- XRP may be heading to its key resistance of $1.33, with strong bullish momentum and whale accumulation

- On-chain metrics revealed rising activity, with declining exchange reserves seen too

With its market cap crossing $50 billion, XRP has reasserted itself as a dominant force in the cryptocurrency market. After surging by over 16% in just 24 hours to hit $0.9342, the token’s momentum has now captured widespread attention.

However, the pressing question now is – Can XRP maintain this rally to break past $1 to hit the $2 milestone?

Is XRP gearing up for a major breakout?

XRP’s chart revealed a potential breakout, with the price nearing a key resistance level at $1.33. A decisive move above this level could lead to a rapid hike towards the aforementioned targets. Additionally, the overall bullish trend seemed to be supported by technical indicators.

For example – The stochastic RSI had an extreme reading of 97.56, indicating that XRP was in overbought territory at press time.

While this might suggest short-term corrections, the MACD was bullish and highlighted the market’s positive momentum. Furthermore, the broader market sentiment appeared to be favorable too, giving XRP the tailwind needed to maintain its rally.

Therefore, breaking through the $1 level might be achievable in the near term. If that happens, $2 will be a realistic mid-term target if momentum holds.

Source: TradingView

XRP whale activity adds fuel to the fire

XRP whales have significantly contributed to this rally by accumulating over 320 million tokens in just 72 hours.

This massive accumulation is a sign of growing confidence among large investors, many of whom are positioning themselves for further gains. Consequently, this buying spree has tightened the available supply, which could lead to sustained upward price pressure.

As whale activity often precedes major price moves, this trend means XRP’s rally may have further room to grow.

