheBlock

Over the past week, the net flows of large holders have remained positive, but with a notable decline. This suggests that even these big players are taking more cautious, calculated moves.

Read Bitcoin (BTC) Price Prediction 2023-24

In summary, for long-term growth, Bitcoin needs consistent fresh incentives to keep its profitable stakeholders from selling. Minor corrections are inevitable as weak hands shake out.

If bulls remain resilient, BTC could push to a new ATH before the weekend. However, surpassing $100K might be delayed.