On-chain activity reflects higher demand

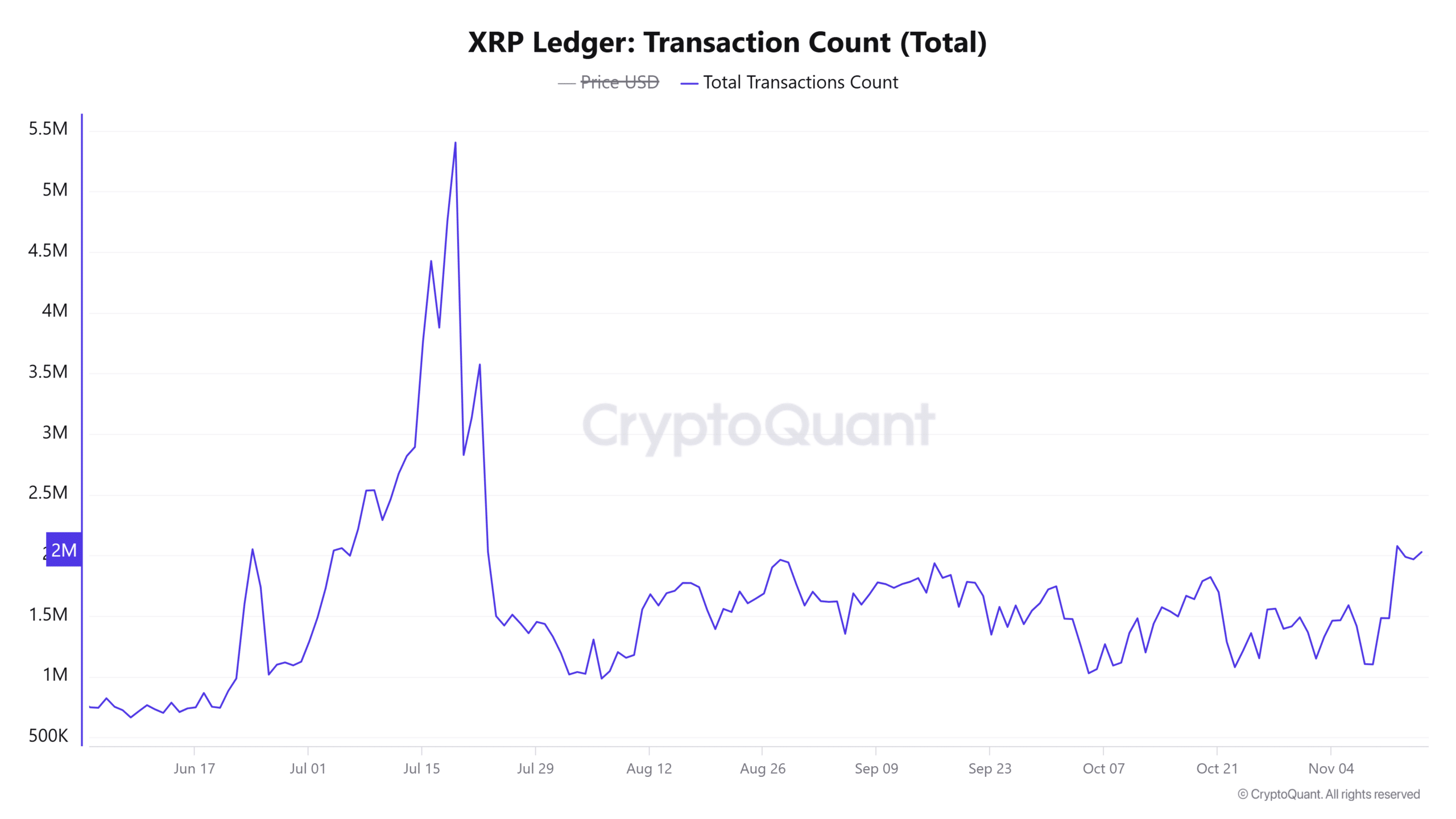

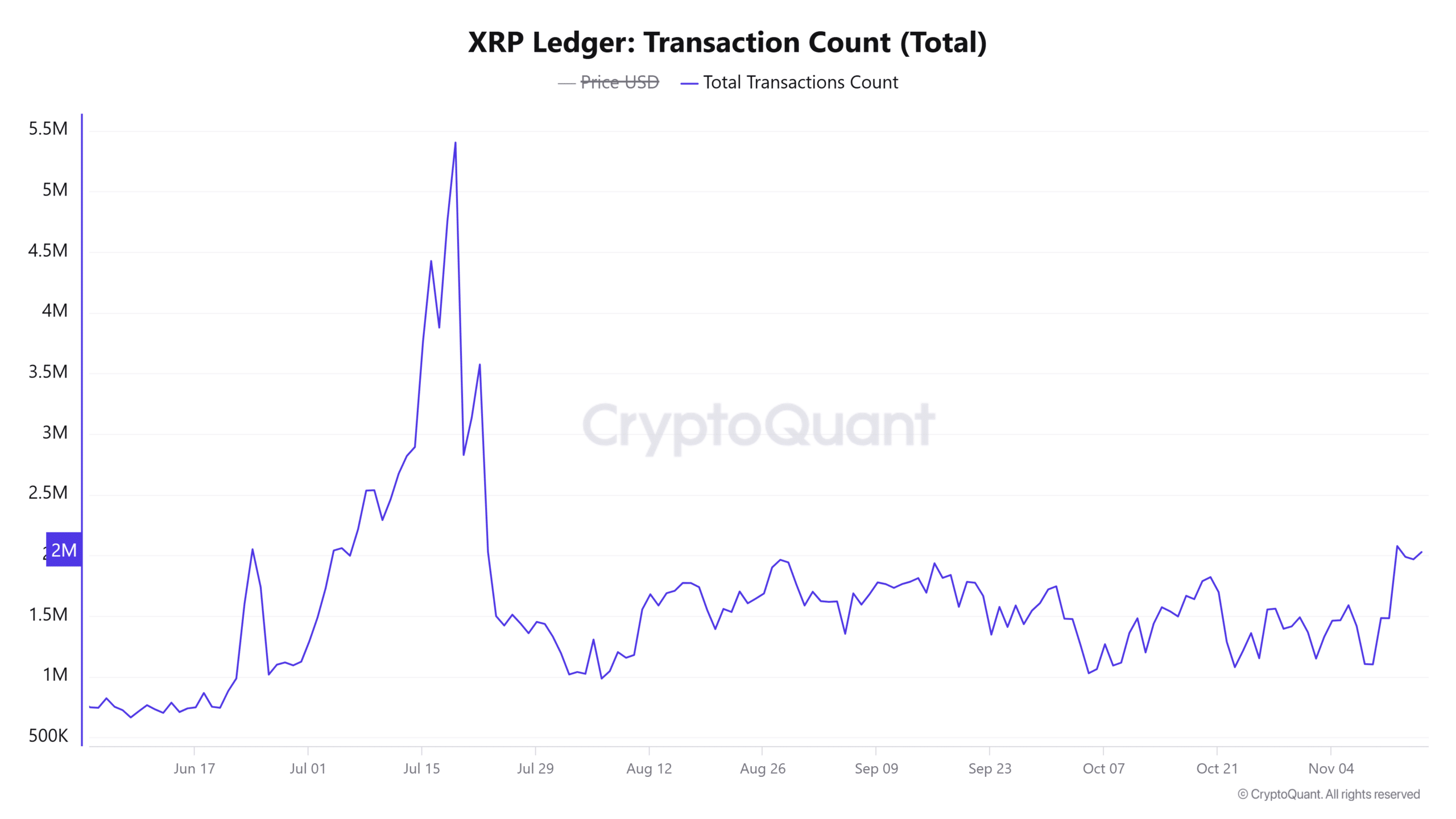

On-chain metrics further supported XRP’s bullish outlook. Active addresses rose by 1.17%, climbing to 27,421.

Such a steady hike highlighted growing network activity and engagement. Moreover, the total transaction count rose by 0.92%, crossing 1.88 million transactions. Taken together, these suggested that XRP’s adoption has been expanding. A development like this often translates into stronger price performance.

Source: CryptoQuant

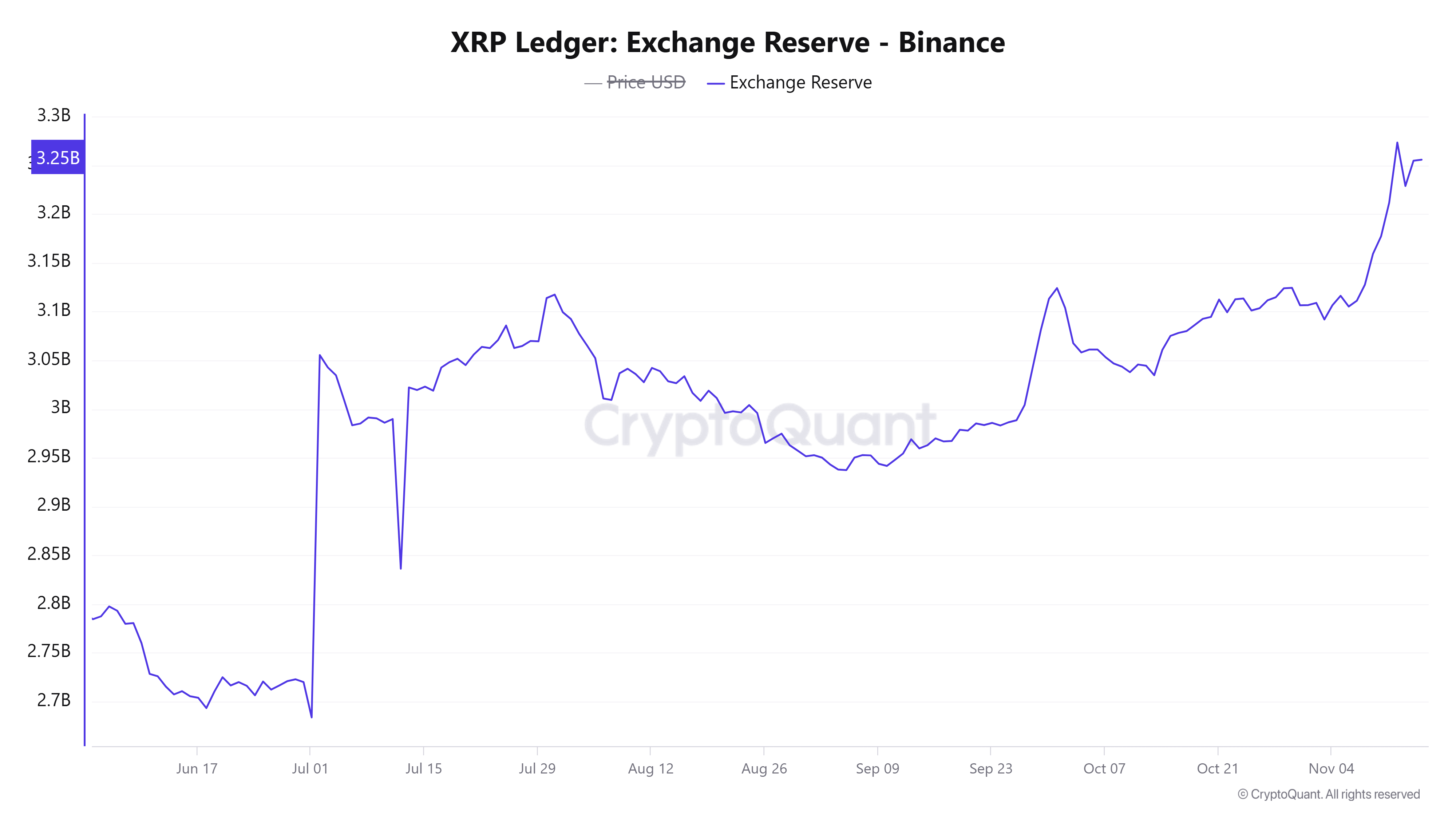

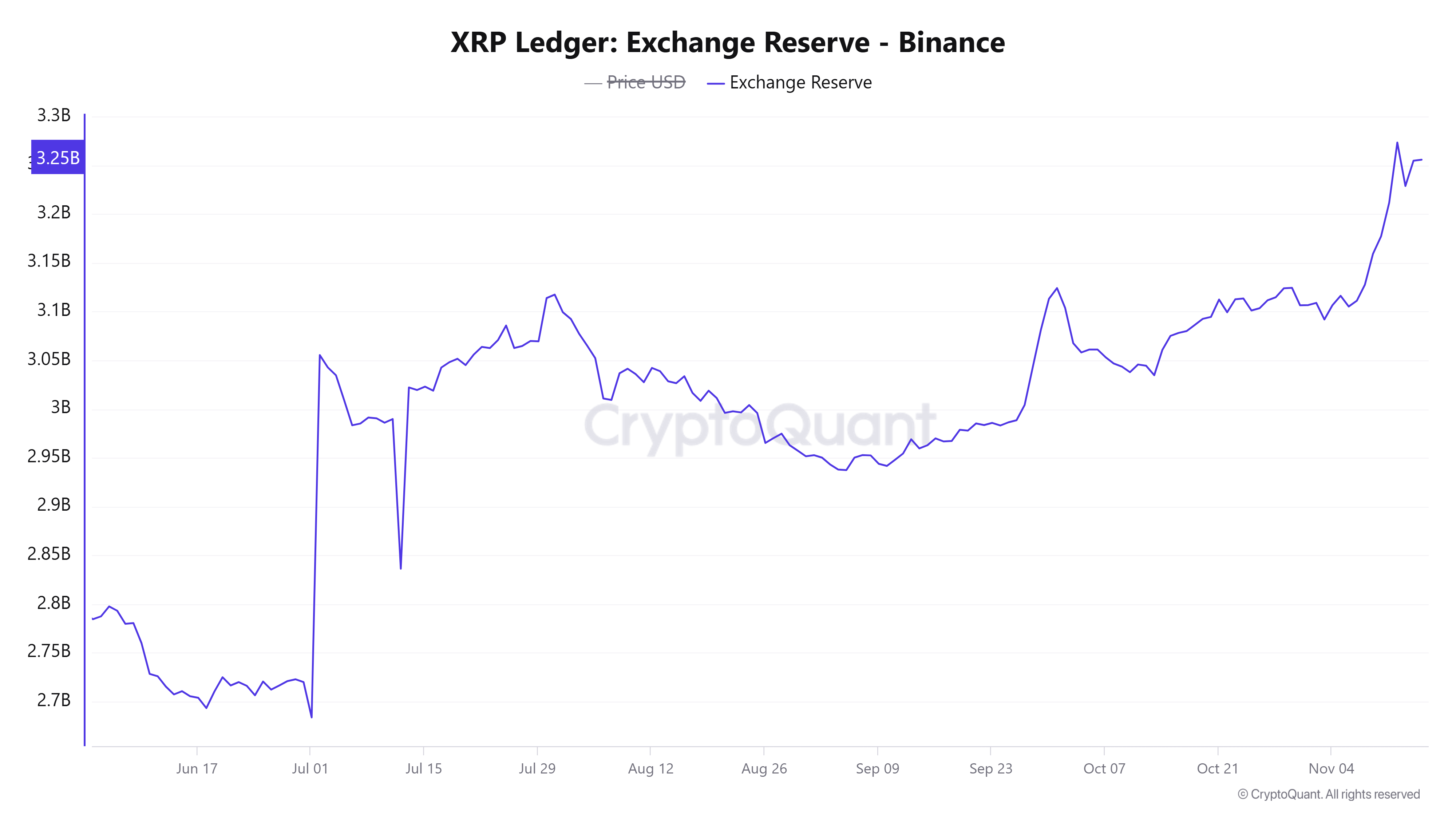

Declining exchange reserves signal reduced selling pressure

Exchange reserves for XRP fell by 0.64% over the last 24 hours, with the same flashing figures of 3.237 billion tokens at press time.

This decline indicated that investors have been moving tokens off exchanges, likely for long-term holding. Consequently, a fall in selling pressure creates a favorable environment for further price hikes. When combined with rising demand and whale accumulation, this metric can strengthen XRP’s bullish case.

Source: CryptoQuant

Read Ripple’s [XRP] Price Prediction 2024-25

XRP’s surge past $50 billion in market cap and strong technical and on-chain indicators suggested that breaking $1 may be imminent. The next few days will be critical for confirming this upward trajectory on the charts.